A Record Level of Investor Complacency

July 2017 Client Letter

Last month I wrote to you about the deleterious effects of the central-bank liquidity bubble on deep-value opportunities. Deep value stocks aren’t the only casualty of excess central-bank liquidity, though. There is a more ominous problem brewing in markets. Global central banks’ hair-trigger approach to providing monetary stimulus at every hint of market turmoil has institutionalized the idea that volatility will not be tolerated.

Investors used to call it the “Greenspan put,” which morphed into the Bernanke and Yellen puts, but now the idea has gone global. Central banks have created a dependency on financial market liquidity. Investors are buying and selling securities (mostly buying) with the assumption that easy money will always be there to bail out bad decisions.

A Record Level of Investor Complacency

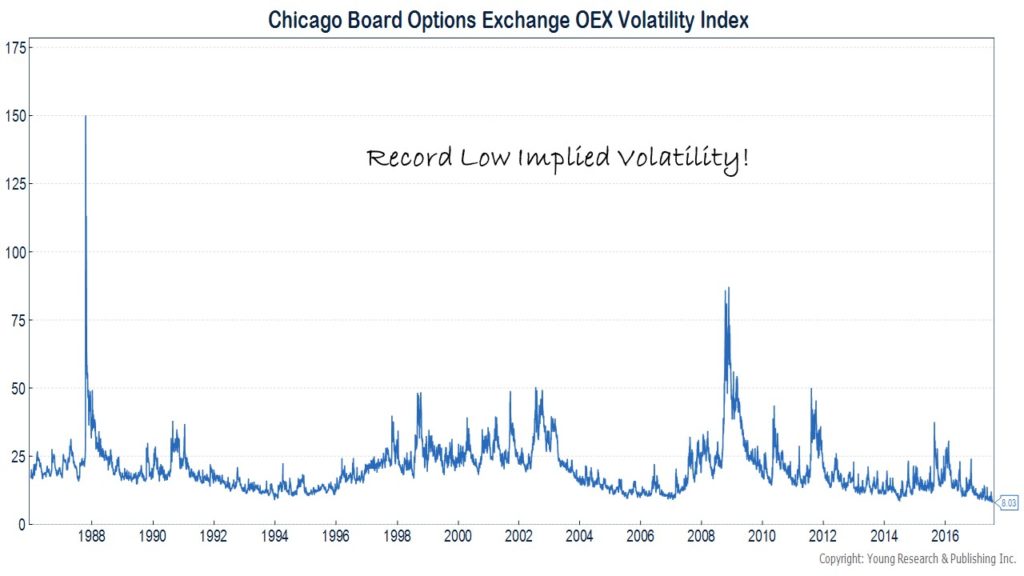

Implied volatility has fallen to record lows. The lower the level of implied volatility, the more complacent investors are about the possibility of a stock market correction. Our chart below provides some historical perspective. We are using the VXO as a measure of implied volatility here, as it has a longer history than the more popular VIX. The VXO measures implied volatility on the S&P 100, whereas the VIX measures implied volatility on the S&P 500.

Stock market corrections have also gone dormant. Stocks haven’t experienced as much as a 5% pullback in more than a year. This is only the sixth time since 1950 that the S&P 500 has gone 12 months without a 5% correction.

The Problem with Low Volatility

What is so bad about a prolonged period of low volatility? On the surface, low volatility would seem to be a plus for markets. After all, the Dow, the S&P 500, and the NASDAQ are all trading at all-time highs. The problem is that, historically, periods of stability breed instability.

When investors become conditioned to expect risky assets to be a one-way train, the trades can get bigger and more brazen and ultimately lead to a major bust. We saw that scenario play out economy-wide during the real estate collapse, but it also occurred in the stock market during the dotcom bubble. Investors became complacent about the risk of loss in businesses that were little more than a domain name, a business plan, and a server. When sentiment changed, markets crashed.

We don’t yet know what the catalyst for the next bust will be, but one place to look is the world’s central banks. An unwinding of the unprecedented amounts of central-bank liquidity could easily derail markets.

Ultra-low interest rates and trillions worth of bond buying each year have created an unhealthy reliance on central-bank liquidity. Earlier this month, global equity markets started selling off on news that the European Central Bank might remove its pledge to increase its bond-buying program if the euro-area economy got worse. There was no mention of an end to the program or even a tapering of purchases. Investors apparently started dumping shares because the ECB signaled the euro-area economy was so strong it didn’t warrant even more stimulus than it was already getting.

How will markets react when the ECB finally decides to end its bond-buying program?

The Secret Sauce of a Dividend Strategy

Since he started in the investment industry over five decades ago, my dad has taken a conservative, dividend-centric approach to the stock market. In his book, The Intelligent Investor, Ben Graham laid the foundation for what would become my dad’s dividend-based investment strategy.

Graham said “One of the most persuasive tests of high quality is an uninterrupted record of dividend payments for the last 20 years or more. Indeed, the defensive investor might be justified in limiting his purchases to those meeting this test.”

Today dividends lie at the heart of all the stock market investing we do for clients. If a company doesn’t return cash to shareholders, we aren’t interested.

