The Decisions You Make Today

June 2022 Client Letter

My blood pressure readings were a little high at my annual physical in January. Not to the point where medication was required, but enough to schedule a June follow-up. My doctor suggested returning to a consistent exercise schedule. Between the end of 2021 and January of 2022, my exercise routine was disrupted due to travel and getting COVID. He felt getting back to my prior fitness habits would bring down my BP numbers.

Following doctors’ orders, I got back at it. Between my annual physical and the June follow-up, not a week went by where I did not exercise at least three days. Heading into the June appointment, I accumulated 57 consecutive daily workouts. While several of the workouts were wimpy, for the most part, I took things seriously. I now have newfound muscles, and when in race mode on the Peloton, I can finish in the top 5% of all riders.

My doctor is approximately 10 years older than me. He, like me, has a daughter and two sons. He is also one of the more physically fit people I know. For these reasons, I use him as my health and wellness benchmark. He also has given me one of my favorite pieces of health advice, telling me the decisions I make in my 50s will set the stage for life in my 60s.

This advice plays well in many areas of life. Decisions made today can set the stage for a successful future.

One important decision we make for clients is focusing on what we feel to be the “blue-chip” area of the stock market. Sectors including consumer staples, health care, and utilities can hold up relatively well when stock market volatility is high. We also tend to eschew the more faddish segments of the market. Over the past several years, there has been a lot of excitement in meme stocks and cryptocurrencies. But these types of investments tend to be speculative in nature versus what we would consider an investment. In our view, a healthy portfolio has limited exposure to speculation. Instead, it concentrates on companies dominant in their industries, with real cash-flow generation, and those that seek to raise their dividends annually.

Jamie Dimon Calling an Economic Hurricane

Jamie Dimon, chair and CEO of JPMorgan Chase, recently unleashed an economic forecast that caught people’s attention:

“You know, I said there’s storm clouds but I’m going to change it … it’s a hurricane,” Dimon said Wednesday at a financial conference in New York. “While conditions seem ‘fine’ at the moment, nobody knows if the hurricane is a minor one or Superstorm Sandy,” he added.

“You’d better brace yourself,” Dimon told the roomful of analysts and investors. “JPMorgan is bracing ourselves and we’re going to be very conservative with our balance sheet.”

Why Staying the Course Makes Sense

Typically, during problematic environments, staying the course is a prudent investment decision. Vanguard founder Jack Bogle did as much as anyone to help popularize the investing mindset of staying the course and not panicking during difficult times. In 1994, Bogle advised this in his book Bogle on Mutual Funds:

Think long-term. Do not let transitory changes in stock prices alter your investment program. There is a lot of noise in the daily volatility of the stock market, which too often is “a tale told by an idiot, full of sound and fury, signifying nothing.” Stocks may remain overvalued, or undervalued, for years. Patience and consistency are valuable assets for the intelligent investor. The best rule: stay the course.

It can be tempting to try to get out of the market ahead of an economic hurricane and get back in when markets have bottomed, but in practice, this is often a loser’s game. No one sounds a siren at the top of the market or rings a bell at the bottom telling you when to place your trades. Properly timing the market means selling when everyone else is convinced the party will never end and buying back in when the doomsday economic headlines are on the front page of the newspaper. And, even if you get things broadly right, you might still have been better off staying the course.

