No Easy Choices

December 2020 Client Letter

America’s pension fund managers face some difficult choices. With bond yields near record lows and pension liabilities rising, pension managers have to choose between taking more risk or asking for employers and employees to make greater contributions.

Low prospective bond returns are not the only challenge pension fund managers face. As explained in a recent Wall Street Journal article, Wilshire Consulting, an adviser to large pension funds, recently lowered its 10-year annual return projection for stocks to 5.5%. The firm’s 10-year projection for bonds fell to 1.75% from 3.25%.

Lower Your Return Expectations

If Wilshire is right, investors in a 50-50 portfolio should expect no more than a 3.63% return over the next decade. That’s a far cry from the 7.2% return assumed by the median U.S. public pension plan. In Canada, pension fund managers assume something closer to 5.6%. If the 25 largest U.S. funds used that same 5.6%-return assumption, their assets would fall about $1.5 trillion short of the value of their liabilities.

How will pension funds make up the shortfall? The prudent option would be to increase contributions, but when greater contributions require tax hikes, the decision is not so simple. Faced with the apparently untenable option of asking plan sponsors to hike taxes, some pension plans are trying to boost returns by investing in assets that allow managers to assume higher future returns because past performance has been strong. Think private equity and venture capital. Other managers have taken the unusual step of using leverage to try to boost returns.

Prudent Man Missing at Pension Funds

It is difficult to rationalize the thought process. It wasn’t that long ago that stocks were viewed as inappropriate investments in pension plans. In 1962, only about 5% of pension fund assets were invested in stocks. And even in 1982, only about a quarter of pension fund assets were invested in equities. Today, thanks to the Fed’s decision to decimate interest income, pension fund managers are using borrowed money to leverage stocks in an effort to boost returns.

Leveraging pension assets to boost returns is against the advice of the Government Finance Officers Association. The strategy of borrowing money to boost returns is also not permitted in your IRA account.

What Do Pension Funds Have to Do with You and Your Portfolio?

What do pension fund problems have to do with you and your portfolio? We are all investing in the same public markets. Individuals, pensions, and other investors are faced with the same prospective returns offered in the public markets.

And while individual investors might not chase returns by borrowing on margin or investing in private-equity funds, some are looking in the rearview mirror and chasing growth stocks in an attempt to reach for return.

After all, if today’s low-prospective return environment presents a challenge, doesn’t it just make sense to invest in growth shares? Investing in growth certainly sounds like a better way to earn a return.

Who doesn’t want growth in their stocks? And why? Plus, haven’t growth stocks beaten the market by a lot over recent years?

Value-Oriented Strategies the Long-term Winner

Indeed, the latter point is undoubtedly true; but, unintuitively, over the long run, value-oriented stocks have performed best.

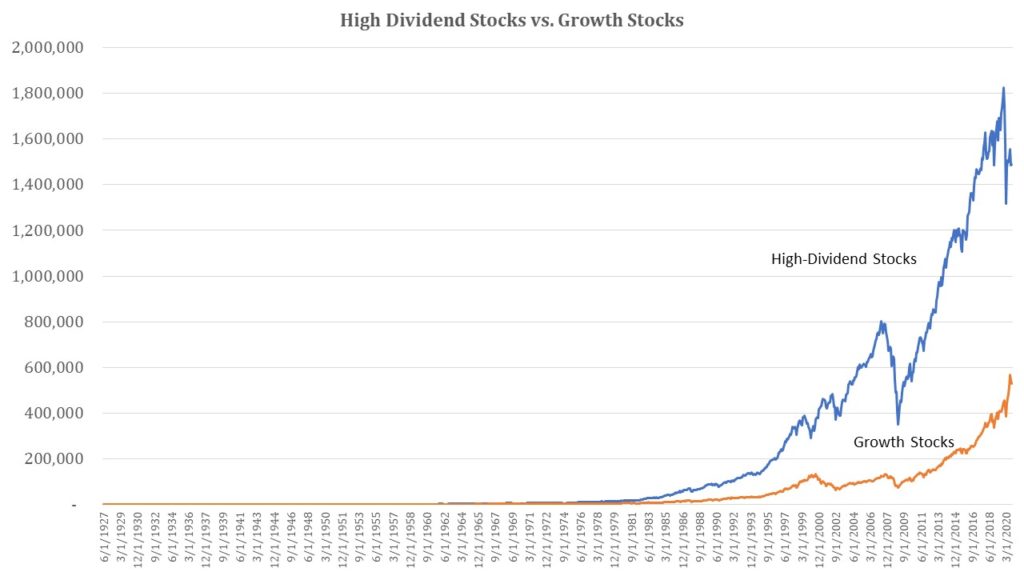

The chart below shows the long-term performance of $100 invested in high-dividend-yield stocks (value-oriented) versus $100 invested in growth stocks. The data comes from the Kenneth French Data Library. High-dividend stocks are measured by the top 30% of stocks ranked by yield and weighted by market value. Growth stocks are measured as the top 30% of stocks ranked by price to book (the most common metric to distinguish growth from value) and also weighted by market value.

