A Lack of Breadth

November 2015 Client Letter

Despite modest gains in the U.S. stock market this year, most U.S. stocks are down year-to-date. Outside of a handful of names, it has been a challenging year for equities and most especially for global equities.

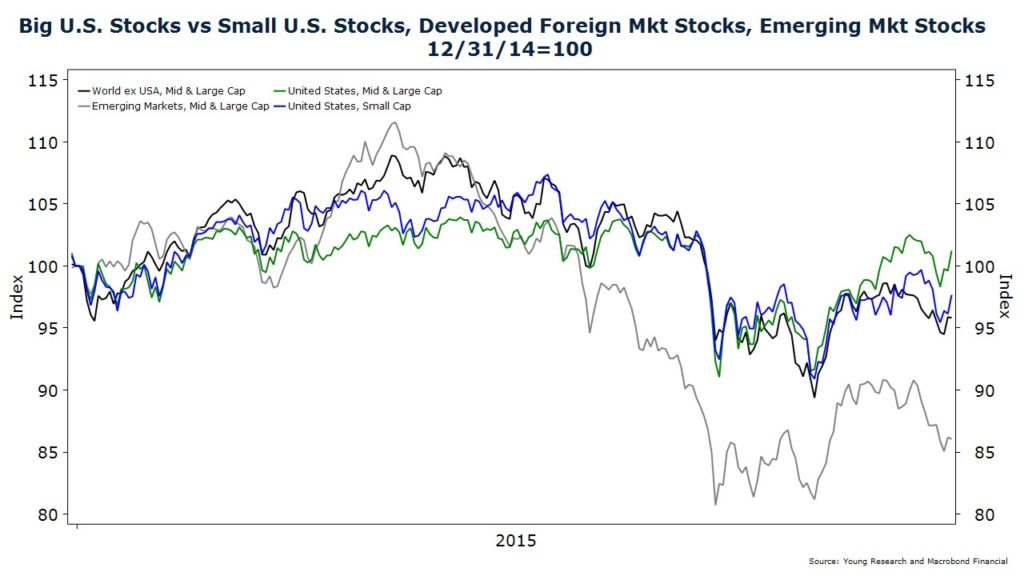

In the chart below we compare the performance of big U.S. stocks to small U.S. stocks, foreign developed market stocks, and emerging market stocks. The only group that has managed to stay out of the red YTD is big U.S. stocks.

How have the big-cap U.S. stocks managed to stay in positive territory when most companies in these indices are down on the year? Fewer and fewer big stocks are responsible for the gains. Analysts call it a lack of breadth. A recent USA Today piece explains.

In Wall Street-talk, a lack of market breadth refers to a condition when just a handful of stocks—normally large-company names with big market values—drive the performance of major stock indexes such as the Standard & Poor’s 500 index that are weighted by market-capitalization. Wall Street views stock rallies driven by a smaller and smaller pool of winning names as a sign of market weakness, lack of leadership and a dearth of strength under the surface of the broader market.

The term “Nifty Fifty” was born back in the late 1960s when a handful of growth stocks, such as IBM, Polaroid, McDonalds, drove the market up to dizzying heights before falling hard and wringing out all the exuberance in the 1973-74 bear market. A handful of hot tech stocks back in 2000 also drove the Nasdaq to dizzying heights before the tech stock crash.

“The 10 largest stocks in the S&P 500 have contributed more than 100% of the year’s roughly 2% gain” heading into this week’s trading, Verrone and Sohn noted. “By comparison, both 2013 and 2014 saw the 10 largest stocks contribute less than 20% of the year’s advance.” The 10 biggest stocks in the index accounted for just 19% of the gains last year and 15.2% of the index’s return in 2013.

The companies driving performance to the upside include the Amazons, Netflixes, Googles, and Facebooks of the world. Outside of these big-cap shares, the market has been weak. Quoting again from the USA Today piece:

To get a better picture of the ugliness under the surface of the market, read below all the sectors of the market that are in “poor shape,” says Kaltbaum. “We are not making this up.”

He says interest-rate sensitive areas like utilities, real estate and housing have topped or topping out [sic]. Add to that gold and silver, steel, junk bonds, rails, truckers, transports, farm machinery, disk drives, drug stores, hospitals, managed care, media, most commodities including steel, copper and aluminum, hotels, retail especially department stores, and restaurants. And just recently Kaltbaum says food, drugs, beverages, tobacco and household products, insurance, construction equipment and machinery, casino and gaming have joined the group. “Lastly, most oils, while rallying some and turning a little bit—are still not leading,” he says. “This just shows you what a big-cap market this is underneath the surface.”

So to summarize, the businesses that make things, move things, provide life-saving medical care, or produce food and hygiene products are lagging while a few websites and gadget makers are driving the market higher.

Investors who don’t own these Internet stocks and gadget makers are having a rough go of it. Fund managers who tend to be evaluated on a much-too-frequent quarterly or annual basis are taking serious career risk if they don’t own Google or Netflix. The risk of underperformance is so great that some submit to the pressure and chase returns by buying these riskier assets. But in our view it is difficult to argue that any manager buying these stocks is adhering to the Prudent Man Rule.

The Prudent Man Rule

The Prudent Man Rule directs trustees “to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.”

We doubt that many portfolio managers believe Netflix, trading at over 385X earnings, is anything but a speculation. It’s owned widely because many feel they have to own it if they want to remain gainfully employed. That’s not to say Netflix isn’t a useful service, or that Apple doesn’t make great products. I’m a Netflix subscriber and I own many Apple products, as I am sure many of you do. But companies that make great products don’t always make prudent investments.

