A 25 Year Focus on Dividends and Income Investing

November 2014 Client Letter

This month marks 25 years since Richard C. Young & Co., Ltd. began helping conservative retired and soon-to-be-retired investors. During our two-plus decades investing for clients, we have made income investing a focus of our investment strategy. We believe that for investment purposes, as opposed to speculation, a stock portfolio with an emphasis on dividends can be a winning approach.

The framework for making our investment decisions is largely thanks to Ben Graham’s The Intelligent Investor, first published in 1949. The Intelligent Investor has been credited as one of the best books on investing ever written. Many investors have been drawn to Graham’s style of value investing, which is thought to protect investors against areas of possible substantial error and to teach investors to develop long-term strategies with which they will be comfortable down the road.

Here are two of our favorite Ben Graham quotes:

One of the most persuasive tests of high quality is an uninterrupted record of dividend payments going back over many years. A record of continuous dividend payments for the last 20 years or more is an important plus factor in a company’s quality rating.

and

For the vast majority of common stocks, the dividend record and prospects have always been a most important factor in controlling investment quality and value. In the majority of cases, the common has been influenced more markedly by the dividend than by reported earnings. In other words, distributed earnings have had a greater weight in determining market price than have retained earnings.

The Capital Appreciation Trap

A painful lesson learned by many investors during the past 15 years is to not rely solely on capital appreciation for stock-market gains. Investors who were seduced by the promise of speculative gains during the dot-com bubble and in the years leading up to the real-estate collapse were left not only with decimated portfolios, but with portfolios that produced little annual income.

The ultra-low-yielding NASDAQ Index has increased more than threefold over the last five years, but the ugly reality for NASDAQ investors is that the index remains below its level 14 years ago. That’s almost a decade and a half without a net positive return! Even the stodgier Dow Jones Industrial Average has experienced long periods of no growth. Over 16 years, from 1965 to 1981, the blue-chip Dow fell 10% in price. Sixteen years is most of a retirement for many investors. The dismal performance of the NASDAQ and the Dow in these two periods is a sobering reminder that stock prices can remain depressed for long periods.

