Revisiting the Arithmetic of Portfolio Losses

August 2023 Client Letter

In March I wrote about the arithmetic of portfolio losses. With the more speculative indices, such as the Nasdaq 100, delivering impressive returns so far in 2023, it is worth revisiting this concept. Year to date, the Nasdaq 100 index is up 36%. Compare that to the Dow Jones Industrial Average, which is up 4.2%, or the FTSE High Dividend Yield Index, which is down slightly on the year.

Investors who don’t have portfolios concentrated in the big-technology stocks driving the Nasdaq 100 (and even broader-based indices) this year may fear missing out. A flat portfolio in the face of 30%-plus returns can be frustrating, but focusing on this year’s gains without putting them in the context of last year’s losses is not at all constructive.

By example, in 2022 the Nasdaq 100 was down 32.4%, and the FTSE High Dividend Yield Index was down .32%. For investors not familiar with the arithmetic of portfolio losses, the Nasdaq 100’s loss of 32.4% last year and gain of 36% this year sounds better than the FTSE High Dividend Yield’s losses of .3% last year and .7% this year. However, the arithmetic of portfolio losses illustrates why that is not the case.

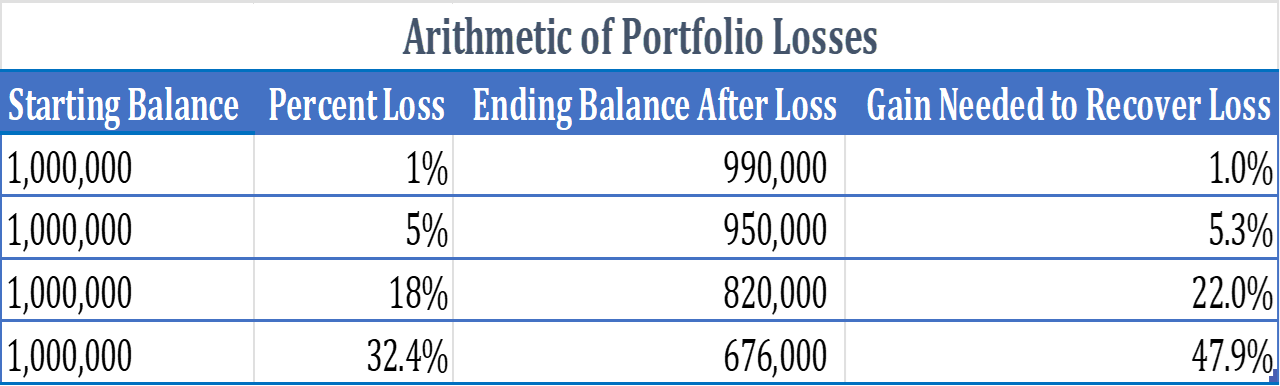

Recovering from a loss of 32.4% requires a gain of 48%. Remember, the larger the loss, the greater the gain needed to get back to even. Small losses are easily recouped. If your portfolio loses 1%, it only takes a 1.01% gain to get back to even. If your portfolio loses 5%, it takes about a 5.25% gain to get back to even. A loss of 18% (S&P 500 loss in 2022) requires a gain of 22%, and as already mentioned, a loss of 32.4% requires a 48% gain.

The table below shows the gains required to get back to even for a 1%, 5%, 18%, and 32% loss.

Combining 2022 and 2023 returns, the Nasdaq 100 is still down about 8% despite this year’s impressive returns, while the FTSE index is down 1%. What’s more, the maximum drawdown (peak to trough decline) from year-end 2021 for the Nasdaq 100 index was 34% compared to 13.4% for the dividend index.

In our view, the tendency of dividend paying stocks to fall less in bear markets than more speculative shares is part of what makes them appealing to investors in or nearing retirement and especially to investors taking distributions from their portfolios.

The trade-off of investing in shares with lower volatility is that they tend to lag in up markets just as they lead in down markets. Lower volatility tends to cut both ways. The last two years are extreme examples in both directions and should not be taken as a guide to future outperformance or underperformance.

It is also important to remember that the last two years of total portfolio returns are unlikely to represent how the portfolios we manage for you will perform over the long run. Stocks have basically been flat, and as interest rates have increased substantially over the last two years, there has been a stiff headwind for bonds.

We believe the headwind for bonds should ease over the coming years, though. Using the 5-year Treasury as an example, starting from today’s yield of 4.45%, the interest rate on this bond would have to increase by 3.55 percentage points to a yield of more than 8% for the position to be at a loss two years from today.

