Consistency

March 2022 Client Letter

Fortunately for me, the worst part of getting COVID-19 was the effect it had on my fitness program. As I wrote in my last letter to you, I have been exercising consistently since my Peloton bike arrived in April 2021. But a combination of unexpected travel and a mild form of the virus led me to miss many weeks of workouts.

When I finally got back into the saddle, my absence from my near-daily workouts was shockingly noticeable. On the first ride, it was evident my body was out of sync and not happy to be peddling. The Peloton data display allows riders to compare current workout metrics to past metrics. My post-COVID numbers were way off; and, since returning to the bike, I am still nowhere near where I was previously.

I observed a few things since getting back into an exercise routine: 1) Before COVID I was in much better shape than I had given myself credit for. 2) I now understand why I was in such good shape: It wasn’t from working out for hours each day at maximum effort or intensity. It was simply that for months, from April into December, I was exercising daily. Aided by the Peloton suite of fitness offerings, I not only biked but also mixed in their strength, stretch, and foam rolling classes. Even when short on time or not feeling motivated, I would do at least a 10-minute workout which, in my book, counts toward daily exercise. The consistency of my efforts had really begun to pay off.

Consistency can also be used as part of a successful investment strategy.

Dividend Consistency

Our Retirement Compounders® (RCs) equity program targets consistent dividend-payers. The longer the record of regular dividend payments, the better. Companies that have paid consistent dividends through numerous economic expansions and contractions are often quality businesses.

In the RCs, we favor firms with consistent records of paying regular dividends, but we also like firms that have consistently increased annual dividends. A growing stream of dividend income can solve a lot of problems for investors.

How Dividend Stocks Can Help You

For starters, and especially topical today, dividend growth can help offset the impact of inflation on the purchasing power of your retirement portfolio. Companies that pay meaningful dividends and raise those dividends over time also provide a more meaningful foundation for long-term capital appreciation. What do I mean by meaningful? Consider a non-dividend-payer whose price has risen because investors believe the firm’s prospects have improved. Zoom circa early 2020 comes to mind as an illustrative example.

In February of 2020, a share of Zoom could be purchased for $105. To put some context around the price, at $105 per share, Zoom was trading for 25X sales. Sales for the prior 12 months were $622 million. Historically, a 25X sales multiple indicates investors anticipate significant growth in the future.

The pandemic hit in March, and lockdowns started soon after. Zoom’s business boomed. The share price rocketed upward to $470 by September of 2020. At $470 per share, Zoom was trading at 97X sales, which had increased to $1.6 billion. If investors anticipated rapid growth in February, expectations were off the charts by September.

Today, Zoom does annual sales of $4 billion. That is more than six times the sales number from February of 2020. A six-fold increase in sales in two years is an impressive feat. The problem for Zoom investors is that sentiment on the company’s future prospects has cratered. As of this writing, Zoom shares are trading at $99 per share, which equates to “only” 7X sales. Despite a truly colossal increase in sales, shareholders are 6% poorer today than they were two years ago.

Contrast a company like Zoom with a hypothetical dividend-payer. I’ll keep the arithmetic simple for illustrative purposes. Assume a starting share price of $100, an annual dividend of $3, and a dividend growth rate of 7.2%. At 7.2% growth, the dividend will double in 10 years. To maintain a 3% yield in 10 years, the share price would also have to double. A cold hard stream of cash you can deposit in the bank provides a more meaningful foundation for capital appreciation than an increase in sales that is more of an abstract concept to shareholders.

Dividend Stocks Tend to Fall Less in Bear Markets

What other problems can dividend stocks help investors solve? Bear markets aren’t fun for anybody. This is especially true for those in or nearing retirement. Retired investors may rely on their portfolios for income, and those nearing retirement simply don’t have as much time to make back the losses. While not a cure-all, stocks with a consistent record of paying and increasing dividends tend to fall less in bear markets than do non-dividend-payers. Why? Not only are companies that consistently pay and increase their dividends most often more stable and cash-generating, but when prices fall, a reliable dividend can provide a floor under the price as yields rise.

Dividend consistency is comforting during periods of market volatility like we have today. The current bout of volatility has been wicked for non-dividend-payers and high-growth/technology companies. You may recall from previous letters that technology shares have come to dominate the S&P 500. Apple, Amazon, Google, Facebook, Microsoft, Nvidia, and Tesla are among the ten largest stocks in the index.

The Big Bust in High-Growth/Technology Stocks

The table below lists some of the more recognizable high-growth technology companies that are among the worst 10 performers in the S&P 500 YTD.

