The Best Rule Is: Stay the Course

September 2021 Client Letter

Thanks to a modest monetary gift from my grandfather, I began investing in the early 1990s. Given that my dad was editor of the monthly investment newsletter, Richard C. Young’s Intelligence Report, investment advice was never in short supply. One individual my dad began featuring in his letter during the 1990s was Jack Bogle, founder of The Vanguard Group. Back then, Bogle was new to the scene as far as the general investing public was concerned. But at 2 Training Station Road in Newport, RI, where I grew up, he had already become a household name.

What attracted my dad to Bogle was how he brought simplicity to a complex industry. And he did so with integrity. In a forward to an edition of Bogle’s first book, my dad wrote, “I have given copies of Bogle on Mutual Funds to both my son and daughter, who base their own mutual fund investing on the principles outlined in Jack’s book. It is the first reference source I recommend to anyone who is seriously investing for the future.”

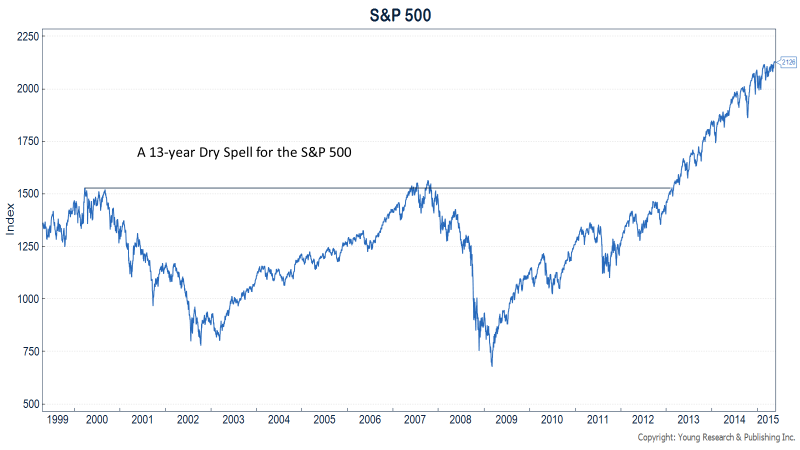

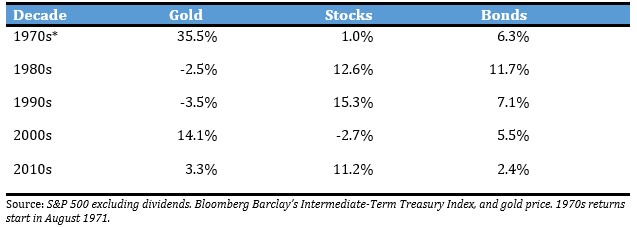

My frame of reference for investing began nearly 30 years ago with the obvious help from my dad and an emphasis on the principles outlined by Jack Bogle. Much of the early wisdom I gained from Bogle has been an invaluable guide. One of the first tenets I learned from him was to think long-term. Bogle wrote, “Do not let transitory changes in stock prices alter your investment program. There is a lot of noise in the daily volatility of the stock market, which too often is ’a take told by an idiot, full of sound and fury, signifying nothing.’ Stocks may remain overvalued, or undervalued, for years. Patience and consistency are valuable assets for the intelligent investor. The best rule is: stay the course.”

Emotionally Challenged

Now I know that staying the course and thinking long term are no longer novel investing concepts. And yet we still find individuals unable to practice these basic principles. A whole field of study is dedicated to these emotionally challenged investors; “behavioral finance” studies the effects of psychology on investors and financial markets. It focuses on explaining why investors often appear to lack self-control, act against their own best interest, and make decisions based on personal biases instead of facts. And it’s one of the reasons that individuals seek out professional guidance.

Several weeks ago, I read an interview in Barron’s. The gentleman interviewee was a respected 70-year-old economist and professor from Boston, MA. He understands personal financial planning, taxes, finance, and health care.

Barron’s asked how he was invested with his own money. He responded:

It seems to me that the stock market is overvalued and dependent on the Federal Reserve’s support and its commitment to low-interest rates. And I view that as an unsupportable policy, so I view the stock market as very risky. About half my assets are in cash because I think this is a very tricky investment climate.

