The Primary Reason to Save and Invest

September 2020 Client Letter

As you plan for your retirement, or if you are already retired, what is your primary financial consideration? For many of you, the primary reason to save and invest is to provide income during retirement. From what clients have told me over the years, planning for retirement and actually being retired require two different mindsets. For some, entering retirement is an adjustment that feels a little strange. For decades, individuals save and invest diligently, building their investment portfolio. Then retirement hits and, instead of saving, the drawdown phase begins.

We’ve always favored dividend-paying stocks because dividends are the fuel for compound interest. But, aside from the compounding benefit, dividends also offer the comfort of providing a relatively dependable and predictable stream of income, which can be a real boost during retirement years.

Income Seekers Face Uphill Battle

Today, crafting a portfolio with an income stream is not easy. Investors seeking income face an uphill battle. Investing in certificates of deposit (CDs) and Treasury securities to generate safe and secure retirement income is no longer an option. Intermediate-term Treasury notes yield just 0.27%. On a $1,000,000 portfolio, that is a whopping $225 per month in income. My electricity bill is more than that.

To make matters worse, if the Federal Reserve has its way, Treasury yields won’t rise meaningfully for years. The Fed recently announced that it is doubling down on its strategy of neglecting retired investors and savers to raise inflation. They didn’t use those words exactly. Jay Powell, the Fed Chair, couched the bad news in Fed-speak. He said that instead of targeting a 2% inflation rate as the Fed has done in the past, it will now target an average inflation rate of 2%. Moving forward, the Fed will allow inflation to run above 2% to make up for periods when inflation is below 2%.

What does the Fed’s new inflation strategy mean for you? To achieve this new goal, the Fed will leave interest rates lower than it otherwise would for even longer than it otherwise would. Whether or not this new strategy will work remains questionable. Part of the Fed’s problem is that it takes a narrow view of inflation, and its preferred inflation gauge uses non-market prices for about 30% of the index.

One example of the distortions created by the Fed’s use of non-market prices is in the price of housing. The Fed’s preferred inflation gauge uses an imputed (read: made-up) price for housing. Since year-end 2009, the price of housing using the Fed’s measure is up by 2.6% annually. Over the same period, the actual cost of housing, as measured by the Case-Shiller Housing Index, has risen by 4.1% annually. If the Fed properly measured the cost of housing, inflation would have been 0.30% higher than reported, and much closer to the Fed’s 2% target.

Cost of Retirement Income Never So Expensive

While the Fed complains about below-target inflation, it leaves out the cost of retirement income, which is arguably one of the most important prices in the economy. Unfortunately, investors saving for retirement or those in retirement don’t have that luxury. Thanks to the Fed’s zero-interest-rate-for-longer policy, the cost of retirement income has never been so high. David Rosenberg of Rosenberg Research in Toronto puts it this way:

As the boomers head into retirement age, what do they need? Income. What has this Fed strategy done? It has stripped the markets of income and forced investors into growth stocks. Those are long duration stocks. Retirees don’t need duration. They need cash flow.

Jim Grant, editor of Grant’s Interest Rate Observer, gives some thought to the particular sort of inflation experienced by the near-retiree:

I wonder if our monetary masters realise that they have created a rip-roaring inflation in the cost of retirement. The lower the interest rate, the greater the principal required. At a 5 per cent yield, a $1m nest egg delivered $50,000 a year. You need a fivefold larger egg to produce that at 1 per cent.

Generating retirement income from lower-risk assets will not be easy in the near term. Investors will likely need to be selective, tactical, and patient. Taking on more maturity and credit risk is also on the table because the Federal Reserve has left investors with no good options.

I don’t intend to sound too down on the yield environment, though. If you think in cycles, the upshot of today’s depressing yields is that we are coming off of an 8- to 12-month period of very strong performance for bonds. Better days and better opportunities will come in the bond market.

Boosting Dividend Income

To boost overall portfolio income, we have been working to upgrade the yield on our common stock portfolios. This is obviously a moving target as higher prices beget lower yields, but we are making progress. Some of the recent trades we have made to help boost portfolio yield include the sales of Texas Roadhouse and Cracker Barrel, which both suspended dividends due to COVID-19. We like both companies; but with the share prices having recovered substantially from the depths of the COVID-19 crash and no guidance on when dividends may resume, we moved out of both names and into higher-yielding alternatives.

