Headline Investing

June 2021 Client Letter

As things look today, it appears we may head into summer facing more troubling financial headlines than we saw during the first half of this year. Inflation has been a big topic this past month, but now headlines regarding volatility are becoming more prevalent.

While I was writing this month’s letter, a visit to the Barron’s homepage included the following headlines:

- The Dow Just Had Its Worst Week Since October. Why It Could Get Worse.

- Investors: Prepare for a Volatile Summer.

- Interest in Buying Stocks Is Fading. Check Out the Numbers.

All three headlines are, of course, meant to grab your attention, but basing investment decisions on headlines designed to sell subscriptions is not the best strategy.

After a big bull-run like the one markets experienced over the last year, it is natural to feel unease about the prospect of a correction. Who wants to see the value of their portfolio fall from a high? I often remind clients feeling anxious about a potential correction that markets move in two directions.

The S&P 500 was up nearly 12% in the first four months of the year. If stocks continued to climb at that rate for the balance of 2021, the S&P 500 would be up 40% for the year. While stocks have gained 40% in a single year, the last time it happened was 1954—over six decades ago. The more likely scenario is that stocks won’t be up 40% for the year, which implies a correction in price or at least a lull in the pace of gains.

Despite what financial headlines want investors to believe, the fact that markets periodically experience declines does not necessarily warrant concern or panic.

Headlines Don’t Predict the Direction of Stocks

Headlines, after all, are often poor predictors of the direction of stocks. Remember this one from The Atlantic in 2016? “Donald Trump’s Economic Plans Would Destroy the U.S. Economy”. The author writes, “Trump has promised to make America great again. But a closer look at his policy proposals, such as they are, suggests that within his first few years as president, he would more likely make America recessionary again.”

And it wasn’t just journalists who got it so wrong. Even Nobel-Prize-winning economist Paul Krugman said Donald Trump would bring global recession.

Clearly, no recession was caused by Trump’s election or the policies he put in place. Contrary to what The Atlantic and Paul Krugman predicted, the economy and markets boomed, and unemployment fell to the lowest level in decades.

We heard similar catastrophic predictions about what would happen to the United Kingdom if they went through with Brexit.

Foreign Policy ran with a headline in 2018 that said, “A No Deal Brexit Will Destroy the British Economy.”

How is the U.K. doing post-Brexit? The excerpt below is from a recent article in The Telegraph that provides a nice summary.

Rewind five years, to the morning after a vote that took almost everyone by surprise, and the consensus was that the British had committed economic suicide. The pound dropped by the most on record, at one point getting close to parity with the euro and even the dollar. Investors fled from the London market. A new Prime Minister was desperately searching around for some kind of strategy for leaving the EU, and business was attempting to work out how it could cope with our departure. As we now know, the predictions of Project Fear turned out to be wildly overblown. House prices haven’t collapsed, unemployment hasn’t soared, and although some jobs have been lost, factories have not relocated wholesale to France and Spain, nor has the City decamped en masse for Frankfurt and Paris even if Amsterdam has picked up some trading business.

Reading the headlines and the news is a necessary part of managing an investment portfolio, but it’s important to remember that headlines are written to sell newspapers and subscriptions, and news is best used to inform rather than to advise.

