Bonds Play Role in Portfolios

October 2022 Client Letter

By year-end 1993, I had about 18 months experience in the investment industry. During that short period, I had it relatively easy. The U.S. economy was enjoying its 33rd straight month of economic expansion, interest rates were still on the low side, and inflation was tame. As we rolled into 1994, it appeared we could have another year of market stability.

The Fed had held interest rates at around 3% for the previous 18 months. Interest rate hikes had not been a consideration for markets. As we know from this year, things can go a lot better when concerns about Fed hikes are not on the table.

But the ugliness began on February 4th when the Fed decided to raise rates by 0.25 percentage points. This was the first of many unexpected rate increases. And what initially looked to be a promising year resulted in the worst bond market in history. As the Fed raised rates, the bond market wreaked havoc on financial companies, hedge funds, and bond mutual funds.

Fortunately for our clients, we were invested in high-quality bonds with intermediate maturities. No junk, no leverage, no complicated derivatives. So, while our clients saw a decline in the value of their holdings, they could take relative comfort in their portfolio of safe-haven U.S. Treasury securities. Interest payments would be uninterrupted, and the principal would be paid back at maturity.

Bonds Play Role in Portfolios

This year has also been an ugly one for bondholders. Some investors are now questioning if bonds should still play a role in their portfolios. The Bloomberg U.S. Aggregate Bond Index (the Dow or S&P 500 of the bond market) is down over 16% YTD. That’s still better than the 20% YTD drop in the S&P 500 and the 30% loss in the tech-heavy NASDAQ; but it’s disappointing nonetheless.

Notwithstanding 1994 and 2022, we continue to believe that bonds belong in a well-diversified portfolio. In our view, this year’s poor performance is likely an aberration caused by global central banks holding interest rates at zero or less for more than a decade, which drove yields across a wide spectrum of bonds to historic lows. When the starting yield on a bond is at ultra-low levels, less interest income is available to buffer price declines when interest rates increase.

Historically, it is rare for bonds to decline in a calendar year. According to Morningstar, since 1926, bonds have had only 15 annual declines, and the magnitude of those declines averages a scant 2.4%. Stocks have experienced 26 annual declines over the same time, with an average loss that exceeds 13%.

