Dividend Stocks and Long Dry Spells in the Market

April 2014 Client Letter

During most stock-market cycles, usually in the later stages of a bull market, investor behavior can take a speculative turn. Caution is thrown to the wind as consensus builds that the market has nowhere to go but up. Investments considered safe fall out of favor, carefully developed asset-allocation plans are abandoned, and risky investments become fashionable.

These periods can lead to emotionally charged investment decisions with the potential to wreak havoc on investment portfolios. Based on anecdotal evidence we now observe (some of which we shared with you in recent letters), there are signals that investor sentiment has entered this speculative phase. Many investors today seem to worry more about generating the highest possible return (irrespective of risk) and less about crafting a suitable investment portfolio based on desired investment objectives.

Five years into this bull market, it is understandable that investors might wonder whether potential gains have been missed. With hindsight being 20-20, one could assume the only possible outcome was the one realized—a bull market. But events could have turned out much differently. During the bear-market lows in 2009, the risk of outright depression appeared greater than it had been in most investors’ lifetimes.

An important consideration when reflecting on the bull market is time periods. The media and Wall Street are enthusiastic about returns for the last five years but often exclude 2008 and the first two months of 2009 from their performance figures. Most of us are invested throughout up and down cycles. Excluding either bear or bull markets will not accurately reflect the success or failure of an investment portfolio.

The major stock-market averages have made substantial gains from their 2009 lows. However, measured more comprehensively over a full market cycle, returns have been rather disappointing.

How disappointing? Let’s look at the NASDAQ as an example. Of the three major U.S. market averages, the NASDAQ Composite Index has been the best-performing index during this bull market. That makes it an easy target to pick on.

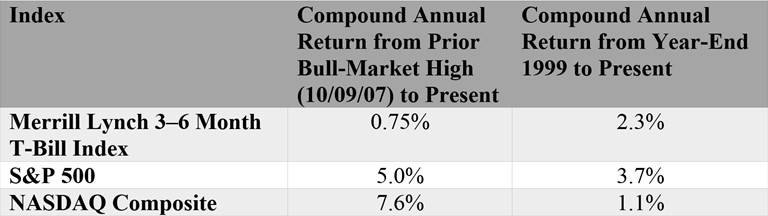

The NASDAQ is up an impressive 240% (27% compounded annually) since its March 2009 lows. Investors trying to make up for lost returns by chasing performance in NASDAQ stocks are likely hoping for similar future returns. What these investors may not appreciate is that when measured from the prior bull-market high in October of 2007, the NASDAQ is up a much more modest 7.6% annually. Not terrible, but not the shoot-the-lights-out returns many are counting on, either.

Now consider this surprising figure: since year-end 1999, the NASDAQ is up only 1.1% per year. That is nearly two full cycles and most of a retirement for many investors. Risk-free T-bills earned more than NASDAQ stocks over the same time period.

You may be thinking the NASDAQ isn’t a representative example because it was at the epicenter of the dot-com bubble, and fell much more than other major market averages during the bust. This is true, but a similar pattern emerges when evaluating the performance of the broader S&P 500. As shown below, from the October 2007 prior bull-market high, the S&P 500 has generated a total return of only about 5% per year. When measured from year-end 1999, the index generated a return of 3.7% per year. That beat T-bills, but not by much, and with significantly more risk.