Inflation Headlines

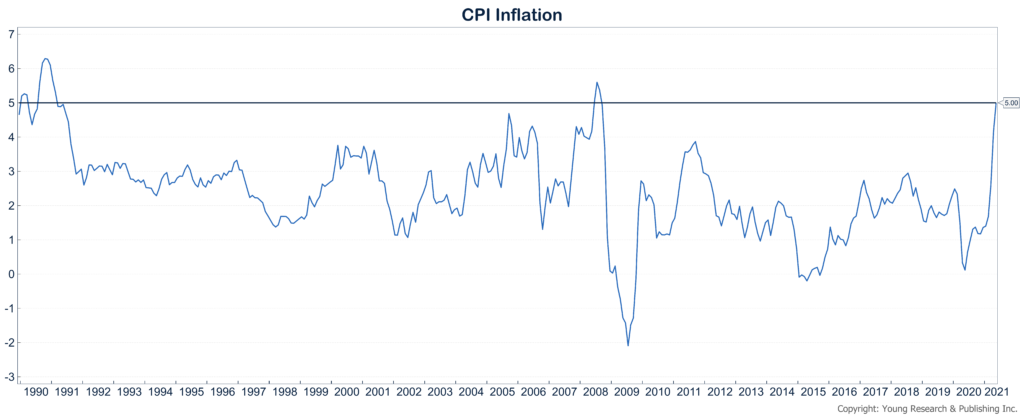

As mentioned above, the dominant theme in today’s financial headlines seems to be the prospect for faster inflation. Measured by the Consumer Price Index (CPI), inflation is 5% today. Inflation of 5% or more has been rare over recent decades. The chart below shows the annual rate of inflation for the CPI since year-end 1989. There were a couple of months in 2008 when oil spiked that inflation rose above 5%; and then in the early 1990s, inflation was over 5% for a few months.

If inflation persists at 5%, it would indeed be a problem for financial markets. Long-term interest rates would likely increase significantly, driving down the price of most assets, including stocks, bonds, and real estate.

Soaring money supply and rising commodity prices do not help put investors’ minds at ease about the prospect of higher inflation. What should offer some comfort is that bond investors with actual money on the line expect inflation in the medium term to average 2% to 2.25%.

Inflation May Be Temporary

For now, we are waiting to see if the higher pace of today’s price increases is temporary or lasting. Low CPI readings from last year, when oil briefly dipped into negative territory, along with pent-up demand and supply-chain constraints caused both by COVID-19 (COVID) and a sudden shift in spending from services to goods appears to be the primary driver of today’s elevated readings. As the economy works through these supply and demand issues, we are likely to get a better read on how much of today’s elevated readings are temporary versus permanent.

If investors begin to believe inflation has gotten ahead of the Fed, we should brace for a potentially difficult period in markets.

What should you do in the meantime?

Two Investment Tactics for Inflation

Number one, be invested. One of the biggest mistakes individual investors make is not being invested. Retirement is expensive, especially when factoring in the constant effects of inflation—whether that inflation is moderate or otherwise. Your dollars will only keep up with inflation if given a chance. They have no chance sitting in your bank account.

Number two is to include assets in your portfolio that can help hedge against inflation. Real assets such as commodities or gold can hedge against inflation, but over the long run, so do stocks. We especially like dividend stocks for this purpose.

Companies that make regular annual dividend increases that exceed the rate of inflation are effectively providing you with an inflation-adjusted income stream.

In our view, on a risk/reward basis, dividend-paying stocks make a lot of sense. Many of the companies we own are ones we consider to be blue-chip, and they possess the characteristics to ride out the business cycle. Dividend payers also tend to provide the most comfort and peace of mind during difficult stock market environments, given their relatively reliable income streams.

Our goal is to buy companies we believe will hold their value for the long term. We are not buying based on what we expect will happen next month or next quarter. And we do not sell just because an industry or a particular company goes through a tough period.

We’ve held energy stocks and pharmacy stocks for years now. Both have experienced difficult environments, but for now, it appears as though they’ve turned a corner. Energy shares tumbled in 2014 when oil prices crashed from over $100 to less than $30. They fell further following COVID when the world locked down and oil demand cratered. Today, oil is trading back above $70 per barrel, and oil and gas shares have recovered.

Pharmacy stocks struggled in recent years partly due to investor fear that Amazon was entering the business. Slow foot traffic, in addition to some pricing pressure in other parts of the pharmacy business, has kept share prices of CVS and Walgreens at deeply depressed levels; but both stocks are now rallying as consumers return, and the Amazon threat hasn’t yet materialized in any meaningful way.

With Six Months Down, How Are We Doing?

I don’t tend to get too caught up in the performance of a portfolio over shorter time frames. I have clients I’ve worked with for over 20 years, and analyzing returns over months and quarters is not always relevant.

But, to provide perspective and outlook for the rest of the year, I will review how our three main asset classes have done so far in 2021.

Retirement Compounders

The Retirement Compounders (RCs) is our globally diversified portfolio of dividend- and income-paying securities. Most RCs securities are individual stocks, including Caterpillar, Evercore, Hershey, Intel, and Visa. We are at the halfway mark of the year, and most of you, as of this writing, have received all your dividends as expected and are also benefiting from dividend increases. In addition, the RCs as a group have had healthy returns YTD.