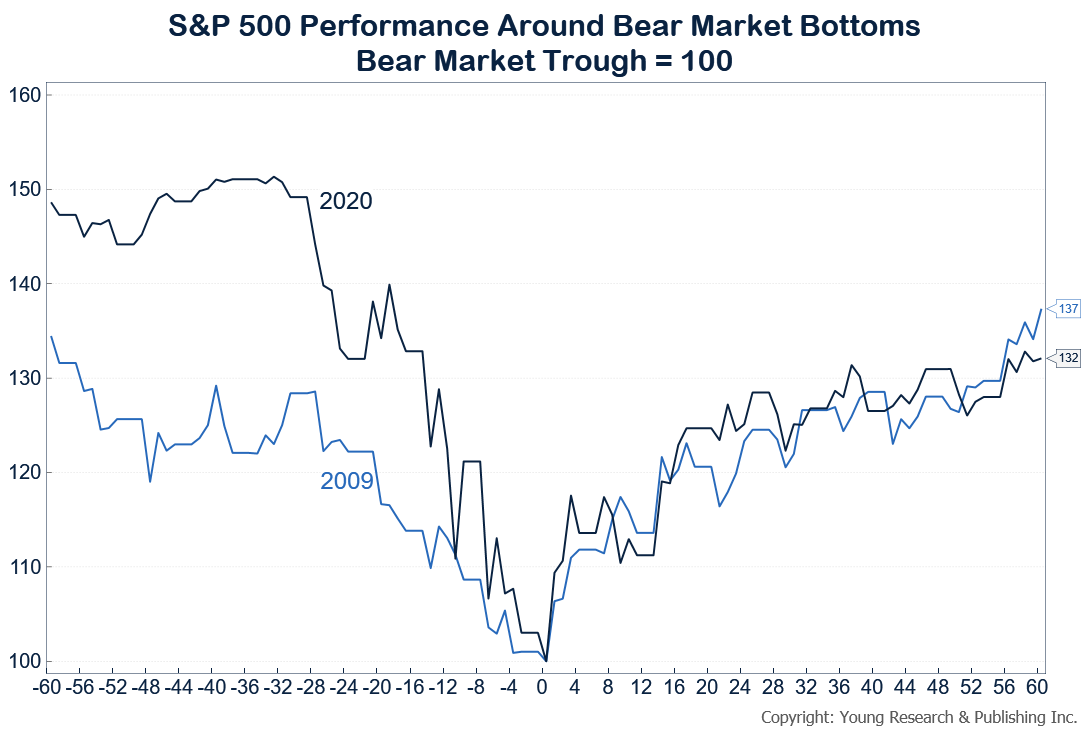

I pulled out of the market when Covid hit, and the market dropped, and I was very proud of myself. But I didn’t expect the Fed would come back in and support the corporate bond market to the extent it did.

For clarification, Barron’s asked if he missed the boat on the market rebound.

I missed out on the rebound, staying out of the market for about half a year.

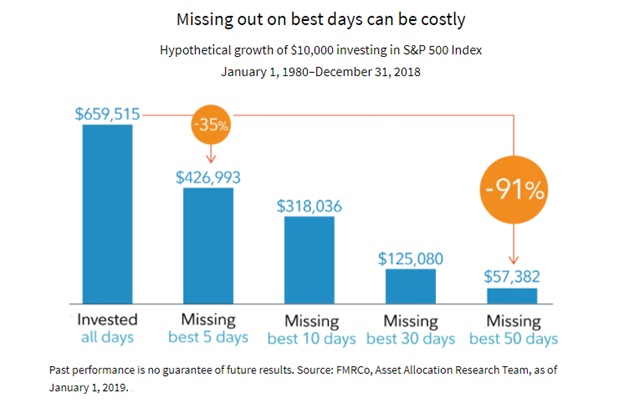

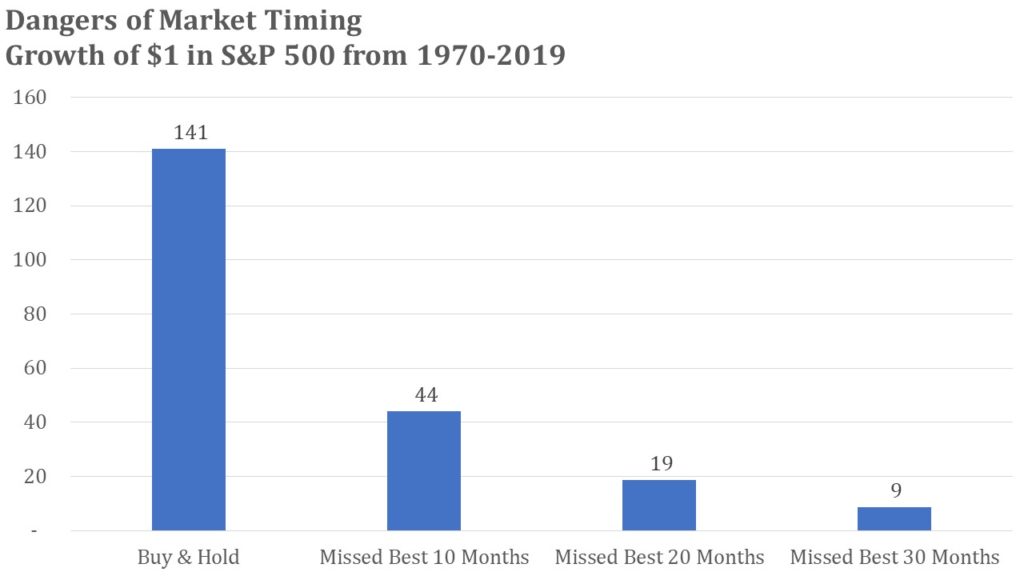

Ouch. Missing out on six months of the Covid recovery hurts. It’s nearly impossible to get those gains back. And while he said he is proud of himself for getting out of the market during COVID, I suspect he may have taken some initial losses. This demonstrates the impact that volatility and negative headlines can have on an individual, including a seasoned investment professional.