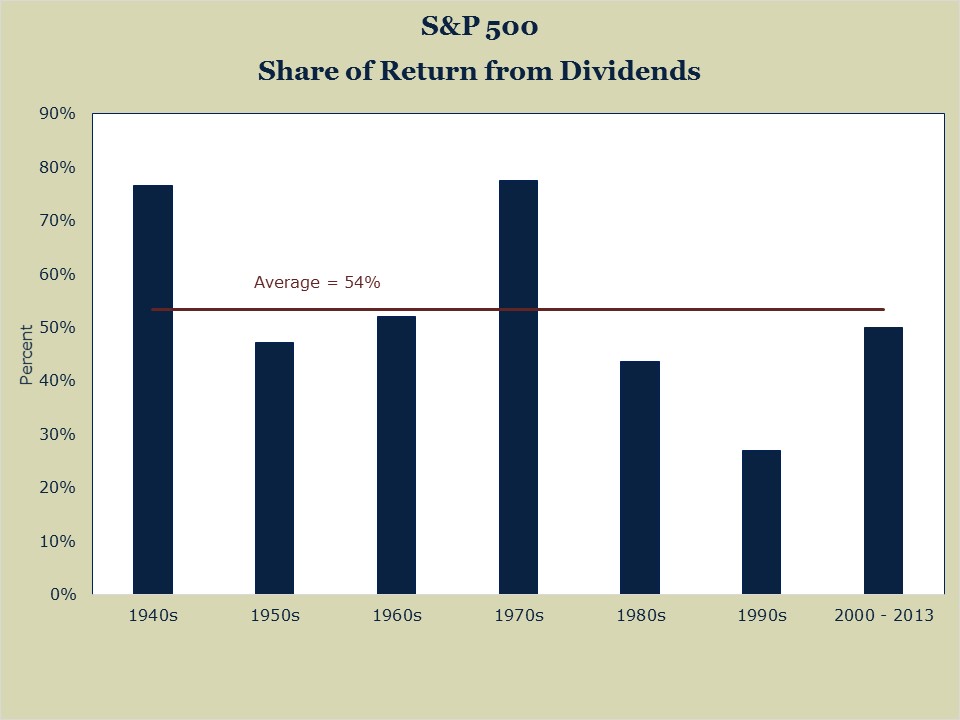

The disappointing returns of the NASDAQ and the S&P since year-end 1999 are a sobering reminder that stock prices can remain depressed for agonizingly long periods. In our view, a solution to these long dry spells is to give dividend-paying stocks a leading role in equity portfolios. Dividends are a vital component of long-term investment returns. Over short time frames and during long bull markets, dividends may seem trivial, but as you can see in the chart below, over the last seven decades, dividends have accounted for an average of 54% of each decade’s stock-market returns. As always, past performance is no guarantee of future results.

When measured over multi-decade periods, the scales become even more tilted in favor of dividends. Over the last 40 years, dividends and the reinvestment of dividends have accounted for over 70% of the S&P 500’s total return.

A Steady Stream of Income

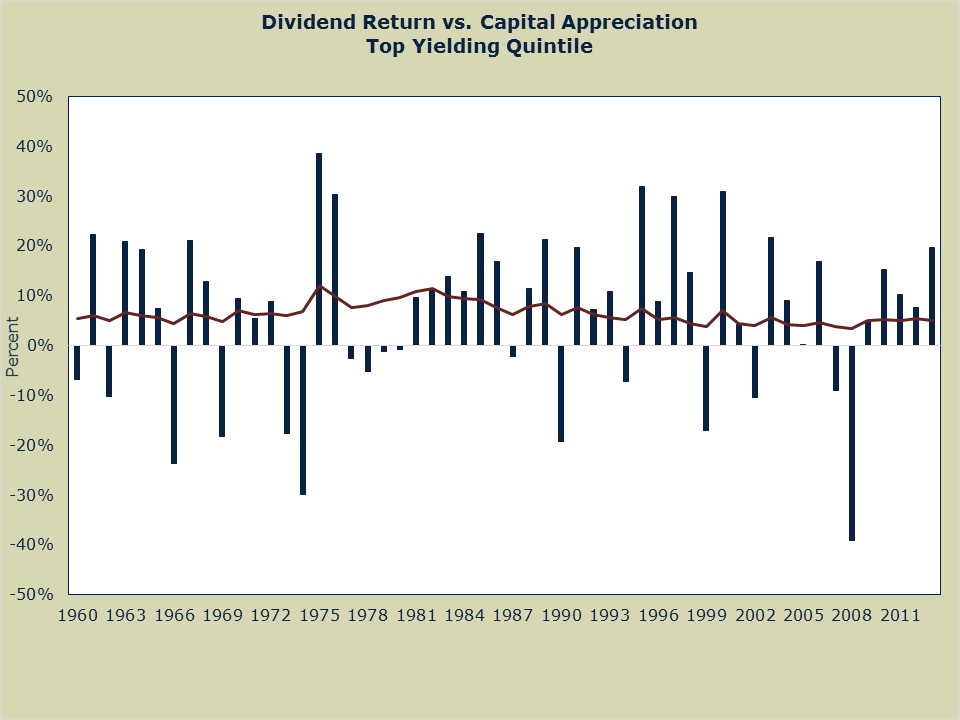

Chart 2 compares the capital-gains component of returns to the dividend component of returns for high-yielding stocks. Note the stability of dividend returns compared to capital gains.

