Navigating a High Priced Market with Solid Economic Growth

October 2017 Client Letter

A Supportive Environment

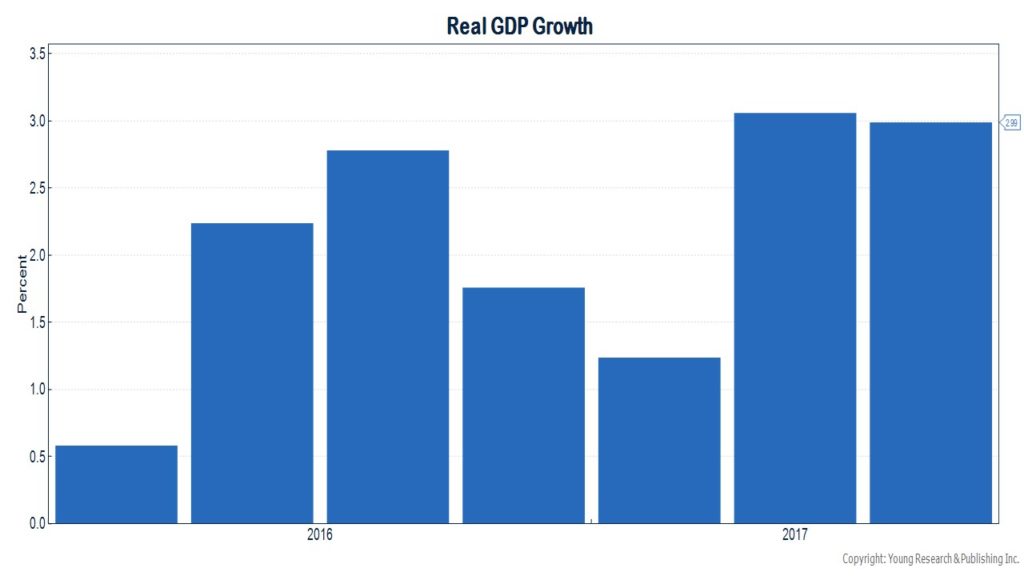

Today we have what appears to be a supportive environment for the stock market. Economic growth, both in the U.S. and globally, has picked up. For the first time since 2014, GDP growth has accelerated to more than 3% for two consecutive quarters. The global liquidity environment remains robust, with the European Central Bank and the Bank of Japan still pumping money into the global financial system. Long-term interest rates remain low by historical standards. Business and consumer sentiment are at highs not seen in years, and corporate profits are rising at a rapid clip, with the prospect of an added boost coming from lower tax rates in 2018.

That hasn’t been lost on the stock market. Investors have bid up shares aggressively over the last 12 months. The S&P 500 is up over 23% since this time last year. And the rally has been relentless. Volatility has all but disappeared. According to MarketWatch, the S&P 500 hasn’t had as much as a 3% correction since November of last year. That is the longest such streak on record.

Sentiment Through the Roof

Investor sentiment is through the roof. The Investors Intelligence Survey’s sentiment numbers show the widest divergence between the number of bulls and bears in 30 years. Young Research’s bubble basket—a group of stocks we consider to be over-owned, over-loved, and over-priced—is up almost 50% YTD. The five most valuable stocks in the S&P 500 are now Apple, Amazon, Microsoft, Facebook, and Google. Their collective profits over the last 12 months are about $105 billion and their total market value $3.06 trillion. That works out to a P/E ratio of over 29X. I am reading about former Target sales managers quitting their jobs and getting rich by shorting volatility ETFs. Really? It probably isn’t a reach to suggest that risk isn’t at the forefront of investors’ minds today.

Valuations Near Record-Highs

The universal enthusiasm of the stock market at what are near-record valuations is difficult to understand for investors such as ourselves who are focused on long-term returns. Starting valuations are the most reliable guide to future long-term returns. But valuations are neither a precise indicator of future returns nor a useful timing indicator. The best one can do with the knowledge that valuations are elevated is to assume that future performance is likely to be much lower than past performance.

