Big US Tech = Big US Exports

March 2025 Client Letter

Recently, our family boarded the Norwegian Cruise Line ship Encore, sailing to the Eastern Caribbean. One port of call was in Puerto Plata, where we had planned an adventurous day exploring the Damajagua Waterfalls. This involved hiking our way into the rainforest and then jumping or sliding our way down the falls.

Unfortunately, due to heavy rains, only a handful of the 27 waterfalls were open. To make up for the shortened excursion, our tour included a visit to a local coffee roasting shop and wood carving demonstration. Wandering through the coffee shop and art gallery, I wondered how they expected tourists to make purchases. We traveled light, with no wallets or credit cards, anticipating an afternoon in the jungle and in rushing waters. I figured most of our group probably did the same. Then I noticed something that answered my question: a piece of paper in a sheet protector thumbnailed to the wall. It announced: Apple Pay Accepted Here.

The Apple Pay sign reinforced two of my favored themes. First, I believe many U.S. companies traditionally designated as technology companies can now be considered consumer staples. Consumer staples are essential products, integral to daily life, that people regularly purchase and use, regardless of economic conditions. In today’s world, this category might include Amazon’s e-commerce platform, Apple’s devices, Google’s search engine; and Microsoft’s operating system, Office Suite and cloud services (Azure).

Second, Big Tech is one of America’s most successful exports. Whether you’re walking down a street in any country or needing to buy a pound of Caribbean coffee in a Dominican tropical forest, the presence of technologies like Apple Pay is often ubiquitous.

United States Big Tech companies, including Apple, Microsoft, Amazon, Alphabet (Google), and Meta are dominant in the global economy. In 2023, the U.S. reported high-technology exports worth approximately $208.5 billion, according to Trading Economics.

Apple’s global sales of iPhones, iPads, and MacBooks generate billions of this figure. Microsoft’s software and cloud services, Amazon’s e-commerce and AWS, Alphabet’s digital services, and Meta’s social networking platforms play crucial roles in driving these export numbers.

U.S. Big Tech contributes significantly to the U.S. economy by creating jobs, driving innovation, and generating substantial revenue from international markets. Their technological advancements and global operations also demonstrate the United States’ innovation leadership and why stocks of these companies can play a role in diversified investment portfolios.

The Year Ahead: Physical AI and AI Agents

As U.S. Big Tech continues to dominate global markets and our daily lives, these companies are also helping to drive the next wave of innovation. Looking beyond traditional software and digital services, here is a look at emerging technologies that will shape the future in 2025 and beyond.

Physical AI is a newer form of AI designed to interact with the real world, bridging the gap between digital intelligence and physical execution. Unlike traditional AI, which excels in digital problem-solving, physical AI integrates principles of physics, enabling systems to operate effectively in real-world environments.

The advancements in physical intelligence represent a significant leap forward for AI, promising to enhance the capabilities of machines in real-world scenarios. In 2025, physical AI advancements will include autonomous vehicles, humanoid robots, knowledge robots, industrial robots, and personal assistants. These technologies will contribute to urban navigation, healthcare, manufacturing, and daily life, driven by improved AI algorithms and sensors for instant decision-making and interaction with the physical world.

Moravec’s Paradox: The Human-Machine Intelligence Gap

While the potential of physical AI is immense, robotic developers have faced a fundamental challenge in replicating human abilities that we take for granted—a phenomenon known as Moravec’s paradox.

Moravec’s paradox is the observation that tasks that are easy for humans, such as perception and mobility, are extremely difficult for machines, while tasks that are challenging for humans, like complex calculations or playing chess, are relatively easy for machines.

This paradox, named after roboticist Hans Moravec, highlights the complexity of human sensory and motor skills, which have evolved over millions of years. It shows the challenge in replicating these seemingly simple tasks in robots despite their proficiency in more abstract, high-level reasoning tasks. Advances in AI are helping robots overcome Moravec’s paradox and to perform more human-like tasks.

Nvidia CEO Jensen Huang envisions a future where robotics and AI are integral to everyday life. In a recent interview, Huang boldly claimed that “everything that moves will be robotic someday,” referring to the rapid advancements in AI and robotics. Huang noted that

the next decade will focus on applying AI to various fields, such as digital biology, climate technology, agriculture, and transportation.

Nvidia’s Omniverse and Cosmos platforms play a crucial role in this vision by enabling robots to learn through digital simulations rather than real-world experiences, which accelerates their development. This shift from AI science to its practical applications marks a significant step towards a robot-forward world, with Nvidia positioned as a key player in this transformation. Other companies involved in robotics include Apple, Amazon, Broadcom, Google, Meta, and Qualcomm.

AI Agents: Autonomous Software Transforming Industries

AI agents are smart software programs that work independently to complete tasks or make choices based on information and set guidelines.

Agents can perceive their environment through sensors, process information, and take actions to achieve specific goals. Examples of AI agents include: Chatbots such as Siri, Alexa, and Google Assistant that interact with users through natural language; algorithms used by Netflix and Amazon to suggest content based on user preferences; and self-driving cars that navigate and make driving decisions.

