Buy Your Straw Hats in Winter

April 2020 Client Letter

Last month, I wrote to you about Ben Graham. Graham was a student of psychology and ahead of his time in behavioral economics. He recognized that investors were far from the calculating, perfectly rational actors many economists assumed. Instead, investors are often motivated by fear and greed. As Graham described it, “The investor’s chief problem—and even his worst enemy—is likely to be himself.”

Over the years, we have written often about emotionalism and how emotionally charged investment decisions can sabotage portfolio performance. At Richard C. Young & Co., Ltd., our goal is to help you maintain a degree of psychological and emotional comfort during your retirement years.

One way we help you maintain comfort is through consistency. As my dad explained over a decade ago:

Consistency through cash flow—that is the goal at our family investment management company, and that is my primary goal for you in these strategy reports. Clients of our family management company are most often soon-to-be-retired and retired investors or conservative small business owners saving for a secure retirement. And it is just such a conservative group I write to monthly. As most of you know, I grew up in Shaker Heights, Ohio, during the Paul Brown/Otto Graham Cleveland Browns era. I learned about consistency from Graham and Brown. Over their 10 years together, the duo racked up a .854 winning percentage.

This consistency has never been matched by another coach and Q.B. Over Graham’s 10 pro seasons, Graham and Brown never once failed to win a division title and play for the championship.

A full 55 years later [and now 65 years later in 2020], I have not forgotten the lesson of consistency I learned from Paul Brown and Otto Graham. Our family investment company office at 500 Fifth Ave. in the heart of Old Town Naples, Florida, is dedicated to Paul Brown, Otto Graham, and the Cleveland Browns of their era. [Our office is now located at 5150 Tamiami Trail North, Suite 400, Naples, Florida 34103].

Over the four and one-half decades [five and one-half now] I have been advising investors, my emphasis on consistency through cash flow and the miracle of compound interest has never changed. When you lose 50% on an investment, you have to make 100% the next time out just to get even. And that is with a zero return. When you focus laser-like on investments that pay you cash in the form of dividends or interest, you mute portfolio volatility and the propensity for debilitating loss.

As of my last letter, I had no idea how your comfort (and mine) would be tested over the ensuing days. The stock market fell from an all-time high into a bear market in record time. It took a total of 16 trading sessions for the S&P 500 to fall 20% and 23 sessions for it to drop 34%.

The selling was indiscriminate in late February and March. Bull markets often end with a process that takes months to complete, not days. By example, during the last bear market, stocks hit their final high in October 2007 but didn’t officially enter a bear market for another eight months. Not this year!

Uncertainty and Anxiety

What is unsettling to many about the virus is its unprecedented nature (in our lifetimes) and the vast uncertainty it has created. We don’t know the path, the true fatality rate, how many people are actually infected, the prospects for herd immunity, the ultimate economic toll, or when we can expect our lives to get back to normal.

Uncertainty causes anxiety and discomfort in people and markets, but it also creates opportunity.

I obviously cannot will the virus out of existence or provide certainty where none exists, but my goal is to offer you comfort during a period of tumult and explain where we see opportunities for your investment portfolio.

Your Portfolio Was Positioned Defensively Heading into the Downturn

Heading into this downturn, your portfolio was positioned defensively. You owned a meaningful position in gold. Your fixed-income portfolio consisted of full-faith-and-credit-pledge Treasury securities and short-term investment-grade corporate bonds. And your largest common-stock-sector exposure was in healthcare and consumer staples. Firms such as Walmart, Kroger, Colgate, Procter & Gamble, Kimberly-Clark, Johnson & Johnson, Medtronic, and Merck. All beneficiaries of America’s newfound hoarding ways (toilet paper and otherwise).

With 20/20 hindsight, there may have been a better way to be positioned heading into a global pandemic. But lacking the luxury of an accurate crystal ball, once again a cash-flow–centric balanced portfolio muted volatility and helped to minimize losses.

America and the World Will Recover

“Abnormally good or abnormally bad conditions do not last forever.” ~ Ben Graham

“To be an investor you must be a believer in a better tomorrow.” ~ Ben Graham

While the COVID-19 pandemic is certainly disturbing on several levels and is unlike anything any of us has experienced, human ingenuity, resilience, and resolve point toward an eventual health, economic, and market recovery. Pandemics are new to you and me; but it is worth pointing out that there have been regional pandemics this century, and there was a major flu pandemic last century. Both eventually ended, and life went on pretty much as it had prior.

That’s not to say that things can’t get worse before they get better. We are hopeful that the nature of this downturn translates into a quick snapback. Still, we recognize that there is a great amount of uncertainty around the timing and magnitude of a recovery.

That uncertainty is partly or even largely responsible for the opportunity we now see in markets.

