A Q&A on the Outlook

May 2012 Client Letter

As a trustee for the City of Naples Firefighter Pension Fund, I am particularly interested in observing how government retirement benefits are disrupting state and municipal finances. Across the country, state and local governments have accumulated trillions of dollars in unfunded retirement promises. To fund these costs, expect taxes to rise, services to be reduced, or a combination of both.

In the years ahead, government retiree costs are sure to play a dominant role in the competition among states to attract businesses and retain citizens. The race will be on to increase the tax base.

Not all states are in equally poor shape. Some states have already initiated reform or never made excessive promises to their workers in the first place. By example, Indiana’s debt for unfunded retiree health-care benefits amounts to about $80 per person. Neighboring Illinois benefits amount to $3,300 per person. Wow! In the current condition, what business or individual would make long-term plans to root in Illinois?

In Naples, the city pension funds are in relatively good shape. This month, our quarterly board meeting was extended over a full day and a half, allowing for extensive discussion with our pension fund consultant, investment managers, and a leading economist. Rather than having to fret about unfunded liabilities, the board devoted much time to the global economy and what could be expected from the equity and bond markets.

Following are several of the good questions and themes raised to our investment panel during the two-day meeting. The answers, however, are mine—reflecting how I would have responded.

Since 2008, it appears the U.S. economy is gradually getting better. And there appear to be small increases in hiring. Are things really improving?

Perhaps, but it is important to put the economic improvement in context. The Fed is still engaged in emergency monetary policy. Short-term interest rates are at zero—and the Fed has promised to keep rates low for another two years or more. There has also been an unprecedented expansion in the Fed’s balance sheet. Nobody knows for sure whether the Fed will be able to successfully unwind its balance sheet fast enough to prevent inflation and slowly enough to prevent another recession. We expect an exit from “emergency” monetary policy to be more complicated than Fed policy makers have suggested. And fiscal stimulus is still propping up the economy.

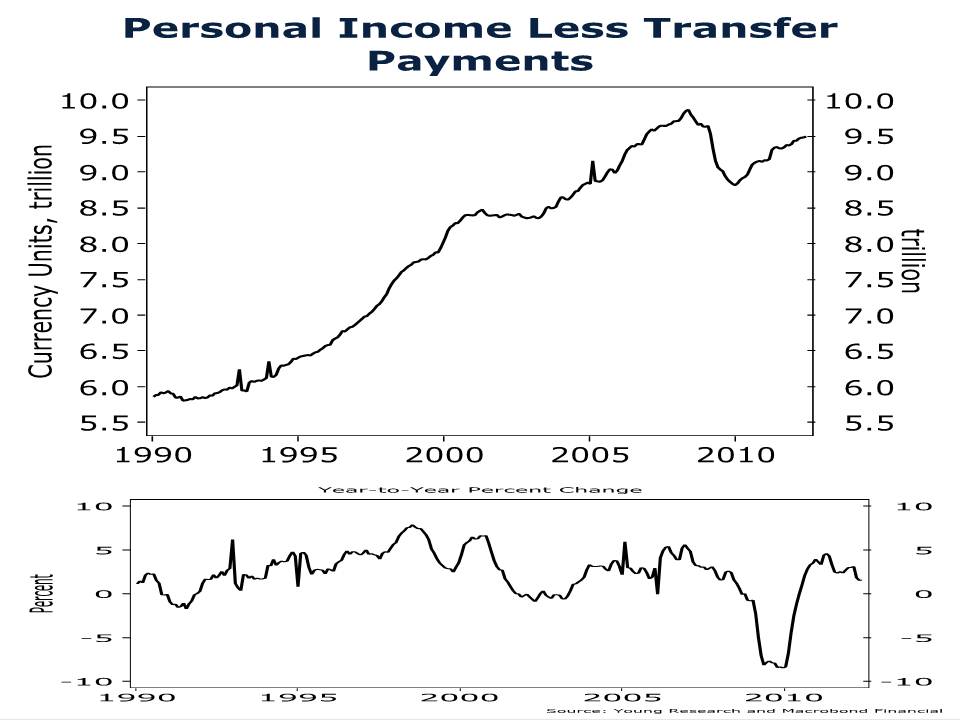

The below chart of real personal income less transfer payments gives an overview of the situation. (“Transfer payments” is doublespeak for income redistribution, just as “quantitative easing” is doublespeak for money printing.) Note the stagnant income growth. And this doesn’t adjust for the temporary payroll tax holiday. Without the tax holiday, income growth would likely be negative. This suggests that much of the improvement we have seen in consumer spending over recent months is attributable to a drawdown in the savings rate. So unless one is confident that zero percent interest rates, trillions in excess reserves, and trillion-dollar budget deficits are sustainable, there is still cause for concern.

Doesn’t a gradually improving economy also gradually lift the stock market?

