Bond Outlook: Dow 20,000 is the Undercard

January 2017 Client Letter

My dad has written for decades that the two most important words in investing are compound interest. Over time, the power of compounding is profound. One of Dad’s oldest friends in the investment business, Dave Hammer, recently relayed a story about the power of compounding that I would like to share with you.

Dave’s great-grandfather, who came to the U.S. from Scotland to work for GE around 1912, used his first paycheck to buy a single share of GE stock. Today, each of his 23 great-grandchildren, including Dave, now have $30,000 worth of GE stock. The compounded annual rate of return on that single share of GE stock with dividends reinvested was 9.50%.

I trust that most of you, like me, would jump at the chance to compound your money at 9.5% for over a century. Unfortunately, for much of the last decade compounding has been tough sledding. Central banks’ near-zero interest rate policies have impaired the power of compounding. By example, at the 0.25% rate of interest paid on money funds and CDs for the last eight years, it would take almost 280 years of compounding to double your money. At a 4% interest rate, it would take only 20 years to double your money.

Fortunately for income investors, savers, retired investors, and you and me, the Federal Reserve has finally started to normalize interest rates. It has been a frustratingly slow process, but it is an improvement nonetheless.

Bond Outlook: Dow 20,000 is the Undercard

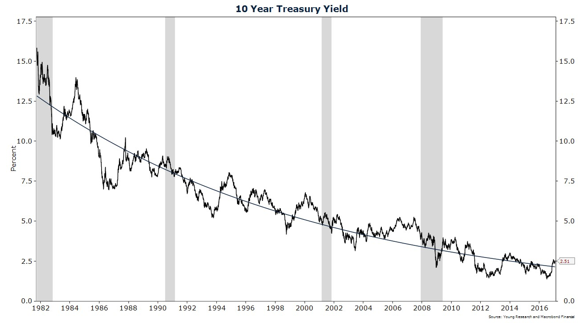

With interest rate policy normalization underway and investors anticipating a pro-growth/pro-inflation agenda from the Trump administration, the secular bull market in bonds may have drawn its final breath last summer.

We won’t know for sure when the multi-decade bull market in bonds ends for some time, but an early signal may come when the 10-year Treasury note breaks above the 2.60% yield level. We consider this to be a much more meaningful milestone for investors than Dow 20,000. And we aren’t alone in that belief.

Bill Gross, the former long-time manager of the PIMCO Total Return Fund, one of the world’s largest bond funds, recently warned that a move above 2.6% would break a trend-line that has been in place since the late 1980s. According to Gross, “It is the key to interest rate levels and perhaps stock price levels in 2017.”

If bonds are entering a secular bear market, should you sell your fixed-income holdings? We advise against such a strategy. Bonds act as a counterbalance in a diversified investment program. And for investors in or nearing retirement, bonds are a necessary volatility dampener in retirement income portfolios.

Going forward, bond returns (and stock returns, for that matter) may not live up to the returns earned over the last 30 years, but a bond portfolio can still deliver meaningful performance in a secular bear market.

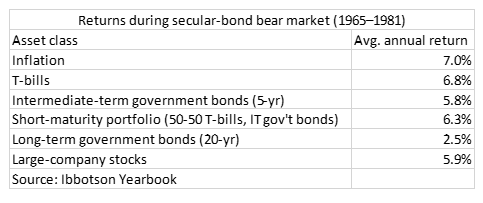

The last big secular bear market in bonds ran from year-end 1965 through 1981, give or take a couple quarters. Inflation raged during this 16-year period, and T-bills, the shortest maturity government securities, performed best (see table). T-bills are ultra-short maturity instruments that, in a rising interest rate environment, allow investors to quickly reinvest maturing proceeds at higher prevailing interest rates.

Hindsight is 20/20, so it would not have been prudent for an investor to place his entire portfolio in T-bills at year-end 1965, expecting to beat stocks and longer-term bonds. If interest rates didn’t rise as far and for as long as they did, a T-bill portfolio might have significantly lagged a longer-maturity government-bond portfolio.

A more prudent approach in 1965 might have been to target a short average-maturity. In the table below we show the hypothetical performance of a short-maturity portfolio, proxied here with a 50-50 portfolio of T-bills and intermediate-term government bonds. The average maturity on this portfolio is about 2.5 years.

During this 16-year bond market bear, a short-maturity government-bond portfolio outperformed both stocks and longer-term government bonds, and it did so with less risk. The portfolio did lag a T-bill-only portfolio, but only by about 0.50% per year.