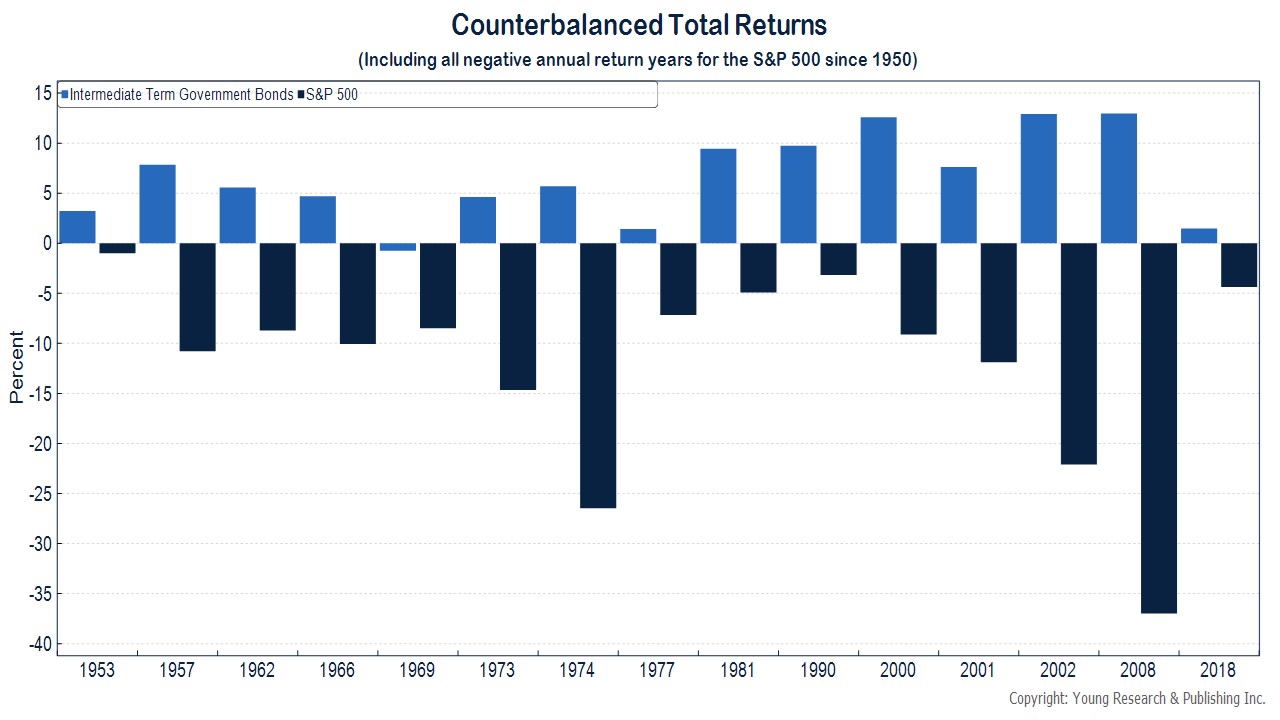

In terms of portfolio construction, it’s also important to remember that bonds tend to counterbalance stocks. The chart below is probably familiar to many long-time readers of this letter. It shows the return of intermediate-term government bonds during down-years for the S&P 500. The time period is 1950–2021. If 2022 ended today, it would be only the second time in the last 72 years that both bonds and stocks lost value in the same year. The historical odds would change from a 93% likelihood of government bonds rising in down stock-market years to 88%. Those odds still look favorable in our book.

Bonds Less Risky Than Stocks

Bond returns tend to be less volatile than stock returns because stocks and bonds are different animals. Bonds are like loans. Bondholders receive mandatory periodic interest payments in exchange for lending money. The amount loaned is the amount that must be paid back at maturity, and the interest rate is set at the time of issuance. In other words, absent a default, you know what your bond will be worth at maturity and how much you will be paid to hold it until maturity. That reduces risk. Contrast that with stocks where dividend payments are optional, there is no maturity, and the future value of a company depends on the earnings profile of that business and how other investors appraise that business at some future date. Lots of unknown variables must be assessed.

Bondholders are also senior in the capital structure to stockholders. What does that mean? If a company goes bankrupt, bondholders are repaid before stockholders. Stockholders typically lose everything when a company goes bankrupt, but bondholders usually get something back. It might be as little as 10% or as much as 70%; but, most often, it’s something.

Holding Bonds to Maturity

Keep this in mind: Although the unrealized losses on some of your bonds may rival the unrealized losses on some of your stocks, there is greater certainty about what you’ll earn on a bond that is down. Let’s look at a hypothetical example: An investor purchases a five-year government bond for $1,000 when interest rates are 2%. One year later, when interest rates increase by 3%, the price of that bond will be about $892.

Okay, so the bond is down in price. But unless somebody is forcing our investor to sell, the loss is temporary. Bonds mature at face value, or $1,000 in this case. If the hypothetical bond I described above is held to maturity, our investor will receive $1,000 plus $20 in interest payments for another four years. Assuming no change in interest rates, as maturity approaches the price of the bond should rise each year, resulting in an average annualized return of 5% through maturity.

Highest Rates in Over a Decade

While the speed of the increase in interest rates has resulted in temporary losses on many existing bonds, we believe higher rates are a resounding positive for long-term investors. We haven’t seen rates this high in Treasury and corporate markets in over a decade.

We are seeing intermediate-term corporate bonds with yields in the 4.5–6% range.

We recently purchased a three-year Southern Company bond for some clients at a yield to maturity of approximately 5.20%. Southern Company is one of the largest regulated utilities in the country. Southern owns and operates regulated utilities Alabama Power, Georgia Power, Mississippi Power, and Southern Power. Through its Southern Company Gas subsidiary, the utility also distributes natural gas through over 76,000 miles of pipeline to about 4.3 million customers in four states. Its energy sources include natural gas, coal, nuclear, and renewables. Southern bonds are rated Baa2/BBB.

Another bond we purchased recently for some clients is a Molson-Coors issue due in four years at a yield of approximately 5.35%. Molson Coors Beverage Company is one the world’s largest beer-makers by market value. The company has a diverse portfolio of beloved and iconic owned and partner brands, including Blue Moon, Coors Banquet, Coors Light, Miller High Life, Miller Genuine Draft, and Miller Lite. The bonds are rated Baa3/BBB-.

