Sticking to the Plan

December 2021 Client Letter

When I turned 50, my mom offered to buy me a Peloton bike. Initially, I was hesitant to accept the gift. I didn’t want a piece of equipment in the house that might go unused or, as my dad would say, become a very expensive clothes hanger. Plus, once owned, there would be zero excuses to not exercise. Not spinning would highlight laziness and lack of both willpower and commitment to health. So, rather than put that undue stress upon myself, I delayed placing the order.

As I began speaking with existing Peloton owners, it became clear I would indeed get lots of use from the bike. One of our clients from Birmingham, AL, told me he has used a Peloton consistently for several years and encouraged me to move forward with the purchase. Around the same time, I had my annual physical, where my doctor informed me that the health decisions I make in my 50s will set the stage for life in my 60s.

I ordered the Peloton on January 9, 2021. Unfortunately, my timing was off. A typical delivery time of several weeks was extended to many months thanks to COVID-19 supply-chain bottlenecks. My Peloton fitness regimen would have to wait until April 9th, when J.B. Hunt would finally arrive with my new exercise companion.

After a recent ride, I checked my workout history. Since getting the Peloton, I have logged over 200 workouts, and I am still going strong. The thought occurred that I may not need to worry about a 2022 New Year’s resolution. My new-year commitments are typically fitness-related, and today I have been following my exercise plan for months.

Aside from assessing personal health and fitness, January is also a time when investors often revisit their financial health and investment plans. With the holidays over and tax season on the horizon, the beginning of the year is a natural time to do this.

Formulating an investment plan is somewhat straightforward; sticking with the plan is often a challenge. We all are exposed to outside influences, including alarming headlines from the media, an ever-growing amount of promotional investment emails, events of the day, and concerns of future events that may or may not occur. The constant barrage of information makes investing a much more difficult task, as emotions around investment decisions can lead us astray.

Fear and Greed

Sticking to an investment plan can be just as difficult in bull markets as it is in bear markets. In bear markets, fear is the dominant emotion that can derail a well-formulated investment plan. In bull markets, greed can wreak just as much havoc. Hearing about friends, neighbors, or a half-wit relative making two or three times their money in a short period of time would make anyone envious. You start to wonder what is so great about your investment plan when you aren’t making the kinds of returns “everyone” else seems to be making.

And it isn’t just individual investors who are prone to abandon a well-formulated investment plan in bull markets. Institutional investors make the same mistake. Some do it purely out of emotion. Other managers get pressured into purchasing shares of companies that have no business being held in a prudently managed portfolio simply because they are evaluated on short-term relative performance.

Tesla

Tesla is a stock that is creating major relative-performance risk for portfolio managers today. Added to the S&P 500 last year, Tesla is now one of the most highly valued companies in the world. Tesla makes quality electric vehicles (EVs), and under the leadership of Elon Musk (a truly brilliant individual), the firm has impressively scaled up manufacturing after being on the verge of bankruptcy only a couple of years ago. But Musk’s genius and Tesla’s newfound manufacturing prowess don’t make Tesla a prudent investment.

In fact, Tesla is far from it, in our view. We believe Tesla is a largely speculative bet on a possible future that implies that something close to a winner-take-all situation will arise in the fiercely competitive auto industry. The company is worth more than the combined value of almost all legacy auto manufacturers. This is true, despite the fact that Tesla is only projected to sell approximately 890,000 vehicles in 2021. In a normal year, the global market is a 90-million unit industry. That’s about a 1% market share for Tesla, the world’s most valuable auto producer. We believe that the assumptions investors are making to justify Tesla’s nearly $1-trillion current market value are simply implausible.

Tesla Part of Broader Mania in Electric Vehicle Stocks

Tesla isn’t the only EV stock being valued using implausible assumptions, though. In fact, Tesla shares look reasonably priced if you compare them to Rivian and Lucid Motors. Both are newly public EV companies. Rivian is valued at $100 billion and Lucid at $65 billion. Neither company has generated any meaningful revenue to date. In our view, a bona fide mania is occurring in the electric vehicle space.

EV-mania is just one sign of the speculation and FOMO (fear of missing out) prevalent in today’s markets. Crypto appears to have gone bananas with joke coins like Dogecoin and Shiba Inu valued in the billions. There are software stocks that have performed incredibly well over recent years, trading at 15, 20, or even 30 times sales. Meme stocks such as Gamestop and AMC seem to trade without regard to fundamentals. Big-cap technology shares are priced at levels that rival the dot-com bubble. By example, Nvidia, the largest chip maker by market value (but not sales), is trading at 85X earnings. To put that into context, when you pay 85X earnings for a business, assuming no profit growth, it takes 85 years to earn back your investment.