Dividends a Vital Component of Long-Term Stock Market Returns

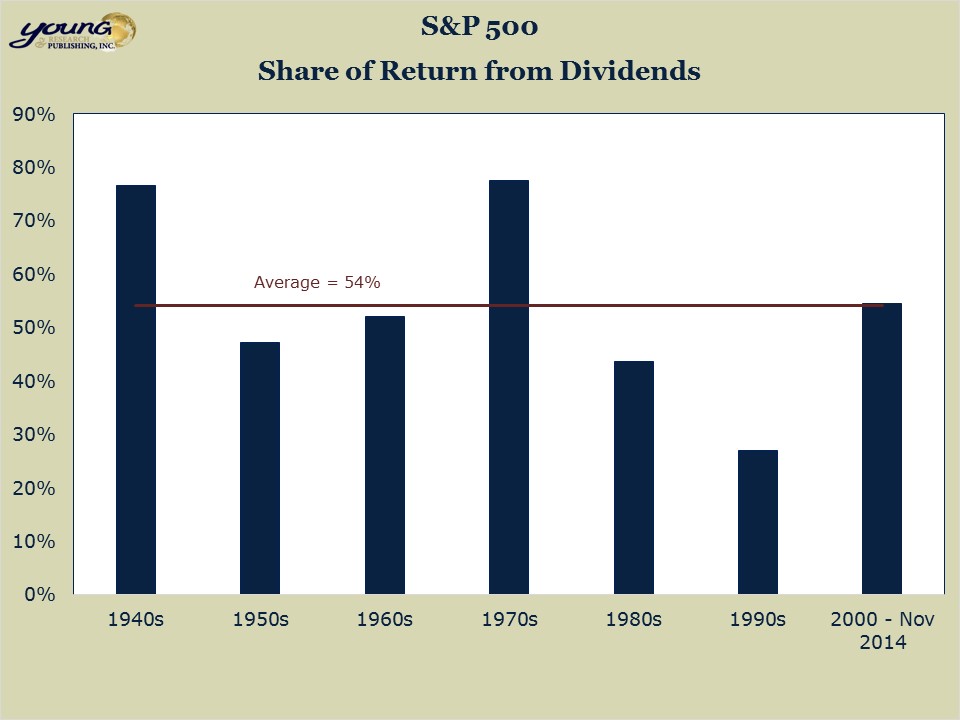

We believe a solution to these long dry spells is to make dividends an important part of equity portfolios. Dividends can be a vital component of long-term stock-market returns. Over short time-frames and during long bull-markets, dividends may seem trivial—but as Figure 1 illustrates, over the last seven decades, dividends have accounted for an average of 54% of each decade’s stock-market returns. Over the last 14 years, when the NASDAQ didn’t gain a single point, high-dividend-payers compounded investors’ money at 9%. And during that 16-year period from 1965 to 1981, when the Dow fell in price, high-dividend-yielding stocks earned a compounded annual return of 8.1%.

When measured over multi-decade periods, the scales become even more tilted in favor of dividends. Over the last 40 years, dividends and the reinvestment of dividends have accounted for over 70% of the S&P 500’s total return. Dividend stocks, and especially high-dividend-yielding stocks, have appeal for many types of investors. A continuous stream of dividends can be used for living expenses (ideal for retirees) or potentially reinvested at a lower share price, resulting in higher future-dividend payments (ideal for long-term wealth accumulation). A steady stream of cash may also make it easier for investors to avoid emotionally charged decisions that can sabotage portfolios in down markets.

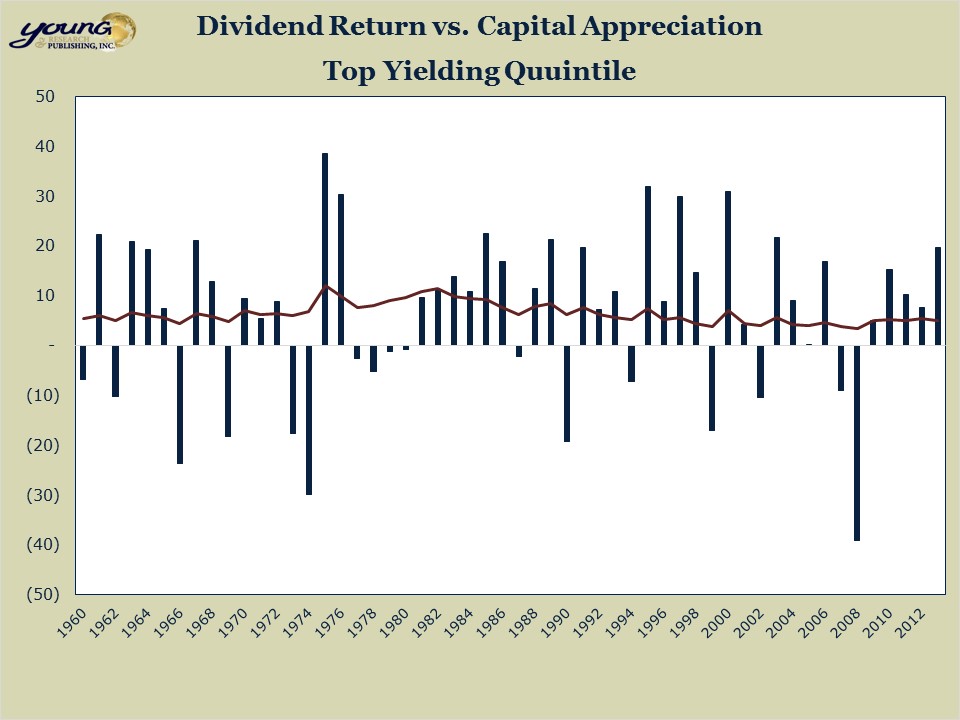

The Stability of Dividend Returns

Figure 2 compares the capital-gains component of returns to the dividend component of returns for high-yielding stocks. Note the stability of dividend returns compared to capital gains.