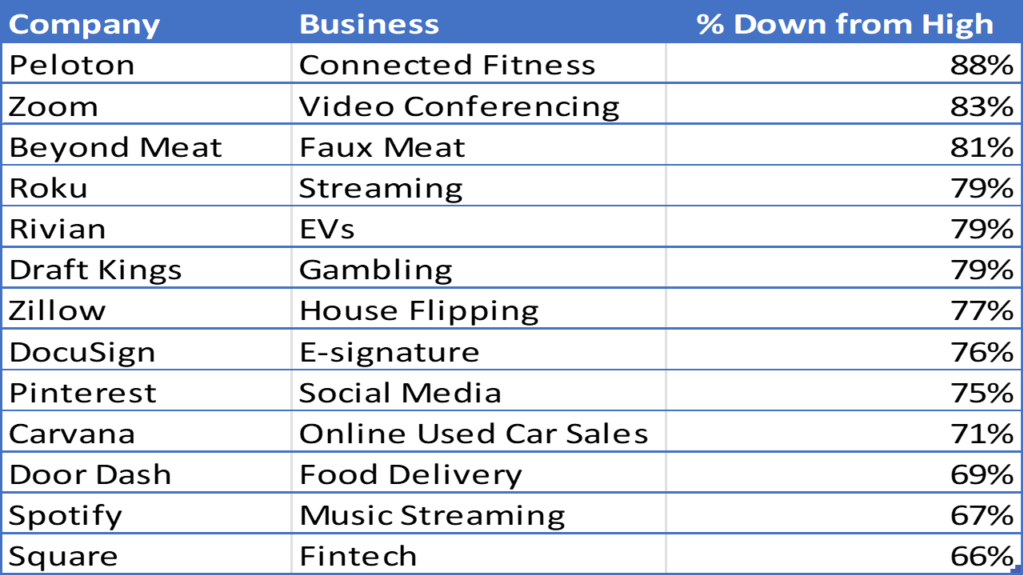

If you broaden the list to include the 1,000 largest companies as measured by the Russell 1000 index, you see carnage in high-growth names rivaling the dotcom bust. The list below shows how much each company is down from its all-time-high price reached within the last two years.

Stodgy Dividend-Payers Fine in Relative Terms

How have stodgy dividend-paying companies performed during the current stock market correction? The average dividend-paying stock in the S&P 500 is down 5% YTD compared to a 19% loss for the average non-dividend-payer. And the S&P 500 High Dividend Index is up 1.4% on the year compared to a loss of 12.2% for the S&P 500.

As inflation has picked up and the price of money risen, companies with potential payoffs far into the future have fallen out of favor with investors. Stocks that generate a steady stream of cash for compounding, and those in industries such as energy that benefit when inflation rises, are back in favor.

Three New International Dividend Stocks

We, of course, continue to pursue our dividend strategy regardless of sentiment toward the businesses we favor. In some RCs portfolios, we recently added new positions in Legal & General, Bridgestone, and Universal Music. All three companies are international businesses. We continue to see long-term value in international shares, as there has been a relative lack of excitement in this sector compared to U.S. stocks.

Legal & General

Established in 1836, Legal & General is one of the UK’s leading financial services groups. With almost £1.3 trillion in total assets under management, L&G is the largest investment manager for corporate pensions in the UK and a UK market leader in pension risk transfer, life insurance, workplace pensions, and retirement income. The pension risk transfer business (PRT) has appeal, in our view. Compared to other insurance lines of business, PRT has higher initial capital costs and higher barriers to entry. Businesses that are offloading the management of their pension plans to a third party won’t pick just any investment manager. New entrants are at a distinct disadvantage to incumbents. Legal & General pays a generous dividend that yields 6%. The company also seeks to increase its dividend at a 3%-to-6% average annual rate over the medium term.

Bridgestone

Based in Japan, Bridgestone is one of the largest tire manufacturing companies in the world. Bridgestone operates in over 150 countries and sells new and replacement tires as well as other rubber-associated products. The global transition to EVs is expected to increase the demand for tires, as the additional weight and torque of EVs will likely mean quicker wear and tear. Bridgestone has the best balance sheet in the industry, which can be an advantage during cyclical downturns. The shares trade at what we believe is an attractive level. What’s more, the stock yields almost 4%.

Universal Music Group

Universal Music Group (UMG) is the premier music label in the world. The company represents many of the top recording artists, including Taylor Swift, Queen, the Beatles, the Rolling Stones, James Brown, Jonny Cash, and Carrie Underwood. Universal’s labels own rights and royalties to about a third of the “music catalog,” essentially all economically relevant music. We love the nature of the royalties and consider them among the best an investor can own. Unlike video, music is listened to over and over, with labels effectively earning royalties each time the music is played. What’s more, copyrights last for decades— in many cases for 70 years from the death of the author. Universal shares yield about 2%, and we are looking for double-digit dividend growth.

AT&T’s Dividend Reset

In the coming months, AT&T will spin off its Warner Media business, which will then merge with Discovery. The combined company will be a formidable competitor in streaming. As a result of the spin-off, AT&T has decided to reset its dividend. The new dividend equates to a yield of 4.84% based on the company’s current share price. AT&T will remain one of the highest-yielding stocks in the S&P 500. While the dividend reset is a disappointment, it was necessary in considering the spin-off and should provide the foundation for faster dividend growth moving forward. The unfortunate reality is that AT&T was not being rewarded by investors for its high-dividend yield and past dividend increases.