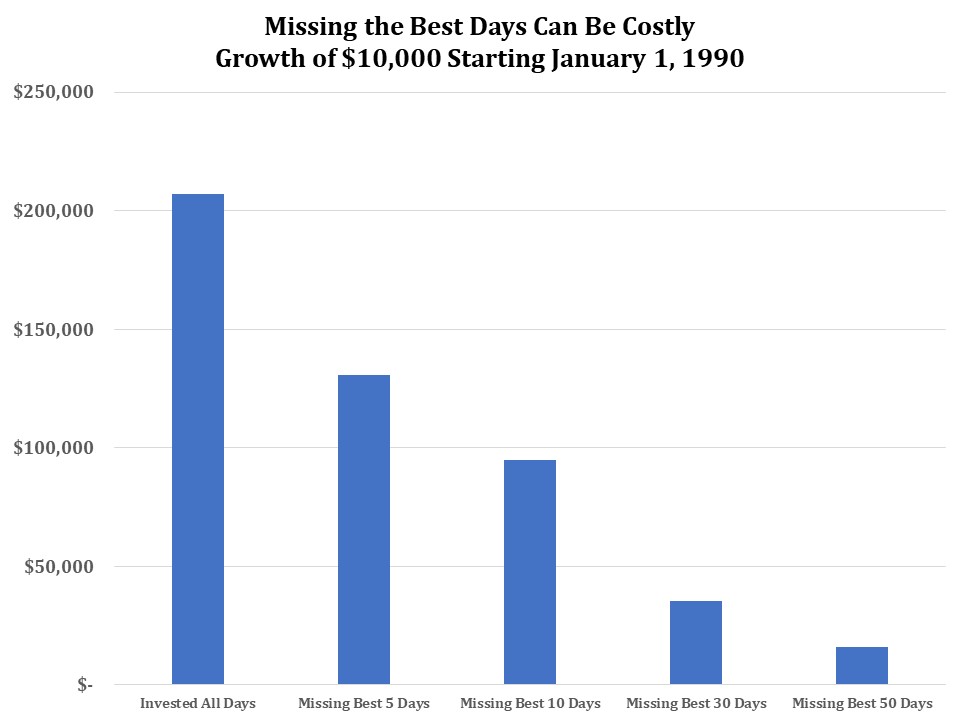

The chart below shows the risk of missing out on the market’s best days. Starting in January of 1990, if you invested $10,000 in the S&P 500 and kept it there, you’d have over $200,000 today. If you missed the 10 best days in the market, you’d have about half as much, and if you missed the best 50 days, your portfolio would be worth about a tenth of the value of the buy-and-hold investor’s portfolio.

Staying the Course Can Be Easier Said Than Done

If you have a portfolio full of more speculative securities, then the emotional hurdle of staying the course becomes harder. Chasing hot newer industries can have unpleasant consequences. I wrote about this in my December 2021 letter:

We believe Tesla is a largely speculative bet on a possible future that implies that something close to a winner-take-all situation will arise in the fiercely competitive auto industry. The company is worth more than the combined value of almost all legacy auto manufacturers. This is true despite the fact that Tesla is only projected to sell approximately 890,000 vehicles in 2021. In a normal year, the global market is a 90-million-unit industry. That’s about a 1% market share for Tesla, the world’s most valuable auto producer. We believe that the assumptions investors are making to justify Tesla’s nearly $1-trillion current market value are simply implausible.

New industries can generate overexcitement and unrealistic expectations. Money pours into the dream that the new player will dominate the market in the years ahead. Investors ignore the lack of profits and the high amount of cash that companies burn through to get their businesses established. Then, when things turn south, their stocks really take a beating and may not even survive. The Wall Street Journal recently summed up this risk for EV startups:

While the rising cost of capital is hitting speculative stocks in other sectors too, EV startups have more to lose than most. Launching a new car maker is extraordinarily expensive, and the costs come years before the profits. Bridging this gap is much easier if money is essentially free, as was the case with the influx of cash from special-purpose acquisition companies last year. Those days are fading fast.

A Balanced Approach

At Richard C. Young & Co., Ltd., we seek to avoid the speculative elements in the market by pursuing a balanced investing approach. A mix of bonds, dividend-paying stocks, and precious metals has most often helped limit risk in our clients’ portfolios while delivering an acceptable return. A well-diversified balanced portfolio will probably never earn the highest return in any single year, but it is also unlikely to deliver the worst return.

Avoiding Speculation with Global Dividend-Payers

For stocks, we favor a globally diversified portfolio of companies that pay dividends and intend to raise them regularly. We favor established blue-chip-type holdings with durable businesses that have weathered a business cycle or two. We avoid startups and companies with unproven track records.

When it comes to dividends, we seek to balance dividend yield and dividend growth. We don’t chase income in the highest-yielding stocks. More often than not, dividends of the highest-yielding companies are at the greatest risk of being cut. We want an above-average dividend yield today and the prospect of a higher dividend tomorrow.

During the current bear market, dividend-paying stocks are down; but they are down much less than the broader market. Higher-dividend payers have been among the best-performing stocks in the market this year. A greater weighting in energy and consumer staples shares has helped in the current environment.

