Dividends the Key Element to Investing

October 2015 Client Letter

In July 1989, just four months before Richard C. Young & Co., Ltd., was incorporated, my dad was interviewed by The Providence Journal Bulletin. In that article, titled “Dividends the Key Element to Investing,” my dad provided the following stock advice:

- The smart individual investor will tie down yield first and let capital gain come as it may.

- Bet on stocks that have dividend momentum.

- Pay no attention to companies that cut or don’t pay dividends.

- Ride out core positions through thick and thin.

- Assemble a portfolio of stocks that has a yield higher than the Dow’s yield and a growth rate in dividends that outstrips the Dow’s growth rate.

Ben Graham’s Dividend Investing Advice

My dad is quick to point out that the dividend-centric strategy is not his invention. He says his interest in dividends started back in the early 1960s at Babson College, when he was introduced to Ben Graham and his book Security Analysis (copyright 1962). In Security Analysis, Mr. Graham writes, “For the vast majority of common stocks, the dividend record and prospects have always been the most important factor controlling investment quality and value. In the majority of cases, the price of common stocks has been influenced more by the dividend rate than by reported earnings. In other words, distributed earnings have had a greater weight in determining market prices than have retained and reinvested earnings.”

Today, investors face a climate where high dividend yields are not abundant. The yield on the S&P 500 does not even break 2%. Loose Federal Reserve policies going back to the 1990s have reduced yields by propping up stock prices. To counter the effects of low yields overall, we manage equity portfolios by selecting stocks of companies with policies that favor dividend increases year after year. By example, if dividends increase 5% every year, after five years a stock with an initial yield of 2% will yield 2.6% on the initial dollar invested.

Why We Buy Consumer Staples Stocks

When searching the stock market universe for acceptable candidates for our dividend strategy, we spend a lot of time in the consumer staples space. Consumer staples companies make everyday products, including paper towels, diapers, soft drinks, deodorant, and toothpaste, to name a few. They are the antithesis of the current glamour stocks (think Tesla, Amazon, Apple, Google, etc.) that dominate newspaper headlines and financial news networks. There isn’t much room for innovation in the sale of toilet paper and toothpaste. These are boring businesses, but in investing, boring can be a winning strategy.

Consumer Staples Stocks Long-Term Winners

According to Fidelity, since 1962, the boring consumer staples sector has delivered the second-highest return among the 10 economic sectors in the U.S. stock market. Over this period, consumer staples stocks returned a compounded annual 12.9%—almost 2% per year more than both the broader market and today’s favored consumer discretionary and technology sectors. Two percent may not sound like much, but compounded over 53 years, the difference on a $10,000 investment would amount to $3.8 million dollars. Yes, million.

Why have consumer staples stocks delivered such strong returns? One reason is the strong brand value of the businesses in the sector. Many of the leading household brands from 50 years ago are still the leading brands today. The formidable brand value of a Coca-Cola, a Procter & Gamble, or a Unilever creates high barriers to entry that keep competition away and allow incumbents to generate high and sustainable returns on investment.

Consumer Staples Stocks Less Risky

The potential for solid returns isn’t the only reason we favor consumer staples companies, though. Consumer staples stocks also tend to be less volatile than the broader market, and during bear markets, have historically fallen less than the average stock. The reduced risk of consumer staples stocks likely comes from the nature of the products they sell. Even in recessions, consumers continue to brush their teeth, clean their dishes, and wipe up spills.

Consumer Staples Solid Dividend Payers

Solid and sustainable returns on investment, along with stable demand through thick and thin, allow consumer staples companies to return significant capital to shareholders in the form of dividends. In our view, many of the market’s best dividend stocks are in the consumer staples sector. Consumer staples stocks often have higher dividend yields and stronger dividend growth than stocks in other sectors. We believe high dividends today and the promise of higher dividends tomorrow are a powerful tonic for retired investors and those soon to be retired.

Long term, the opportunity for growth in the consumer staples sector is in foreign markets. The U.S. is a mature market for consumer staples businesses, but the U.S. represents only about 5% of the world’s population. In emerging markets, where 85% of the world’s population resides, staples companies are generating robust growth. As incomes in emerging markets rise, so too will demand for consumer staples.

Investing in Healthcare Stocks

The opportunity for businesses in foreign markets isn’t limited to consumer staples companies. Foreign markets also offer profound promise for health-care companies.