Reasons for the gains include lots of money in the system, 0% interest, and the reopening of the global economy, among other factors. Also, year-over-year (YoY) comparisons of corporate earnings have been positive. Given that these factors should remain in place for the rest of the year, it’s reasonable to assume that the stock market may have more juice left in the tank in 2021.

But, as mentioned above, we still need to get a better feel for the inflation outlook. Currently, it appears that the market thinks the Fed has inflation under control. If this outlook changes and the narrative switches to one in which inflation has gotten out ahead of the Fed, markets could get bumpy.

Bonds

Last year caused lots of disruptions in the financial markets. When the COVID crisis began, we braced for yields to collapse across the board. Fortunately, this was not entirely the case within corporate bonds. Reasonably attractive yields remained for a period of time. Yields ended up declining during the rest of 2020, which pushed up the value of our bonds. From a return standpoint, the bonds did extremely well last year—double- and upper single digits for most portfolios.

But the strong returns came with a price: near-historic low yields today. Cash and short-term paper are essentially offered at 0%. And, somehow, we live in a world where U.S. GDP growth for 2021 is projected to be 6.5%. And there are inflation concerns, yet the 10-year Treasury note yields just 1.5%. GameStop and AMC sure do hog a lot of print in the media, but I think the yield on the 10-year Treasury note is the story of the year. Investors, especially those in or nearing retirement, could really benefit from higher interest rates.

Portfolio Insurance

Gold has bounced around this year. Gold declined during the first three months, recovered in April and May, and is now again in negative territory. But this is not a complete surprise. Gold tends to perform well during periods of stress, unrest, and uncertainty. Last year we had all three: COVID, closure of the global economy, riots in the U.S., and an election. When you stir that all together, you get a big heap of uncertainty, which creates an ideal environment for the shiny metal. If you want to know why we own gold in your portfolio, 2020 is your answer. Compared to last year, 2021 is a breeze. There is much less uncertainty, and the global economy is making significant progress. Gold tends to be desired less in these types of benign environments.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Did you know that the U.S. accounts for only about 25% of global economic output? Investors who eschew international stocks may be forgoing most of the world’s economic and investment opportunities. Investing internationally can also better diversify your portfolio. Global economies and markets don’t always move together. When the U.S. zigs, Switzerland may zag. What’s more is that after years of U.S. outperformance, foreign markets may be overdue for a period of catch-up. Over the last decade, the U.S. has outperformed foreign markets; but in the prior decade, it was foreign markets that bested the U.S.

P.P.S. We started purchasing the Fidelity Floating Rate fund in client portfolios last spring when COVID fear was wreaking havoc in financial markets. This fund invests in bank loans. While we tend to favor individual securities in most of our investing, loans are not easily traded and held by individual investors. The only practical way for most investors to gain exposure to loans is via a mutual fund or ETF. Here’s Kiplinger’s nice explanation of the Fidelity Floating Rate fund:

As interest rates fell in 2019 and 2020, investors paid bank loans little attention. But an economic recovery and the likelihood of rising short-term interest rates are prime conditions for these loans, which pay an interest rate that adjusts every few months in step with a short-term [sic] bond benchmark. When yields rise, most bond prices fall. But bank loans, often called floating-rate loans, retain their value. The managers at FIDELITY FLOATING RATE HIGH INCOME, Eric Mollenhauer and Kevin Nielsen perform detailed analysis on each company before they add a bank loan to the fund. Bank loans are typically issued to firms that have junk credit ratings (double-B to triple-C). That means they have a higher risk of default, so Mollenhauer and Nielsen are right to be choosy. Along with 20 analysts, each an industry specialist, the managers build a diversified portfolio one loan at a time based on a company’s prospects over the next two to three years. Floating Rate High Income has a reputation for being more conservative than its peers, tilting toward firms rated double-B, the highest-quality end of high-yield credit ratings. That’s still true, but lately, the fund holds more of its assets than usual in loans rated single-B. These days, it’s a risk worth taking. “With an accommodative Federal Reserve, pent-up demand, and the potential for a big infrastructure package, our companies are set up well,” says Nielsen. The fund yields 3.03% today.