The Narrow Rally

June 2023 Client letter

The S&P 500 and Nasdaq 100 indices have rallied impressively to start the year. After they underperformed blue-chip dividend stocks (FTSE High Dividend Yield Index) last year by the most in at least two decades, both indices are outperforming by a similar amount YTD. Due to the arithmetic of portfolio losses and the necessity to make up for lost ground, despite similar return differences, the FTSE high dividend index is still ahead of both the S&P 500 and Nasdaq 100 from the prior bull-market high. The outperformance of dividend stocks in a bear market and their underperformance when the market rallies sharply are typical of the more conservative nature of higher dividend shares.

What is not typical is the magnitude of the divergence in performance during the recent bear and bull markets. What explains these large gaps? The S&P 500 has become unbalanced and top-heavy, in our opinion. Big Tech has long been a key mover of the Nasdaq 100, but the S&P 500 now seems to be moving to the beat of the same drum.

Apple and Microsoft alone account for over 14% of the index. So, while the S&P 500 may be up significantly YTD, a handful of tech shares plus Tesla—which trades as if it were a tech stock—accounts for most of the return.

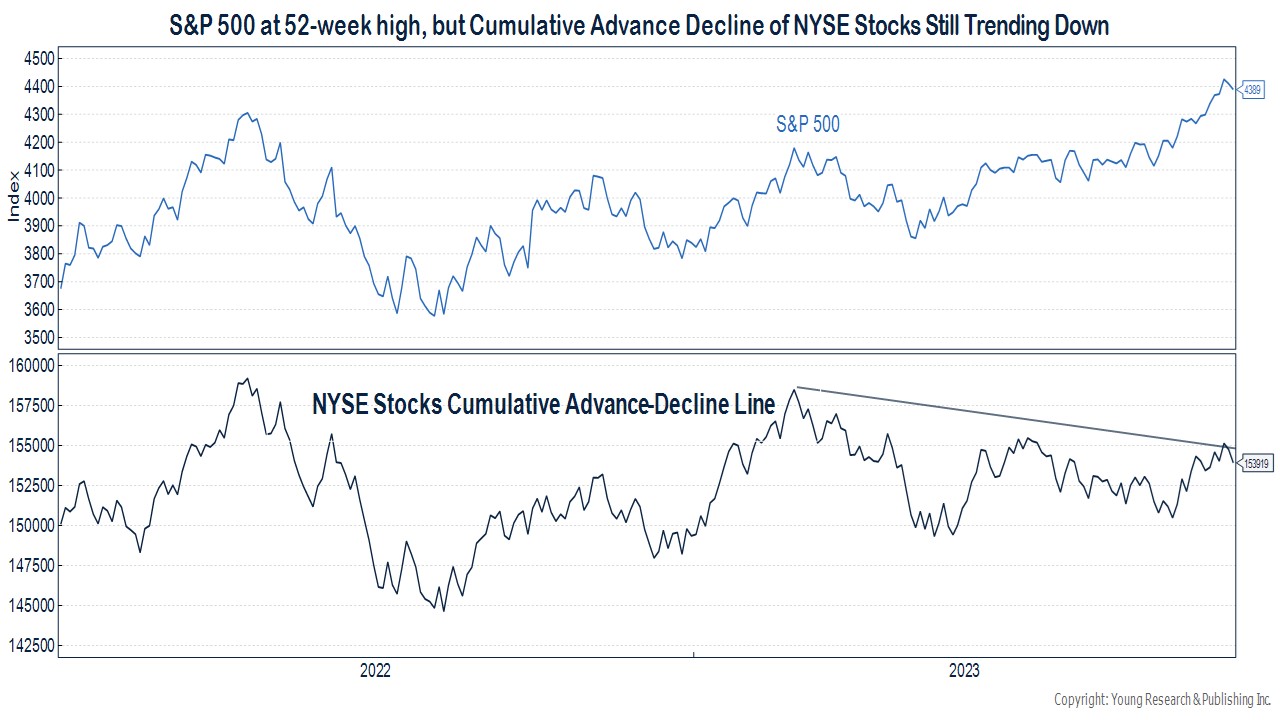

Technical analysts may explain this by telling you that the breadth of the market is weak. A healthy rally is one where many issues participate. One way to measure breadth is to plot the cumulative advance-decline line of NYSE stocks. The chart below shows the advance-decline line along with the S&P 500. The S&P has risen above prior highs in the chart, but the advance-decline line appears to be stuck in a downtrend. That could change quickly, and it has improved of late but not to the degree that signals the market is in a healthy uptrend.