Recently, Oracle introduced its latest AI agents, designed to enhance supply chain operations. These AI agents are part of Oracle’s Fusion Cloud Supply Chain and Manufacturing platform and aim to streamline workflows, automate routine tasks, and improve decision-making processes.

The new AI agents are tailored to support various roles within the supply chain, from procurement to sustainability. They independently or semi-independently perform tasks across multiple applications, reducing the administrative burden on supply chain professionals. This innovation is expected to lead to greater accuracy, efficiency, and agility in supply chain management.

Artificial Intelligence: The New Internet Revolution

For many of us it seems as if this technology has come from nowhere. The speed of newer innovation is quick. One gets the feeling the progress being made today is just getting started and the pace will only hasten from here. To me, it feels as if artificial intelligence is the new internet.

By example, consider this from MIT Technology Review regarding internet search:

We are at a new inflection point. The biggest change to the way search engines have delivered information to us since the 1990s is happening right now. No more keyword searching. No more sorting through links to click. Instead, we’re entering an era of conversational search. Which means instead of keywords, you use real questions, expressed in natural language. And instead of links, you’ll increasingly be met with answers, written by generative AI and based on live information from all across the internet, delivered the same way.

How We Got Here: From CPU Computing to GPU-Powered AI

The way Nvidia explains it, for decades, Software 1.0 was used, which was code written by programmers, and ran on general-purpose central processing units (CPUs). Think of a CPU as the brain of your computer. It’s designed to handle a wide range of tasks, but it does them one at a time (or a few at a time with multiple cores). It’s great for tasks that require a lot of different operations, like running your operating system, browsing the web, or using office applications.

Then came Software 2.0, which uses machine learning and neural networks running on graphics processing units (GPUs).

Machine learning teaches computers to learn from experience. Instead of programming the computer with specific instructions, you give it lots of data and let it find patterns and make decisions on its own.

Neural networks are a type of machine learning inspired by the human brain. They consist of layers of interconnected nodes (like neurons) that process information and learn to recognize patterns, such as identifying objects in images or understanding speech.

The GPU is like a supercharged assistant to the CPU, designed to handle many tasks at once. It’s enhanced for tasks that can be done in parallel, like rendering images and videos or processing large amounts of data quickly. This makes it ideal for gaming, video editing, and artificial intelligence.

This shift from Software 1.0 and CPUs to Software 2.0 and GPUs led to the rise of generative AI, which can learn and create almost anything and paved the way for physical AI and agents.

Investing in AI: Navigating the Six Levels of AI Value Chain

When investing in the AI space, I reference a white paper by McKinsey & Company, which identifies the six levels of the AI value chain. Each level represents a critical component of the AI ecosystem.

I think it can be beneficial to diversify across various AI levels, attempting to capture the wide range of potential opportunities and innovations driving the industry. This approach could also help mitigate risks associated with any single segment.

McKinsey & Company’s six levels of the AI value chain, with examples of companies within each level, are as follows:

