A Simple But Effective Strategy to Compound Wealth

April 2019 Client Letter

As you know, we are fans of the simple but effective strategy of compound interest. Compounding is the process of using your dividends to buy more shares of the company that just paid them to you. Over time, the act of continually reinvesting dividends creates a snowball effect in which your initial investment grows exponentially. The exponential growth of one’s savings is why Albert Einstein described compound interest as the greatest discovery of all time.

Looking back at the fourth quarter of 2018, compounding enthusiasts can see the bonus received even though the stock market was behaving terribly. As the stock market fell, most companies continued to pay dividends. For companies whose share price declined, those dividends were reinvested at not only a lower share price, but with a higher yield.

The P&G Example

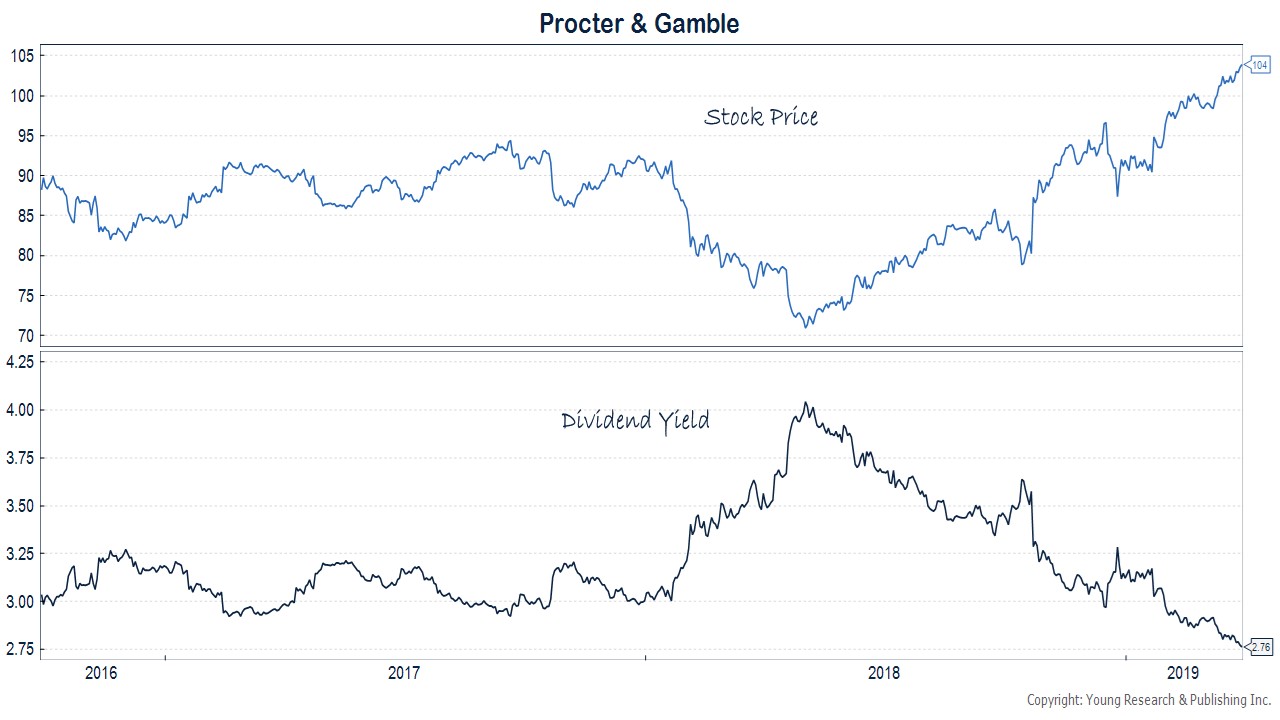

Procter & Gamble shares didn’t sell off nearly as much as the broader market last quarter, but in early 2018, they were down 23% from a prior high. The first quarter 2018 sell-off in P&G shares provided investors with an opportunity to buy more shares at a lower price and a higher dividend yield.

