A Conservative Bond Strategy

December 2016 Client Letter

The Wall Street Journal recently profiled the former CEO of the Cato Institute, John A. Allison, who was rumored to be a candidate for Treasury Secretary in the Trump Administration. Who better to help the new administration reinvigorate free-market capitalism in America than the former head of America’s leading free-market think tank?

Allison also has deep knowledge of the financial system. Prior to his post at the Cato Institute he was the long-time CEO of BB&T, a once-sleepy Carolina-based farm bank that Allison helped turn into one of America’s biggest regional banks. During his tenure as CEO, BB&T’s shares delivered shareholders a compounded annual return of 10.7% compared to 7.3% for the S&P 500 and less than 4% for the S&P Financials index.

BB&T’s success during one of the most difficult periods ever in banking can be traced to Allison’s conservative lending strategy. Many questioned Allison’s conservatism until the banking industry was deep in the throes of crisis. The WSJ explains:

Yet Mr. Allison instilled a conservative lending culture. BB&T avoided negative-amortizing loans and complicated structured products that Mr. Allison called “esoteric” and “illogical.”

That meant BB&T was often overshadowed by North Carolina rival Wachovia Corp., whose risky mortgage loans fueled huge growth before the crisis—only to then cause its downfall. That bank was purchased during the height of the crisis by Wells Fargo & Co.

Mr. Allison was unafraid to criticize his rivals or his regulators. In an interview during his final weeks as BB&T CEO, he complained that “til really very recently, we were told over and over that if we just had as good a risk management (model) as Wachovia, then we would do very well.”

While less known than his peers at big banks, Mr. Allison ranks as one of the most legendary bank CEOs in recent history, said Christopher Marinac, director of research at FIG Partners LLC. “He’s head of the class,” said Mr. Marinac. “A lot of folks didn’t understand the conservatism of BB&T until the crisis, but they appreciated it after.”

Sticking with a prudent strategy while your competitors are having success with a more cavalier approach takes patience, perspective, and perseverance. This is especially true for publicly traded companies where short-term performance pressure is immense.

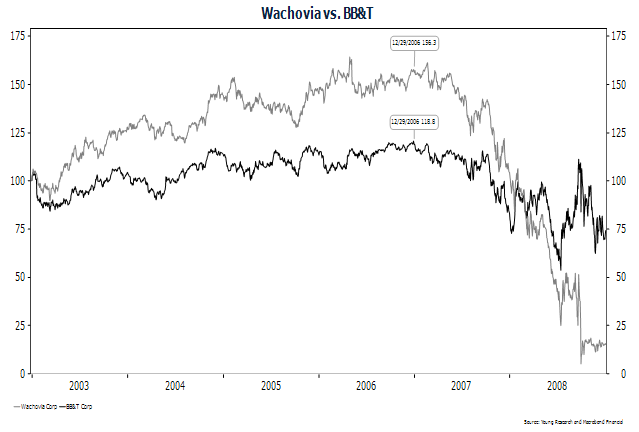

Our chart below compares the stock performance of BB&T to Wachovia (one of BB&T’s temporarily more successful competitors). The chart runs from year-end 2002 through year-end 2008 when Allison stepped down as CEO. For the four-year period ending in 2006—when the housing finance bubble was in full force—Wachovia shares returned 56% compared to 19% for BB&T. As soon as cracks started to emerge in the foundations of the housing boom, fortunes quickly changed. Over the next two years, Wachovia shares plummeted by 90% and were only spared from bankruptcy by a Wells Fargo takeover. BB&T shareholders were spared the threat of bankruptcy and much agony thanks to Allison’s prudence, perspective, patience, and perseverance.

Unfortunately, Trump did not offer Allison the Treasury Secretary job (or Allison turned it down). In my humble opinion and in the opinion of our Chairman, there was no better man for the job.

As a conservative investment counsel firm that specializes in balanced portfolios, we can sympathize with Allison’s position leading up to the financial crisis. When markets are calm, risk is often misunderstood and underappreciated by the investing public. This is true in both the bond market and the stock market.

