Long-Term Investing Not as Easy as it Looks

May 2017 Client Letter

I’ve written critically of Amazon.com’s profitability in past letters, but my criticism of the company doesn’t extend to Jeff Bezos, Amazon’s CEO. Bezos may have run Amazon.com for years without turning a meaningful profit, but there is no denying the guy is brilliant. In the span of two decades, Bezos turned Amazon.com into one of America’s largest companies. He continues to disrupt and decimate brick and mortar retail, and under his leadership Amazon has spawned an entire new industry in the form of Amazon Web Services. And if that doesn’t do it for you, you should at least give the guy credit for convincing some of Wall Street’s brightest analysts that a dollar worth of sales is just as good as a dollar worth of profits.

What have been the keys to Bezos’s success? In Bezos’s first shareholder letter in 1997, he said “It’s all about the long term.”

Bezos told WIRED in 2011, “If everything you do needs to work on a three-year time horizon, then you’re competing against a lot of people. But if you’re willing to invest on a seven-year time horizon, you’re now competing against a fraction of those people, because very few companies are willing to do that. Just by lengthening the time horizon, you can engage in endeavors that you could never otherwise pursue. At Amazon we like things to work in five to seven years. We’re willing to plant seeds, let them grow—and we’re very stubborn.”

The same patience-based philosophy that Bezos uses to manage Amazon.com can be applied to investing. The more patient you can be with your investments or your asset manager, the more likely your chances of achieving long-term investment success.

The benefits of a long-term approach are widely recognized, but the ugly reality is that few institutional and retail investors are patient. Many don’t have the willingness and others lack the ability to invest at Jeff-Bezos-like time horizons.

Institutions talk a big game when it comes to long-term investing, but most are put on a tight leash by their investors. They may get a pass for underperforming for a year or two, but three years of underperformance can ruin a business.

If you are willing to approach investing with the same relentless focus on the long term with which Jeff Bezos manages Amazon.com, you open a whole new set of opportunities with a lot less competition.

Long-Term Investing Not as Easy as it Looks

Investing for the long run is not easy. There is a reason many investors are impatient. If you are looking for instant gratification, long-term investing isn’t for you.

The time it takes to harness the power of compound interest is a great example of the difficulty of long-term investing. The power of compounding offers little benefit over a few quarters or even a year or two, but over 7, 10, or 20 years, compound interest offers profound benefits.

Investing for the long run also requires one to periodically take a contrarian viewpoint. If you are investing with a five- to seven-year time horizon, chances are something in your portfolio will experience a downturn. Maybe you buy a cyclical stock whose business takes a sharp turn for the worse during a recession. Or maybe you own a chicken restaurant when an avian-borne virus cripples demand. A long-term investor must plan for such scenarios and be willing to give the companies he owns time to recover.

Taking a Patient Approach with Energy

Energy is one recent example of an industry we have stuck with even though it fell out of favor a couple of years ago.

Many of the energy stocks we own experienced deep share-price corrections when oil fell from over $100 per barrel in 2014 to $26 in February 2016. We didn’t liquidate all our energy stocks when the near-term outlook turned bleak. We instead decided to increase our exposure to oil and gas pipelines. We felt that the selling in pipeline companies with limited oil price exposure was overdone at the time. Patience was the proper decision in this case.

Two of our Biggest Pipeline Investments

Two of our biggest investments in the pipeline space are exchange-traded notes (ETNs). ETNs are like exchange-traded funds (ETFs) in that investors can buy and sell the securities throughout the day. Unlike ETFs, which hold shares of underlying companies, ETNs are debt obligations of issuing banks.

The two ETNs we own in many common stock portfolios are the ETRACS Alerian Infrastructure MLP ETN issued by UBS and the JPMorgan Alerian MLP Index ETN issued by JPMorgan. The performance of both ETNs is tied to the performance of oil and gas pipeline MLP indices.