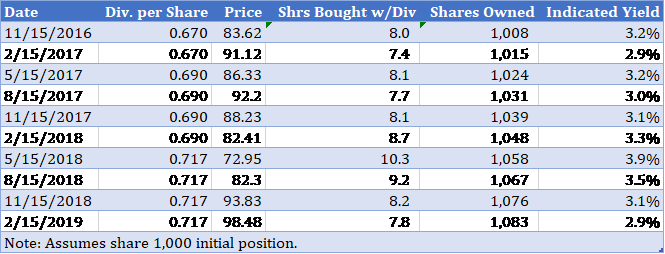

The table below shows the quarterly dividend pay dates for Procter & Gamble, along with the dividend amount, closing share price on that date, the number of shares purchased with dividend payments, and the indicated dividend yield based on the closing share price.

In November 2016, P&G was trading at $83 per share and offered a yield of 3.2%. P&G shares were range-bound for the ensuing 18 months until they fell to a low of about $70 in early 2018. Up until the second quarter of 2018, P&G’s quarterly dividend provided enough cash flow to purchase about eight more shares of the stock at an indicated yield of 2.9% to 3.2%.

With the May 2018 dividend payment, the dividend generated enough cash flow to buy an additional 10.3 shares at an indicated yield of 3.9%—a 25% increase in the yield earned on reinvested shares only two quarters prior.

P&G is one example of a broader trend that occurs when you invest and reinvest in dividend-paying shares during market downturns.

Opportunities for 4% Yields

The December volatility also pushed the yields on some of our other favored names above 4%.

IBM

Most Americans are familiar with IBM, the storied technology industry giant. The Computing-Tabulating-Recording Company (CTRC), which would later become IBM, was founded in 1911. CTRC built scales, clocks, and other devices for keeping track of information. The business would continue to grow and change, staying on the cutting edge of technological demand. More recently, IBM has been a pioneer of artificial intelligence (AI), with its Watson AI system that has become a household name and indispensable to some businesses. Alongside its AI, IBM is a major supplier of cloud and security services. The cloud-computing market is expected to grow by 18% per year until 2023 to $623.3 billion. IBM shares yield 4.5% today.

Verizon

Verizon is the descendant of some of America’s oldest telephone companies, but today it is on the cutting edge of wireless technology. Verizon is pioneering 5G ultra-wideband networks, which will be significantly faster than 4G and capable of carrying massive amounts of data. All that data capacity will be necessary to operate the coming “Internet of Things.” High data speeds and bandwidth will be necessary when nearly every device people use is hooked up to the Internet. Today, Verizon operates a 4G LTE network covering 2.5 million square miles and 98% of the American population. The company also runs a fiber-optic network providing high-speed Internet to six million customers, and a media company that includes major brands like Yahoo, Engadget, and TechCrunch. Verizon shares are yielding 4% today.

ExxonMobil

Another 4% yielder is ExxonMobil. This giant business is one of the world’s largest publicly traded energy and chemical companies. In 2018, ExxonMobil produced 3.8 million barrels of oil equivalent per day and sold 5.5 million barrels of petroleum products per day while selling 26.9 million tons of chemical prime product each day. In 2018, ExxonMobil recorded $36 billion in cash flow from operating activities, its highest since 2014. Exxon returns loads of that cash to shareholders and uses much of the rest to invest for the future. Last year Exxon spent nearly $26 billion on capital and exploration expenditures.

In addition to high yielding stocks like these, we incorporate more modest yielders that offer dividend growth potential into our investment portfolios. One such company is Air Products.

Air Products

One company that exemplifies my dad’s motto of “dividends today and more dividends tomorrow” is Air Products (APD). APD is a world-leading industrial gases company that sells products like bottled oxygen and acetylene to businesses. Air Products was founded by Leonard Parker Pool in 1940 to provide onsite production of industrial gases. Today the company has 16,000 employees and operations in 50 countries. Air Products’ board of directors has increased its dividend every year for the last 35 years. And for the last 10 years, the board has raised the company’s dividend at an average rate of 9.63% per year.