Reduce Risk with Dividend Stocks

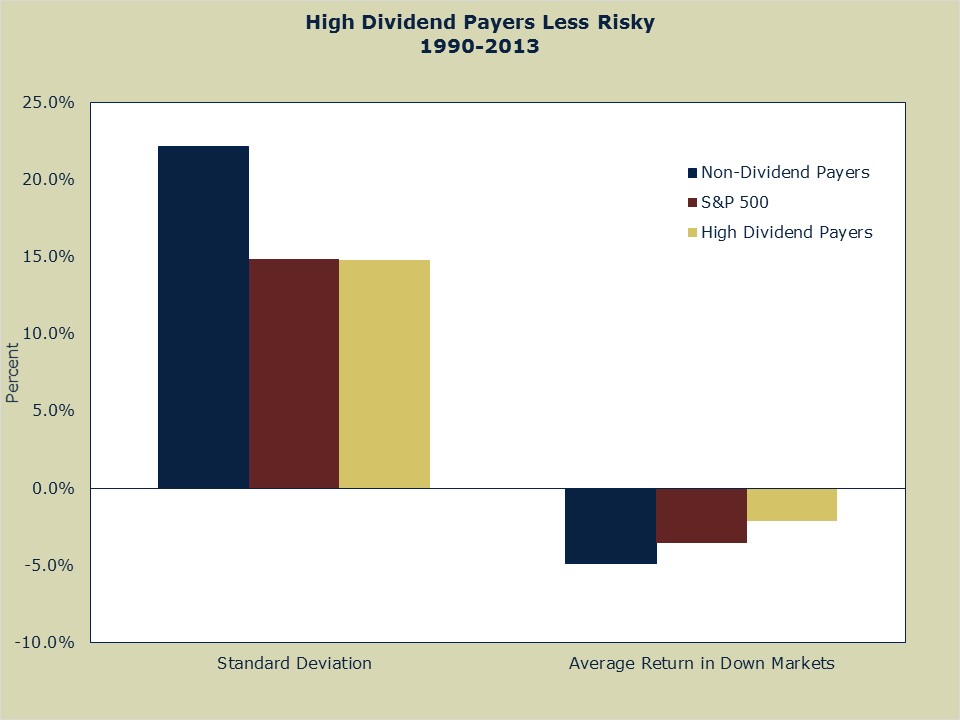

What’s more, dividends help reduce portfolio volatility. Chart 3 shows that high-yielding stocks have been less volatile than non-dividend-paying stocks. And high-yielders have held up better in down markets than both non-dividend-payers and broad-based stock-market indices such as the S&P 500.

Dividends as a Quality Filter

A dividend strategy can also help you avoid many of the pitfalls that wreak havoc on even the most seasoned investors’ portfolios. Dividend-paying companies are often more durable businesses than non-dividend-payers. Payers are also more likely to operate in industries with higher barriers to entry and have stronger balance sheets than non-dividend-payers. And because there is a stigma associated with cutting dividend payments, the consistent payment of dividends may be seen as a signal of management confidence in the future prospects of a company. This is especially true of companies that raise dividends. Management teams rarely commit to higher dividend payments unless they are confident the dividends can be maintained through thick and thin.

Cold, hard cash in the form of quarterly dividend payments can also help investors avoid some of the most deplorable examples of corporate fraud. Who can forget the accounting frauds of Enron, WorldCom, and Tyco that decimated many retirement portfolios? Not a single company in the group paid a meaningful dividend. Companies can manipulate and fake earnings by using creative accounting techniques, but regular dividend payments can’t be faked.

A Free Lunch?