What factors could derail the market? Risks we are monitoring include underwater securities on bank balance sheets, potential problems in commercial real estate and its impact on bank balance sheets, inflation remaining stickier than anticipated, and the Fed hiking farther than anticipated or leaving rates higher for longer than anticipated. Valuations, especially considering the more attractive fixed-income landscape, also remain a concern.

There are of course always risks. Bull markets are said to climb a wall of worry. Attempting to move entirely in or out of the market based on potential risks is a loser’s game. Market timing may sound like an appealing palliative to alleviate anxiety about market risks, but there are better strategies for managing risk. In “The Case Against Market Timing,” Bloomberg News recently highlighted some of the risks and failings of market timing.

But for investors with decades of investing ahead of them, sitting on the sidelines is a surefire way to sabotage long-term returns—even if cash looks more attractive than it’s been in years. Many money market funds yield 4% or more and Treasury bills yield around 5%.

Investors have been fleeing stock mutual funds for the relative safety of money funds since last year.

Equity mutual funds saw more money going out than coming in every month of 2022, peaking with a $94.7 billion outflow in December, according to the Investment Company Institute. For all of 2022, a net $472 billion left stock funds.

Assuming that money wasn’t reinvested, it missed out on the subsequent rally that’s seen the S&P 500 gain 8.6% and the Nasdaq 100 surge 21% this year through Monday’s close.

Trying to time the market involves two decisions—when to get out and when to get back in. Many investors who pull money from the stock market during turbulent times wind up sitting in cash for too long, debating when it’s safe to return, and miss the rebound as a result.

Many investors make the mistake of getting out of the market on its worst days, even though the best and worst days are often clustered together in times of volatility. The opportunity cost of missing those best days, compounded over time, is large.

A JPMorgan Asset Management analysis found that someone who invested $100,000 in a fund tracking the S&P 500 Index from Jan. 3, 2000 to March 31, 2023, had an annualized return of 6.5%. For those who missed the 10, 20 and 30 best days, the respective returns were a mere 3%, 0.7%—and a 1.2% loss.

Looking at results over an even longer period of 50 years, an analysis by Citi Global Wealth found that an investor’s returns would have been reduced by 9.5% each year if they missed the 100 best days.

Instead of trying to move in and out of the market to manage risk, we craft balanced portfolios and focus our equity investing on what we believe are higher-quality dividend-paying stocks.

Bonds Still Serve a Role for Many Investors

Bonds delivered disappointing results in the face of a falling stock market last year, but in our view this is no reason to be discouraged. While positive returns would have offset some of the weakness in stocks, the increase in yields is a welcome development for investors who have suffered through years of distortive 0% interest rate policy.

Medium-term U.S. Treasury bonds currently offer yields of 4%, with high-grade corporate bonds paying closer to 5.5%. High-quality corporate bonds have a high probability of making all scheduled interest and principal payments. According to S&P Global, the highest one-year default rate for A-rated bonds was .39%, and for BBB-rated bonds it was 1.02%. While the sharp increase in interest rates has resulted in unrealized losses showing on your statement, these losses will be temporary if you hold the bond to maturity and the issuer does not default. Getting paid a known and fixed value at maturity is a feature that does not exist with stocks.

We also anticipate that, should the stock market take another significant dip in response to a recession or other economic concerns, bonds would perform better than they did last year. With interest rates bordering on their highest levels in 15 years, there is meaningful room for yields to fall and bond prices to rise in a recessionary environment.

Use Quality to Manage Risk

On the stock side of portfolios, we look to manage risk by purchasing stocks that pay dividends and have a history of increasing those dividends. Over the last two decades, in down months for the S&P 500, non-dividend-paying stocks were down about 50% more than high-dividend-paying stocks. This isn’t always true. For example, during March 2020, high-dividend-payers were down slightly more than non-dividend-payers. However, on average, we believe high-dividend-payers will hold up better in down markets than non-dividend-payers.

When a recession or other market-related events cause investors to flee risk assets, it is shares of companies such as Procter & Gamble, one of the premier household products manufacturers, where stock investors often find comfort. P&G has paid a dividend through every bull and bear market, every recession and expansion, and every financial crisis since 1871. P&G has also increased its dividend every year for the last 69 years.

We don’t just buy defensive dividend-payers. We also include more cyclical businesses such as banks and industrials. These stocks do tend to be prone to more volatility, and their dividends are more likely to be cut (we have owned some in the past, including Intel) than companies like P&G in an economic downturn. But to craft a well-diversified portfolio, one should also include companies that perform well when the economy is booming.