Increasing the Quality Component of Fixed Income

We recently boosted our clients’ exposure to Treasury securities. We owned a Treasury position for clients pre-COVID, and shortly after COVID began and yields on corporate bonds spiked higher, we sold Treasuries and moved into higher-yielding and lower-quality corporates. As the economic and credit cycles matured and Treasury yields moved up sharply, we have added to full-faith-and-credit-pledge Treasuries.

We own Treasury positions for most clients maturing in one, two, three, and six years. All four positions have yields to maturity of more than 4% today. We continue to favor shorter-term maturities overall as yields are higher than on longer-term bonds. As the economic cycle matures, we may decide to extend maturities.

One area of the Treasury market we have not yet moved into is Treasury inflation-protected securities (TIPS). TIPS are inflation-indexed bonds, which one might assume are the place to be with inflation raging; but TIPS are down almost as much as regular Treasury bonds YTD. The Bloomberg U.S. Treasury Inflation Linked Bond Index is down 13.37% compared to a 15.05% decline in the Bloomberg U.S. Treasury Total Return Index. Why are TIPS performing poorly in an inflationary environment? TIPS are an inflation hedge, but it is more accurate to say that TIPS are a hedge against unexpected inflation. When inflation began to rise last year, investors started to anticipate higher rates of inflation, and they factored that into the price of TIPS. The rise in interest rates this year has impacted the price of TIPS and normal Treasury bonds in a similar fashion. Higher rates equal lower prices.

We invested in TIPS in the past when we viewed the real rate as especially compelling. We may purchase TIPS again in the future if the yield rises to compelling levels or the inflation built into the price of TIPS falls to a level that is lower than we believe is reasonable.

A Lost Decade in Stocks?

I have been receiving questions about the possibility of stocks going nowhere for ten years. It’s difficult to accurately predict this given the abundance of unknown factors that markets will encounter: U.S. elections; monetary, fiscal, and tax policies; economic and business cycles; new technologies and medical breakthroughs; geopolitical events; black swan events, etc.