Fixed-Income Portfolio Strategy

We recently purchased two 10-year maturity bonds. One was issued by Starbucks and the other by Union Pacific. The Starbucks bond was purchased at a yield of approximately 3% and the Union Pacific bond at a yield of approximately 2.85%. Both bonds have investment-grade ratings of Baa1/A-.

With interest rates on the rise, some investors may wonder if purchasing a 10-year bond makes sense. Headlines in the financial press warning about a bond bubble certainly don’t help set bond investors at ease.

It is important to keep in mind that we are crafting an entire fixed-income portfolio. While a portfolio comprised exclusively of 10-year bonds may have too much interest-rate risk, a portfolio of short, intermediate, and longer-term bonds is likely less sensitive to rising interest rates. This is true for the fixed-income portfolios that we manage for you. The individual bonds we purchase are only one component of the portfolios.

Today we are holding a higher than normal cash allocation, which helps to lower the interest rate risk of your fixed-income portfolio. In fact, so far this year, cash has been the best performing component of the fixed-income portfolios we manage.

In addition to the investment-grade bonds like Starbucks and Union Pacific that we purchase in fixed-income portfolios, we also hold the Fidelity Floating Rate Fund and the iShares Broad U.S. High-Yield ETF (USHY). The Fidelity Floating Rate fund invests in floating-rate loans with a duration close to zero. The high-yield-bond ETF we own has an intermediate-term duration. Both tend to perform well when the economy is strong and interest rates are more likely to rise.

Less Than Half the Interest Rate Risk

Overall, when you factor in the cash, the range of maturities of the investment-grade bonds, and the lower-grade bond funds, our clients’ portfolios have less than half of the interest-rate risk of the most popular broad-based bond indices.

Preparation and Planning Make Volatility an Opportunity

The first meaningful stock-market correction in almost two years can be unsettling for investors who have become accustomed to markets moving in only one direction. The headlines are concerning, as they often are when stocks are falling; but with proper preparation and planning, volatility can be welcomed as an opportunity.

When we help you craft a portfolio that is best aligned with your goals and objectives, we account for corrections, bear markets, inflationary periods, deflationary periods, recessions, and many other factors. It may not seem like it when markets are in free fall, but this was part of the plan. The reason you may have a more conservative strategy than some of our other clients is because you are either unwilling or unable (due to income needs, shorter time-horizon, etc.) to tolerate a significant downside. That doesn’t mean no downside. Every investment strategy outside of T-bills can be expected to fall in value at some point. Successful investing is about aligning your portfolio with your goals and objectives and then not allowing emotionalism to get the better of you when market turbulence inevitably hits.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm Regards,

Matthew A. Young

President and Chief Executive Officer

P.S. At their low, the energy companies in the S&P 500 that produce oil and gas to fuel America’s auto fleet and keep the electricity running accounted for 1.9% of the market value of the index. At the same time, Facebook accounted for 2.4% of the index’s market value. When one social media company is worth more than an entire sector as vital as energy, something is out of whack. In the Retirement Compounders, energy shares have long been a meaningful allocation. That didn’t help performance when nobody wanted to touch energy stocks and oil futures were trading at a negative price, but it is helping today. We do not try to mirror the S&P 500 or any other index. We favor certain energy companies, in part, due to their attractive dividends and their tendency to keep pace with inflation.

P.P.S. Gold is often seen as an investment that can protect against inflation, but it is also viewed as a hedge against chaos and troublesome global events. Gold has lived up to its chaos hedge brand as geopolitical tensions flare with Russia invading Ukraine. Gold is up 7% YTD, while stocks and bonds are both down. There are many ways to invest in gold and many different gold funds to choose from. We favor gold ETFs that invest directly in the metal as opposed to gold mining companies. Gold miners can provide significant leverage to the price of gold, but that leverage cuts both ways, and gold miners come with additional risks: operating risk, hedging risk, financial risk, and nationalization risk. But even after you narrow your options down to ETFs that hold physical gold, there are still at least 10 to choose from. For new money, we favor the SPDR Gold MiniShares (GLDM) ETF. GLDM is a lower-cost and lower-priced alternative to SPDR Gold Shares (GLD). We still hold GLD for many clients who own the position at a large unrealized gain, but in all tax-deferred accounts and for new accounts, we buy GLDM. We favor GLDM for liquidity and cost. GLDM has $5 billion in assets under management and trades about 5 million shares per day. Not the most volume, but plenty to establish a position meant to be held for the long term. After a recent fee cut and reverse stock split, GLDM is now the lowest-expense-ratio physical-gold ETF, and it has the second-lowest transaction costs of all gold ETFs.

P.P.P.S. We recently updated both Part 2A and Part 2B of our Form ADV as part of our annual filing with the SEC. This document provides information about the qualifications and business practices of Richard C. Young & Co., Ltd. If you would like a free copy of the updated document, please contact us at (401) 849-2137 or email cstack@younginvestments.com. Since the document was last updated in March 2021 there have been no material changes.