Shopping for Straw Hats in Winter

Where do we see opportunity today? Some investors see opportunity in what you might call COVID-19 bunker baskets. Netflix, Amazon, DocuSign, and Zoom are all popular stocks today. But unless you believe the pandemic is more than temporary (we do not), buying shares in these firms today is a lot like buying your straw hats in summer. We prefer to buy our straw hats in winter.

Companies that are out of favor and impacted most by the coronavirus are trading at levels we haven’t seen in years. Are these companies facing more business risk than an Amazon or Netflix today? Many are, but at today’s depressed prices, we believe the margin of safety is significant.

The concept of a margin of safety was popularized by Ben Graham. In The Intelligent Investor, Graham explained, “The danger in a growth-stock program lies precisely here. For such favored issues the market has a tendency to set prices that will not be adequately protected by a conservative projection of future earnings…. The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price.”

With the investment landscape shifting profoundly over the course of a couple of weeks, we have been more active over the last six weeks than we have been in years.

The bond market is where the bulk of our activity has been focused, but we’ve also been active in precious metals and common stocks.

In bonds, with the Federal Reserve quickly slashing interest rates to zero and buying tens of billions worth of Treasuries and mortgage-backed securities each and every day, we have liquidated all of our Treasury holdings to be used for higher-yielding and higher-returning opportunities.

We’ve purchased corporate bonds at yields and spreads (yield advantage to Treasuries) that we haven’t seen in nearly a decade. Below is a list of some of the bond issues we purchased in many client accounts in recent weeks. You will note the maturity on some is much longer than we typically favor, but the yields and spreads were significant at the time of purchase. Higher yields and spreads drive down both the duration and the risk from a rise in Treasury rates. (Higher Treasury rates often coincide with narrowing spreads.)

- Lowe’s: 4.05% | Due: May 2047 | Yield to maturity: ~4.7% | Rating: Baa1 / BBB+

One of America’s largest home improvement retailers. - Weyerhaeuser: 4.0% | Due: April 2030 | Yield to maturity: ~3.85% | Rating: Baa2 / BBB

Timber and timber products firm, and one of the largest private landowners in America. - Valero Energy: 3.40% | Due Sept. 2026 | Yield to maturity: ~6.25% | Rating: Baa2 / BBB

One of the largest independent refining companies in the U.S. - FedEx: 4.40% | Due Jan. 2027 | Yield to maturity: ~5% | Rating: Baa2 / BBB

One of the largest package delivery companies in the world.

In addition to purchasing corporate bonds, we have also been buying the Fidelity Floating Rate High Income Fund. We have owned this fund in the past. We favor the position during times of stress in the bond market, when yields are high and the margin of safety is elevated.

The Fidelity Floating Rate High Income Fund invests in bank loans issued by companies rated below investment grade. The loans float with short-term interest rates, so there is no interest rate risk.

The senior bank loans that the Fidelity Floating Rate High Income Fund invests in get paid before stockholders and bondholders in the event of default. The historical recovery rate (the percent of face value an investor typically gets when a company defaults) on bank loans has averaged 70%, which compares favorably to the 45% historical average recovery rate of high-yield bonds.

Our average purchase price was completed at an S.E.C. yield approaching 8%. At current prices, the Fidelity Floating Rate High Income Fund has an S.E.C. yield of 7.53%. At a 7.53% yield, 25% of the Fidelity Fund’s loans could default, and it would perform no worse than a T-bill (assuming the 70% historical recovery rate holds). The highest default rate in the data available for bank loans is 12%, which occurred during the 2008 financial crisis.

Cash Demand and Margin Calls Soared

After such a long period of calm in markets, the abrupt lock-down of the economy created some unorthodox moves in securities prices. With the demand for money soaring because of the lock-down, liquidations spiked, and so did margin calls. The selling was indiscriminate. Even Treasury bond prices went temporarily haywire, and so did precious metals.