While it’s nice for the stocks we buy to be in favor, it isn’t the core goal of our Retirement Compounders strategy. We take a very long-term perspective focused on limiting volatility and compounding growth. It is possible that RCs-type stocks could remain in favor for years, or they could fall out of favor in a matter of months. If we are buying companies that pay a decent dividend today and we have confidence the dividend will increase over time, we can remain patient while the power of compounding takes over. If the market’s opinion of your portfolio is concerning to you, just remember Bogle’s view on the market: “a tale told by an idiot, full of sound and fury, signifying nothing.”

Beware of the Headlines

Sometimes it’s best not to pay too much attention to the headlines of the day. There are many questionable headlines, blogs, and emails highlighting stories or trends that do not pan out.

For example, not even two years ago, Zoom, the video conferencing software company, was worth more than ExxonMobil. Negative oil futures prices, combined with a belief that oil and natural gas would become worthless, soured sentiment on Exxon shares, and the pandemic boom in video-conferencing software made Zoom’s rise seem unstoppable.

CNN helped fuel the soured sentiment on Exxon with an article explaining that the world would never recover its thirst for oil:

All this could mean that global demand never returns to its 2019 record high, a scary prospect for oil companies and their employees from Texas to Western Europe, and countries such as Russia, Nigeria, or Iraq that depend heavily on selling crude.

“I think the pressure to accelerate the forces driving the energy transition will only increase as a result of this crisis,” said Mark Lewis, global head of sustainability research at BNP Paribas Asset Management in Paris.

CNN’s reporting from that time seems ridiculous, as does the fact that one of the world’s largest producers of a resource vital to the health of the global economy would be worth less than a company that sells a product with big established competitors offering the same thing for free.

Recent developments and policies do not necessarily mark the beginning of a new trend or the end of a current industry. The establishment of hostile government policies toward fossil fuel companies does not mean conventional energy stocks are bad investments. As an old-hand value investor, Bill Smead said in Barron’s: “I was 10 years old when the U.S. government banned tobacco ads on television. Guess what was the best-performing stock on the New York Stock Exchange over the next 40 years? Philip Morris [PM].”

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. President Reagan said, “The nine most terrifying words in the English language are: I’m from the government, and I’m here to help.” Joe Biden is here to help with gasoline prices. As if policies preventing drilling in certain regions and making it more costly and difficult to produce oil and gas haven’t helped enough already. Now Biden is telling refining companies they need to produce more gas. Look for taxes and price controls next. Neither help. They simply limit future supply.

P.P.S. Writing for Behavioural Investment, Joe Wiggins observes: “During a bear market, it is hard to see anything ahead but unremitting negativity. Our tendency will be to believe that things will keep getting worse—prices will be lower again tomorrow. Our ability to make good, long-term decisions during a bear market is severely compromised. Rational thought will be overcome by the emotional strains we are likely to feel—what happens if things keep getting worse and I didn’t do anything about it?”

During volatile markets, patience is fundamental to achieving long-term investment success. The power of compound interest is not harnessed over weeks or months but over years and decades. Patience is also fundamental to investing in companies. Sometimes companies go through rough patches. As a shareholder, it can be frustrating to experience these periods, but a patient approach can be rewarded.

P.P.P.S. Heading into the last bond-market downturn, we had a meaningful allocation to full-faith-and-credit-pledge Treasury notes. When COVID started, and yields on corporate bonds soared, we sold our clients’ Treasury notes and purchased higher-yielding corporate bonds. Until recently, we have focused on corporate bonds; Treasury yields were simply too low.

Given how much rates have risen, we are again purchasing Treasury securities. Yields are relatively attractive, and with some concerns about a recession or Jamie Dimon’s economic hurricane, it seems prudent to us to reintroduce this asset class back into portfolios.

P.P.P.P.S. The Silver Lining in the bonds. The good news is that you have survived the worst bond market in a generation. The fixed-income portfolios we manage for clients are down less than the broader bond market after taking into account our intentional overweighting in cash and some shorter-maturity high-yield bonds and loans, but they are still down.

It is also important to keep in mind that, except in the event of default, bond prices will gravitate upward, back toward par value as they approach their maturity date. There is no such force acting on stocks. Excessive valuations or a new earnings growth trajectory can lead to what is effectively a permanent loss on individual stock positions. That is not to say that yields won’t continue to rise; but we anticipate the pace of increase to be slow, providing time for interest income to accumulate and lessen the blow of any further decline in prices.