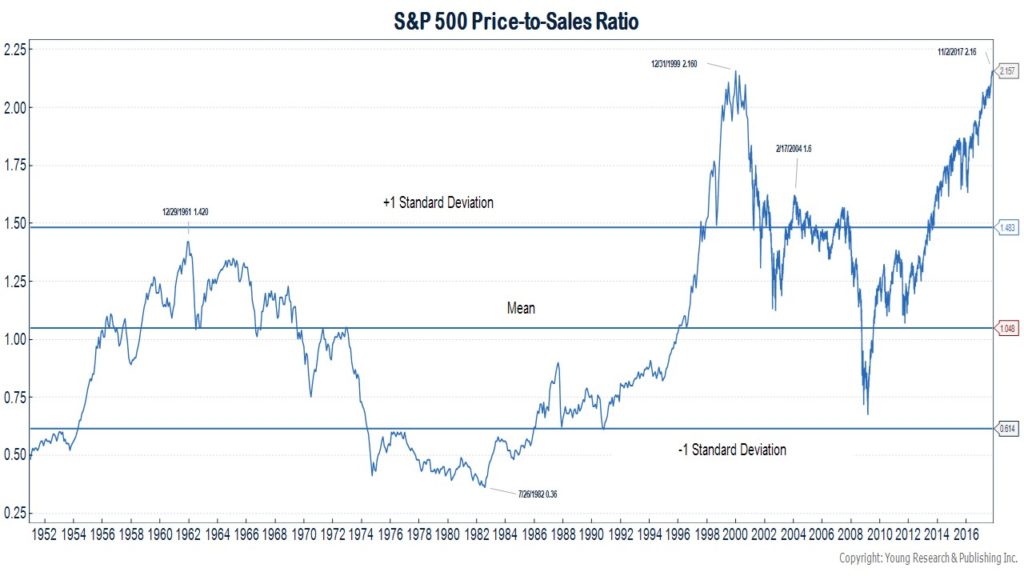

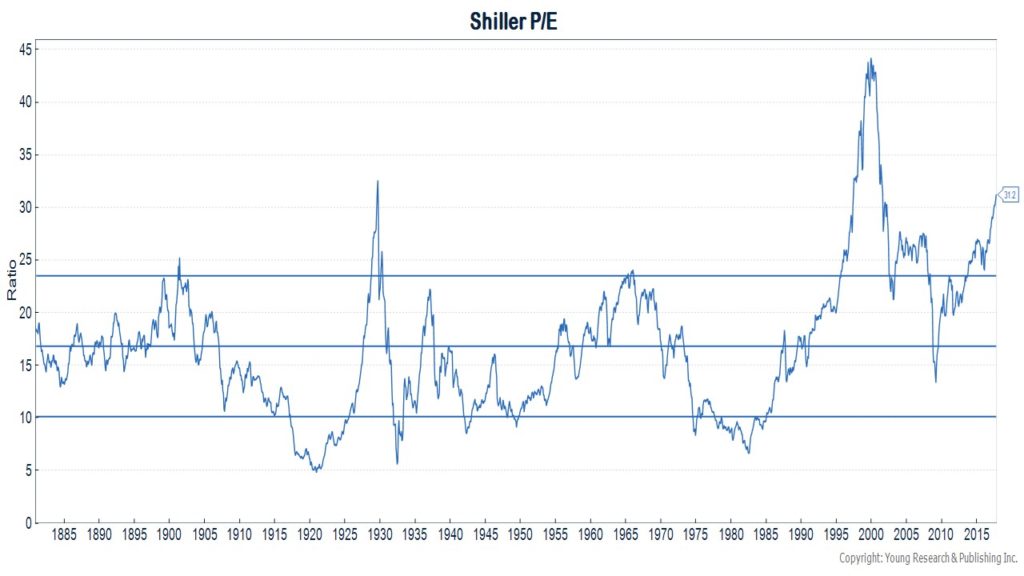

How much lower? In almost seven decades of market history, the S&P 500 price-to-sales ratio has never been higher than it is today. That includes during the stock market bubble of 2000. Robert Shiller’s cyclically adjusted price-to-earnings ratio is also near prior-bubble highs. Shiller’s P/E smooths earnings to adjust for cyclical fluctuations. Stocks have only been more expensive by Shiller’s metric at the height of the 1929 stock market bubble and during the 2000 bubble (see charts below).

How Do Bull Markets End?

Recessions are most often what end bull markets. Valuations were at record highs in the late 1990s, but it wasn’t until the 2001 recession that the stock market really cracked. When it did, stocks, of course, fell by more than half from their prior high and wiped out almost all of the 104% gain in the S&P 500 from year-end 1996 to the March 2000 high. Valuations would have told you future returns were going to be low in 1997, 1998, and 1999, but that didn’t come to pass until the recession.