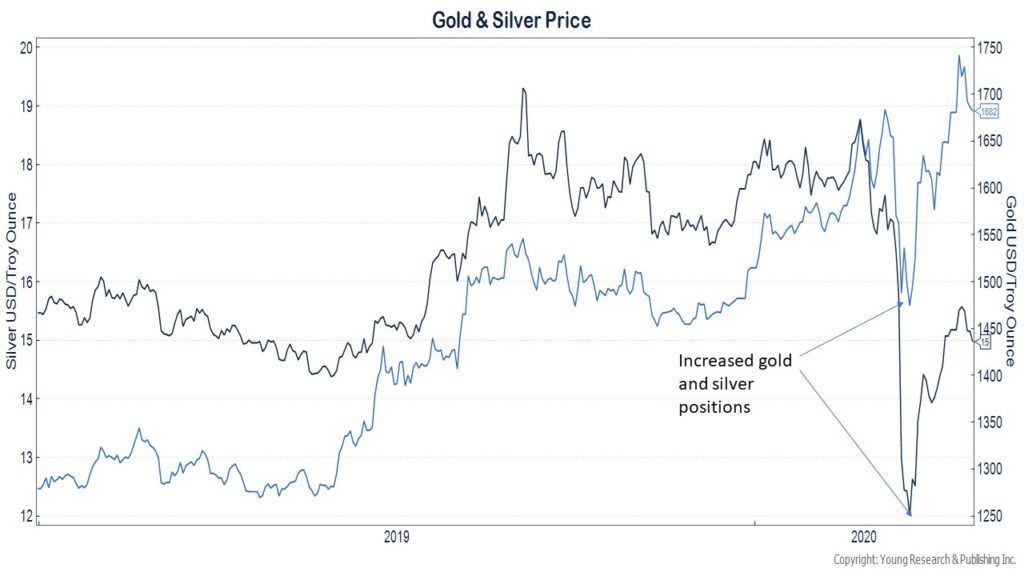

In mid-March, gold and silver prices started to fall with other risky assets. Seeing a potentially inflationary fiscal and monetary stimulus coming down the road, we felt gold and silver should have been rising in price.

On March 19, for most accounts we doubled your position in silver and increased your position in gold by 25%. As the liquidity panic subsided, gold and silver prices rallied. The chart below shows the price of both metals along with the date we bought more for you.

We weren’t trying to pick the bottom, but sometimes you just get lucky!

Precious metals are an area of the market we want to continue to hold. The amount of monetary and fiscal stimulus we see on a global scale is unlike anything since World War II.

The U.S. is poised to run a budget deficit in excess of $3 trillion this year. Who will buy all of those Treasury bonds?

Cue Jerome Powell & Co.

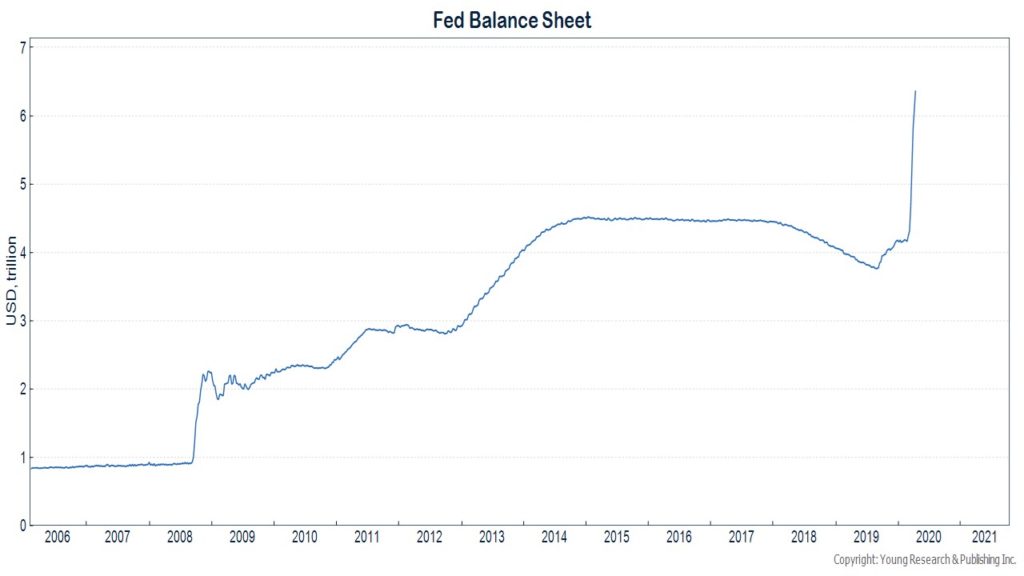

Since the end of February, the Federal Reserve’s balance sheet has expanded by over $2 trillion, and the Fed is far from finished.

Maybe this all works out, and the inflation that will surely be created remains contained in financial markets as it did during the last decade. But if it doesn’t, your gold and silver will shine even brighter.

Common Stock Opportunities

In our Retirement Compounders portfolios, we initiated positions in a number of securities. For many clients, we started a position in McDonald’s, Starbucks, Texas Roadhouse, Polaris Industries, Rockwell Automation, Equity Residential, Chevron, and Valero, among a few others.

Chevron

We purchased Chevron shares at a yield of 7.85%. Twenty-dollar oil prices have savaged the oil industry, but we think the majors (Chevron, Exxon, BP, Royal Dutch Shell, etc.) have the balance sheet, diversification, and savvy to come out stronger than they went in. Chevron and the other major integrated oil firms have prioritized their dividends. We believe Chevron’s dividend is safe for the next 12 months, even if oil prices stay at these depressed prices. If today’s prices are sustained much longer, the supply of oil will likely decline sharply.

