The Great Comeback

May 2023 Client Letter

Several years ago, when my family was considering taking our first cruise, many of you encouraged me to set sail, promising I would not be disappointed. We started research on various cruise lines and destinations and were ready to make our deposit. Then COVID hit, closing the cruise industry for most of 2020 and half of 2021 and leading to disappointment for a lot of us.

In March we regrouped and made the short drive from Naples, FL, to Port Everglades in Fort Lauderdale and boarded Celebrity Beyond. For this trip we conducted zero research; we simply signed up for the exact cruise that friends of ours recently made.

Upon boarding the ship, I learned several things. The first was that the Beyond was a new ship with its official debut in April 2022. The second was that our cruise would be the first full-capacity voyage for the Beyond. This was terrific news to the ship’s crew after suffering through the pandemic pause. According to Cruise Lines International Association’s 2023 report, cruise tourism is expected to reach 106% of the 2019 level this year. The cruise industry continues to be one of the fastest-growing tourism sectors, jumping from 29.7 million in 2019 to a predicted 36 million by 2024 and 39.5 million by 2027. Norwegian Cruise Lines is calling it the “Great Cruise Comeback.”

Hoping for a Comeback in Bond Yields

After more than a decade of ultra-low interest rates, many investors have been hoping for a great comeback in bond yields. Bonds have long served as a counterbalance for conservative investors and those in or nearing retirement. Investors looking to maintain a prudent risk/reward strategy tend to appreciate the reduced volatility that has historically come from including a fixed income component in their portfolios. Bonds have historically provided ballast even when rates were low, but the ultra-low level of yields for the last decade has made bond investing more challenging.

Fortunately, the past year has seen a significant increase in short-term interest rates, including those earned on cash sitting in your money market. The yield on your Fidelity Treasury money market is over 4.5% today—the highest it has been since 2007. Treasury bills are also offering their highest yield in over 15 years. Three-month T-bills currently yield 5.15%.

For short-term maturities, the yield comeback has been in full swing. Unfortunately, intermediate and longer-term yields haven’t increased as much as short-term yields. Five and 10-year Treasuries yield 3.45% and 3.43%, respectively. Short-term Treasuries are influenced primarily by short-term interest rates, which are set by the Federal Reserve. Long-term rates are influenced more by inflation and economic growth.

A good back-of-the-envelope guide to a fair yield for long-term Treasuries is the rate of nominal economic growth. This century, nominal G.D.P. growth has averaged 4.4%. Over the last year, nominal G.D.P. has increased by 7%. By this metric, the 3.43% 10-year Treasury yield is still too low.

Of course, the stage of the business cycle, supply and demand factors, and many other issues can influence bond yields and their appeal at any given point in time. What factors might push longer-term interest rates higher? A resolution of issues we are seeing in the banking system, faster growth, inflation that turns out to be stickier than is currently anticipated, or perhaps a change in the market’s assessment of the additional yield needed to invest in longer-term Treasury bonds. Historically, long-term Treasuries offered additional yield as compensation for taking on the additional risk in long-term bonds. In recent years, that premium has disappeared.

In the meantime, we continue to hunt around for corporate bonds. For example, we recently purchased an A-rated, 5-year Medtronic bond. Medtronic is a leading medical devices company. Medtronic invented the first wearable pacemaker in 1957. Recently Medtronic received F.D.A. approval for its Micra AV2 and Micra VR2 pacemakers. The AV2 and VR2 are the world’s smallest pacemakers. With approximately 40% more battery life compared to previous generations, the AV2 and VR2 are expected to last an average of 16 and 17 years, respectively.

Re-investment Risk

With more attractive yields on short-term bonds, some investors are inclined to focus exclusively on these issues. While buying the shortest maturity bills and notes can be a sound strategy under certain circumstances, it is not without risk. The risk many investors focus on when purchasing Treasuries is duration risk, but re-investment risk may be just as important today. Re-investment risk is the risk that maturing short-term bills and notes will have to be re-invested at lower rates if interest rates decline. For example, if the Fed pivots and begins cutting rates, it is possible that short-term interest rates will drop below the level of today’s intermediate-term bond yields. Investors who purchased short-term T-bills would end up missing out on higher yields on longer-maturity issues.