We aren’t anticipating a secular-bond bear market the magnitude of the one from 1965 to 1981, but a more tempered version of that bear market is possible. Our advised strategy for investing in bonds in a secular bear market is to be tactical and err on the side of keeping maturities and durations short.

That doesn’t mean we won’t vary the maturity and duration profile of our clients’ fixed-income holdings in an effort to take advantage of cyclical fluctuations in interest rates. It simply means if we don’t have a strong feeling on the direction of interest rates, our plan is to minimize risk by keeping maturities short.

Donald Trump and the Economic Outlook

I have written in recent letters that our firm believes the economy is in the winter stage of the economic cycle but that we don’t see the immediate risk of recession. Does a Trump victory change our economic outlook?

Dan Mitchell, a Senior Fellow at the Cato Institute, recently wrote on Trump’s policy and the road ahead.

For the next four years, I suspect I’m going to suffer a lot of whiplash as I yank myself back and forth, acting as both a critic and supporter of Donald Trump’s policy.

This happened a lot during the campaign, as Trump would say very good things one day and then say very bad things the next day. And now that he’s President-Elect Trump, that pattern is continuing. Consider his approach to American businesses. In the space of just a few minutes, he manages to be a Reaganesque tax cutter and an Obamaesque cronyist.

I guess the only way to make sense of Trump’s policy is that it’s a random collection of carrots and sticks. The carrots are policies to encourage companies to create jobs in America, and Trump is proposing both good carrots such as a much lower corporate tax rate and bad carrots such as special Solyndra-style handouts (except, instead of loot for green energy, firms get loot for maintaining production in America).

And the sticks are all bad, ranging from public shaming to explicit protectionism. […]The mere fact that politicians think they have the right to interfere with the internal decisions of companies is a dangerous development.

It’s cronyism on steroids.

And even if Trump somehow restrains himself (how likely is that?!?), sooner or later that bad mentality will lead to bad policy. […]

My fear is based on lots of real-world evidence.

Consider the federal income tax, which started as a simple 2-page form with a top rate of 7 percent, but now has become a 75,000-page monstrosity with confiscatory rates.

We share Dan’s sentiment. President-Elect Trump and the Republican-controlled Congress have signaled an intention to pass a pro-growth agenda focused on tax reform, regulatory reform, and infrastructure spending, but Trump has also come out with some bad carrots and disturbing sticks.

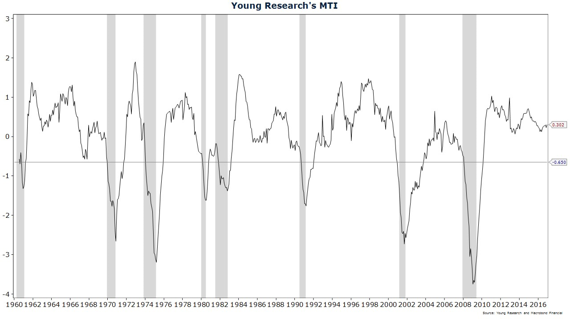

We will of course be monitoring how Trump’s carrots and sticks affect the economy and your investments. Our favored guides to how Trump’s policies will impact the economy are Young Research’s new Market Tension Index (MTI) and the Conference Board’s Leading Economic Index.

Young Research explains the MTI as your GPS to the economic road ahead. The MTI is a composite index of indicators that have historically peaked at the onset of recession. Below is a long-term chart of Young Research’s MTI. The shaded areas indicate periods of recession in the economy.

As you can see in the chart, Young Research’s MTI begins to fall sharply at the onset of recession. Every drop in the MTI does not signal recession, but every time since 1960 that the MTI has dropped below -0.65 (the horizontal line on the chart), after a period of economic expansion, the economy has entered recession.

At a current reading of 0.24 the MTI remains in expansion territory. So no recession signaled, but a late-cycle feel, in our view. For recession to be called by the Leading index, we would want to see three months of revised negative data. The last two months of data were up and flat, meaning that if there are no further negative revisions to past data, it would not be until May, at the earliest, that the leaders could signal recession.

Stock Market Opportunities

Since the election, stocks have rallied to new highs from what we believe were already lofty levels. Can the rally continue? While tax reform and other pro-growth measures are bullish for stocks, the prospect of higher interest rates and trade spats are negatives. We continue to approach stocks with caution and prefer to focus on areas of the market where we still see opportunity.