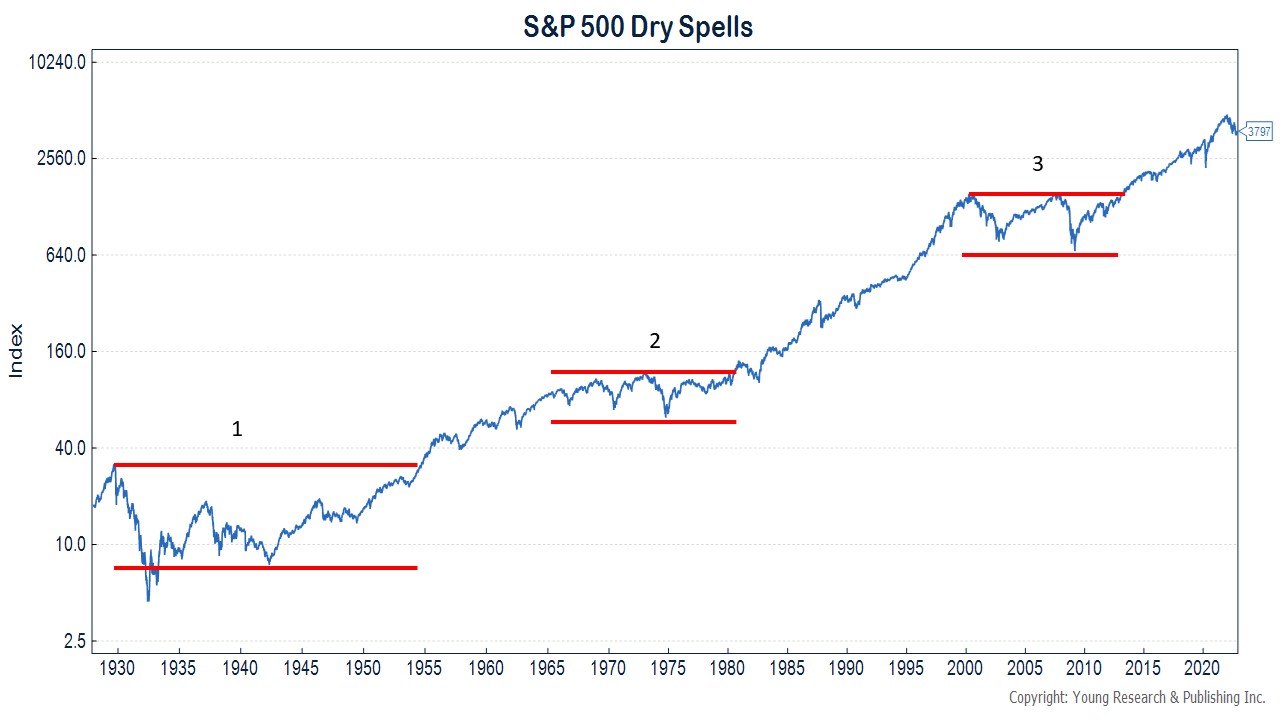

Regardless, investors are wise to prepare for long periods where the stock market does not appreciate. It’s not unheard of for stocks to lag for extended periods. This can be especially true for investors who lack proper diversification.

The chart below highlights the three secular bear markets for stocks over the last century. The dotcom bust is likely the most memorable to investors today. Those who concentrated their portfolios in new economy stocks in the late 1990s felt the most pain. It took the Nasdaq more than 17 years to surpass its dotcom high.

While it may be difficult to forecast a lost decade for stocks, what might one do to prepare for such an outcome?

First, diversify. If your entire portfolio is not in stocks, a lost decade will not impact you as much, and it may give you an opportunity to invest in stocks at more attractive levels following a correction. Bonds may have just had their lost decade, so the next ten years look better than the recent past.

Focusing on sectors of the market that offer value is also advisable. Long dry spells in the market tend to begin when valuations are stretched. Buying cheaper stocks is unlikely to eliminate all downside, but it may help you recover quicker. Our measure of value has long been focused on dividends. Dividend yield is an indicator of value, and the dividend record is often a signal of company strength. Firms that are short on cash flow rarely pay dividends. Dividends also have the added benefit of providing you with a stream of cash if equity prices remain stagnant for a long period of time.

Dividend Strategies Taking in Billions

As technology and innovation stocks struggled in 2022, dividend stocks came back in favor. Investors are putting billions into dividend funds. What took them so long to get dividend religion?