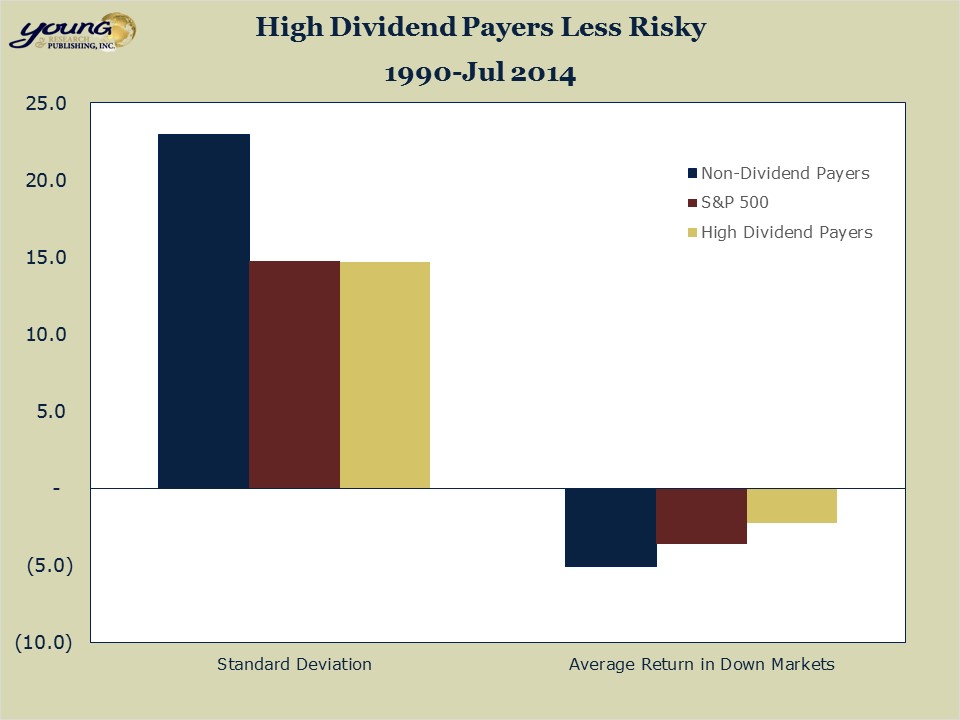

Dividend Stocks are Less Volatile

What’s more, dividends help reduce portfolio volatility. Figure 3 shows that high-yielding stocks have been less volatile than non-dividend-paying stocks. And high-yielders have held up better in down markets than both non-dividend-payers and broad-based stock-market indices such as the S&P 500.