The Treasury maturities we favor change with the level of interest rates, the shape of the yield curve, and our outlook for the business cycle. Today we are purchasing bonds that mature in approximately one year, two years, five years, and seven years. The shorter-term maturities offer higher yields, while the longer bonds provide some protection from re-investment risk should rates fall. Prior to the collapse of Silicon Valley Bank, we were targeting maturities out to 10 years. Rates fell quickly following the bank’s collapse, and we have shifted our maturities as a result.

A “set it and forget it” strategy doesn’t work for bonds. Our fixed-income strategy evolves with the credit cycle, the business cycle, the economic cycle, and the level of interest rates and credit spreads. A few months into the recovery from COVID we owned almost no Treasury securities and were investing in below-investment-grade high-yield bonds and floating-rate notes. Last year, we exited below-investment-grade fixed-income securities and boosted our allocation to Treasury securities, focusing on short maturities first and, more recently, extending maturities.

The changes we make to fixed-income portfolios aren’t designed to predict interest rates, economic growth, or the business cycle. We are simply aligning portfolios with what we believe are the most favorable risk/reward trade-offs prevailing in the market. In poker terms, we’re playing our best hand with the cards dealt. We aren’t trying to predict the next card to come out of the deck.

One Year Later, I Bonds Lose Some Appeal

A year ago, Series I savings bonds (I bonds) were receiving lots of attention. I bonds are U.S. savings bonds carrying a floating interest rate that rises and falls with the Consumer Price Index. The interest rate resets every May and November. Last May the rate hit a juicy 9.62%. That rate reset in November to a still-attractive 6.9%. Now the May reset has lowered the rate to 4.3%.

According to Bloomberg.com:

Because of the twice-yearly resets, the date investors purchase their I bonds can make a big difference to their returns. Bonds purchased before the end of April will provide six months of the prevailing rate of 6.89%. Then, six months from their purchase date, they’ll take on the 4.3% rate for the subsequent six months. But someone who waits now will take on the 4.3% rate for six months and then the still-unknown rate, to be set Nov. 1, for the following six months.

I bonds are not the worst purchase an investor could make, but they do come with some notable drawbacks. There is a maximum purchase amount of $10,000 annually using cash, and $15,000 if you use a portion of your tax refund. I bonds earn interest for 30 years unless you cash them in first. You can cash them in after one year; but if you cash them in before five years, you lose the previous three months of interest. I bonds also must be purchased directly from the Treasury website or via your tax return.

Does De-Dollarization Threaten My Financial Security?

I am frequently asked about the threats posed by de-dollarization. If you are not familiar, de-dollarization refers to foreign countries reducing their reliance on the U.S. dollar as a means of exchange and a store of value in international trade and financial transactions. This can be done by diversifying foreign currency reserves, promoting the use of other currencies in international trade, and establishing alternative payment systems that bypass the U.S. dollar.

The loss of reserve currency status is a perennial favorite topic of some in the financial press and in certain corners of the internet. The implications of a loss of reserve currency status sound frightening. Soaring borrowing costs, a plunging U.S. dollar, excessive inflation, a diminished role for the U.S. on the world stage, and turmoil in financial markets are cited as potential outcomes if the world were too de-dollarize.

When foreign governments take steps to reduce their reliance on the U.S. dollar, the predictions of doom sound like they may be coming true. China and Brazil recently agreed to settle trade in their own currencies. And Russia has been settling trade directly with China since the West cut it off from the SWIFT system in retaliation for invading Ukraine.