As you can see in the chart, high-dividend stocks are the clear winner. Over the long run, it’s not even close. One hundred dollars invested in high-dividend stocks in June of 1927 is worth almost $1.5 million today. That same $100 invested in growth stocks is worth about $530,000 today.

The reason value-oriented shares outperformed growth shares is not because growth shares don’t have greater growth—they do. Value’s outperformance comes from a rebalancing effect. By example, you might buy a stock when the dividend yield is far above the market and sell that stock at a later date when the yield is far below the market. The same thing happens with growth stocks. A growth stock selling at a high price-to-book value may see growth slow, pushing it out of growth stock territory and resulting in growth funds selling the shares at a lower price.

According to Rob Arnott, chair of Research Affiliates and former editor of the Financial Analyst’s Journal, from 1963 through 2007 this rebalancing effect added 5.4% annually to value strategies and detracted 7% annually from growth strategies. The net effect was a 12.4% advantage for value shares. Since 2007, these figures are about the same. So even though growth stocks have greater growth in their fundamentals than value stocks, that growth differential isn’t enough to overcome the drag that growth strategies suffer from because of the rebalancing effect.

But if value-oriented strategies have a structural advantage over growth strategies, why have value shares lagged over recent years? Value-oriented strategies have had their longest period of relative underperformance on record, punctuated by their worst relative-performance year on record this year (through October).

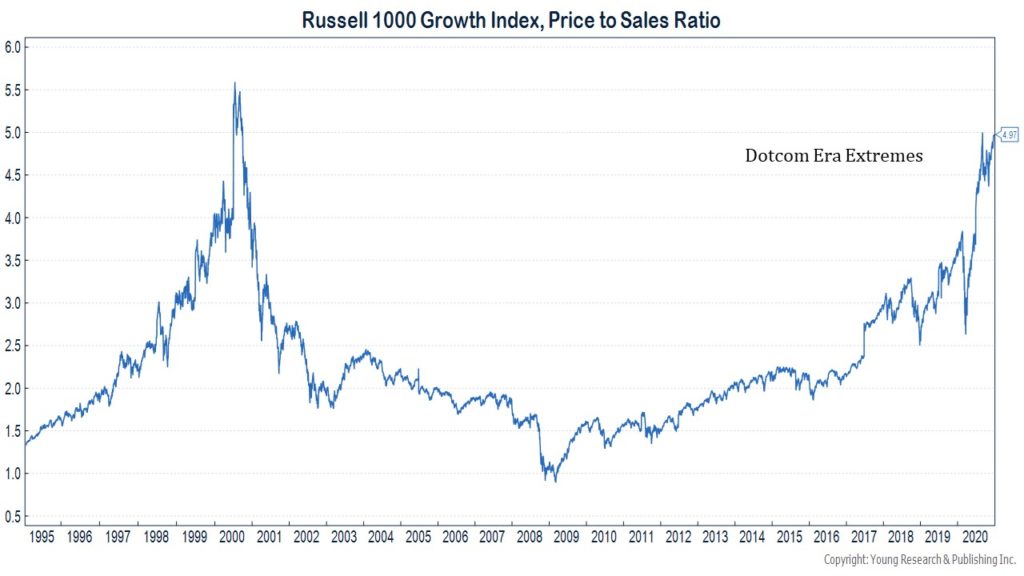

Growth’s strong relative performance can be attributed entirely to investors’ willingness to pay what seems like an ever-increasing price for the same dollar of sales, earnings, dividends, or book value. The chart below shows the price-to-sales ratio of the Russell 1000 Growth index. The recent spike rivals what was seen in growth stocks during the dotcom bubble.

Growth Stock Bubble

Does this mean growth shares and growth strategies are in a bubble? Probably. Jeremy Grantham’s G.M.O., an authority on bubbles, believes growth stocks have entered a bubble similar to the one in 2000. Whether it’s the speculative activity in blank-check companies and other IPOs, the massive rallies in bankrupt companies, or the performance of clean energy and electric vehicle (E.V.) stocks like Tesla, the mania is obvious.

G.M.O. summed up the mania in E.V. stocks in their third-quarter letter to investors.