When demand returns, be it next quarter or next year, the supply-demand balance will likely be much tighter, leading to higher prices. The best cure for low oil prices is still low oil prices. At an almost 8% dividend yield, we believe the margin of safety in Chevron shares is substantial.

Polaris Industries

Polaris is a firm we owned many years ago. Polaris manufactures ATV’s, motorcycles, boats, and snowmobiles. At its low, the stock was down over 60% from its year-end 2019 level. Polaris will likely have a difficult year, maybe two, but we anticipate an eventual recovery in sales and profits to prior highs. We purchased the stock at 7.3X past-peak earnings and a dividend yield of almost 5%. Over the last decade, Polaris has traded at an average price-to-earnings ratio of 18X. We feel good about the margin of safety in the shares.

Over the coming months, I will have more to say about some of the other stocks we’ve added to portfolios in recent weeks; but I do want to mention that with a few of the firms we own, we have either seen or may see dividend holidays.

What is a dividend holiday? We consider a dividend holiday a temporary suspension of quarterly dividend payments. Texas Roadhouse and Cracker Barrel, which are both sit-down restaurants, have instituted dividend holidays. For obvious reasons, both firms have announced they would suspend dividend payments to conserve cash and allow time for the impact of the virus and lock-downs to be assessed. We view this as a prudent move on the part of both management teams. Being forced to close every single restaurant you operate—with no date certain on when you can reopen—demands caution.

The ugly reality is that the economy has ground to a halt. You can’t blame management teams for wanting to stay liquid in this environment. And rather than avoiding the shares of firms that may institute dividend holidays, we are proceeding at a measured and deliberate pace, and buying at prices we believe offer a significant margin of safety.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. In addition to taking advantage of opportunities during the market volatility, we have also used the volatility to lower your potential tax bill. We have been harvesting losses where we feel it makes sense. By example, we recently harvested some losses in energy stocks as well as in shares of Lowe’s, which we swapped for Home Depot. We like both firms, and both provide exposure to similar economic trends.

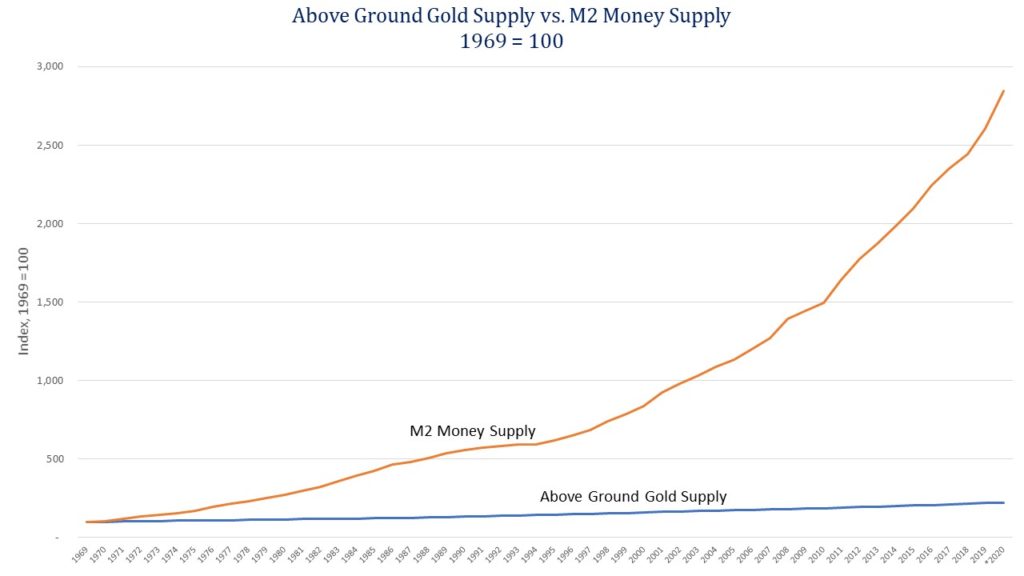

P.P.S. Did you know that over the last five decades, the above-ground supply of gold has compounded at about 1.6% per year? Over the same period, the monetary base has compounded at 8.1%, with growth since the last financial crisis averaging nearly 14% per year. M2, a broader measure of money supply, has compounded at 6.75% since 1969 and 6.2% since the last financial crisis began. A visualization may help. Looks like a bullish signal for gold prices over the long run.

P.P.P.S. We recently updated both Part 2A and Part 2B of our annual SEC Form ADV. This document provides information about the qualifications and business practices of Richard C. Young & Co., Ltd. If you would like a free copy of the updated document, please contact us at (401) 849-2137 or email cstack@younginvestments.com. As you were notified in October 2019, since Part 2A of Form ADV was last issued on March 18, 2019, Richard C. Young & Co., Ltd. has added a new investment management program and updated the descriptions for its existing investment management programs. Each updated description includes an increase in the asset allocation range, allowing for greater equity exposure.