An Unusual Year

October 2020 Client Letter

A combination of market volatility, political and economic uncertainty, and many unsettling events in the U.S. have delivered one of the most challenging and unusual years we have faced as investors. The year began on a positive note. In January, annual GDP growth was expected to be about 2%, unemployment rates were near all-time lows, and the most concerning headline for the markets was a trade war with China. All in all, we were cruising along nicely.

And then a black swan hit when the global economy was shut down in response to COVID-19. For good measure, the U.S. added trillions of dollars in stimulus, short-term interest rates were cut to zero, riots and burnings ensued, and we witnessed a circus of an election season. It’s enough to make one wonder how all these events could possibly be compressed into a mere eight months.

While the stock market has rebounded significantly from its March lows, and third-quarter GDP rebounded at a 33%-plus annual rate, there is nothing stable or certain in the world in which we currently invest.

Instability an Ever-Present Danger

Where might instability strike? COVID and the evolving reaction to COVID remain top of mind as a potential risk to stability. But the risks with the most impact are often those that few are thinking about.

A prolonged period of easy money is one risk we worry about. Easy money isn’t a risk in and of itself, but prolonged periods can act as a magnet for black swans (rare but impactful events). Easy money sets the conditions for risk to build, unnoticed, or underappreciated, in the system.

Risk-seeking behavior may increase more this cycle than in past cycles. During the spring, we had perhaps the biggest bailout of speculators, hedge funds, and over-leveraged companies in history. It is unlikely these actors have been humbled by their near collapse. On the contrary, many have likely been emboldened to take more risk. The red lines of who will be bailed out have been thrown out the window. Even formerly prudent investors may be letting down their guard on proper risk management.

Federal Reserve Bank of Boston President Eric Rosengren has pointed out the risks associated with prolonged easy money. Mr. Rosengren believes today’s loose policies have created an unstable buildup of risk in the financial system.

Rosengren opposed the Fed’s effort to bail out the stock market in 2019 with low-interest rates and now believes low rates are having a negative impact. Rosengren pointed to a buildup of debt in the commercial real estate market and other sectors. The reach for yield from low rates within these sectors may have allowed problems to fester. He said:

The increased risk buildup, such as the reaching-for-yield behavior in commercial real estate or increased corporate leverage, make economic downturns including this one more severe. These are issues that I and others spoke about quite extensively in the years before the pandemic hit.

If we expect to remain in a low-interest-rate environment for a protracted period of time, we need to take more precautions against financial stability risks for when the next economic shock hits.

Concentration Risk of Market

The concentration of the companies driving the stock-market rebound is also a risk to stability. We often think of the stock market in terms of specific indexes such as the Dow Jones Industrial Average or the S&P 500. The Dow is a price-weighted index of 30 companies, with the top five accounting for 30% of the value of the index. The S&P 500 is market value weighted, and its top five names account for 23% of its value. One sector—and one that is most unfriendly to the income-oriented investor—accounts for nearly 40% of the S&P 500.

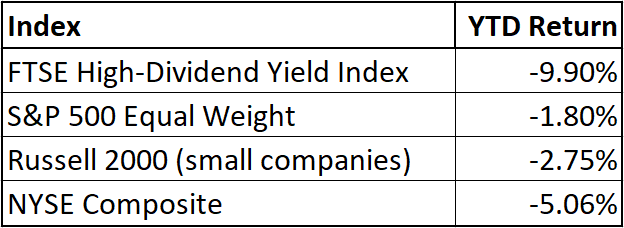

Both the Dow and the S&P are up YTD, but take out the top five names in the S&P 500, and it would be down about 1% for the year. A broader look at markets shows that the perceived stability and complacency some have in the stock market may be unwarranted. As the table below indicates, an index of dividend stocks is down YTD, as is an equal-weighted index of the S&P 500. Small stocks and the NYSE Composite index are also down on the year. What would happen to the perceived stability of the market if the top five stocks in the S&P 500 cratered? Healthy stock-market recoveries are broad-based recoveries.

Benchmark Investing Counterproductive Today

For many reasons, index investing is a strategy we find counterproductive today. Paul Woolley, writing at the Financial Times, explains some of the problems with index or benchmark investing:

All investing boils down to a choice of two distinct strategies implemented in a variety of ways. One is buying securities that are priced cheaply in relation to their expected future cash flows, which is what everyone assumes is done with their savings.

Bizarrely, the other is almost the exact opposite: buying securities whose prices have recently been on the rise or that have already gone up most, both without reference to fundamental value. Another version of this, though present on a lesser scale, is selling assets that have recently been going down in price.

This second strategy has its origins in what might justifiably be termed “the curse of the benchmarks”. Most large funds delegate to external asset managers by setting index benchmarks, often with limits on how far returns should stray from the index return. Benchmarking is now shown to amplify mispricing by forcing managers to chase prices instead of fundamental value.

Trend-riding momentum investors successfully game this response, pushing prices higher knowing that benchmarkers are likely to come along later and be prepared to pay more. Price-only investing explains much of what is going wrong in financial markets. It is also the essence of short-termism.

When investors obsess about prices, corporate bosses are encouraged to do the same. With the added incentive of early-exercise stock options, they seek to maximize the company’s share price instead of building the business for the future. Among the ways to do that are reducing capital expenditure and research and development, focusing on quick pay-off projects, share buybacks, and raised debt levels.