A Conservative Bond Strategy

For a number of years now, our fixed-income strategy has been to maintain a short duration portfolio. In the bond market, duration is a measure of a bond’s sensitivity to changes in interest rates. Maturity and duration are related. The shorter the maturity of a bond, everything else equal, the shorter its duration. Bonds with lower duration are impacted less by changes in interest rates than bonds with longer durations.

To better explain duration, an example may be useful. The 2.125% Treasury note that matures on 12/31/2021 has a duration of 4.7. That means that for a one-percentage-point increase in interest rates, the price of this bond will decline by approximately 4.7%. If interest rates were to fall by one percentage point, the price of this bond would rise by approximately 4.7%.

With the Fed and other global central banks pinning short-term interest rates near zero and pressuring long-term interest rates lower with trillions of bond purchases, we have viewed the risk-reward in long-duration bonds as unfavorable. In our view, investors haven’t appreciated the risks in long bonds. This was especially true in July when long-term bond yields fell to record lows. Investors in long-duration bond portfolios looked like the smartest guys in the room when yields hit these lows, but the significant increase in interest rates since has taken all of the air out of that balloon.

From the low-point in long bond yields on July 8, the Vanguard Long-term Government Bond ETF has lost 16.6% of its value. The loss in the Vanguard Short-term Government Bond ETF over the same period was -0.84%. Investors who reached for additional yield in long bonds over the summer may now have a much greater understanding of the merits of a short-duration portfolio.

With a short-duration portfolio, we welcome increases in interest rates. Our clients’ short-maturity bond portfolios are well positioned for a rising interest rate environment. As interest rates rise, maturing bonds can be reinvested in higher-yielding bonds, thereby boosting interest income.

Stock Market Risk Underappreciated

We believe similar underappreciation for risk also occurs in the stock market. During bull markets, the risk in stocks can be overlooked. Investors flock to glamor stocks and other high-flyers that may be performing well, but whose long-term business prospects may be more suspect.

At Richard C. Young & Co., through thick and thin we pursue a dividend-based equity strategy that helps our clients harness the awesome power of compound interest.

I like to think of compound interest as your silent warrior. Ben Franklin said of compound interest, “Tis the stone that will turn all of your lead into gold.” Albert Einstein is said to have described compound interest as the greatest mathematical discovery of all time.

John Maynard Keynes, the famed (or infamous, depending on your point of view) economist, explained in a series of papers and lectures in 1928 what the awesome power of compound interest did for England.

Keynes traced England’s success from the late 16th century, starting with a treasure Francis Drake had stolen from the Spaniards in 1580. Keynes was writing at the height of the British Empire, and he chalked England’s success up to compounding. He wrote:

In that year he [Drake] returned to England bringing with him the prodigious spoils of the Golden Hind. Queen Elizabeth was a considerable shareholder in the syndicate which had financed the expedition. Out of her share she paid off the whole of England’s foreign debt, balanced her Budget, and found herself with about £40,000 in hand. This she invested in the Levant Company, which prospered. Out of the profits of the Levant Company, the East India Company was founded; and the profits of this great enterprise were the foundation of England’s subsequent foreign investment. Now it happens that £40,000 accumulating at 3.25 per cent compound interest approximately corresponds to the actual volume of England’s foreign investments at various dates, and would actually amount today to the total of £4,000,000,000 which I have already quoted as being what our foreign investments now are. Thus, every £1 which Drake brought home in 1580 has now become £100,000. Such is the power of compound interest!

Keynes further opined that “the power of compound interest over two hundred years is such as to stagger the imagination.”

The focus of Keynes’ speaking series was the future and the possibilities that awaited England’s grandchildren as they inherited the Empire. The damaging impacts of WWII unfortunately crushed the optimistic vision that Keynes laid out in his paper.

Despite the apparent risk-on sentiment in markets since the election, we continue to focus on dividend-paying companies operating in industries with high barriers to entry or offering durable competitive advantages. Not only do these types of firms lay the foundation for a powerful compounding program, but they have historically provided downside protection in bear markets.