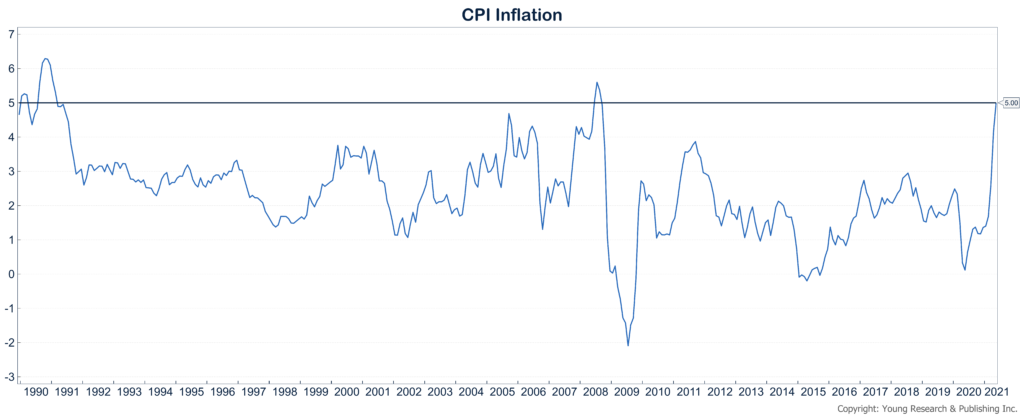

Volatility and steep stock-market declines often lead to the type of emotionally charged investment decisions that sabotage portfolio performance. I have referenced Dalbar’s data many times before in these monthly letters, and this time, the message is stark. For the 30-year period ending in 2016, the average investor underperformed the stock market by a staggering 6.18%, and the bond market by an equally disturbing 5.77%. Investors buy at the wrong time and sell at the wrong time. Volatility and emotion are often contributors here.

The best course of action, as Jack Bogle encouraged, is to stay the course when markets become volatile. An important element to staying the course is having a portfolio that adequately reflects your risk tolerance, your time horizon, and your past experiences during difficult times.

The Wall Street Journal’s Jason Zweig nicely summarized past experiences.

Try recalling how frightened you felt as an investor in February and March 2020. … No matter what you think now, you were terrified then. Everybody was. But the epic recovery from the Covid crash of early 2020 has reinforced the sense that markets are safer now. … That’s made it all but impossible for most of us to reconstruct how afraid we were only a year-and-a-half ago. We see the past through a rearview mirror made of rose-colored glass. Brushing aside our losses creates a false bravado that makes us think we can weather the future with less fear than we suffered in the past.