Financials are an area where we think prospects have recently improved. With Trump in the White House and Republicans controlling both houses of Congress, an effort to roll back Dodd-Frank financial regulations are likely and interest rates—after years of being pinned near zero by misguided monetary activism—should start to rise. With both earnings and valuations depressed in the banking industry, its investment prospects look much brighter than they did only a few months ago. The bank shares we own in client portfolios have rallied sharply since the election. The big custody banks—Bank of New York Mellon and State Street—remain some of our favored banks. We also like PNC Financial. PNC is a diversified regional bank with a large share of income generated from fees as opposed to interest income. PNC also owns a significant interest in BlackRock, a leader in the booming exchange-traded fund business.

Another sector we like, and one that has fallen out of favor since the election, is healthcare. Investing in out-of-favor areas of the market is by definition never a popular strategy, but we think it offers long-term opportunity.

The great John Neff was a master at buying out-of-favor shares. Neff was long-time manager of the Vanguard Windsor Fund. From the time he took over management of the fund in 1964 until his retirement in 1995, he compounded investors’ money at 13.7% per year compared to a 10.6% return for the S&P 500. On a $10,000 initial investment, that performance advantage amounted to over $331,000.

How did Neff do it? He invested in the forlorn, the unloved, and the out of favor. John was noted for his patience and willingness to be out of sync with the market for extended periods. He took over Windsor with the intention of taking outsized positions where he saw opportunities for promising returns. In an industry focused on quarterly returns, that takes guts, patience, and perseverance.

In his book, John Neff on Investing, John writes,

My inclination to buy out-of-favor stocks comes naturally, but by itself doesn’t account for beating the market. Success also required lots of perseverance. You have to be willing to hang in when prevailing wisdom says you’re wrong. That’s not instinctive; more often than not, it goes against instinct.

Neff’s strategy was simple. He invested in low-P/E stocks with solid fundamental growth. He favored yield when possible, only took cyclical exposure when he was being compensated for it, and sought out solid companies in growing fields.

CVS, a stock we own in many client portfolios, would likely check many of Neff’s boxes today. We view CVS as a high-quality business operating in a growing field. The shares trade for 14.2X next year’s earnings, and we are looking for long-term growth of 8%+ per year. The S&P 500 sells for 17.2X next year’s earnings, and we anticipate long-term growth of no more than 6% per year. If you consider CVS an above-average company as we do, you are getting a higher-quality company than the average S&P 500 company, at a better price.

What’s more? In our view, CVS has a powerful growth-tailwind at its back. The company is the largest pharmacy healthcare provider in the U.S., with over 9,600 pharmacies and 1,100 walk-in medical clinics, and is a leading pharmacy benefits manager, delivering services to over 80 million members.

Seventy-six percent of the U.S. population now lives within five miles of a CVS pharmacy. Why does CVS’s pharmacy footprint provide a powerful growth-tailwind to the company? Demographics are the key here. The number of Americans aged 65 and over is expected to increase by 18% over the next five years and 38% through 2025. This older demographic uses twice the number of prescriptions than the under-65 population. Increased utilization, combined with growth in specialty medications, is expected to fuel a 6% rise in prescription spending annually over the next decade.

Have a good month. As always, please contact us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President & Chief Executive Officer

P.S. The greatest wave of technological innovation since the dot-com era could be developing right now. But it’s not a new social media company attracting attention, it’s a set of technologies that could add real productivity to the world and improve the standard of living for everyone. The Internet of Things (IoT) is the term being used to describe the set of technological advances in communications, sensors, and data handling that has enabled companies to take everyday devices like lamps and HVAC systems and connect them to networks for remote monitoring and control. The IoT is only one facet of the technology landscape that will continue to reshape the American economy.

In the February issue of Intelligence Report, my dad wrote,

How much do you know about the Internet of Things (IoT)? Well, many futurists predict “65% of children entering school today will end up in jobs that don’t yet exist.” For example, drivers’ licenses will not exist because we will not be driving autos. And the IoT, in conjunction with 3D printing, will allow new (non-rejectable) organs to be built for the body.

We will continuously assess the risks and opportunities created by these new technologies.

P.P.S. With all the uproar in the media today about “fake news,” how can savvy actors invest in an age of compromised and biased information? The ugly reality for investors is that it is getting harder to find sources of information that can be trusted. With falling ad sales eroding quality at many of the best print publications, revelations about political motivations behind some purportedly objective stories, and the proliferation of fake news content across the Internet, finding a source of trustworthy information is harder than ever. At Richard C. Young & Co., Ltd., our goal is to separate the wheat from the chaff so you don’t have to.