Tesla has risen some 800% since the fall of 2019 on the back of 17% growth in vehicles sold. It now has a greater market cap than the sum of all the other U.S. automakers, all the European automakers, and all the Korean automakers, with Honda, Mazda, and Nissan thrown in for good measure. That collection of companies sold approximately 100 times as many cars as Tesla did in 2019. But Tesla isn’t the craziest thing that happened this year, and that is true even if we restrict ourselves to looking only at the electric vehicle companies named after Nikola Tesla. This spring a would-be Tesla called Nikola went public via a reverse merger with a SPAC at a valuation of $3 billion. In the 2020 E.V. frenzy, it rose 10-fold to a market cap of about $30 billion. This company is a rare bird in the stock market, a pre-revenue manufacturing company. In fact, Nikola is not only pre-revenue, having never sold any vehicles it has produced, it has never produced a vehicle. Further, it has not even built the factory in which it aspires to build the trucks that it has yet to sell….

With a combination of some of the highest valuations ever seen and clear corresponding manic investor behavior, it seems clear to us that growth stocks are indeed in a bubble.

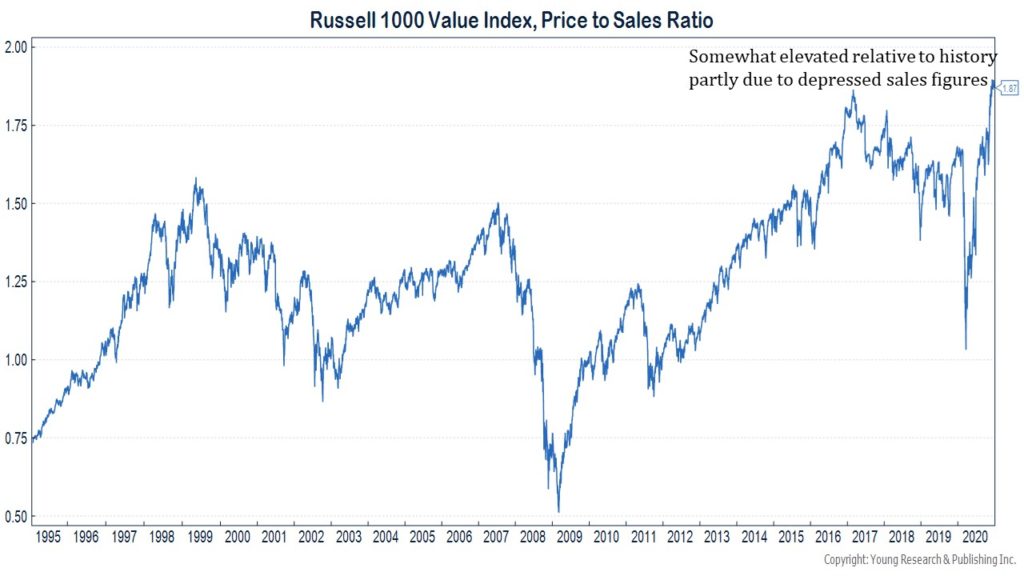

As was the case during the dotcom bubble, the mania has left behind value-oriented shares. The price-to-sales ratio for the Russell 1000 Value Index is somewhat elevated based on the depressed level of sales, but nowhere near the extreme levels seen in growth shares.

While Wilshire Associates is right to lower its return projection for the broader market, the sectors and strategies of the market that have lagged more recently may offer better relative long-term opportunities moving forward.

We would include dividend stocks in that camp. This past year was not a great one for dividend investing. But it could have been much worse. Back in March, three of our main investment-related concerns included how long the economy would be closed, the 10-year Treasury yield dropping to 0.54%, and how company dividends would be impacted.

While we had reasonable confidence you would continue to receive the expected cash flow from your equities, there was no way to be sure early on. You will be pleased to know that most stocks in your portfolio did not suspend or cut their payouts this year. There were a couple of notable exceptions, including Cracker Barrell and Texas Roadhouse. Being forced to close up shop made dividend cuts the prudent decision for these businesses.

Some of the companies we own for many of you increased their dividends in 2020. Despite a challenging and uncertain environment, Home Depot, Chevron, Air Products, Evercore, Union Pacific, and Sika all paid greater dividends in 2020 than they did in 2019.

Home Depot

At Home Depot, they say the company is “built from all the right materials.” It’s a clever way to describe a home improvement goods store; but it also sums up Home Depot’s core value structure that relies on creating shareholder value, entrepreneurialism, taking care of employees, excellent customer service, respect for all people, doing the right thing, building strong relationships, and giving back. Home Depot began implementing that vision back in June of 1979 when it opened two warehouse stores in Atlanta, Georgia, that stocked 25,000 products, a number that dwarfed the competition. Today, Home Depot operates over 2,200 stores in the United States and Canada, each averaging 105,000 square feet in size. This year, Home Depot was added to the Mergent Handbook of Dividend Achievers after raising its dividend for each of the last 10 years. With an eye towards its core tenet of creating shareholder value, Home Depot increased dividend payments at an average annual rate of 19.71% for the last decade. Shares yield 2.22% today.