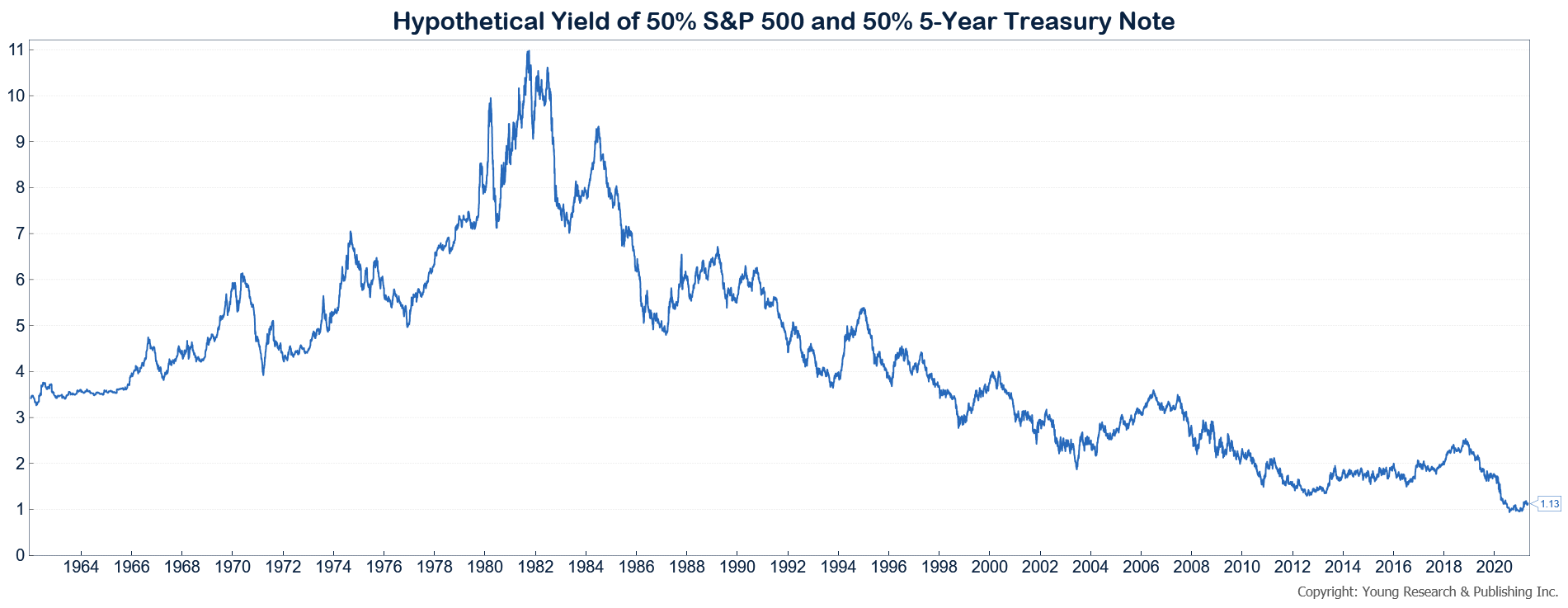

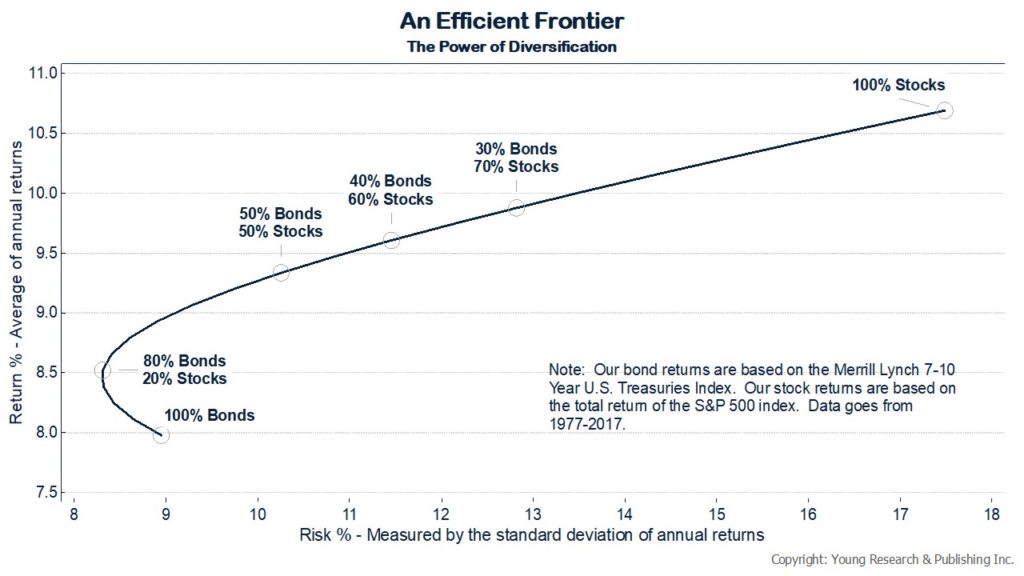

While risk can never be eliminated from an investment portfolio, proper diversification can help cushion the blow of big stock-market declines. That can allow retired investors and those approaching retirement to avoid hitting the panic button.

I often find that once investors own a quality, diversified, and balanced portfolio, volatility is viewed in a different light.