- Hardware: Nvidia, Broadcom

- Cloud providers: Microsoft, Alphabet, Amazon

- LLM model developers: Alphabet, Meta

- Model hubs and MLOps: Google Vertex AI, Microsoft Azure ML

- Applications: Meta, Alphabet, Oracle

- Services: IBM, Microsoft, Oracle

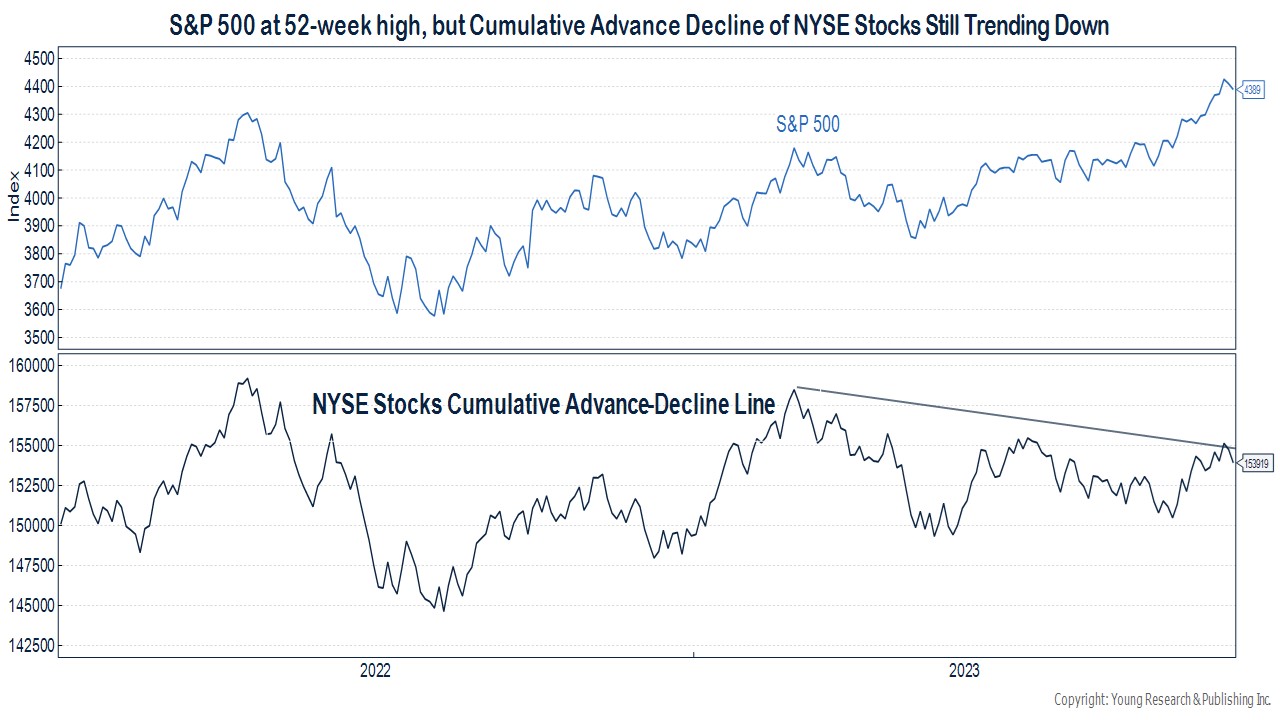

Market Volatility

For the week ending February 21st, we saw some volatility back in the market with the Dow and Nasdaq down over 2% and the S&P 500 down 1.6%. Many of the stocks highlighted in this letter were down more: AMZN -5.2%, AVGO -4.19%, NVDA -5.3%, and QCOM -4.5%.

To offset these down periods, it can be helpful to own stocks that might zig while the rest of the market zags. Traditionally, this could mean owning dividend-paying stocks from defensive sectors including utilities and consumer staples. Two examples of these type of stocks are The Southern Company and Coca-Cola.

Southern Company: Generating Consistent Dividend Growth

Dividend investors may look to Southern Company (SO) due to the company’s consistent track record of returning cash to shareholders. The company, with a current dividend yield of 3.28%, has paid a dividend since 1948 and raised its dividend for 23 consecutive years. SO has also increased its total revenues to 26.7B in 2024 from 17.4B in 2015 while increasing net income to 4.4B from 2.3B during the same time period.

Southern Company, headquartered in Atlanta, Georgia, is a leading energy company serving nearly 9 million electric and gas utility customers. Southern Company’s energy mix is diverse, including nuclear, natural gas, coal, hydro, solar, and battery storage facilities. The company manages nearly 77,000 miles of natural gas pipeline, operates 14 storage facilities with a capacity of 150 billion cubic feet, and provides digital wireless communications and fiber optics services through Southern Linc.

Looking ahead, SO could benefit from increased electrical demand due to overall economic growth in the regions it serves. In a January blogpost, Amazon announced plans to invest $11 billion to expand its infrastructure in Georgia to support cloud computing and AI technologies.

Coca-Cola: Brand Power Beyond Soda

Coca-Cola (KO) has long been an investment destination for dividend investors given that KO has had 62 years of consecutive dividend growth. The global beverage company operates in 200 countries and over the years has expanded its brands to include water, sports drinks, coffee, tea, and, believe it or not, milk.

Are you familiar with Fairlife milk? The brand has emerged as a standout choice in the crowded dairy market. Making Fairlife unique is its innovative ultra-filtration process, which enhances the protein and calcium content while reducing sugar and removing lactose. This is a winning formula for health-conscious individuals, fitness enthusiasts, and those sensitive to dairy.

A significant contributor to Coca-Cola’s growth has been its investment in Fairlife. Originally launched in 2012 as a joint venture with Select Milk Producers, Fairlife was fully acquired by Coca-Cola in 2020 for $980 million. By 2022, Fairlife’s sales surpassed $1 billion, driven by its Core Power protein shakes.

Aside from its dividend, investors like KO for its brand awareness, as it’s one of the most recognized brands in the world. This helps the company with pricing power as loyal customers are willing to pay a premium for its namesake product. And KO is profitable. Earnings per share increased 12% year over year in the fourth quarter and minus a tax-related decrease, KO generated $10.8 billion in free cash flow, which helps pay its dividend.

Maintaining a Diversified Portfolio

The rapid advancement in technology is reshaping the global economy and investment landscape. As innovation accelerates, companies positioned at the forefront of these transformations—whether in AI, cloud computing, or robotics—are likely to offer opportunities to investors. At the same time, maintaining a diversified and balanced portfolio with defensive sectors, including consumer staples and utilities, may provide stability during market fluctuations.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Cybercrime continues to grow in both number and complexity. Protecting your financial accounts from unauthorized activity is a group effort. You have an important role to play. Implement multi-factor authentication (MFA) on your financial accounts. Also, do not save the login information (user identification and password) to your financial accounts on your electronic devices.