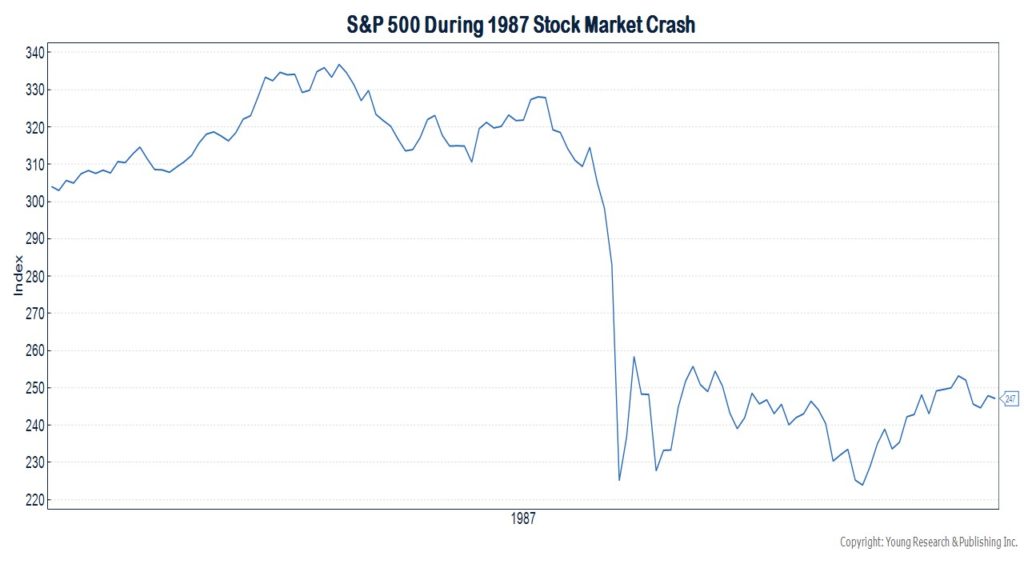

That doesn’t mean all bull markets end from recession. The stock market crash in 1987 wasn’t caused by recession. The 1987 crash was caused by a market that had risen too far too fast and by program trading, a market structure issue. One could make similar arguments about 2017. Stocks have run quickly over the span of a year, and there are market structure issues that could exacerbate any sell-off. The chart below shows the 1987 crash in the S&P 500. After rising almost 40% in the first eight months of the year, the stock market fell 33% over the ensuing two months with a 20% loss on October 19, 1987. For perspective, a 33% loss on the S&P 500 today would push the index down to 1,730 from 2,880 today and wipe out four years’ worth of returns.

OK, then. Stock market valuations are elevated and present long-term risk, but the current environment is supportive of markets. How does one navigate such an environment? As we regularly advise, select a strategy and allocation that fits your personal financial situation and stick with the plan through thick and thin. Ignore what the FAANGs are doing. In our view, they aren’t appropriate investments for retired investors and those soon to retire. Don’t pay attention to the newly minted millionaires that are shorting volatility—they may very well be wiped out in the end. Stay in your own boat and follow the course you have plotted for yourself.

My dad is one of the most adept people I know at sticking to an investment plan, regardless of whichever mania or panic of the day is distracting advisors, pundits, and investors. He recently posted what I consider to be a must-read for our clients at his new investments site (www.youngsworldmoneyforecast.com):

“With the exception of the large sums of money that I invested in zero-coupon treasuries (Benham Target Funds) in the 1980s and 1990s, I have never invested based on how much money I expected to make. I work to make money. And I save to keep every dime of the money I have worked a lifetime to earn. There was a day when I had darn few of those dimes. Those days made an indelible impression on me, and will so forever.

I invest with a rolling 10-year average annual return portfolio target of a balanced 4+%. This modest target is based on the normalized annual portfolio draw I advise for retired investors. Long-term balanced targets include surviving through agonizing periods of negative returns for the stock market in general. I remember like it was yesterday the tortuous 16-year bear market of 1965 through 1981. This period encompassed my entire career in the institutional research and trading business. It terminated with the Dow down 10% from where it began. Had I not emphasized 100% fixed income in my own account and in our college savings program for Matt and Becky, my goose would have been cooked. It never pays to be an investing know-it-all.

My investments today, for me and for all our clients, combine a mix of intermediate and short fixed-income securities and portfolios of dividend-paying stocks. Annual dividend increases are always at the forefront of my investment process. Ben Graham advocated a portfolio mix of 75/25—25/75 fixed income and equities. Ben eschewed moving outside of this range, and I’ve never come across evidence that supports otherwise.