The ETN Advantage for MLP Funds

We favor ETNs over ETFs for oil and gas master limited partnerships because ETNs avoid double taxation. The MLP ETFs on the market are structured as corporations. Taxes are paid at the fund level and the shareholder level. With the ETNs, investors pay taxes on distributions once at the shareholder’s ordinary income tax rate. Distributions paid on ETNs held in tax-deferred accounts are obviously untaxed.

MLP ETNs Still Have Appeal

We believe oil and gas pipeline MLPs continue to offer some of the most attractive yields for income investors. The ETRACS Alerian Infrastructure ETN and the JPMorgan Alerian MLP Index ETN yield about 6.4%. Compare that to a yield of about 3% on utilities.

At a 6% yield, why don’t we invest everything in MLPs? It could be tempting to overload a portfolio with high-yielding MLPs in today’s low interest rate environment, but proper diversification remains a cornerstone of prudent investing. The oil and gas pipeline business may be a simple one with attractive economics and high yields, but that didn’t prevent MLPs from losing half of their value during the oil market sell-off.

Proper diversification doesn’t require one to spread his assets across every market sector in exact proportion to the sector weightings of the major market indices, as many closet indexers do. But a properly diversified portfolio should include exposure to sectors with varying sensitivities to both the U.S. and global economies.

Global Diversification

In addition to diversifying across sectors, we also believe it is useful to diversify globally. If you own foreign shares, you know that investing globally hasn’t been in favor over recent years. U.S. stocks have outperformed international stocks (MSCI ACWI ex US) by more than 10 percentage points per year over the last five years; but, just as sectors move in cycles, so do global stock markets. Despite the relative underperformance of international markets, we have maintained a global approach. Like compounding, the benefits of global diversification can accrue to investors over the long run.

International Stocks Dominating in 2017

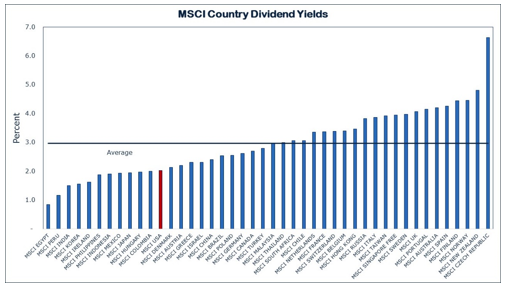

Year to date, international stocks are dominating U.S. stocks. The MSCI All Country World Index, excluding the U.S., is up almost 14% in 2017. Looking out over the next five years, we believe foreign shares will continue to be a good place to invest. In terms of dividends, foreign stocks have greater yields than U.S. stocks, as you can see in our country yields chart below.

In international markets, we favor European shares today. We are investing in the United Kingdom, Germany, Switzerland, Sweden, and Norway, among others. In addition to the higher-dividend yields offered in these markets, European stocks also trade at discounted valuations when compared to U.S. markets. There is also long-term opportunity in many European currencies, in

our view. We think the one-two punch of discounted valuations and undervalued currencies is attractive.

Bond Market Update

In fixed income, we continue to look to improve yield as market conditions change. Earlier this year when longer-term interest rates were higher than they are today, we added longer-term bonds to improve yield.

With yields now moving down, we have shifted our focus back to shorter-maturity bonds, with less interest-rate risk and greater opportunity to roll into higher-yield bonds as rates rise. We have also been active in floating rate bonds (floaters). We recently purchased Pepsi floaters in many portfolios.

The Pepsi floaters have a five-year maturity, but they make quarterly interest payments that fluctuate with short-term interest rates. The Pepsi floaters pay 0.365% above three-month LIBOR. LIBOR is a short-term interbank lending rate. The current coupon rate on the Pepsi floaters is 1.53%. If the Fed hikes rates 0.25% again in June, the coupon rate on the Pepsi bonds will increase about 0.25% at the next coupon reset date.