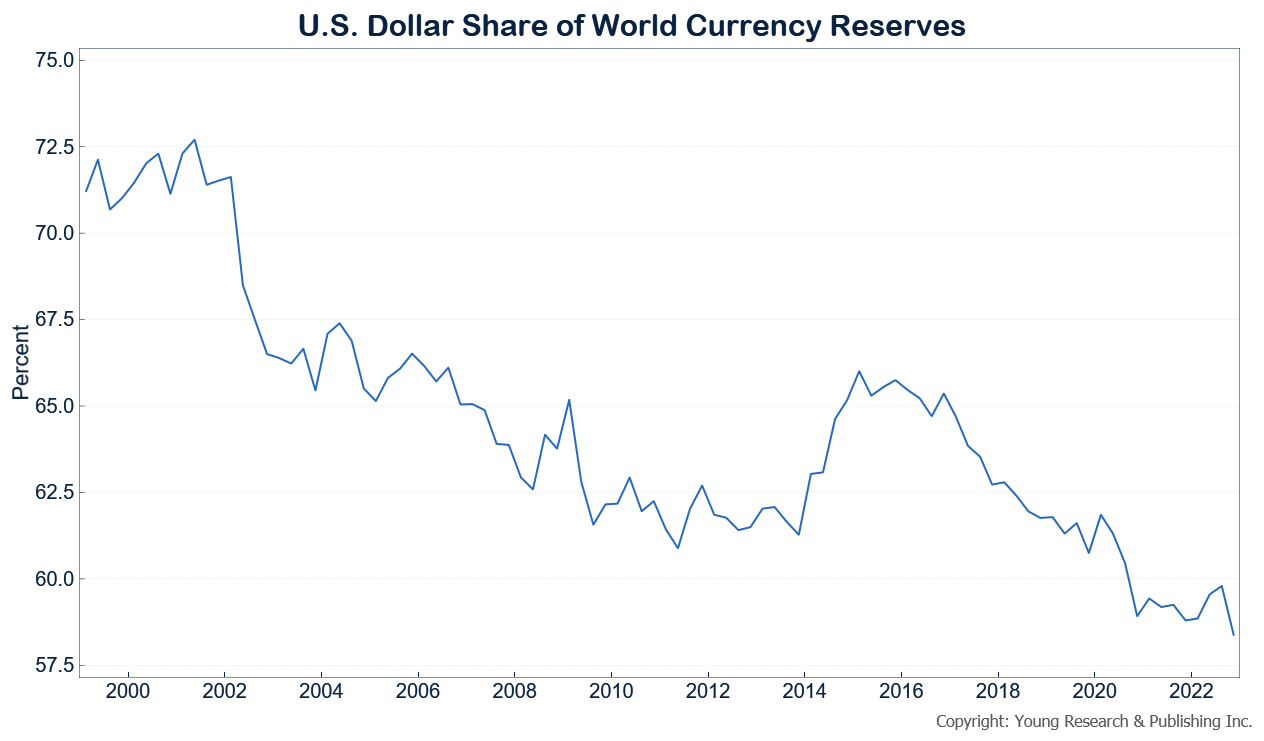

The U.S. weaponizing the dollar probably doesn’t make many countries sanguine about continuing to rely on our currency; nor does soaring federal debt and deficits, but the fact is the dollar’s looming demise is most likely exaggerated. For starters, the dollar is not the world’s reserve currency. It is a reserve currency. And the dollar’s share in the world currency reserve basket has been falling for over 20 years with almost no impact on the economy, interest rates, the U.S. dollar, or the USA’s geopolitical influence. The chart below shows that, in 1999, dollars were 72% of allocated currency reserves. Today that figure is 58%. The Chinese renminbi’s share of total world currency reserves is 2.7%.

Why don’t more foreign governments purchase yuan in their currency reserve basket? There are likely many reasons. Two that come to my mind are 1) China being a single-party system that may have some inherent stability risk, and 2) China’s capital account being closed. Funds can’t come and go at will from China like they can in the United States.

The U.S. dollar is the world’s primary reserve currency because the United States is the world’s largest economy; it has the deepest and most liquid capital markets; it has a freely floating exchange rate and an extremely competitive economy and commercial sector, a well-established rule of law, property rights, and a constitution that limits the potential for significant change at will by a small majority. If you are a smaller country reserve manager entrusted with preserving a rainy-day fund meant to stabilize your country’s currency in the event of economic turmoil, will you buy Chinese yuan, Brazilian real, Russian rubles, Indian rupee? Or will you buy the U.S. dollar?

Even if you don’t buy my reasoning on why the dollar will remain the primary reserve currency for years to come, walk through the implications of some of the more ominous outcomes cited by the dollar doomers. Take a hypothetical example of the dollar taking a steep dive because all foreign governments simultaneously decided to rush out of U.S. dollars. (Very unlikely, but still a useful thought exercise.) If the U.S. dollar fell by 35% tomorrow, what would that mean for the competitiveness of U.S. manufacturing? Would Airbus still be able to compete with Boeing? What about China’s low-frills EV sector with Tesla? Or Kubota with Deere? What do you think would happen to the demand for Miami Beach condos or brownstones in New York and Boston? The U.S. is still a manufacturing powerhouse and a country with desirable assets. If the U.S. could suddenly sell goods, services, and assets for 35% cheaper than our competitors, would that not drive up the demand for U.S. dollars and increase the dollar exchange rate?