Sticking with a Plan

One of the most important determinants of achieving long-term investment success is making a plan and sticking to it. Your plan may differ from another investor’s plan, and his plan may differ from the next guy’s plan. Every investor has a different ability and willingness to take risk. Long-term investing does not have to be a one-size-fits-all exercise. The mistake that many investors make is not in developing a plan but in abandoning that plan during unfavorable periods in markets. Wholesale strategy or asset-allocation shifts in pursuit of higher returns or smaller losses can decimate portfolio returns and make it much more difficult to achieve the goals one set out to achieve in the first place.

Including both stocks and bonds in a portfolio is one of the best ways we know of to help temper the ups and downs of markets. As recently noted in Kiplinger:

“You engage in asset allocation because, like ballast in a boat, you want to minimize the sway of the portfolio,” says Sam Stovall, chief investment strategist at investment research firm CFRA Research. More important, “because you’re smoothing out the fluctuations, your emotions are less likely to become your portfolio’s worst enemy.

Risks with Investing

Allowing the fear of missing out to drive investment strategy is a mistake not only because it often leads to greater portfolio volatility and to concentration risk. Diversification is said to be the only free lunch in investing. As an advisor, crafting diversified portfolios for clients also means always having to say you’re sorry. The nature of diversification means at least one position or asset class in a portfolio is likely to be lagging or performing poorly.

So why does Richard C. Young & Co., Ltd., an advisory firm interested in client satisfaction, insist on crafting diversified and balanced portfolios? Despite it setting the stage for some difficult conversations, insisting on diversification is simply the right thing to do.

Risks abound across the global investment landscape. There are, of course, knowable risks like chasing performance in overvalued and overbought shares, but there are also unknowable or extremely low probability risks that are difficult to plan for. The way to reduce the potential impact of these risks is to diversify.

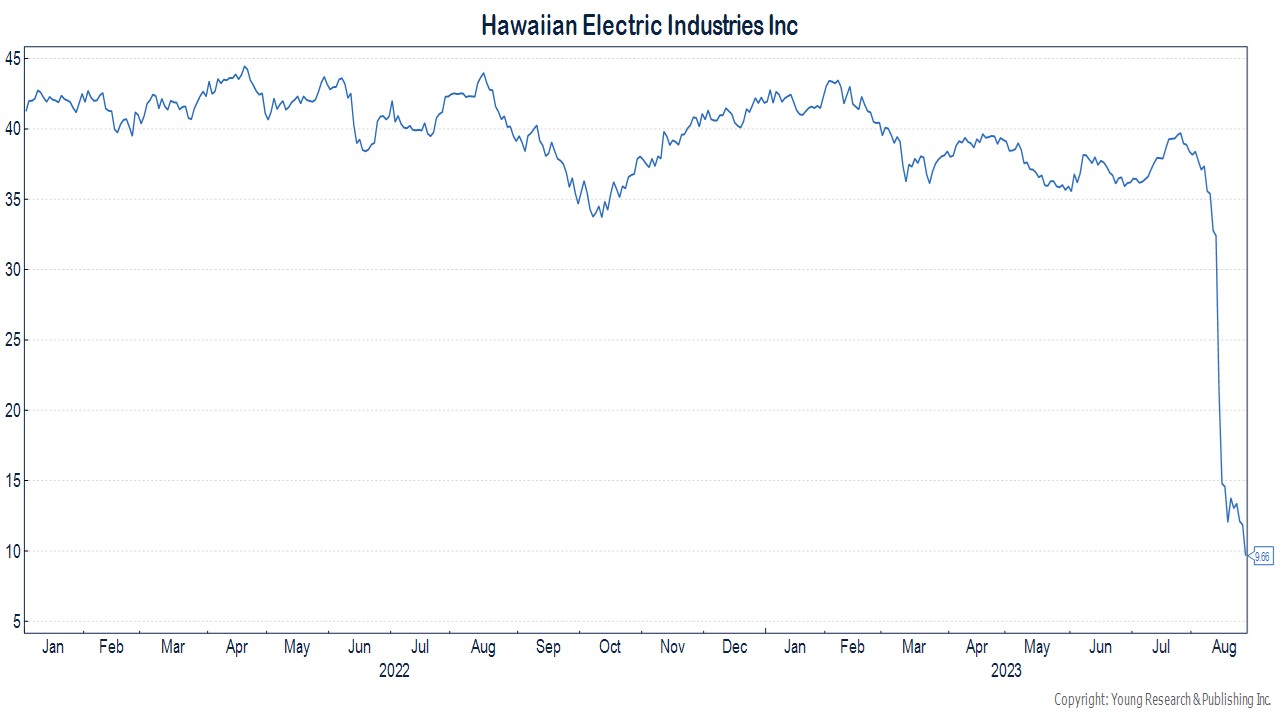

Take Hawaiian Electric as an example. Hawaiian Electric runs two regulated utilities that provide electricity to approximately 94% of Hawaii residents in Oahu, Hawaii, Maui, Lanai, and Molokai. Sounds like a stable business in a desirable state to live and visit. Electric utilities have low business-cycle risk, and there is almost no risk of new entrants as the industry is a regulated monopoly. Why not load up on utilities, collect the fat dividends, and benefit from monopoly economics? What could go wrong?