Patience is a Winning Approach

We advise regularly that patience often leads to long-term investment success. A patient approach has been a winning approach over the last six months. Investors who panicked and tried to engage in market timing by “getting out” during the December sell-off may have missed much of the subsequent rebound.

The Dangers of Market Timing

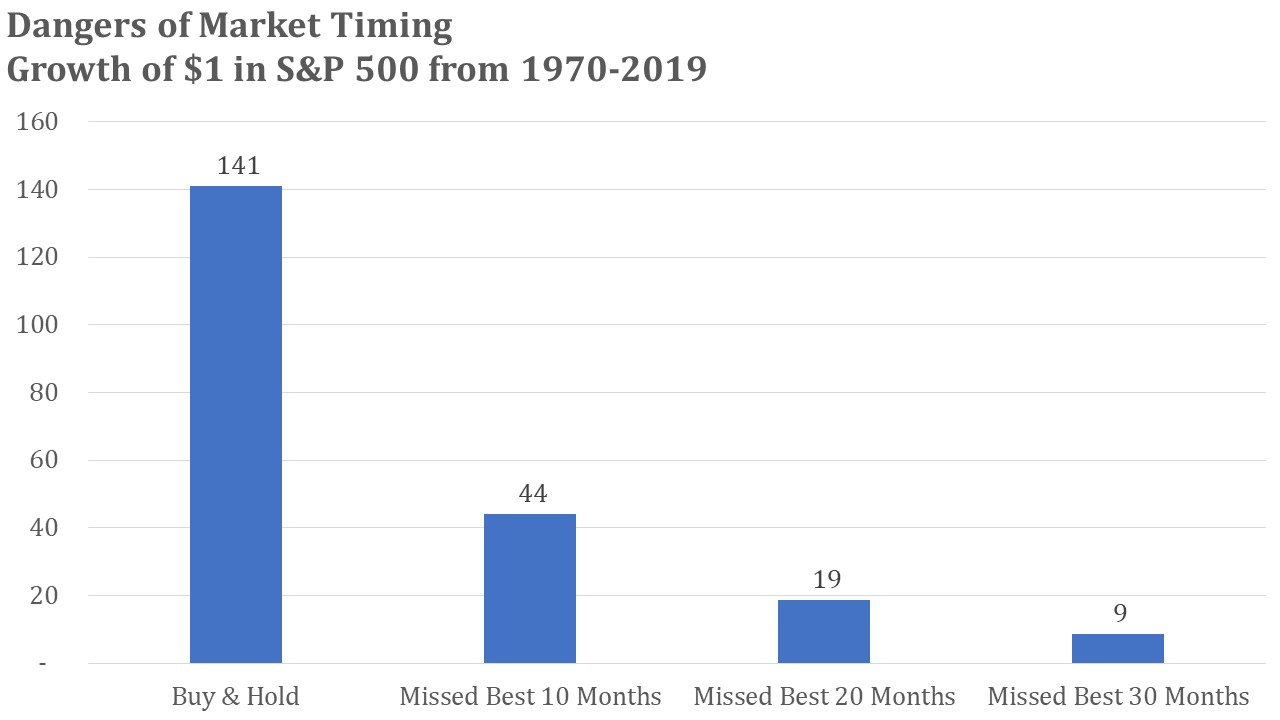

The chart below highlights the dangers of market timing.

If a buy-and-hold investor put $1 in the S&P 500 at the end of January 1970, he would have $141 today. If that same investor tried to time the market but missed the best 10 months, he would have $44 today. If he missed the best 20 months, that $1 would be worth a mere $19 today. Market timing not only risks losing out on significant gains, but it also risks missing vital dividend payments.

What’s Your Investment Plan?