The prospect of a corporate tax-cut and other potential pro-growth initiatives from the Trump administration surely brightens the economy’s near-term prospects, but the single most reliable indicator of future stock market performance is valuation. Today, stocks’ valuations are at some of their highest levels on record. That doesn’t guarantee the market is poised to fall (low long-term returns are also a possible outcome), but it certainly increases the risk of a downturn. In this type of environment, why wouldn’t an investor favor shares that provide greater downside protection?

In our view, many investors do not fully appreciate the role global central banks have played in supporting equity markets via negative interest rates and massive bond-buying programs. It is true the Federal Reserve has begun to scale back monetary stimulus, but the Bank of Japan and the European Central Bank (ECB) continue to inject liquidity into the global financial system at a rate of over $150 billion per month or almost $2 trillion per year. That’s nearly double the highest pace of monthly bond purchases from the Fed. The Bank of Japan has gone so far as to buy stocks directly, and the ECB is buying corporate bonds. Japan is now one of the top 10 shareholders in 30% of the stocks included in the country’s main equity indices. This level of intervention in markets by monetary authorities is simply unprecedented.

What happens to equity prices when these pillars of support are eliminated? We of course cannot be sure how today’s interventionist experiment will end, but we continue to prefer an investment strategy favoring a balanced portfolio featuring quality securities.

In my dad’s year-end investment strategy report, he concluded with comments, as he often does, regarding Ben Graham. Graham, the father of value investing, was one of the most successful investors of all time. My dad tells his readers, “If you have read The Intelligent Investor cover to cover, you are head and shoulders above the vast majority of the investing public. To this day, the amount of investing insight and wisdom packed into this single volume remains unmatched. Some of Graham’s most valuable advice was to the defensive investor. For example, Graham wrote, ‘One of the most persuasive tests of high quality is an uninterrupted record of dividend payments for the last 20 years or more. Indeed the defensive investor might be justified in limiting his purchases to those meeting this test.’”

Two decades of continuous dividend payments is a persuasive test of quality. This is especially true with today’s mergers, acquisitions, spin-offs, and other corporate restructuring activities. Only a minority of U.S. businesses survive for more than two decades in their same form, and an even smaller minority manages to make regular dividend payments for the entire period.

Our Retirement Compounder’s equity portfolio focuses on companies that have long records of not only consistently paying dividends, but also of increasing those dividends each and every year.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm Regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Johnson & Johnson, Inc. (JNJ), one of our long-held equity securities, operates six biotech incubators that provide startups with laboratory space, R&D support, and VC funding. JNJ’s researchers get to learn from working alongside others in the industry, and JNJ has the first eyes on any new developments that may come out of the incubators. Innovation has kept Johnson & Johnson at the forefront of the healthcare industry for over 125 years. That’s an unmatched record.

P.P.S. Barron’s recently outlined a bullish case for AT&T. “AT&T investors are getting the best of both worlds today. The stock’s 4.85% dividend yield is almost twice that of the 10-year Treasury and well above the 2% paid by the S&P 500. And with AT&T’s (ticker: T) stock trading at 13 times forward earnings, its valuation looks attractive. AT&T also offers growth potential. Under a President Trump, the telecom giant should benefit from a kinder regulatory environment and lower taxes. The company should also profit from its continuing move into media, particularly its proposed $106-billion purchase of Time Warner (TWX), now awaiting regulatory approval.” AT&T is a stock we own in many client portfolios.

P.P.P.S. After employee salaries and material spending, Procter & Gamble’s third-largest cost is in advertising. In our Retirement Compounder’s equity portfolios, we favor companies that produce premium brands with a perceived value greater than that of their competitors. P&G certainly fits this mold. Recently, P&G divested around 100 of its less valuable brands to focus on its better names. P&G is diverting the divested brands’ ad dollars into bolstering the company’s champions like Tide, Pampers, and Febreze. Each of these brands will get a boost in advertising “reach” by 10% to 20%. Additionally, Procter & Gamble has paid a dividend since 1891 and has a current yield of 3.25%.