Focus on Dividends

As many of you are aware, we are one of those advisors who eschew the Netflixes of the world, even if it means temporarily trailing the broader market averages. We aren’t focused on relative performance, and we advise you to take a similar view. In equity portfolios, we invest in dividend payers and focus only on those with a strong record of regular dividend increases.

Buying High Barrier to Entry Businesses

Our work doesn’t stop there, though. We also strongly favor companies and industries with high barriers to entry. It’s easy to forget that, after a couple of years of spectacular gains, many of today’s market leaders operate in some of the lowest barrier-to-entry businesses.

What’s the problem with low barrier-to-entry businesses? A recent Wall Street Journal included two notable articles that highlight the risks of investing in low barrier-to-entry businesses.

Flipboard’s Flop

The first article was titled Flipboard, Once-Hot News Reader App, Flounders Amid Competition. For those of you unfamiliar, Flipboard is an iPad app that allows users to read articles on the Web in a magazine-like format on tablets and phones. Flipboard quickly became one of the top 100 apps in Apple’s App Store. Then competition emerged. Zite, Pulse, Feedly, and Apple are all now competing with Flipboard. As are Facebook and Twitter.

Flipboard’s popularity has plunged. The app now ranks 1,030th among all iPad apps in the U.S. Its advertising revenue has fallen by half and the co-founder and chief technology officer have left the company. Flipboard is a private company so we can’t track the value of its shares, but it is probably safe to say Flipboard is worth a lot less today than it was a few years ago.

GoPro: No Barriers to Entry

The same is true of GoPro. GoPro makes wearable-cameras. A gentlemen founded the company in 2002 after a trip to Australia. He wanted to capture action photos of his surfing, but he couldn’t find quality equipment at a reasonable price. GoPro filled a need that the established players in the market hadn’t. But can you guess what happened as soon as GoPro proved there was a market for wearable cameras? Competition emerged. In its latest quarterly report, GoPro reported disappointing third-quarter results and gave weak guidance for the holiday season. The Wall Street Journal reports there are concerns the wearable-camera market is drying up, and GoPro is facing new competition from traditional camera makers like Sony and new entrants such as Chinese smartphone-maker Xiaomi Corp.

Over the last year, GoPro shares are down over 70% and the multiple that investors are willing to pay for a dollar of GoPro earnings has fallen from about 99X down to 14X.

When we evaluate the long-term prospects of a glamour stock such as Netflix, we struggle to see the sustainable barriers to entry. Up until now there has been a lack of competition in the streaming-video space. There has been some limited competition from Amazon and Hulu, but by and large Netflix has been the only game in town in video streaming. But what is true today may not be true tomorrow.

The competition is already starting to heat up. Hulu is now offering a commercial-free service, HBO now has a first-rate app, YouTube is offering a paid service with professional content, there is Sling TV, Apple is in talks to offer a TV bundle, CBS now has an app, and many other channels offer the same.

The new Apple TV could also be a game changer for the industry. Apple is now allowing developers to write their own apps for the Apple TV. That means the owners of content (the companies that now license their content to Netflix) can easily create their own app and sell their content directly to consumers on Apple TV, potentially cutting Netflix out of the equation.

Yes, Netflix now produces its own content, but as the major networks have proven over the years, producing good content consistently isn’t as easy as it sounds. And it could get even more challenging as the barriers to creating and distributing video content fall and consumer choice proliferates. Over the next 5 or 10 years, the content producers could face some of the same challenges publishers have faced over the last 10 years.

I don’t want to give you the impression we know for certain how the video-streaming industry will evolve. We don’t, but we do think it is speculative to pay over 385X earnings for a company that could face a fate similar to Flipboard, GoPro, or, maybe more appropriately, Blockbuster. High valuations and low barriers to entry just don’t make for a prudent long-term investment, in our view.

Our strategy remains focused on investing in companies that pay dividends, increase dividends regularly, and operate in industries with high barriers to entry.

One of our favorite areas of the market today is energy pipelines. In our view, the pipeline industry is the antithesis of the streaming-video industry. The barriers to entry are high. Pipelines own rights of way that are hard to duplicate, and the returns of pipelines are often regulated and protected from inflation.

We boosted pipeline exposure in many portfolios by initiating a position in three pipeline MLP exchange-traded notes (ETNs). MLP ETNs are debt obligations of issuing banks. They can be held in both taxable and tax-deferred accounts. To spread the credit risk, in many portfolios we’ve purchased multiple ETNs. The issuing banks are JP Morgan, Credit Suisse, and UBS. The yields on the three ETNs average about 7.5% today.

Pipeline shares have fallen in sympathy with the price of oil and gas, but pipelines are not directly impacted by falling oil prices. Most pipelines are like toll takers. They are paid based on the volume of oil, gas, and refined products transported over their pipelines. It is true that if U.S. oil production slows as a result of the fall in oil prices, growth prospects at some pipelines may be slightly dented. But when yields of 6%–8% are offered, we feel we can be patient until growth picks up again.

Have a good month and, as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. The Fed next meets December 16–17. Ninety-two percent of economists surveyed are expecting a rate hike. Investors are less confident in a hike. According to futures markets, investors put the probability of a rate hike in December at 69%. While we are hopeful the Fed will finally get off of zero, we would not be surprised if the Fed sits on its hands yet again.

P.P.S. Higher interest rates would be a welcome development, as far as we are concerned. Our clients’ bond portfolios have short maturities. As rates rise we will reinvest lower-yielding bonds that are maturing into higher-yielding bonds, thereby boosting portfolio income.

P.P.P.S. Higher rates could even be a stimulus to the economy. According to J.P. Morgan’s chief global strategist, the first few rate hikes could stimulate growth. One way higher rates can stimulate growth is by boosting interest income. According to J.P. Morgan, a one-percentage-point increase in interest rates would boost interest income by about $65 billion.