Chevron

Chevron is one of the world’s largest publicly traded oil companies. The worldwide economic slowdown has taken a toll on many oil producers by decreasing demand for energy across the board, but Chevron has maintained its AA credit rating and has the lowest net debt of any of its peers. Chevron operates at the lowest “dividend breakeven” price of oil. That means while other oil majors need to dip into savings to pay dividends while oil is selling below, say, $60 per barrel, Chevron can maintain its cash at a mere $50 per barrel of oil. Crude oil prices are above $50 per barrel today. Chevron shares have a yield of 5.98%, and the company has raised its dividend each year for the last 32 years straight.

Air Products

If you’ve ever eaten frozen pizza, you probably weren’t thinking about the nitrogen used to cool the pizza before it was boxed, but maybe next time you will. Much of the nitrogen used to freeze pizza and many other foods is supplied by Air Products. In fact, Air Products supplies gases that enable over 30 industries to do business. Using machines like MRIs, welders, cryogenic freezers, fire suppression equipment, oil fracking rigs, and more demand the specialized gases Air Products provides. Air Products has been in business for eight decades and has increased its dividend each consecutive year for the last 37. Over the last five years, the dividend has compounded at 10.1% per year. Today, Air Products’ shares yield 2.02%.

Evercore

Evercore is an independent investment bank that derives the majority of its revenue from financial advisory services, including merger, acquisition, and restructuring advisory. Evercore has consistently gained market share. The company’s shares took a hard hit during the pandemic as investors responded to the temporary plunge in mergers and acquisitions (M&A) activity. The M&A market has come back to life, along with Evercore’s shares. Evercore has raised its dividend every year for the last 13 years. Over the last five years, the dividend has increased at a 15.4% annual rate. The shares yield 2.25% today.

Union Pacific

This year, as they track their online purchases, many people are learning a lot more about logistics and transportation than they ever wanted to. You may even be tracking your Christmas packages across America as I write, wondering if that special gift will make it in time. The backbone of America’s goods transportation system is the railroad system, and one of America’s largest railroad companies is Union Pacific. That’s the same Union Pacific tasked by Abraham Lincoln to build part of the original transcontinental railroad. Since its days connecting the two coasts of America, Union Pacific has grown to 32,236 route miles, linking most of the western half of the United States in an intricate web of railroad tracks. Union Pacific has increased its dividend each year for the last 13 years, at a whopping rate of 21.22% on average over the last ten. Shares of UNP yield 1.91% today.

Sika

Sika is a Swiss-based building products company. Its products are used primarily for bonding and sealing. The firm produces additives for concrete, sealants for roofing and flooring, waterproofing systems, and light-weighted components for the automotive and wind-generation industries. Innovation is one of Sika’s key strategic pillars. Sika has 800 unique patent families with over 3,400 single national patents. The company’s shares offer exposure to our favored Swiss franc. Sika pays a modest dividend; but over the last five years, Sika has increased its dividend at an almost 14% annual rate.

Confidence and Comfort

Home Depot, Chevron, and Union Pacific are blue-chip household names, whereas Air Products, Sika, and Evercore are not as widely known. We view these lesser-known companies in the same high regard as the more familiar names. Owning a combination of blue-chip household names as well as off-the-beaten-path names helps to diversify your portfolio.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Treasuries and GNMA securities were once a large component of the fixed-income portfolios we manage for clients. With Treasuries yielding less than 0.50% all the way out to a five-year maturity and GNMA securities yielding less than 1%, our current focus has shifted to individual corporate bonds with a small emphasis on floating-rate loans and high-yield bonds.

P.P.S. The U.S. Congress just passed a $900-billion stimulus bill. This was a scaled-down version of the first bill. After dumping trillions into the economy in the spring, the $900-billion stimulus seems like a small additional step. The left views this stimulus as a down payment; but following the 2009 financial crisis, the U.S. stimulus was $787 billion. Lulled into complacency by low central-bank-manipulated interest rates, America has become numb to the scale of debt and deficits. But rising government debt levels risk igniting inflation once the economy fully recovers. You can already see it in the housing market (not included in the Consumer Price Index). What is the best hedge against the risk of rising inflation? TIPS (Treasury inflation-protected securities) should be your go-to option in most scenarios; but with inflation-adjusted yields of -1%, TIPS are a non-starter today. To hedge inflation in the portfolios we manage for you, we own gold and precious metals, diversify globally, and favor companies with pricing power and the ability to make regular dividend increases.