In our view, it isn’t investing unless it is done with reference to fundamental value. Speculators focus on price. Investors focus on long-term value. As my dad’s late friend Dave Hammer (RIP) once put it, “If you don’t know what something is worth when you buy it, you will never know when to sell it or when to buy more.”

What Type of Outlook Should Investors Adopt?

If you are like most investors who are in or nearing retirement and you rely on—or hope to rely on—portfolio income, you will need to continue to invest a certain percentage of your portfolio in stocks. Due to the extremely low-interest-rate environment, hunkering down with a sizeable commitment to safer securities such as CDs and short-term Treasuries may not be the best move. After inflation, short-term CDs and bonds are in the red. And there is no sign that will change for at least a few years.

At its recent FOMC meeting, the Fed gave strong indications it will keep short-term interest rates near zero for the foreseeable future, which could mean through 2024. If that scenario plays out, CDs and short-term Treasuries will offer essentially no return for three-plus years. No return is better than a loss, but it is not a long-term strategy for generating income or compounding wealth.

Focus on Quality

Our strategy for the period ahead remains as consistent as it has always been. We plan to invest in dividend-paying stocks with a record of making regular dividend increases.

Companies such as Union Pacific and Johnson & Johnson are the types of businesses we favor.

Union Pacific

Union Pacific Corporation is a railroad company incorporated in 1969 but with roots back to 1862 when President Abraham Lincoln signed the Pacific Railway Act. The Union Pacific Railroad was one of two companies charged by the Act with the task of laying 1,912 miles of track from Omaha to Sacramento to create the Transcontinental Railroad. Today, UNP’s tracks cross 32,200 route miles. Many run through difficult-to-replicate rights of way that UNP has held for decades. Startups would be hard-pressed to compete in areas where UNP already has a unique presence. Today, UNP’s shares yield 2.22%, with plenty of money on the balance sheet to pay dividends.

Johnson & Johnson

Another company that meets our criteria is Johnson & Johnson—founded in 1886 by Robert Wood Johnson, with his brothers James and Edward, to produce antiseptic surgical dressings and sutures. Today, Johnson & Johnson is the world’s largest and most broadly-based healthcare company. Johnson & Johnson has a strong dividend record, having increased its payout each year for the last 55 consecutive years. Over the last ten years, Johnson & Johnson’s board has increased the dividend at an average rate of 6.87%. Johnson & Johnson is at the forefront of research on treatments and vaccines for COVID-19. The company has tasked its four innovation hubs in Boston, London, San Francisco, and Shanghai with working alongside startups and entrepreneurs to develop next-generation pharmaceuticals, medical devices, and consumer products to solve the world’s health problems. The innovations of today are meant to secure Johnson & Johnson’s competitiveness for years to come.

Both Johnson & Johnson and Union Pacific possess many of the characteristics we look for in our equity portfolios:

- High barriers to entry and durable/proven business models where we have a level of comfort around what the economics of the business will look like in 5 to 10 years;

- Strong balance sheets and/or readily available access to capital markets;

- Reasonable valuations given the growth characteristics of the business; and

- Higher yields over lower yields and higher dividend safety over lower dividend safety.

In contrast:

- We tend to avoid industries with high risk of disruption or structural challenges; and

- We avoid long-shot situations.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Gold prices have soared YTD, handily outperforming most major and minor stock market indices.

Falling bond yields, a weaker dollar, risk of rising inflation, and a hedge against stock market and general economic turmoil are the likely catalysts for gold’s rise. We have owned gold ETFs in client portfolios almost since the first gold ETF was listed in the U.S. My dad’s history with gold and silver goes back to the 1970s. We view gold as an important component of a well-diversified portfolio, but moderation is the key. We would rarely advise more than a 10% weighting in gold. Gold is a hedge. It is an asset we would much rather see fall in price than rise, as falling gold prices are most often associated with rising stock and bond prices.

P.P.S. A friend of our family recently asked my dad for investment advice. This person was not looking for individual stock recommendations but rather looking for basic advice on strategy. Our friend requested the advice not be technical as it was going to be provided to a novice investor. Here is what my dad wrote:

- I rarely invest in stocks that pay no dividend.

- I also insist on long-term annual dividend growth. Over the long term, stock prices most often follow dividend increases upward.

- I don’t like companies with high P/E ratios. In fact, stocks with single-digit P/Es are most appealing.

- Consumer expenditures account for $7 out of every $10 of real GDP, so I use Vanguard’s broad Consumer Staples ETF portfolio as a handy shopping list for many of my individual stock purchases. This allows me to craft portfolios with an average yield of nearly 3%.

P.P.P.S. Consumer staples shares have long been among our most favored areas of the stock market for the conservative investor. The defensive nature of their businesses tends to help staples stocks hold up better during recessions than more cyclical businesses. Toilet paper, toothpaste, breakfast cereal, and groceries aren’t the most glamourous products, but they are purchased in good times and in bad. The reliable nature of demand for toilet paper and toothpaste, by example, allows staples companies to offer investors consistent dividend growth regardless of the current position of the economic cycle. In fact, more than a dozen consumer staples companies are members of the Dividend Aristocrats club, which comprises companies that have increased their dividends for at least 25 consecutive years.

P.P.P.P.S. Each year, Barron’s ranks the nation’s top independent advisors. Richard C.

Young & Co., Ltd. has been recognized on this list for nine consecutive years.*

* Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Rankings are generally limited to participating advisors and should not be construed as a current or past endorsement of Richard C. Young & Co., Ltd. Barron’s is a trademark of Dow Jones & Company, Inc. All rights reserved.