Our clients’ equity portfolios include only dividend- and income-paying stocks. We favor companies that pay meaningful dividends and are willing and able to make regular dividend increases.

The latter part of our dividend strategy is a step that novice investors often neglect. In our experience, many beginner dividend investors buy stocks solely on the size of their dividend yield. The highest yielders may offer the prospect of juicy returns, but, more often than not, an ultra-high dividend yield is an indication of a looming dividend cut.

We have found the best dividend stocks are those that can pay a sustainable dividend and increase it regularly.

Dividend Growth is Key

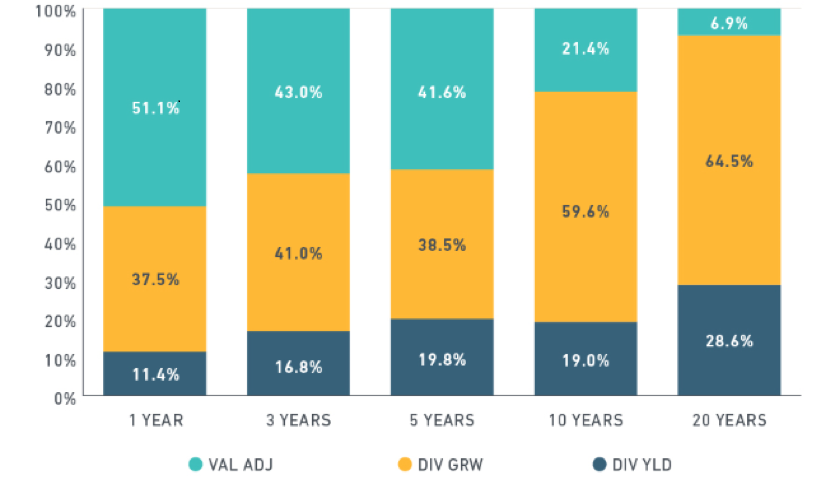

MSCI published a report last year highlighting the importance of dividend growth to the return of global equity benchmarks. The chart below, taken from the report, shows that the longer the time horizon, the more important dividend growth becomes to overall return. Over short periods of time, returns are dominated by changes in valuation, but over the long run, dividend growth dominates. For the 20-year period ending in 2015, dividend growth contributed 65% to the total return of the MSCI All-Country World Index.

Average absolute return contribution from Dividend Yield, Dividend Growth, and Valuation Adjustments for different holding periods.

A Dividend Growth Powerhouse

Visa, a stock we own in many common-stock portfolios, is a company where dividend growth is the primary driver of returns. Visa operates the world’s largest consumer-payment system, with nearly 2.5 billion credit and other payment cards in circulation across more than 200 countries. Visa isn’t a high-yielding stock. In fact, it is the lowest-yielding company we own. Visa sports a dividend yield of only 0.66%, but the company is a dividend growth powerhouse. Over the last five years, Visa has compounded its dividend at a rate of almost 26%. Not surprisingly, the total return on Visa shares over the same period is also 26%.

Health Care and Dividend Growth

Like Visa, health-care stocks are a sector of the market where dividend growth is the dominant driver of returns. The health care sector has a below-average dividend yield but an above-average dividend growth rate. Dividend growth for the S&P 500 Health Care Sector over the last five years has averaged 9% per year.

For most of our health-care investing, we favor a basket approach. The Vanguard and Fidelity Health ETFs are our products of choice. The ETF approach minimizes development and patent risk while still providing exposure to what we view as a favorable macroeconomic theme.

The Opportunity in Health Care

The portfolio managers of the Eaton Vance Worldwide Health Sciences Fund led off a recent Barron’s interview by extolling the benefits of investing in health care stocks.

Health care benefits from an aging population. There is a lot of innovation under way by drug makers, medical device companies, and companies developing technologies used to deliver health care. From a growth perspective, it is a great time to be invested. Also, stock valuations are compelling. The health care sector trades at a discount to the Standard & Poor’s 500 index. This isn’t a regular occurrence. It has happened just three times in the past 25 years.