One of the keys to successful investing is having a plan in place and a portfolio suitable for your individual financial needs and risk tolerance. You do not want to be in a position of panicking and realizing too late that your nest egg’s strategy does not sync up with your personality or financial goals.

As my dad reminded his readers in 2013, having patience and a plan is essential to long-term investment success.

Your goal should never be what to sell next; rather, it should be [about] what stocks you can hold through thick and thin. It is true that portfolio activity, for most investors, runs inversely to consistent long-term performance. How should you measure performance and how should you construct an all-weather portfolio? First, “all-weather” means you do not want to be jumping in and out of the market attempting to predict bull and bear markets. For five decades, I have been investing my own money as well as advising conservative investors saving for retirement. As such, I have invested through many gut-wrenching bear markets and disastrous single years like 2008, which ended with the speculative non-dividend-paying NASDAQ down a frightening 40% for the year. Through all the years of turbulence, I have remained fully invested in a balanced, widely diversified securities portfolio featuring a counter-balanced approach.

I have firsthand experience of what happens when counterbalancing is not in force. The Harleys I rode back in the old days had engines bolted straight to the frame. Talk about vibration and calamity. The constant vibration caused nuts and bolts to loosen and fall off. When you’re on a long-distance road trip, a breakdown in the middle of nowhere is cause for concern. I have found myself in just such a situation and it’s no fun. Today’s Harleys feature counterbalanced engines offering both a smooth ride and a minimum of road trip calamities.

A 2008 Test Kitchen

Counterbalancing simply makes common sense. Let’s look at 2008 as a test kitchen. All the broad averages got hit. High ground, so to say, was achieved by owning positions that got hit least. Consumer staples worked well; no matter how bad the times, investors are not going to forsake toilet paper, toothpaste, or their prescription drugs from Walgreens or CVS.

Counterbalancing a Core Strategy at Richard C. Young & Co., Ltd.

Counterbalancing is at the heart of how we manage portfolios for you. A mix of stocks and bonds helps reduce volatility.

As many of you are aware, the bond market has been challenging over the last decade. The Fed’s ultra-low interest rate policy and quantitative easing have made it difficult to generate interest income. That difficulty was reinforced following the Federal Reserve’s March FOMC meeting.

What Did the Fed Decide in March?

The Fed announced an even more dovish decision than Chairman Powell had hinted at in January. Powell took any additional rate increases in 2019 off the table and announced a much faster-than-expected end to the roll-off of the Fed’s balance sheet.

Bonds will stop rolling off the balance sheet in September, with a reduction in the pace of roll-off starting in May—that’s next month. During the crisis and in its aftermath, the Fed increased the size of its balance sheet by $3.6 trillion, but it is only taking back about $750 billion of that amount.

Inflation is the Patsy

The Fed justified this pivot to an easy money stance by claiming it hasn’t credibly achieved its symmetrical inflation target of 2%. In other words, Powell & Co. want to see inflation above 2% before they consider raising rates.

Core inflation was running at 1.94% at the time the Fed announced that decision. So, if Chairman Powell is to be taken at his word, getting an indicator that measures inflation in a $21-trillion economy up a few basis points is vital.

We’re suspect.

The real motive here looks to be putting a floor under the level of asset prices. There’s really no other credible way to explain the Fed’s behavior, in our opinion. Despite evidence that suggests monetary policy managed for the level of asset prices is at the heart of the boom-and-bust cycles of the last two decades, the Fed appears unphased.

How Are We Investing Under the Fed’s New Interest Rate Regime?

With the Fed’s decision in March, the odds we are at the top of the interest-rate cycle have increased meaningfully, in our view. It is not a foregone conclusion, but the bar appears to have been raised significantly for further interest-rate hikes.

That doesn’t necessarily mean a recession is right around the corner, but it is a recognition this expansion is 10 years old, U.S. growth has slowed some, global growth is soft, and the yield curve is inverted.