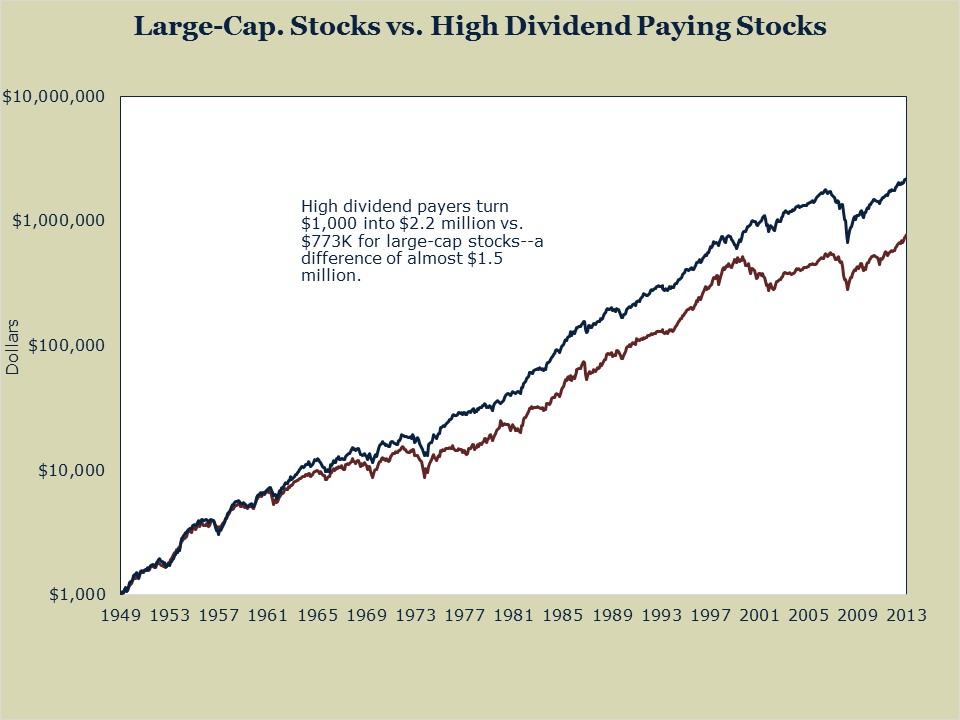

What is the trade-off for consistent income, lower risk, and higher quality? How do higher returns sound? Although one might expect a high-quality, low-risk strategy to generate lower long-run returns, the opposite has been true. Over the long run, high-yielding stocks have outperformed the broader market. Not every year, of course, but over time, the highest-yielding quintile (top 20%) of stocks beat the market by a substantial margin (Chart 4). Again that is no guarantee of future results.

Dividend stocks, and especially high-yield dividend stocks, can have appeal for all types of investors. A continuous stream of dividends can be used for living expenses (ideal for retirees) or reinvested in down markets at a lower share price, resulting in higher future-dividend payments (ideal for long-term wealth accumulation). A steady stream of cash also makes it easier for investors to avoid the emotionally charged decisions that tend to sabotage portfolios in down markets.

Have a good month, and as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Best regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Several months ago, I briefly profiled the strong 2013 performance for consumer discretionary stocks— a sector we tend to avoid. In a rather quick about-face, the S&P 500 Consumer Discretionary index—which includes autos, media, retail, and hotels—is down nearly 5% in 2014 and is the year’s worst-performing sector. Stocks contributing to steep losses include Best Buy, Amazon, and GameStop, down 38%, 23%, and 20%, respectively.

P.P.S. The best-performing sector for 2014—and by a wide margin—is utilities. YTD, the utilities sector is up 13%. We favor utilities companies for several reasons. A main reason is that the industry in which they operate has high barriers to entry. I would not characterize many of the companies in the discretionary sector as businesses with high barriers to entry. Utility companies also tend to pay a relatively high dividend yield, often raised annually. Annual dividend increases are one way to combat the nasty effect of inflation.

P.P.P.S. Despite assurances from the Bureau of Labor Statistics that inflation is under control, many Americans will notice significant price increases this grilling season. U.S. beef prices are at all-time highs. USDA choice-grade beef reached a record $5.28 a pound in February, up from $4.91 one year ago. The same grade of beef cost $3.97 in 2008.