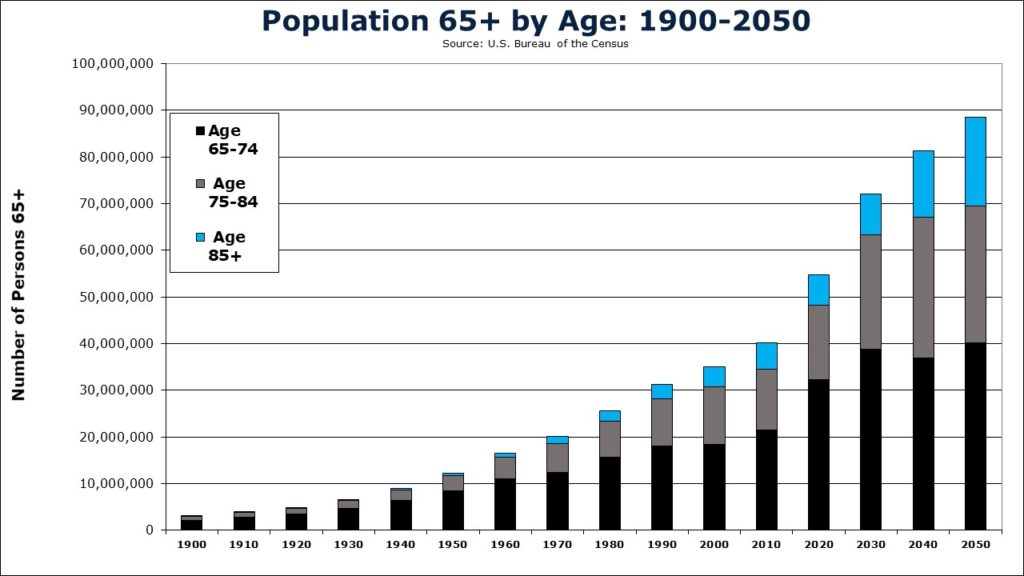

We see the aging of America as a powerful secular tailwind for the health care sector. According to the Census Bureau, in 2020 there will be nearly 55 million Americans aged 65 and over. By 2030, that number will jump to over 72 million, a 30% increase in just 10 years. What’s most concerning is that the percentage of America’s population aged over 65 will climb to a record-high 19.3%, meaning fewer young Americans supplying services, care, and pension payments to more older Americans.

In the 1960s, the number of Americans over 65 was about 9% of the total. By 2030, that percentage will have more than doubled, as life expectancies increase and fertility rates decline. These demographic trends will have a profound impact on the health care system.

Inevitably, as people get older, they demand more medical care. By 2020, the health-care system needs 1.6 million new workers. It is not even close to being on track to meet that goal. Research performed by the Association of American Medical Colleges projects shortages of physicians of between 52,300 and 95,900. That means America will be short about as many doctors as the entire population of Dubuque, Iowa. It doesn’t help that a third of currently active physicians will be 65 or older within 10 years.

In response to the shortages of care, the U.S. will likely endure higher prices, and such an outcome will hopefully spur technological advancement. Advances in medical tech will increase the productivity of the doctors who remain. An example is robotic technology that allows doctors to perform surgeries from faraway places.

Another way Americans will cope with fewer doctors per capita is by taking more prescription drugs. With fewer surgeons per capita, more Americans could remain untreated for painful ailments. In a 2015 study, the CDC reported that 40% of Americans 65 years and over were on five or more prescription drugs. About 65% were on three or more. And 91% were on at least one prescription drug.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. A big deal was made of the recent Snap Inc. IPO. The social media platform is a favorite among young people, and Wall Street was hungry to invest in a network that is home to 158 million users. In 2014 Snap refused a buyout offer of $3 billion from Facebook, which would have valued each share today at about $4.40. By March of 2017 Snap was being valued at $23 per share. Shares ultimately sold to underwriters at $17 and, on its second day of public trading, shares closed at $27.09. But it’s been all downhill from there. Snap shares closed well below their IPO price at $14.89 yesterday, with the market capitalization of the company sinking to $17.2 billion. Even Morgan Stanley, a lead underwriter of Snap’s IPO, has downgraded the company’s shares. Not all IPOs are winners. If the founders and managers of a company are the sellers in an IPO, would you really want to be the buyer?

P.P.S. Is Apple a stock market bully? That’s how Simon Maierhofer describes the company in a recent story at MarketWatch. Apple, Amazon, and Google are in a race to become the first trillion-dollar company; but, unlike the others, Apple is included in the Nasdaq 100, the S&P 500, and the Dow Jones Industrial Average (DJIA). Apple’s inclusion in all three indices gives it a disproportionate amount of sway over their performance. Apple’s value represents 11.6% of the Nasdaq 100, 3.62% of the S&P 500, and 4.61% of the DJIA. That’s a big portion of each index for one company. Apple’s performance to the S&P 500 is more important than the performance of the bottom 100 companies in the index.

P.P.P.S. A recent article in CNN Money listed some of the most common financial mistakes Americans are making. The first and most obvious is waiting too long to start saving for retirement. Getting an early start is paramount to unlocking the magic of compound interest. If you have children or grandchildren, tell them to save early and save often. Other financial pitfalls include buying homes and cars that are too expensive for a family budget. Being house-poor will deprive you of the ability to save for the future. Another problematic financial behavior is purchasing depreciating assets on credit. Does it really make sense to pay 19% interest on last month’s groceries? Lastly, people should avoid making late payments on debt at all costs. Late payments can kill credit ratings and drive up borrowing costs on everything from mortgages to auto loans and credit cards.

P.P.P.P.S. Low long-term bond yields in the face of a Fed that is hiking short-term rates has helped sustain one of the greatest yield-reaching episodes on record. TINA, as in, There Is No Alternative, has been the stock market mantra for the last seven years. The danger is that if longer-term interest rates rise, shareholders will return to cash and bonds. A reversal in sentiment is all it would take to drive yields back to more normalized levels and likely lead to an unwind in the trade—not a comfortable foundation on which to build one’s retirement portfolio. Despite low yields, bonds remain a necessary component of a well-balanced retirement portfolio.