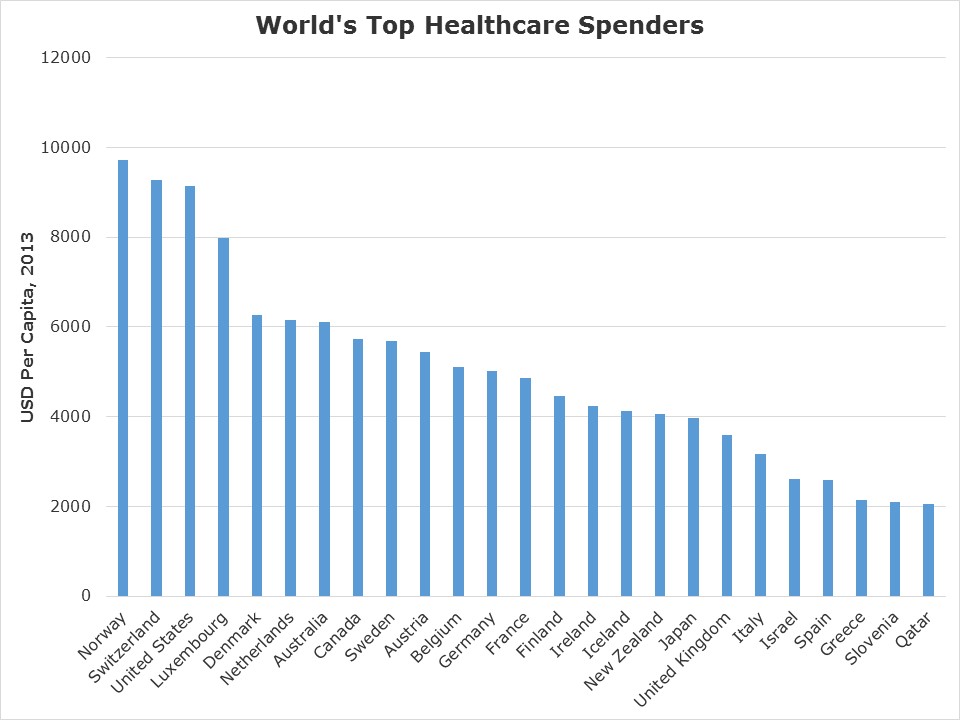

Consider the two secular trends likely to drive health-care spending for decades to come: aging and population growth. Take a look at our first bar chart below and you’ll see the 25 countries with the highest per-capita health-care spending (2013). It’s no surprise to see Norway, Switzerland, the U.S., Luxembourg, and Denmark listed in the top five. The rest of the list (excluding a few small tax-haven countries) is filled out by various European countries, Canada, Israel, Japan, Australia, Qatar, and New Zealand. These wealthy nations seem willing to spend whatever it takes, either privately or publicly, to protect the health of their citizens.

These countries are likely to demand more prescription drugs, more medical devices, and more consumer-branded medical products in the coming years. The world’s population is aging, and with aging comes a greater demand for medical treatment. According to the UN, “The global share of older people (aged 60 years or over) increased from 9.2 per cent in 1990 to 11.7 per cent in 2013 and will continue to grow as a proportion of the world population, reaching 21.1 per cent by 2050. Globally, the number of older persons is expected to more than double from 841 million people in 2013 to more than 2 billion in 2050.”

Deloitte LLP says that population aging will

Create additional demand for health care services in 2015 and beyond, primarily in Western Europe and Japan, but also in countries including Argentina, Thailand, and China, where it will combine with a sharp decline in the number of young people. Life expectancy is projected to increase from an estimated 72.7 years in 2013 to 73.7 years by 2018, bringing the number of people over age 65 to around 580 million worldwide, or more than 10 percent of the total global population. In Western Europe and Japan the proportion will be higher, at 20 percent and 28 percent, respectively.