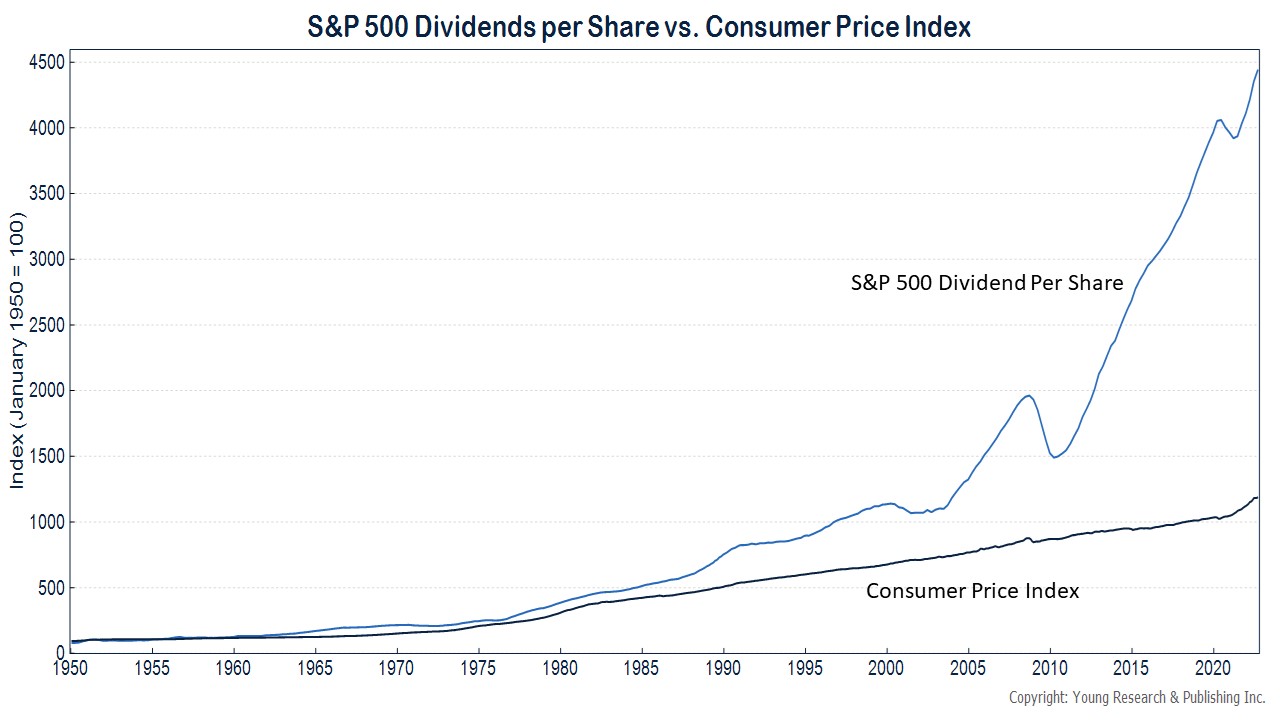

Inflation risk may be driving some of these flows. In inflationary periods, companies that pay dividends and increase those dividends may be able to provide investors with a hedge against inflation. The chart below shows the Consumer Price Index vs. Dividends Per Share for the S&P 500. Both series are set to 100 in 1950. Historically, dividend growth has outpaced inflation.

Our dividend strategy isn’t entirely focused on yield. A higher yield isn’t always a better yield. We want dividends today and higher dividends tomorrow. Firms that can pay sustainably rising dividends often have strong balance sheets, and they generate healthy cash flow that rises over time.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. At Richard C. Young & Co., Ltd., we seek to avoid the speculative elements in the market by pursuing a balanced investing approach. A mix of bonds, dividend-paying stocks, and precious metals has most often helped limit risk in our clients’ portfolios while delivering an acceptable return. A well-diversified balanced portfolio will probably never earn the highest return in any single year, but it is also unlikely to deliver the worst.

P.P.S. For stocks, we favor a globally diversified portfolio of companies that pay dividends and intend to raise them regularly. We favor established blue-chip-type holdings with durable businesses that have weathered a business cycle or two. We avoid startups and companies with unproven track records.

When it comes to dividends, we seek to balance dividend yield and dividend growth. We don’t chase income in the highest-yielding stocks. More often than not, dividends of the highest-yielding companies are at the greatest risk of being cut. We want an above-average dividend yield today and the prospect of a higher dividend tomorrow.

P.P.P.S. Writing for Behavioral Investment, Joe Wiggins observes: “During a bear market, it is hard to see anything ahead but unremitting negativity. Our tendency will be to believe that things will keep getting worse, prices will be lower again tomorrow. Our ability to make good, long-term decisions during a bear market is severely compromised. Rational thought will be overcome by the emotional strains we are likely to feel—what happens if things keep getting worse and I didn’t do anything about it?”

During volatile markets, patience is fundamental to achieving long-term investment success. The power of compound interest is not harnessed over weeks or months but over years and decades. Patience is also fundamental to investing in companies. Sometimes companies go through rough patches. As a shareholder, it can be frustrating to experience these periods, but a patient approach can be rewarded.

P.P.P.P.S. If you are considering when to start taking your social security benefits, you may be interested in Delaying Your Social Security Has Rarely Been This Profitable by Bloomberg’s Alexis Leondis. Several informative issues are raised: “… Even if you don’t collect benefits, the COLA adjustment—8.7% for 2023—still gets factored into the amount you’re eligible to receive starting at age 62. And it gets compounded, so each year you hold off on collecting to full retirement age (somewhere between 66 and 67 depending on when you were born) or beyond will make your eventual payout even juicier. The benefit increase stops when you reach age 70.”

P.P.P.P.P.S. Each year, Barron’s ranks the nation’s top independent advisors. Richard C. Young & Co., Ltd. has been recognized on this list for 11 consecutive years (2012–22).

* Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Rankings are generally limited to participating advisors and should not be construed as a current or past endorsement of Richard C. Young & Co., Ltd. Barron’s is a trademark of Dow Jones & Company, Inc. All rights reserved.