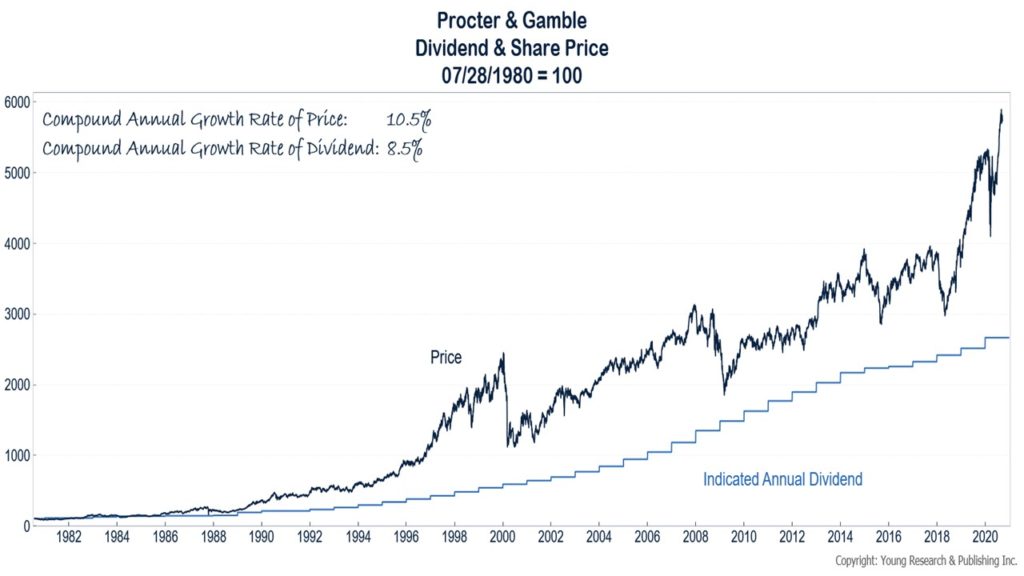

We continue to favor common stocks that pay healthy dividends and have a record of making regular annual dividend increases. The chart below on Procter & Gamble stock illustrates the benefits of a dividend-focused investment strategy.

The chart shows the price of Procter & Gamble stock and the indicated annual dividend rate. Both series start in July of 1980 and are set equal to 100 on that date. Over the last 40 years, Procter & Gamble’s share price has compounded at a 10.5% annual rate, and the dividend has compounded at an 8.5% annual rate. As goes the dividend, so goes the stock price.

When you concentrate on dividend growth and stability, you don’t have to think about capital appreciation. Capital appreciation will take care of itself as long as the dividend is growing. Consider what would happen if P&G’s share price didn’t keep pace with its dividend. In July of 1980, P&G paid a dividend of about $0.12 per share. The split-adjusted price of the stock was $2.38. Today, P&G’s dividend is about $3.16 per share. If P&G was still trading at the $2.38 it traded at in July of 1980, the stock would yield over 132%. You probably have a better chance of getting struck by lightning than seeing a big blue-chip stock with strong dividend coverage, offering a yield of 132%.

Addressing the Decline in the U.S. Dollar

We view the scale of the monetary and fiscal stimulus recently undertaken, as well as the size of U.S. debt and deficits, as bearish signals for the U.S. dollar.

Some strategies being recommended to investors to diversify away from the U.S. dollar include investing in diversified international equity exchanged-traded funds (ETFs), currency ETFs, and hard assets.

What is our take on each of these strategies? As you know, we have long crafted globally diversified portfolios of individual common stocks. We favor an individual-security strategy over a strategy that uses broad-based ETFs, as it allows us to take a more focused and targeted approach. For example, we recently increased our allocation to international stocks by purchasing a basket of Swiss companies whose businesses are focused in Switzerland and Europe.

Swiss Franc Fundamentally Sound

What is it we like about Swiss stocks and the Swiss franc? The Swiss franc has long been viewed as one of the most fundamentally sound currencies in the world. The five-decade trend in the Swiss franc vs. the U.S. dollar is one of appreciation. Underpinning the franc’s strength is Switzerland’s low and stable inflation. I mean real low. So far this century, Swiss consumer price-inflation has averaged less than 0.50%. Contrast that with the U.S., where inflation that far outpaces Swiss inflation still isn’t high enough for U.S. policymakers.

Are Currency ETFs a Good Way to Diversify Internationally?