Below is a price chart of Hawaiian Electric shares. The shares are down 75% in August alone.

Hawaiian Electric Industries shares have plunged because there is mounting evidence that the company’s equipment was involved in starting the recent tragic Maui fires, which have sadly caused over 100 confirmed deaths and people still missing. Liabilities from the fires could sink Hawaiian Electric. Some victims of the fires have already filed suit, accusing Hawaiian Electric of negligence. The lesson for investors: Take the free lunch and diversify.

Inflation

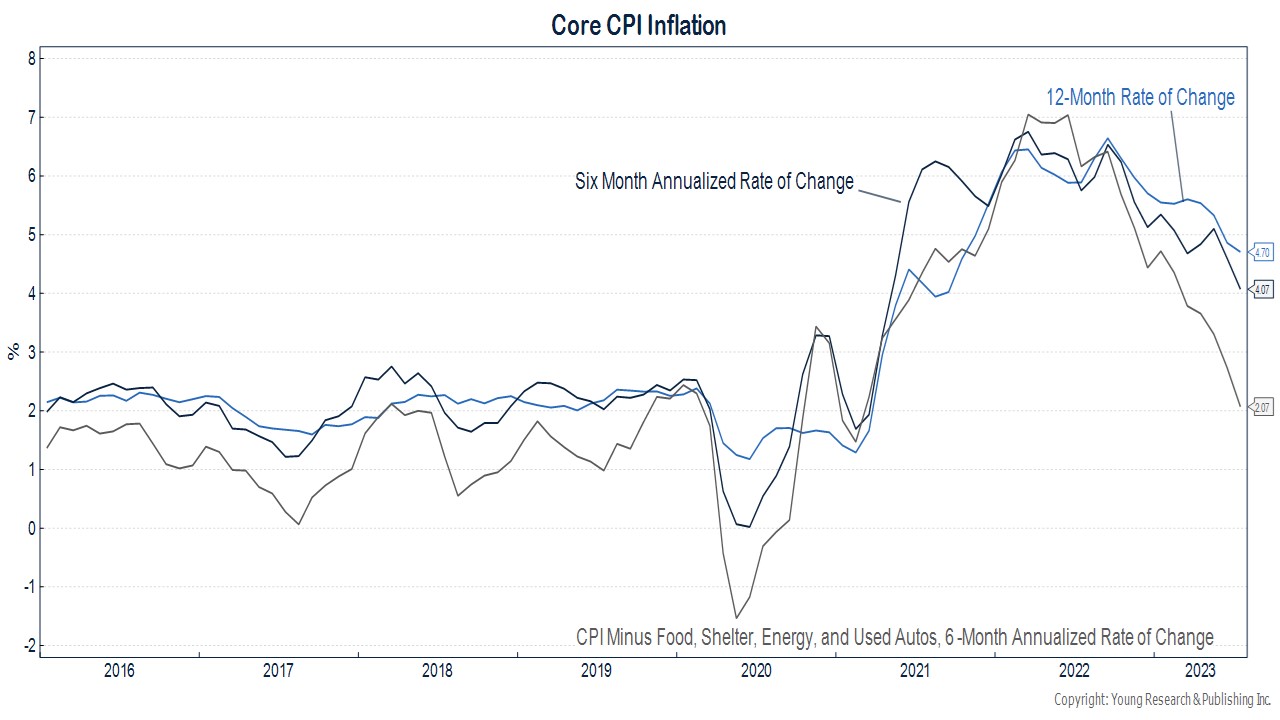

After being an afterthought for investors for a decade or more, over the last two years inflation has become a primary focus. The Fed, politicians, and investors have all been focused on it. Some investors I speak to don’t think inflation will go away. It may feel that way as the methods the Bureau of Labor Statistics uses to measure inflation don’t make it a particularly intuitive indicator to gauge; but inflation is, in fact, falling.

Perhaps the disconnect between perception and reality with respect to inflation is the fact that falling inflation does not mean a decline in prices. Falling inflation simply means the rate of increase in prices has declined. On average, prices are still going up, just at a slower pace. If you anchor your inflation estimates on goods or service prices from two years ago, inflation still seems to be rampant.