Sleep Well at Night

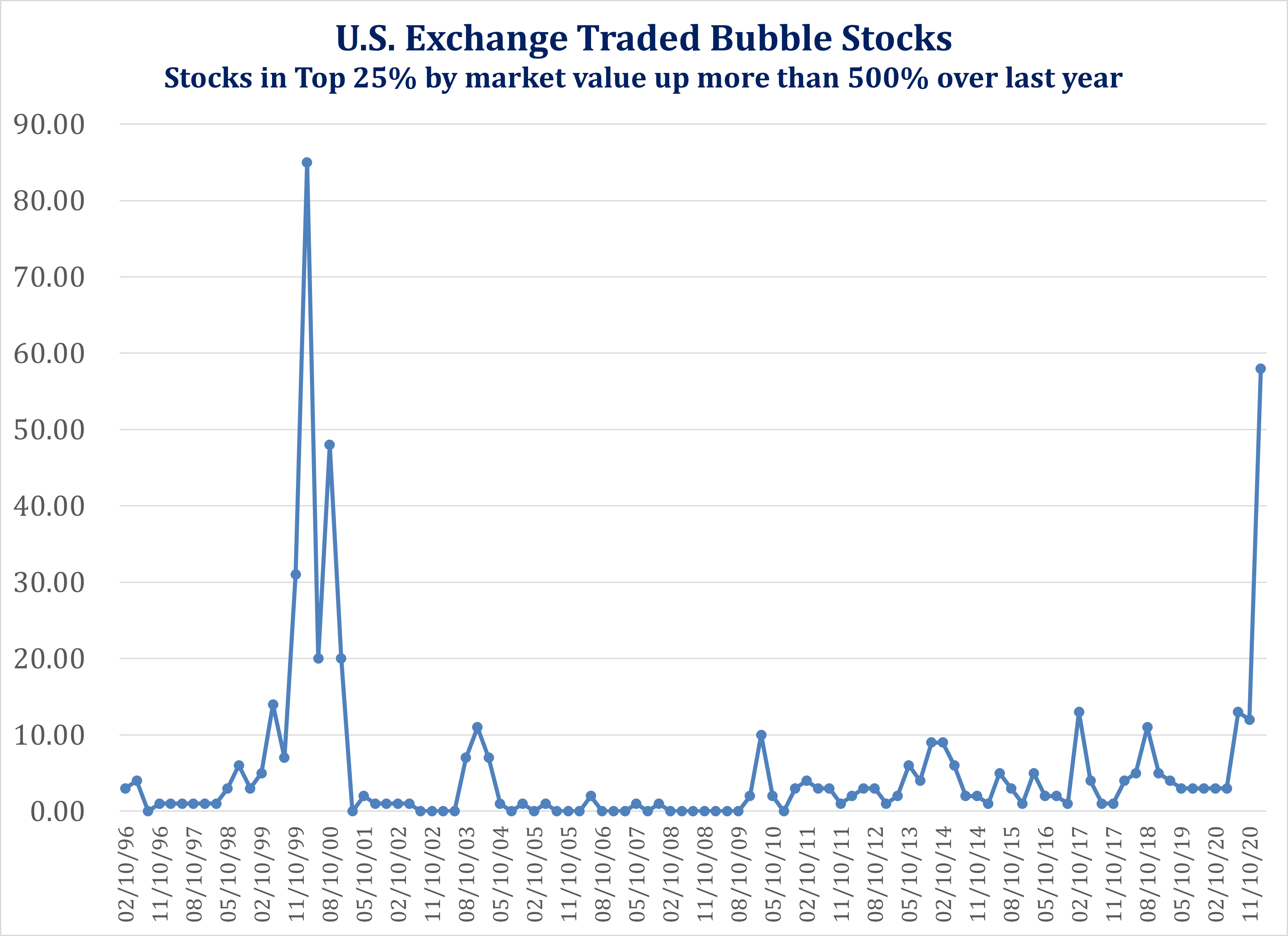

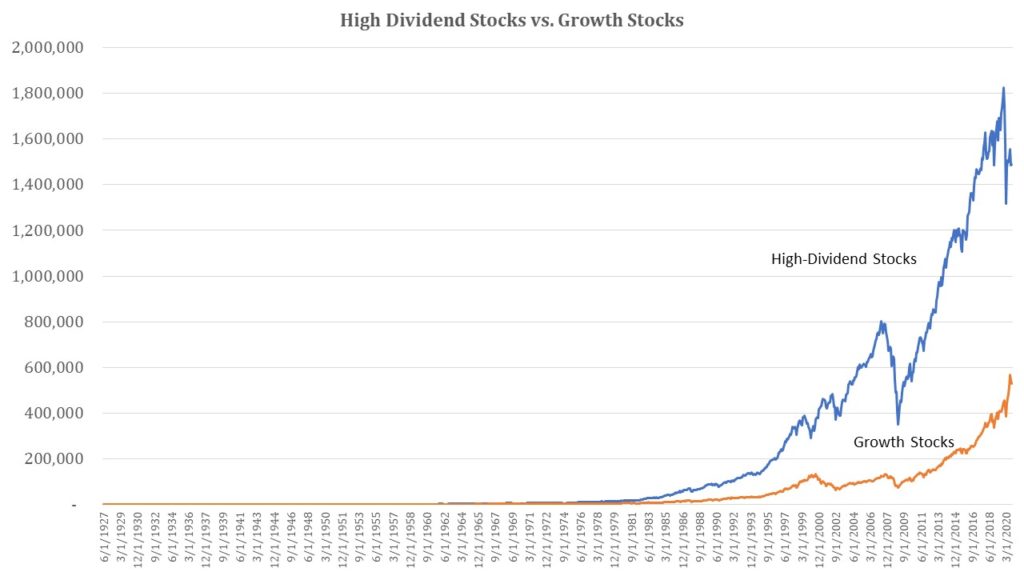

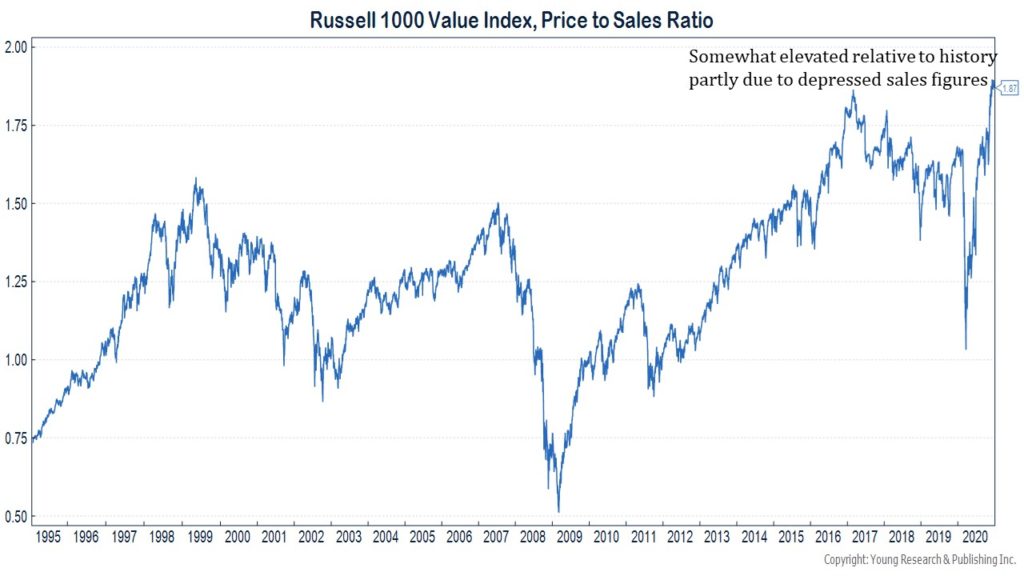

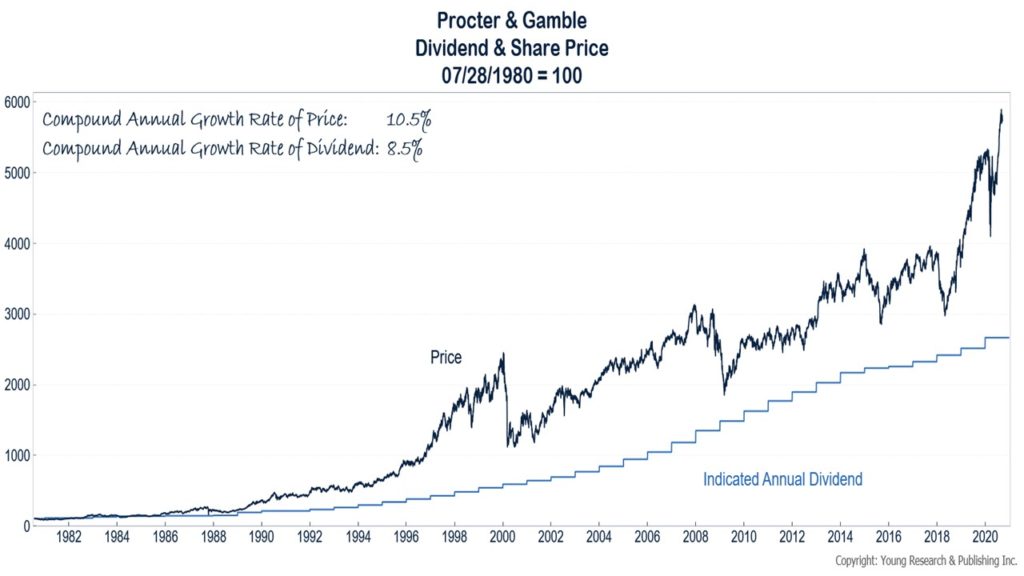

Another strategy for helping you to ride out volatility and sleep well at night is owning the more boring and stodgier parts of the market. The boring and stodgy, by definition, are not going to provide the flashy appeal and hype of names like GameStop, Tesla, and Bitcoin. But flashy appeal can come with a price in the form of higher valuations, inconsistent track records, and a sole reliance on capital appreciation as opposed to capital appreciation and consistent, annual dividend payments.

We mostly focus on boring and stodgy stocks, which tend to be big blue-chip companies that are dominant within their industry. They can provide predictable sales and profit growth throughout the business cycle. Usually, they are financially stable with healthy balance sheets.

During August, we placed several trades in a number of portfolios that can be described as boring and stodgy. Those stocks included Northwest Natural Holding, Conagra Brands, and Reynolds Consumer.

All three are typical of the companies we tend to target. We lean toward companies with a track record of annual dividend increases or ones where we feel confident about future annual dividend increases.