One of the more cyclical stocks we like is Texas Instruments (TI). TI is known for its pioneering work in the field of analog chips. These vital components serve as the building blocks for countless electronic devices. TI’s analog chips play a crucial role in enabling functions like signal processing, power management, and data conversion in a wide range of products, including smartphones, industrial equipment, automotive systems, and more. While TI hasn’t enjoyed the same boom as chipmakers like NVIDIA from excitement over artificial intelligence, we believe it has higher barriers to entry and lower disruption risk than a company such as NVIDIA. Analog chips are often low-cost components that are designed into electronic devices. Manufacturers may be reluctant to switch suppliers to save what is often an insignificant amount of money. Texas Instruments’s shares yield 2.85% today, and the company has increased its dividend for 19 consecutive years.

More on De-Dollarization

Last month I wrote that de-dollarization was unlikely to threaten your financial security. Two recent Bloomberg articles on this topic provide additional insight into why the dollar is likely to remain the primary reserve currency for the foreseeable future.

While the U.S. move to weaponize the SWIFT payment system to punish Russia has been seen as a catalyst for a move away from the dollar, Bloomberg reports the share of payments via SWIFT in dollars has actually risen since last year:

Since Russia invaded Ukraine in February 2022, use of the dollar in global transactions has only grown, jumping to 42.7% from 38.9%, according to Swift, the member-owned cooperative that provides financial messaging services to more than 10,000 institutions and corporations in 210 countries. A decade ago, the dollar’s share was less than 35%. Clearly, the world sees benefit in transacting business in a currency where the rule of law takes precedence.

That rule of law is what draws capital from all around the world to the US in good times and bad. In the week before lawmakers agreed on raising the debt ceiling, the US Treasury Department auctioned $120 billion of two-, five- and seven-year notes. What’s remarkable is that even with all the breathless commentary about the US heading for a sure default, each of the sales attracted much higher-than-average demand from a group of buyers generally seen as a proxy for foreign investors. So-called indirect bidders took 68.2% of the $42 billion in two-year notes offered, the most for that maturity since 2009, according to data compiled by Bloomberg. For the $43 billion in five-year notes, they took 72.7%, the second-most on record, while it was an equally gaudy 72.3% for the $35 billion of seven-year notes offered.

Much of the talk concerning an alternative reserve currency seems to come from the so-called BRICS countries (Brazil, Russia, India, China, and South America).

The influence of the BRICS coalition could be substantial, given the group has 42% of the world’s population. But economically, it delivers just 23% of total global output and only 18% of trade…

The defining element for a reserve currency is where it is the second-most used currency for domestic transactions. The dollar is pretty much the most-utilized method of exchange across the world after each nation’s own currency —sometimes even surpassing domestic currencies. Almost every commodity, including oil and gold, trades in dollars. Even crypto-currencies are paired almost exclusively with the greenback….

A common currency is on the agenda. One Russian idea is to make it part-backed by gold—although moving gold bars around is no simple matter. Despite a mutual dislike of the extended reach of the US Treasury’s Office of Foreign Assets Control, the grouping’s fundamental differences are too wide for it to make headway.

The bottom line is that de-dollarization is unlikely to be a threat to your personal financial security over a time horizon that necessitates a change in investment strategy today.

Is Inflation Finally Cooling?