Energy Transfer Equity Bond Sale

We don’t often actively trade bonds unless we need to reposition the duration of portfolios or cut credit exposure, but one bond we recently sold in many portfolios was an Energy Transfer Equity issue. Energy Transfer Equity is the general partner of Energy Transfer Partners, an oil and gas pipeline MLP.

Like many bonds issued by pipeline MLPs, the Energy Transfer Equity bonds fell sharply during the oil price crash of 2014 and 2015. From a price of $112 in the summer of 2014, the Energy Transfer Equity bonds fell to a low of $78.50 in February 2016. We felt the bonds were oversold in February of last year, and we decided to stay the course with our position. As oil prices stabilized and sentiment toward the oil and gas sector improved, the Energy Transfer Equity bonds we owned for clients moved back to a price of about $112, which is where we recently liquidated them.

Why did we sell the ETE bonds after holding them through a deep downturn and recovery in price? Two reasons. First, over time the management team at Energy Transfer Equity has taken a more aggressive approach with the use of debt than we are comfortable with. Second, Energy Transfer Equity’s limited partner, Energy Transfer Partners, also recently closed on an acquisition of Sunoco Logistics. We own Sunoco Logistics bonds in many portfolios. The Sunoco bonds have a higher rating than the Energy Transfer Equity bonds. We didn’t want to double our clients’ exposure to what is now essentially one organization, so we held the higher-rated bonds and sold the lower-rated bonds.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. I recently came across an article touting the performance of technology stocks for the 15-year period ending in April. Included in the article was a table showing the performance of tech stocks for various time periods. It showed how technology stocks had been some of the best-performing stocks of the last 5, 10, and 15 years. While I won’t dispute the facts, this is the type of analysis that can lead investors off course. If you instead move the starting point of the analysis back a couple of years to year-end 1999, you will find that technology stocks earned a compounded annual return of 1.6% compared to 6% for the blue-chip Dow. What’s more, most of the outperformance for the tech stocks over every period measured came not because of consistent out performance, but as a result of a bull-run for tech stocks over the last three years. As we write often, tech businesses are some of the lowest-barrier-to-entry businesses investors can purchase, and tech shares tend to perform worst during bear markets. Something to keep in mind as we move into year nine of this bull market.

P.P.S. The Department of Labor’s new fiduciary rule goes into effect on June 9, 2017. As a fiduciary to retirement investors, we acknowledge our responsibility to act in accordance with ERISA and/or the Internal Revenue Code. Any investment recommendation or advice we provide will continue to be made in your best interest. The recommendations we make must not cause us, or any affiliated entity, to receive compensation, whether directly or indirectly, that is unreasonable as may be defined by ERISA and/or the Internal Revenue Code.

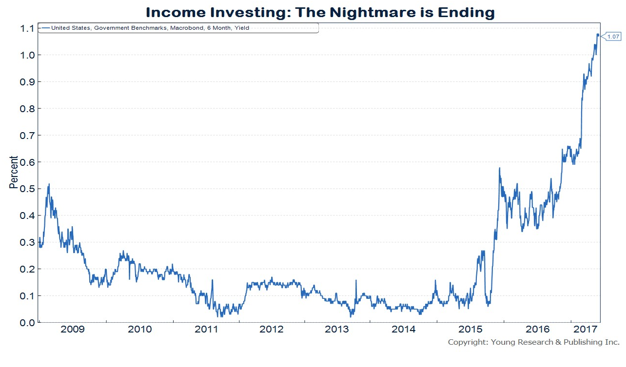

P.P.P.S. For eight long years, conservative investors, retired investors, and income investors have suffered through a nightmare environment. Risk-free income in the form of full-faith-and-credit U.S. Treasury bills has been held off the market by a Federal Reserve more interested in serving the interests of Goldman Sachs than America’s savers.

As our chart shows, that nightmare appears to be ending. There is still a long way to go to get back to normal, but an investment in 6 month T-bills will yield you more than a full percentage point in income today.

It will only take you about 72 years to double your money as opposed to the 700 plus years when rates were a mere 10bps.