The speculative element in markets is almost unavoidable. Speculation is even running rampant in the S&P 500 index. Recent commentary from Alhambra Investments highlighted some sobering statistics on the S&P 500:

The top 10 stocks in the S&P 500 make up 30.1% of the fund. Is this the diversification you expected when you bought an index with 500 stocks?

These top 10 stocks have an average P/E of 43.7. Yes, that includes Tesla at 137 times earnings (based on data from Morningstar) so if we take that out the average drops to… 33.3.

The top 20 stocks in the index make up 38.9% of the fund with an average P/E of 38.3.

The top 25 stocks make up 42.2% of the fund with a P/E of 34.6.

Two of the stocks in the top 10 are different share classes of Alphabet (Google). So you really have 30% of the fund is just 9 stocks. Furthermore, if you exclude JP Morgan and Berkshire Hathaway, you have 27.6% of the fund invested in 7 companies: Microsoft, Apple, Amazon, Tesla, Alphabet, Meta Platforms (Facebook), Nvidia (chip maker for crypto mining). Do you think those companies will be in the top 10 a decade from now? Only 4 of the top 10 from 2011 are still in there. Only one stock from the 2000 top 10 remains (Microsoft).

The current concentration of the fund is unprecedented. Its long-term average is about 18% in the top 10. It reached 26 during the dot com mania. Is it still prudent to use this fund as your main equity exposure?

A Balanced Approach

At Richard C. Young & Co., Ltd., we seek to avoid the speculative elements in the market by pursuing a balanced approach. A mix of bonds, dividend-paying stocks, and precious metals has most often helped limit risk in our clients’ portfolios while delivering an acceptable return. A well-diversified balanced portfolio will probably never earn the highest return in any single year, but it is also unlikely to deliver the worst return.

Focus on Investment-Grade Corporates

In bonds, we focus on investment-grade corporates. We currently favor an intermediate maturity and duration. Duration is a measure of the interest rate sensitivity of bonds. The longer the duration of a bond, the greater its interest rate sensitivity. With interest rates near record lows today, some investors are avoiding bonds altogether out of concern that rising interest rates will hurt the value of their bond portfolio. This is not a concern we share. Not all bonds are equal. Longer duration bonds would likely suffer large price declines if there were a significant increase in long-term interest rates. For the intermediate-term bonds we currently favor, the price fluctuations tend to be much more modest. In addition, we are also holding a higher than normal cash allocation, which helps lower the total duration of the “fixed income” assets in our clients’ portfolios.

A Bad Year in Bonds is Down 5%

In the almost 50-year history of the Bloomberg Intermediate Corporate Bond Index, there have only been four down years (assuming 2021 ends in negative territory). The worst year on record was 2008 when the index lost 4.82%. Importantly, that loss was not because the general level of interest rates rose (the bond bears’ concern today), but because of the risk of widespread defaults from the financial crisis.

Avoiding Speculation with Global Dividend Payers

For stocks, we favor a globally diversified portfolio of companies that pay dividends and intend to raise their dividends regularly. We favor established blue-chip-type holdings with durable businesses that have weathered a business cycle or two. Startups and companies with unproven track records are avoided.

When it comes to dividends, we seek to balance dividend yield and dividend growth. We don’t chase income in the highest-yielding stocks. More often than not, dividends of the highest-yielding companies are at the greatest risk of being cut. We want an above-average dividend yield today and the prospect of a higher dividend tomorrow.

The Opportunity in Energy

The energy sector is a dividend-rich sector and one of interest for us today. Energy shares are deeply out of favor with the institutional investing crowd. ESG investing has become a dominant strategy in the market. Apparently BlackRock, and many other institutional investors, see themselves as climate crusaders. Despite that they are supposed to be fiduciaries for their clients and not political activists, firms overseeing $130 trillion in assets have joined the Glasgow Financial Alliance for Net-Zero. Richard C. Young & Co., Ltd. is not a member.