Currency ETFs are another way to diversify away from the U.S. dollar. We have owned foreign-currency ETFs in the past, but we don’t own any today. When we do invest in currency ETFs, we favor the currency-specific ETFs rather than the index or basket approach that seems more commonly promoted. When the yield environment allows for it, we also tend to favor foreign-currency-denominated government bonds over currency ETFs. You save on the expense ratio and, in many cases, own an asset free of default risk. With negative government bond-yields in many countries today, we haven’t been active in this market.

Our favorite currency is, of course, gold. We have a meaningful allocation to gold and silver for clients, and we added to those positions earlier in the year. With both metals up significantly YTD, a period of consolidation should be anticipated, but we continue to favor both for diversification.

Never Underestimate the Importance of Patience in Investing

The importance of patience to your long-term investment success cannot be overstated. Certain segments of today’s stock market are reminiscent of the dotcom bubble. Some glamour stocks have been rising 4% or 5% each day with no meaningful rhyme or reason. The fear of missing out may be pushing some stocks to unsustainable levels. The temptation to participate is surely there, but this is a dangerous and speculative game.

Take Tesla, for example: Tesla shares gained 74% in August to become one of the largest companies in the U.S. The sky was the limit… until it wasn’t. Investors who bought Tesla on August 31 lost 34% over the following five trading days. A 33% loss wipes out a prior 50% gain, and a 50% loss wipes out a prior 100% gain.

In the short run, sentiment matters much more than fundamentals. In the long run, fundamentals win out. Stocks can slowly climb higher over a period of months or years and then crash suddenly, wiping out much of the gain.

The same can happen in reverse. UPS is a stock we have invested in for years. Over the last five years, UPS shares have lagged the market.

Wall Street wasn’t happy that UPS was investing so much into its business to meet rising demand. Rising demand always seemed like a good problem to have, in our view. And we were happy to collect the 3% yield that was rising at a 5.7% annual rate while UPS invested more in its business. A 3% yield with an almost 6% dividend growth rate gets you close to a 9% total return.

What’s wrong with that?

Nothing, it turns out. Starting in May, UPS shares caught fire. Sentiment has shifted on UPS. Rising e-commerce demand because of COVID-19 was the catalyst. UPS shares are up more than 70% since mid-May. UPS investors are now ahead of the industrials sector and the S&P 500 since year-end 2015.

Impatient investors likely missed the boat here.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Of the top seven stocks in the S&P 500 accounting for 26% of the index, not a single stock trades at less than 33X earnings. Only three of the seven pay a dividend, and the average yield of the dividend-payers is 0.77%. For long-term investors, the S&P 500 should no longer be considered a useful benchmark to follow. On the other hand, if you are a trader or speculator, the S&P 500 may now be right up your alley.

P.P.S. There is nothing wrong with people who want to speculate in the equity markets. Speculation has always been part of the financial landscape, and it always will be. The problem occurs when speculation is confused with investment. Speculating with your serious money is never wise. That is true even though some speculators make money some of the time—just as some gamblers make money some of the time. But, as we all know, the longer you sit at the roulette table, the greater are your chances of leaving it a loser. The same is true of stock market speculation.

P.P.P.S. Reporting on why the stock market is on shaky ground, Barron’s Ben Levishohn wrote on September 5:

Either way, a reckoning is coming. The Nasdaq has gotten too far ahead of itself for it to end any other way, despite protestations that the rise has been well deserved. Low interest rates make expensive stocks look cheap, and business models look unstoppable, and the looming threat of a coronavirus second wave makes tech stocks look all the more attractive.

“We believe this is the final and more-speculative stage of our summertime melt-up scenario,” says Chris Harvey, U.S. equity strategist at Wells Fargo Securities. “Experience suggests that at the tail-end of a melt-up funny things happen.”

P.P.P.P.S. Charles Ellis, investment consultant, former chair of the board of the Institute of Chartered Financial Analysts, and former director of The Vanguard Group wrote the book Winning the Loser’s Game: Timeless Strategies for Successful Investing. Ellis writes how the real challenge in portfolio management is how to manage risk.

Even though most investors see their work as active, assertive, and on the offensive, the reality is and should be that stock and bond investing alike are primarily a defensive process. The great secret of success in long-term investing is to avoid serious losses. The saddest chapters in the long history of investing are tales about investors who suffered serious losses they brought on themselves by trying too hard or by succumbing to greed.