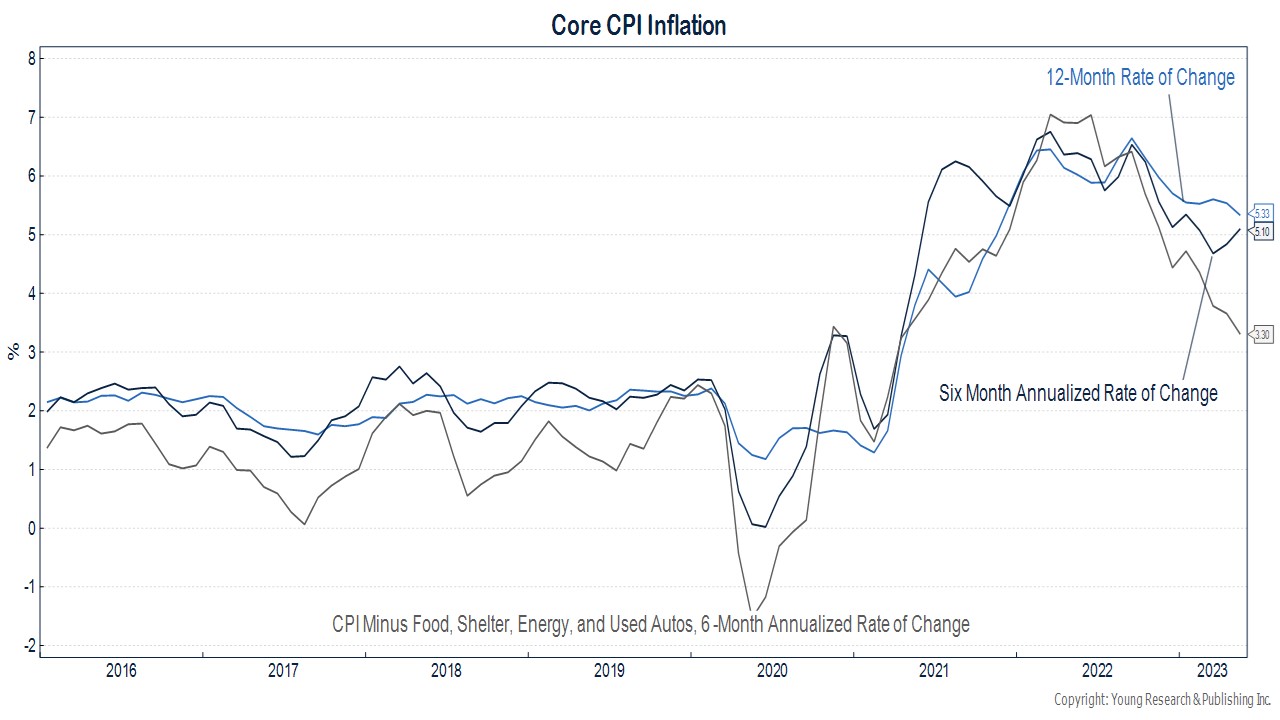

Recent inflation data has shown some encouraging signs. The year-to-year percentage changes for both the headline consumer price index and the core consumer price index are still far too high, but annualizing the rates of change in the seasonally adjusted inflation data looks more encouraging.

The chart below shows the annual percentage change in the core CPI, the 6-month annualized percentage change in the core CPI, and the 6-month annualized percentage change in the core CPI minus shelter and used autos.

Core CPI is still running at 5.3%, but it has fallen from a peak. On a six-month annualized basis, core inflation is running at 5.1%; but if you strip out shelter and used autos, the six-month annualized rate of change is now at 3.3%. Why take out shelter and used automobiles? Housing prices and rental prices have already started to fall, but their declines have a lagged impact on the CPI. Used autos also appear to be at unsustainable levels and have started to decline.

To be clear, it is still too early to call an end to elevated inflation, but a further cooling off in inflation data without a recession (which isn’t yet evident in the data) would be the best possible outcome.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. One positive headline for the economy that might be overlooked is the continuing return to pre-pandemic behavioral norms. According to Transportation Security Administration figures, more travelers passed through airports during Memorial Day weekend compared to the same holiday before the pandemic.

The Transportation Security Administration reported that around 9.78 million people moved through security checkpoints between Friday and Monday, compared with 9.74 million during the same period in 2019.

“This summer travel season could be one for the record books, especially at airports,” said Paula Twidale, senior vice president of AAA Travel, in a statement.

P.P.S. Careful with Venmo and Cash App. The New York Times recently reported that “Unlike deposits in savings and checking accounts at federally insured banks, funds stored in many ‘peer to peer’ apps aren’t automatically protected, potentially putting cash at risk if the app’s parent company stumbles financially, the Consumer Financial Protection Bureau warned in a consumer advisory this month.” Millions of Americans use these apps to send money to friends and buy goods and services. Annual transaction volume is approaching $1 trillion and is expected to exceed $1.6 trillion by 2027. If you or any of your family members have a high balance in your Venmo or Cash App accounts, it may not be a bad idea to consider moving those funds back to an FDIC-insured account.

P.P.P.S. As noted in the WSJ, an important housekeeping item is making sure you have a will. Believe it or not, “…54% of Americans told Gallup they didn’t have a will in 2021. Even the wealthy put off estate planning—one in five Americans with investible assets of $1 million or more don’t have a will, according to a recent Charles Schwab survey.”

“If you die without a will, a range of state laws dictate who gets your assets, and your loved ones may get nothing. They might get kicked out of the family house and could face hefty surprise tax bills.”