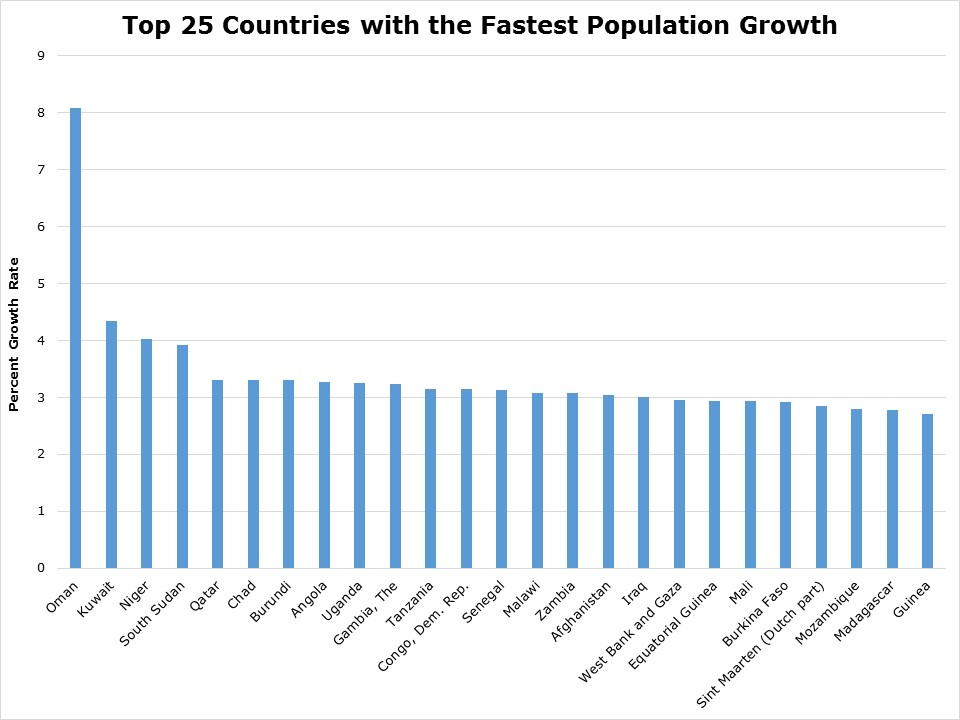

On our second chart, you’ll find the opposite end of the spectrum, a list of the fastest-growing countries by population (2014). These are mostly countries in Africa, with a few from the Middle East, as well as a lone Caribbean country. Africa is much more peaceful than it used to be, with only a regional war here and there. (If that language doesn’t reassure you, consider that it could also be used to describe Europe today.)

Fifteen of these economies have grown over 100% on a per-capita GDP basis in the 10 years ending in 2013. That’s through a housing crisis in the U.S. as well as a global financial crisis. During that time, many of these countries were at war, some with the U.S., and one didn’t even exist in 2003. A 2011 report from the World Health Organization showed that “Income (per capita GDP) has been identified as a very important factor for explaining differences across countries in the level and growth of total health care expenditures.” Despite war and hardship, emerging markets are growing and will most likely demand better services in the future.

As emerging markets grow, and developed markets age, demand for health-care products and services is likely to rise. We believe that American pharmaceutical, medical device and consumer health-care companies will be beneficiaries of that growth. We gain exposure to the healthcare industry by purchasing the Vanguard Health Care ETF (VHT) and the Fidelity MSCI Health Care Index ETF (FHLC) for clients.

Energy Transportation

Pipelines are another sector where we find the types of businesses that have the capacity to pay a growing stream of dividends. Like many consumer staples businesses, the pipeline business is a simple and boring business. You lay pipe, move oil and gas through it, and charge a volume-based fee that increases with the rate of inflation. What’s not to like?

Apparently a lot, if the Alerian MLP Infrastructure Index is any indication. The index has fallen 35% from its high in 2014. It fell especially sharply toward the end of September in what was reminiscent of the forced deleveraging of MLP pipeline shares during the financial crisis.

Investors in the pipeline MLP sector tend to paint with a broad brush. When oil and gas prices are down and oil and gas producers fall, pipeline businesses tend to get sold in sympathy. But while some MLPs are exposed to oil and gas prices, many are not. Companies that transport gasoline or jet fuel from refineries to end markets aren’t negatively impacted by falling oil prices, by example. In fact, lower oil prices are a boon to firms that transport gasoline as lower prices tend to boost demand.

We view the sell-off in pipeline MLPs as a short-term dislocation that, if anything, creates opportunity for serious long-term investors. Pipelines remain a vital part of the U.S. energy infrastructure, and we are confident they will remain so for decades into the future.

The pipeline and consumer staples sectors both tend to be higher-dividend-paying sectors. Most often, dividend-paying companies are stronger and more durable businesses than non-payers. Payers often have higher barriers to entry and stronger balance sheets than non-payers. And because there is a stigma associated with cutting dividend payments, the consistent payment of dividends is a signal of management confidence in the future prospects of a company. This is especially true of companies that raise dividends. Management teams rarely commit to higher dividend payments unless they are confident that the dividend can be maintained through thick and thin.

Have a good month and, as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. Judy Shelton recently explained how the Fed’s interest rate policy has promoted Wall Street’s interests at the expense of the ordinary investor in the article “Why Aren’t GOP Candidates Blaming the Fed?” published on the CNBC website October 22, 2015.

We have seen that the Fed’s decision to keep interest rates at zero these past seven years has not accelerated economic growth. Instead of financing capital investment to expand production, companies used the cheap money to buy back their own shares and pursue mergers and acquisitions at a blistering pace. Great for boosting stock prices and enriching investors, but hardly productive when it mostly amounts to window dressing and dubious synergy claims.

Guess who has been subsidizing Wall Street’s deal making? Thanks to the Fed’s repression of interest rates, people with ordinary savings accounts are forced to contend with pitiful returns from their own efforts to be financially responsible. At the end of 2006, the average yield on a one-year CD was 3.8 percent, according to Bankrate.com; currently, the average yield for a one-year CD is 0.28 percent.

P.P.S. In a September 29 interview with Forbes, Charles Koch had this to say:

My view of the political realm, not just now but for many decades, is that the Democrats are taking us down the road to serfdom over the cliff at 100 miles an hour and the Republicans are going around 70 miles an hour….

There are a lot of topics we could talk about but two really big ones. One is we have out of control spending, irresponsible spending by both parties that are taking us toward bankruptcy as a country and as a government. Related to that is we’re headed toward a two-tiered society. We’re destroying opportunities for the disadvantaged and creating welfare for the rich. This is coming about by misguided policies creating a permanent underclass, it’s crippling the economy and corrupting the business community.