The raw data tells a more encouraging story. The chart below updates a chart we ran in June that shows the six-month annualized rate of change in core CPI and core CPI minus shelter and used autos. We have also included the 12-month rate of change in core CPI. All are off their highs of 2022, with the six-month annualized rate of change in Core CPI minus shelter and used autos down near the Fed’s 2% target.

Cash is King Again… and So Are Treasuries

For the first time in 22 years, cash yields are higher than the earnings yield on stocks. The earnings yield on stocks is simply earnings divided by the price. For the S&P 500, the earnings yield is 4.7%. The Fidelity Treasury money market yields nearly 5%. Treasury yields on notes maturing within three years are also higher than the earnings yield on the S&P 500. With the economy still showing some resilience in the face of higher interest rates, we could see another interest rate hike or two by the Fed over the next 6-12 months. That could push cash yields up even higher.

I cannot overstate the benefit of today’s high cash yields. Ultra-low interest rates were a drag for conservative investors and those interested in income for over a decade. Ultra-low interest rates also greatly distorted markets, inflating valuations and keeping zombie businesses alive with free money. At today’s 5% money market yields, an investor could double his money every 14.4 years. At the 0.25% yield that prevailed for most of the 2010s, it would take 288 years.

In addition to the higher yield on money market funds, Treasury and corporate yields are also at attractive levels. Short-term Treasuries offer yields between 4% and 5%, and short-to-intermediate-term corporate bonds offer yields of 5% to 6% depending on maturity and rating.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. During a recent Barron’s Q&A session the magazine asked, “What are your best fixed-income strategies right now?” I agree with the response given by the head of fixed income for BNY Mellon:

First and foremost, we’re constantly telling investors to not get over enamored with very short-term instruments. Right now everyone’s like, “Look what I can get for T-bills and look what I can get for cash.” We tell them to diversify, to extend durations, to get out of cash. We’ve been pounding the table on not being overweighted in cash and reminding clients that while it looks really attractive now, it could change very suddenly. Those rates that you thought were really compelling could go away; a 5% yield could turn into a 3% yield.

P.P.S. Yahoo! Finance recently cautioned investors not to ignore potential risks and become too complacent:

“Expectations are on the more optimistic side. So any small thing could rattle investors,” said JPMorgan Private Bank senior markets economist Stephanie Roth. “There are a long list of things that are potentially surprising to markets. Everybody is generally complacent. So it could be any negative news that would scare investors.”

And this from Truist strategist Keith Lerner:

We see a market more vulnerable to bad news as stocks have become extended on a short-term basis… and already have seen some of this vulnerability in the first few days of August on Fitch’s surprise downgrade of US debt. Also, the move in the 10-year US Treasury yield above the 4% level will likely act as a headwind to further expansion in already lofty equity valuations.

P.P.P.S. Best-selling author Morgan Housel explores the strange ways people think about money in his book The Psychology of Money:

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people. Money—investing, personal finance, and business decisions—is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real-world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride marketing, and odd incentives are scrambled together.

Barron’s interviewed Housel in July, covering a range of money-related topics. Barron’s asked Housel what is the biggest mistake investors make. He responded:

Not being introspective enough about what your goals and risk tolerances are. A lot of people think of investing in the same way they would think of math, where there’s one right answer for everyone. Like it doesn’t matter how old you are, where you are from, two plus two is always four for everybody. There’s no black and white law that’s like that, and a risk that is good for you to take might be terrible for me to take and vice versa.

The biggest thing is realizing that there are a million different games to play, and you have to figure out the game that works for you. A lot of investors get tripped up because they start to emulate maybe somebody on TV, maybe somebody on Twitter, maybe someone in their own household, and they start playing a game that is the wrong game for them.

P.P.P.P.S. Parts of the U.S. economy continue to remain resilient. As reported in MarketWatch, “An ISM barometer of U.S. business conditions at service companies such as restaurants and hotels strengthened to 54.5% in August from 52.7% in the prior month. This is the highest level since February. Economists polled by the Wall Street Journal had expected the index to slip to 52.5%. This is the eighth straight reading above the 50% threshold that indicates expansion in the economy. The details of the report were also strong. Activity improved to 57.3% in August from 57.1% in the prior month. The new orders index rose 2.5 percentage points to 57.5% in August. The employment index rose 4 percentage points to 54.7%. Prices rose 2.1 percentage points to 58.9% in the month. Thirteen out of 18 industries reported growth in August.” According to Kurt Rankin, senior economist at PNC Financial, “Strong new orders activity is an indication that consumer and business activity in the U.S. economy continue to defy gravity — higher interest rates, accumulating debt, and depleted savings have all failed to squash services spending thus far and the ISM Services PMI reveals that the trend is tilting higher once again.”