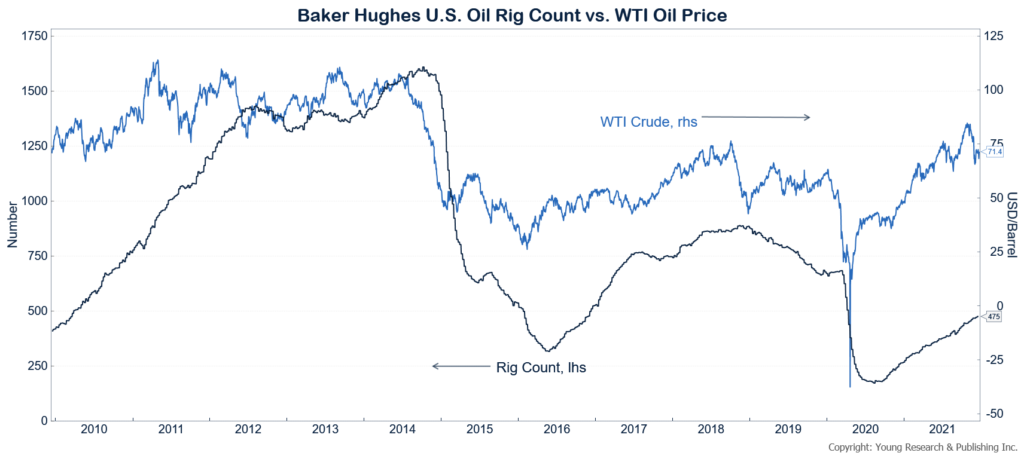

With institutional investors actively avoiding oil and gas companies for non-economic reasons and government policy seeking to incentivize alternatives, capital investment in the energy sector remains depressed despite elevated oil and gas prices. The chart below compares the Baker Hughes U.S. Oil Rig Count with the price of West Texas Intermediate crude oil. The rig count remains below pre-pandemic levels despite oil prices being meaningfully above pre-pandemic levels.

Without significant capital investment in the oil patch, production naturally declines as wells are depleted. Even if oil and gas firms ramped up capital investment tomorrow, it would take time for production to respond. As a result, the oil market is likely to remain tight well into next year. That bodes well for oil company stocks.

It is also important to point out that hostile government policy toward fossil fuel companies does not mean conventional energy stocks are bad investments. An old-hand value investor, Bill Smead recently said this in Barron’s: “I was 10 years old when the U.S. government banned tobacco ads on television. Guess what was the best-performing stock on the New York Stock Exchange over the next 40 years? Philip Morris [PM].”

Could Chevron or Phillips or another oil company become one of the top-performing stocks over the next 40 years? We wouldn’t rule it out.

CVS Making a Run

Patience is fundamental to achieving long-term investment success. The power of compound interest is not harnessed over weeks or months but over years and decades. Patience is also fundamental to investing in companies. Sometimes companies go through rough patches. As a shareholder, it can be frustrating to experience these periods, but a patient approach can be rewarded. From 2018 until the spring of 2021, CVS’s stock price made little improvement and even went through periods of loss. Of late, things seem to be improving.

In general, we seek to maintain a buy-and-hold mentality, but for various reasons, we are never hesitant to sell a position. With CVS, its struggling share price was not reason enough for us to sell. During this period, the company maintained its dividend and repaid a significant portion of the money it borrowed to acquire Aetna. Debt reduction, while not as appealing as additional dividend payments, ultimately benefits shareholders. How? Paying down debt reduces lenders’ claims on a company’s assets. A smaller slice of the pie for lenders means a bigger slice of the pie for shareholders.

CVS is a business we continue to like. With a pharmacy benefits manager and an insurance company serving 39 million consumers, CVS is obviously more than a retail pharmacy. CVS sees itself as a leading health solutions company. CVS plans to move deeper into primary care and home health-care. It plans to close 900 existing pharmacies over the next three years and will have three types of retail storefronts with two focused on delivering health-care services.

As part of this recently announced vision, CVS also said it would resume buybacks for the first time since 2017, and the board of directors has decided to increase its dividend by 10% next year. CVS shareholders are up handsomely YTD.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. After three consecutive double-digit years of gains in the stock market, investors would be wise to lower their expectations in 2022. David Solomon, chairman of Goldman Sachs, recently said, “I’m not a believer that double-digit equity returns compounding in perpetuity is something as an investor you should expect. I’ve been involved with a number of investment committees and charitable foundations, college boards, etc., and certainly, my mindset is the returns we’ve received over the last three to five years are different than what we should expect as we go forward.” We continue to favor stocks that are big, blue-chip-type companies that are dominant in their industry and generate cash.

P.P.S. For decades, meaningful inflation hasn’t been an issue for companies to navigate, but that hasn’t prevented Lowe’s and Home Depot from doing so successfully this year. A combination of less frequent purchases by consumers and a broad assortment of inventory has allowed Home Depot and Lowe’s to tactically tweak their prices to cover higher costs. A recent WSJ article explained it like this: “If the cost of stocking paint goes up quickly for Lowe’s, it can react by making paint, paintbrushes, and trays all a little bit more expensive, for example. That way, shoppers faceless sticker shock on individual items.”

P.P.P.S. CNBC recently ranked Richard C. Young & Co., Ltd. number five on their list of top 100 advisory firms that best help clients navigate their financial lives.

* Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Rankings are generally limited to participating advisors and should not be construed as a current or past endorsement of Richard C. Young & Co., Ltd. Barron’s is a trademark of Dow Jones & Company, Inc. All rights reserved. The information contained in this letter is for informational and educational purposes only. It is not intended, nor should it be considered investment advice or a recommendation of securities. Past performance is not a guarantee of future results. It is possible to lose money by investing. You should carefully consider your investment objectives and risk tolerance before investing. Please contact our office directly with any questions regarding items appearing in this letter.