Northwest Natural Holding Company, through its subsidiaries, builds and maintains natural gas distribution systems and invests in natural gas pipeline projects. Northwest Natural Holding serves residential, commercial, and industrial customers in the United States and Canada. Northwest Natural Gas shares yield 3.57%. The company has paid a dividend every year since 1952, and they have increased the dividend each year for 65 consecutive years.

Conagra Brands, Inc. manufactures and markets packaged foods for retail consumers, restaurants, and institutions. The company offers meals, entrées, condiments, sides, snacks, specialty potatoes, milled grain ingredients, dehydrated vegetables and seasonings, and blends and flavors. Conagra shares yield 3.65%, and we are looking for double-digit dividend growth over the medium term.

Reynolds Consumer owns the Reynolds Wrap brand, which markets aluminum foil, parchment paper, plastic wrap, and oven bags. Reynolds also owns Hefty brand trash bags, plates, and cups. Reynolds trades at a reasonable valuation and offers a relatively attractive dividend yield of 3.20% today. We anticipate dividend growth of 5%–7% over the medium term.

The Three Ds: Dividend Yield, Dividend

Growth, and Dividend Growth Consistency

Most of our equity purchases need to meet certain criteria to be added to our portfolio. Three of those criteria include a dividend, a history of dividend growth, and a decent dividend growth rate. Limiting purchases to companies that pay and increase dividends tend to keep us out of the more speculative, high-flying areas of the market.