Since my earliest investing days in the 60s, I have relied upon the ground rules and reference material I studied while an investment major at Babson College. It was based wholly on the advice given in my Graham & Dodd textbook and my studies in Dr. Wilson Payne’s investment seminars. Decades later, I’ve not changed my philosophy.

Through the years, I’ve had the privilege of influencing the investment thought process of thousands of individual and corporate investors around the globe. Many have been my management clients since I started Richard C. Young & Co., Ltd. in the late 80s, and the majority would likely agree with me that I am perhaps the most consistently boring, prudent, patient investment advisor on the planet. I certainly hope this is so. Like The Hobbit, I view adventures (in this case investing adventures) as “nasty disturbing uncomfortable things” that “make you late for dinner.”

I am ultra-conservative in my daily affairs of life, which includes personal security preparation, and I see no purpose in not applying the same protection to financial security.

I modeled our family company after the old-line investment counseling family-run firms that populated Boston’s financial district along State, Federal, Milk, and Congress streets in the sixties—a harking back to a more gentrified era in investing. Many of these fine old white-shoe firms were my clients when I was associated with the internationally focused Model Roland & Co., where I was involved in institutional research and trading.

My clients, such as the venerable Boston Safe Deposit & Trust, State Street Bank & Trust, and First National Bank of Boston, built their foundation on The Prudent Man Rule.

The Prudent ManRule directs trustees “to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.”

These are the conservative principles our family investment council firm practices. Our firm’s focus from the beginning was, and today is, based on The Prudent Man Rule along with the theories of dividends and compounding pioneered by Ben Graham.Over the decades, I’ve learned that most individuals do not possess the requisite patience and discipline to excel as successful long-term investors. The patience-deprived universe tends to be what I think of as needy hip-hop investors. They look for the financial markets to either bail them out of past investing indiscretions or, worse yet, to produce rewards far beyond reasonable levels of commensurate risk. Our family investment management firm does not offer the type of environment suitable for the needy or greedy.

The needy and greedy tend to possess an investor twitch that requires action—lots of action. This crowd looks to market timing, second-guessing, and what-if-ing. Most of the big moves in any investment cycle come in the year or two after the exact bottom of a cyclical bear market.

Well, market timers most often sell out late in bear cycles, and then are too afraid to get back into the market in time to catch the initial upsurge. The needy/greedy tend to miss the big gains every time.

At Richard C. Young & Co. Ltd., our goal is to remain balanced as well as fully invested. This repetitive plan, definitely counter-intuitive to many investors, ensures never missing the big moves. It also requires never participating in any meaningful way in the bubble or blow-off stage of over-priced markets that are on the precipice of cratering and wiping out a lifetime of savings along the way. No thanks. I long ago learned this bedrock principle.

Today’s investment landscapes and processes have become so difficult that for most individuals going it alone, especially while preparing for a safe and secure retirement, is no longer comforting or attractive. Many of the old standby bastions of investing are no longer an option. I am referring to the vast majority of all-managed equities mutual funds and a wide swath of the indexing ETF universe. The fund industry has simply outgrown its skin. Funds have grown too big, and their options in dividend-paying common stocks are too few, due to size constraints for massive funds. This is only common sense.

With minor exceptions, I no longer advise these out-of-phase funds. Rather, stocks of individual dividend-paying companies including smaller concerns and foreign securities, are our focus for clients. At our management company, we craft what we label Retirement Compounders® portfolios.

Investing in foreign securities is not the province of the individual investor or, for that matter, most advisors. Having been directly involved in researching and trading in foreign securities since 1971, I can assure you that process presents a sticky wicket best left to experienced hands. Markets are thin, currency valuations enter the picture, and macro events often call the tune in foreign securities investing.

I travel to Europe frequently. Decades of on-the-ground anecdotal evidence-gathering and personal contacts allow me to form the direct knowledge imperative in the decision making of investing in foreign securities. With the exception of my old stomping grounds in Boston, I am more comfortable today in Paris, by example, than any big U.S. city. More international decision makers and event making potentates visit Paris annually than any other city in the world. On each new visit, I gather a wealth of intelligence to support my global investment strategy. This boots-on-the ground anecdotal evidence-gathering, in conjunction with my decades of daily inference reading, allows our firm to offer clients a distinct perspective on the international investing landscape.”

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Each year, Barron’s ranks the nation’s top independent advisors. Richard C. Young & Co., Ltd. was again recognized on this list, appearing for the fifth consecutive year.