Fighting Inflation

One of our long-favored investing sectors is consumer staples. Why do we like consumer staples companies? Staples stocks tend to have durable competitive advantages, many in the form of brand value built up by decades of major advertising campaigns. Companies that produce food and household products are also less impacted by the business cycle than are auto firms, for example. Strong brand value, along with the non-discretionary nature of the goods, and their low wallet share, gives many consumer-staples firms pricing power. In an inflationary environment, when the cost of producing and transporting goods is rising, having the ability to pass those costs onto consumers without destroying either volume or market share is valuable.

Procter & Gamble is one of our long-held consumer staples stocks. P&G’s pricing power was on display in its latest quarterly results. For the third quarter, Procter & Gamble reported better-than-expected sales and profits. Both were helped by a 10% increase in prices. P&G also upgraded its outlook for 2023, forecasting fiscal 2023 organic sales growth of 6%, up from its previous projection of a 4% to 5% increase.

Cash-Flow Machines

Procter & Gamble, as well as many of the consumer staples companies we own, generate significant amounts of free cash-flow. Free cash-flow is the cash left over after making capital investments to maintain and expand a business.

Companies that generate significant amounts of free cash-flow have the ability to pay healthy and increasing dividends, buy back shares, pay down debt, or make acquisitions.

Dividends are, of course, our favored use of a company’s free cash-flow. Dividends provide a degree of certainty in an uncertain market. Companies that pay reliable dividends provide cold, hard cash to shareholders regardless of the performance of the share price.

Dividend stocks also tend to hold up better in down markets than do non-dividend payers. For example, if a stock were yielding 4% today and the dividend was believed to be rock solid, there is a likely limit to how far investors would permit that stock to fall before buying it solely for the dividend yield.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. According to a recent WSJ article, apartments were the second-worst-performing real estate sector over the last year, falling 21%. Looking back at the red-hot real estate market in 2021, many investors believed that higher rents were baked into the cake for years to come. As such, a lot of money flowed into various residential REIT investments. Oftentimes when a sector has had a run-up, sentiment is positive, and the financial press is filled with headlines about the sector, it may be a warning flag to investors. Last year was a rough ride for residential REITs. The FTSE NAREIT Residential Property Index was down 31.3%. It’s prudent not to blindly lock onto the success of a stock or industry after it may have had a significant run-up.

P.P.S. Who knew? Apparently, award-winning musician Taylor Swift knows a thing or two about investment due diligence. According to The Telegraph, cryptocurrency trading platform FTX made a serious effort to secure Taylor’s endorsement. Among other questions, the singer asked, “Just tell me that these are not unregistered securities, right?” before she committed to anything.

As highlighted by The Telegraph,

Investing doesn’t need to be very complicated. A company makes products or provides services, charges money for it, and makes a profit. When it gets harder than that to understand, it is usually a swindle. Taylor Swift could see that and saved herself a lot of embarrassment by refusing to have anything to do with FTX. If a few more investment professionals could do that, the financial world would be a safer place.

P.P.P.S. A few helpful points of interest can be gleaned from a WSJ article titled “Why It’s Now Easier to Underestimate Your Expenses and Overspend.” “The power of compounding is a boon to investors, but not to shoppers. Money grows much faster than most people expect because interest is earned on interest,” said Michael Liersch, head of Wells Fargo & Co.’s advice and planning center. A similar concept applies to inflation: prices rise, and if inflation remains high, prices continue to grow on top of already-inflated prices, leaving people off guard. The article highlights how individuals may operate off an outdated budget, underestimate their future spending, and not factor in infrequent expenses. Individuals often ask me, “Matt, how much do I need to retire?” My response is, “How much do you spend in a year?” I stress the need to capture as many of your expenses as possible and review your annual expenses regularly. A trip to the nail salon or hair salon may not seem like a big deal, but they can add up, along with expenses like a housekeeper, new tires for the car, and certain major home repairs that occur every 10 years or so. You want to factor in frequent expenses like groceries and infrequent ones like the removal of tree branches from the front yard.