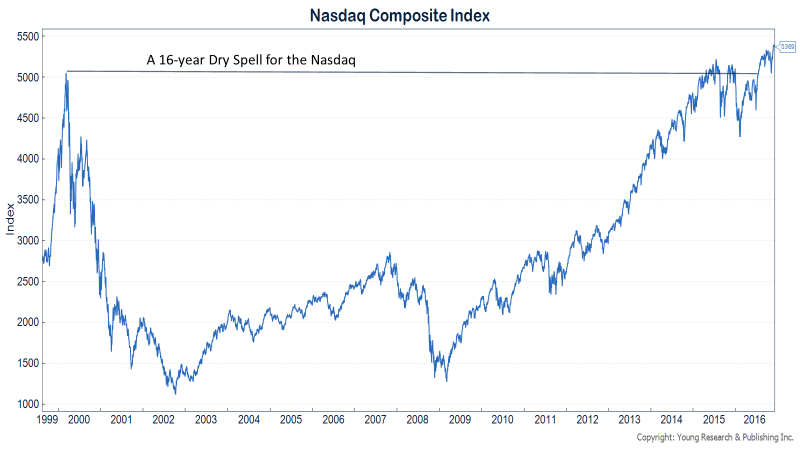

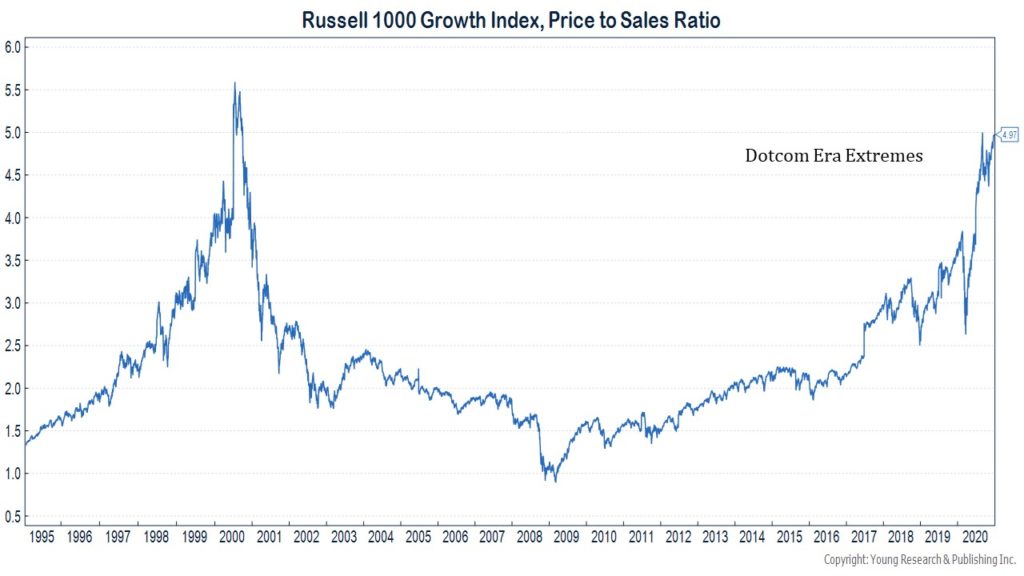

The technology sector is one where the power of paying dividends to shareholders is not well appreciated by management teams and corporate boards. As a result, technology stocks are a sector we tend to eschew. We feel this is not a problem in the long run, as this sector runs the highest risk of catastrophic loss (“a loss of 70% from peak value with minimal recovery”) among the 11 sectors in the S&P 500.

We do own some technology businesses, but we see them as more similar to industrial businesses. The technology stocks we purchase are most often more established and mature businesses with cash flow profiles that support regular dividend payments and regular dividend increases.

Three such tech stocks we own for many clients are Analog Devices, Texas Instruments, and Automatic Data Processing.

Analog Devices and Texas Instruments are both in the analog chip business. Analog chips are used to convert analog or real-world signals such as sound, temperature, and pressure into digital signals that can be processed. In our view, the analog chip business has attractive economics. Analog chips are relatively cheap for buyers, many of them are embedded in products, and their manufacturing processes aren’t overly complicated, so the risk of a customer switching to a different provider is low.

Texas Instruments (TI) is the world’s largest analog chipmaker and a key supplier of embedded chips. The company’s chips serve a wide range of industries. In 2020, 37% of TI’s revenue was from the industrial sector, 27% from personal electronics, 20% from the auto sector, and the balance from communications equipment and enterprise systems. TI shares offer a yield of 2.3%, the company has increased its dividend for 17 consecutive years, and, over the last decade, the dividend growth rate has averaged almost 22.5%.

Analog Devices is a leader in analog, mixed-signal, and digital-signal processing chips. Like TI, Analog serves a diversified mix of industries, including industrial companies, communications firms, automotive firms, and consumer businesses. Analog’s dividend has been increased every year for the past 17 years. Over the last decade, the dividend has grown at a compounded annual rate of more than 11%. The shares yield 1.56% today, and we are forecasting continued double-digit dividend growth in the near term.

Automatic Data Processing (ADP) is not in the chip business. It is one of the largest payroll and tax-filing processors in the world, serving over 920,000 clients and paying more than 38 million workers in approximately 140 countries and territories. If you have worked for a large company in the United States, there is a strong possibility your paycheck was processed by ADP. ADP shares yield 1.84% today. ADP has increased its dividend for 45 consecutive years and, over the last decade, the dividend has increased at a compounded annual rate of more than 10%.

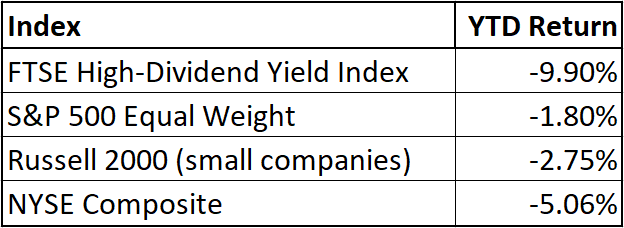

Equal Weight vs. Market Cap

When we craft investment portfolios, we size positions in a fashion that contrasts with the typical weighting scheme of broad-based market indices. Ours is more or less an equal-weight approach. The S&P 500 (probably the most popular broad-based market index) weights positions by market value, so the biggest companies count much more toward the performance of the index than the smallest companies. In fact, Apple’s weight in the S&P 500 is greater than the combined weight of the smallest 150 companies in the index. Put another way, Apple is almost 400 times more important to the performance of the S&P 500 than the smallest company in the index.

Market-cap-weighted indices may give the illusion of diversification, but the truth is investors are effectively making a bet on a handful of stocks in similar sectors. Information technology stocks (like Apple) and Communications Services stocks (that include Facebook and Google) make up 39% of the S&P 500. The top six stocks in the S&P 500 account for a quarter of the index.

The energy sector, which includes companies that make the fuel to run our cars, power our homes and businesses, and transport goods and services across continents and oceans, accounts for 2.5% of the S&P 500.

Market-capitalization weighting works fine when the handful of the largest businesses and sectors that dominate the index are performing well, but such a strategy could be extremely problematic during a market downturn.

In our opinion, something closer to equal weighting provides more robust diversification than market-value weighting.