Looking to next year, we can envision a further step down in U.S. growth. The cyclical effects of the tax cuts are likely to fully wear off by next year. There will be positive supply-side effects from the tax cuts, but we don’t expect those to kick in during an election year that is likely to bring greater uncertainty over the future path of fiscal policy. Polls are likely to be close next year, and some of the politicians’ proposals may dent confidence for businesses and high-income households.

Unconventional Monetary Policy Will Make a Comeback

Contemplating the end of the economic cycle (call it the medium term), we anticipate the Fed will quickly take rates down to zero and bring back unconventional monetary policy. It’s possible the Fed tries to move rates into negative territory or caps long-term interest rates. QE will likely be ramped back up and we would expect it to be much greater in magnitude than prior versions. We’ve seen commentary from some Fed board members about announcing QE that doesn’t stop until economic expansion is sustained.

Fixed-Income Positioning for the Late Cycle

To better position fixed-income portfolios for the road we see ahead, we are gradually moving toward a barbell approach. A barbell approach invests in long-term bonds and short-term bonds. Initially, we will look to target about 20% of fixed-income portfolios in long-term bonds with the remaining 80% in shorter-term maturities.

A barbell approach should provide a greater hedge to portfolios in the event of a downturn in equity markets. This strategy will also incrementally add yield on both the Treasury and corporate side. In Treasury portfolios, longer maturity issues offer higher yields than short-to-intermediate term notes. On the corporate side, spreads on longer-term bonds tend to be wider than they are for short-term bonds. For example, looking at the A-rated Merrill Lynch corporate bond indices, the 1- to 5-year index offers a yield advantage above Treasuries of 0.57% compared to 1.27% for the 10- to 15-year index. Both indices have similar credit quality and duration risk.

As the economic and interest-rate cycles continue to evolve, so too will our fixed-income strategy.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. By this point, people are accustomed to every new product from Apple being described as the “next iPhone.” But with demand for the iPhone seeming to ebb, Apple is making a pivot to build its services business, announcing at a recent event new streaming TV, gaming, magazines, and credit card products. Can services ever be the “next iPhone?” Tripp Mickle reports on Apple’s new strategy for The Wall Street Journal:

In January, Apple reported its first decline in revenue and profit for a holiday quarter in over a decade. By contrast, revenue from the services business grew 33% last year, to nearly $40 billion—accounting for about 15% of the company’s total of $265.6 billion. The company’s ambition in video is to become an alternative to cable, combining original series with shows from other networks to create a new entertainment service that can reach more than 100 markets world-wide. It is the tech giant’s latest attempt to reinvent television, something it has tried to do for about a decade with limited success.

P.P.S. In February, sales of existing homes in the U.S. increased by 11.8%. Laura Kusisto of The Wall Street Journal explains that the market appears to be driven by the strong labor market and rising wages:

Sales of previously owned homes posted their largest monthly gain since 2015 in February, a sign that lower mortgage rates and more attractive prices are helping to lure buyers back to the market just in time for the critical spring selling season. Existing home sales rose 11.8% in February from the prior month to a seasonally adjusted annual rate of 5.51 million, the National Association of Realtors said Friday. That was the second-strongest monthly gain in home sales ever.

P.P.P.S. In a recent op-ed in The Wall Street Journal, Senator Rick Scott of Florida, the state’s former governor, discussed the flight of wealthy Northeasterners, especially New Yorkers, to Florida and other low-income-tax states. The cap on the deduction for state and local taxes has hit the wealthy especially hard in high-income-tax states. Now, wealthy New Yorkers, New Jerseyites, and others are following the fixed-income crowd to places like Florida, Texas, and South Carolina for low taxes and better weather. Scott writes that politicians from high-tax states should “commission a study of Florida to see what happens when conservative ideas are put into practice. The luxury real-estate market in Manhattan may be sagging, but Florida’s economy is thriving, expanding at a record pace.” It sounds like a good idea.