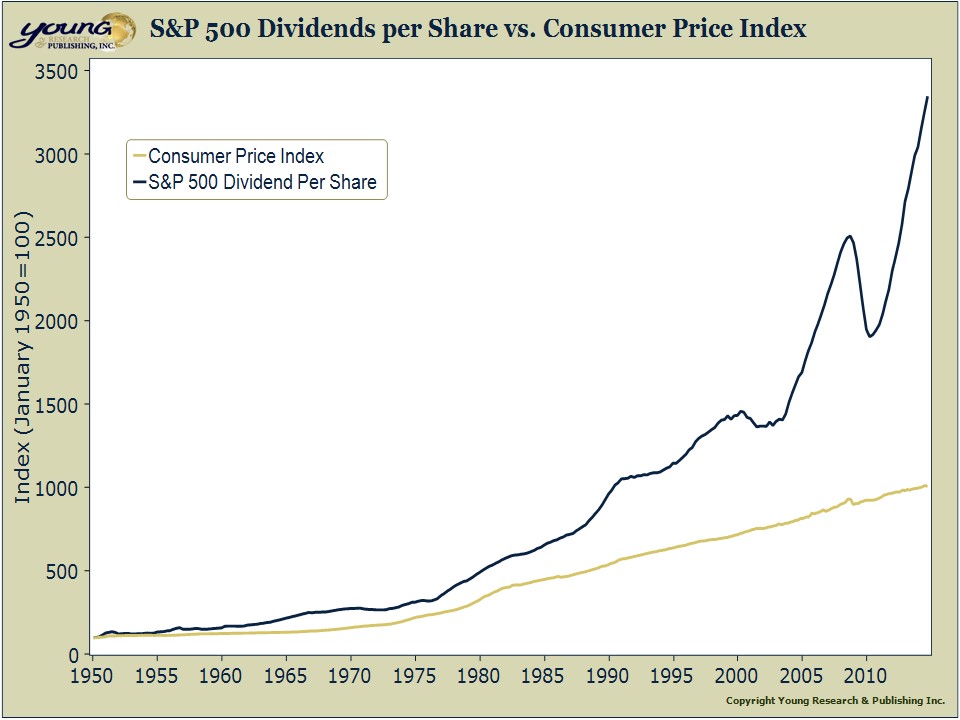

With the Federal Reserve and other global central banks pumping trillions of dollars into the global financial system while holding interest rates at zero, the risk of accelerating inflation is higher than it has been in decades. Stocks shouldn’t be the first asset-class you think of for inflation protection, but they do have an important inflation-fighting role to play in your portfolio.

Dividends Help Fight Inflation

Stocks tend to maintain their purchasing power during inflationary periods because they are real assets. When inflation rises, the revenues, earnings, and dividends of companies tend to rise as well. Figure 4 shows that dividends per share for the S&P 500 have outpaced inflation by a wide margin.

Dividend Stocks a Shortcut to Quality

A dividend strategy can also help you avoid many of the pitfalls that wreak havoc on even the most seasoned investors’ portfolios. Dividend-paying companies are often more durable businesses than non-dividend-payers. Payers are also more likely to operate in industries with higher barriers to entry and have stronger balance sheets than non-dividend-payers. And because there is a stigma associated with cutting dividend payments, the consistent payment of dividends is a signal of management confidence in the future prospects of a company. This is especially true of companies that raise dividends. Management teams tend not to commit to higher dividend payments unless they are confident the dividends can be maintained through thick and thin.

Cold, hard cash in the form of quarterly dividend payments may also help investors avoid some of the most deplorable examples of corporate fraud. Who can forget the accounting frauds of Enron, WorldCom, and Tyco that decimated many retirement portfolios? Not a single company in the group paid a meaningful dividend. Companies can manipulate and fake earnings by using creative accounting techniques, but regular dividend payments can’t be faked.

Obviously a dividend-centered strategy will not totally insulate a portfolio from corporate fraud, negative returns, or other portfolio unpleasantness. But investing in a group of quality companies, each who pays its shareholders annually in cash, is a way of getting off on the right foot and most likely a way to increase one’s comfort level when markets take a turn for the worse.

And perhaps the most persuasive reason and my favorite for investing in payers is the role they play in the compounding process. Compounding is essentially a snowball effect when dividends generate even more dividends. Investors receive dividends not only on their original investments but also on accumulated dividends—allowing a portfolio to grow faster and faster as time passes.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Best regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Three of our currently favored equity sectors, healthcare stocks, consumer staples (with a focus on food and drink companies) and utilities are often recommended as defensive holdings for recessions and bear markets. The thinking here is that, regardless of the economy’s health, people will always take their meds, eat, and drink, and they prefer to do so with the lights on.

The flip side to this argument is that defensive sectors may not be the best holdings during bull markets, when tech and more speculative stocks tend to lead the way.

However, health, consumer staples, and utilities have been more than defensive plays in 2014. All three currently outperform the S&P 500; healthcare leads the way, up 22%, followed by utilities, up 18.9%, and consumer staples, up nearly 12%.

P.P.S. Of the three sectors mentioned above, consumer staples and utilities currently have yields higher than the 10-year Treasury note. Consumer staples yield 2.38% and utilities yield 3.27, while the 10-year stands at 2.32%.

P.P.P.S. For the third year in a row, Barron’s has recognized Richard C. Young & Co., Ltd., as one of the top independent advisors in the country. For nearly 25 years, we have operated as an independent firm, meaning we do not underwrite securities or execute trades or custody assets. Our advice and investment decisions are free of the conflicts of interest that plague commission-based brokers and large Wall Street firms with securities to distribute.