Yes, most often in a slowly improving economy, one would expect the stock market to improve or at least not tumble, but there are a couple of things to point out here. 1) Large-cap U.S. stocks are more a play on global growth than U.S. growth. Europe is in recession, and many emerging economies are slowing. 2) The Fed’s easy-money policies have likely pulled forward some of the returns that investors would typically earn in an economic expansion.

Could we see a correction in stocks if the president and Congress don’t do something with taxes by the end of the year?

A correction is possible. Some of this may be discounted, and we aren’t of the view that the president and Congress will allow all of the Bush tax rates to increase.

What can be expected for capital gains taxes and dividend taxes?

I’m not yet convinced capital gains rates are going up much. Even under Clinton they were treated favorably. I know Obama has been talking about the Buffett tax, but this could be viewed as his first offer in what will be a negotiation. Before Buffett came out with his tax proposal, Obama was in favor of 20% dividend and capital gains rates. That might be a more likely outcome.

Europe is still a disaster waiting to happen. It’s just not certain that Germany can save the rest of them.

Yes, the euro area faces significant obstacles. It appears as though Europe’s bailout attempts are losing traction. The ECB’s massive liquidity injection (LTROs) into the euro-area banking system in December and February only bought a few months of stability before the latest flare-up. The political blowback from harsh austerity programs in many euro-area countries, especially in Greece, has escalated to a tipping point. The Greek anti-austerity party Syriza is gaining in popularity and may win an upcoming election. Syriza promises to renegotiate Greece’s bailout terms with euro-area policy makers, but the currency-union’s solvent members aren’t interested in negotiating. If Greece doesn’t move forward with the agreed-to austerity measures, euro-area policy makers have signaled that Greece may be pushed out of the common currency. The prospect of a near-term Greek exit from the euro has stopped the global equity rally in its tracks. Most European stock markets are now down on the year, and U.S. stocks have given up over 60% of YTD gains.

If Greece is pushed out of the euro, expect more volatility. The magnitude of the damage from a Greek exit will depend on the policy response. If policy makers can build a credible firewall around Spain and Italy, the damage could be contained. It is also possible that policy makers will cave or that Greece will back off of its demands and a new agreement will be reached that avoids a Greek exit. We’ll know more after the Greek elections in June.

Currently, inflation does not seem to be a big threat. There appear to be downward pressures on prices that offset upward pressures. Is this a fair assessment?

Yes, in a weak economy there is typically downward pressure on prices, but with trillions in high-powered money sitting idle on bank balance sheets, one might argue that the risk of future inflation is greater than it has ever been. And under the Bernanke Fed there has been a subtle shift toward accepting greater inflation as long as unemployment remains high.

As a country, the U.S. should benefit hugely from the abundance of newly acquirable natural gas. Exploiting our natural gas reserves could help spur the economy and lower prices.

Yes, there is significant opportunity for the U.S. from cheap energy. Gas itself has export potential, lower energy costs should attract energy-intensive manufacturing, and demand for U.S. gas for industrial uses should also pick up.

What keeps you up at night?

Unfortunately, one could draw up a rather robust list of issues to worry about. During my 19 years working with individual investors, I have found many to be fairly resilient in the face of general stock-market and economic swings. What seems to bother most, as well as myself, is the unknown. The improbable and unpredictable event is what causes sleep disruption. 9/11 was one such event. The collapse of Lehman Brothers and the associated fallout was another. The unknown event carrying significant impact is what concerns me the most.

In today’s uncertain political and economic environment, what gives you confidence?

From an investing standpoint, I take confidence in the durability of both a balanced investment strategy and the types of companies we purchase. A balanced portfolio helps to reduce the probability of extreme outcomes by including assets that may perform differently in different market environments. My dad calls this “counterbalancing” or “the teeter-totter effect.” As basic examples, gold is a hedge against extreme outcomes, and bonds tend to perform better in a weak economy or a deflationary environment. Stocks perform best when economic growth is strong and over the long term help hedge against inflation. Natural resources are a good asset to own in an inflationary environment. A combination of all four assets makes for a more resilient portfolio. We also invest in durable businesses. We favor companies that sell essential goods and services. Two good examples are utilities and consumer staples. Whether there is hyperinflation or a deflationary depression, most Americans will still light and heat their homes, and pay their water bills. And we hope that most would still brush their teeth, use tissue paper, and of course eat.

Have a good month, and as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. The recent Facebook IPO did not register on my enthusiasm meter. Personally, I find much to dislike about social media. Besides, Facebook as a business is not in the ballpark of the type of companies we buy. My prediction is that from an investment standpoint, social media companies have peaked.

P.P.S. There was a time when Atari, Walkman, Myspace.com and others were seen as cutting-edge technologies and even game changers in their respective industries. A problem with cutting-edge technology is that it operates in industries with relatively low barriers to entry.

P.P.P.S. At Richard C. Young & Co., Ltd., we tend to focus on businesses with high barriers to entry. These industries include transportation, energy, energy and water delivery, electricity, and food production. They have a tendency not to become obsolete. And companies within these industries, unlike most tech stocks, offer the potential for the ever-important dividend.