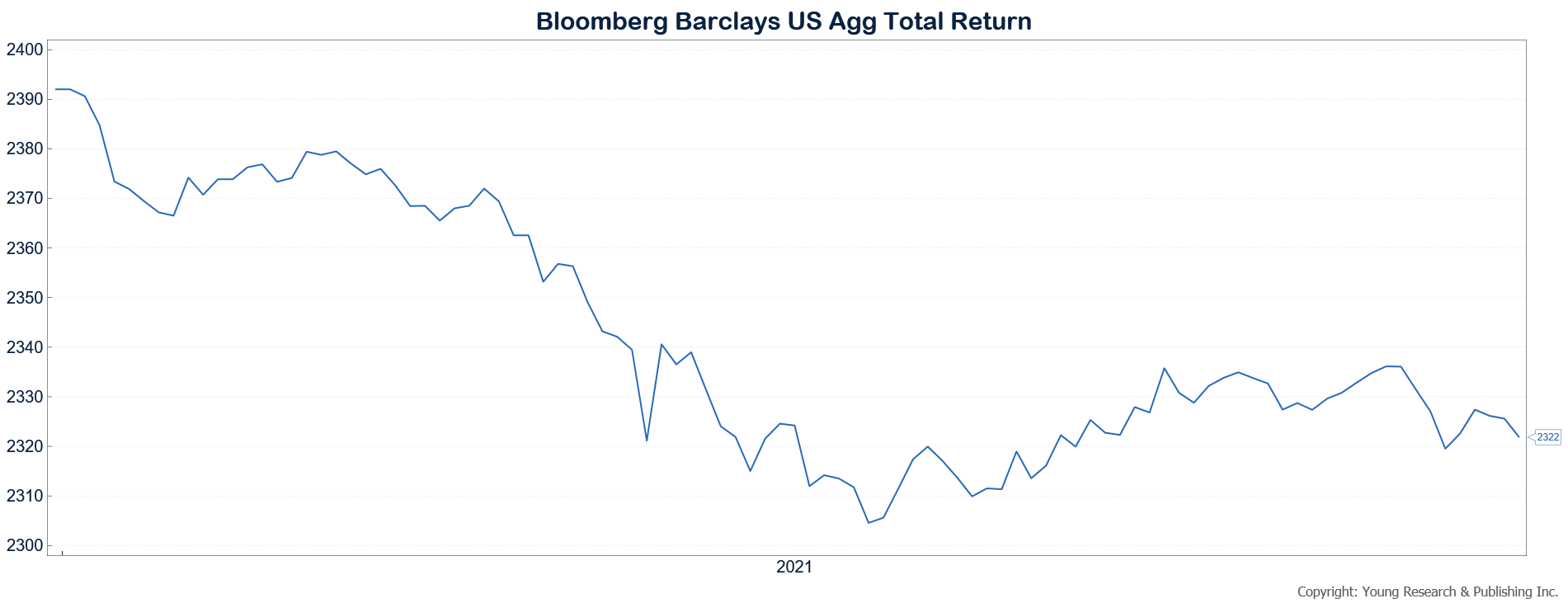

Fixed Income

We recently sold a position in long Boeing bonds that were owned by many clients. We purchased the bonds early in the pandemic. They had a maturity of 20 years, longer than we typically favor, but they also had an attractive coupon that we did not feel was commensurate with the risk of a Boeing default. The market eventually agreed with our opinion, and the bond price rose significantly from our purchase price. We decided to sell the position because the yield advantage the bonds offered had normalized, leaving the bonds more susceptible to both interest-rate risk and a resurgence in credit risk. A further decline in interest rates could theoretically lead to higher prices for the bonds; but we think lower interest rates will more likely come from renewed Covid restrictions. A clear negative for Boeing. The proceeds from the sale of Boeing bonds have been earmarked for more bond purchases.

In the current fixed-income environment, investing in bonds has been challenging. Ultra-low interest rates on Treasury securities are holding down interest rates on corporate bonds. While corporates offer better yields than Treasuries, they are still low by historical standards. Our approach for the current environment has been to be highly selective and hold an elevated cash position. We aren’t wild about holding cash, but cash brings down the maturity profile and interest-rate risk of a bond portfolio, and it provides optionality for a sudden change in circumstances. You can think of a high cash balance as a Treasury position in normal times. Coming into Covid, we held a significant portion of fixed-income portfolios in Treasuries. That didn’t look like a great idea until the corporate bond market started to fall apart in February and March. Having dry powder in the form of Treasuries allowed us to take advantage of the dislocation in corporate bond markets and scoop up bonds like the Boeing issue we just sold.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Hard work, patience, and compounding. If you are looking to pass some financial wisdom down to your kids or grandkids, here is something worthwhile you can share. The maximum amount workers can contribute to their 401(k) for 2021 is $19,500. And if you are under the age of 50, you can contribute $6,000 to an IRA. If someone makes max contributions to both, they could save $25,500 annually. Assuming an average annual return of 7% and allowing 35 years of compounding, these contributions will grow to roughly $3.8 million.

P.P.S. As I have written in the past, we often have investment strategy discussions with the adult children of current clients. Some clients reached out, asking if there is flexibility with our new account minimums. The answer to this question is yes. If you have children or other family members you believe would benefit from our investment counsel, please encourage them to give us a call or send an email. We are happy to help.

P.P.P.S. Have you met your 2021 required minimum distribution (RMD)? Do you plan on making a charitable donation from your IRA in 2021? To help us facilitate the processing of your RMD by year-end, we recommend you submit a completed distribution form before December 1. If you haven’t satisfied your RMD and don’t have a distribution plan in place, please contact our office as soon as possible. Submitting your request early will allow us to address any problems before year-end. If you fail to take your RMD by the December 31 deadline, a 50% penalty may be assessed on the amount you are required to take.

P.P.P.P.S. Each year, Barron’s ranks the nation’s top independent advisors. Richard C. Young & Co., Ltd. has been recognized on this list for 10 consecutive years.

* Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Rankings are generally limited to participating advisors and should not be construed as a current or past endorsement of Richard C. Young & Co., Ltd. Barron’s is a trademark of Dow Jones & Company, Inc. All rights reserved.