The Royal Road to Riches: Blue-Chip Dividend-Paying Stocks

October 2019 Client Letter

Several years ago, the Wall Street Journal reported the investment success of Vermont resident Ronald Read. The story recounted how Read accumulated an estate valued at almost $8 million. Mr. Read, who passed away at age 92, made a modest living pumping gas for many years at a Gulf gas station in Brattleboro.

How a Vermont Gas Station Attendant Turned a

Blue-Collar Job into Millions

How did Read manage to become a multi-millionaire? He invested in dividend-paying blue-chip stocks. As Anna Prior wrote in the WSJ, Mr. Read received the actual stock certificates and “left behind a five-inch-thick stack of stock certificates in a safe-deposit box.” At his passing, Mr. Read owned over 90 stocks and had held his positions often for decades. The companies he owned paid longtime dividends. And when his dividend checks came in the mail, Read reinvested in additional shares. Apparently, he was a master of the theory of compound interest. Not surprisingly, his list of stock holdings included such seasoned dividend-payers as Johnson & Johnson (dividend since 1944) Procter & Gamble (dividend since 1891), J.M. Smucker (dividend since 1949 ), and CVS Health (dividend since 1916 )—all names we follow and own for clients. No highfliers for Ronald Read, and certainly no speculative, unseasoned technology names.

At Richard C. Young & Co., Ltd., our investment strategy is also focused on seasoned blue-chip dividend-paying firms with a record of increasing dividends regularly. We further favor companies with durable competitive advantages that operate in industries with high barriers to entry.

Risk Should Always Come Before Return

Like most investment managers, our goal is to make money for our clients; but, unlike some, we are focused first on risk and then on return. Returns are important, but the strategy used to achieve those returns and especially the amount of risk taken to earn those returns is critical.

Getting Lucky With Netflix

Take Netflix by example. Over recent years, some investors have earned exceptional returns by “investing” in companies like Netflix. Over the last decade, Netflix shares have compounded at almost 45%. Any investor who bought and held shares of Netflix for the last decade (easier said than done) has likely done well. But how much risk was taken to earn those returns?

In 2009 Netflix was just getting into streaming, and it still had a big DVD-by-mail business. Netflix generated no original content to speak of and was up against formidable competitors such as Comcast in distribution and Disney and HBO in content creation. If streaming was Netflix’s future, a prudent investor might have reasoned the company would have a tough row to hoe.

Netflix circa 2009 was essentially a nice-looking user interface and some licensing agreements. What’s more, even if Netflix was successful, it would be faced with a wholesale transfer-pricing problem. What is a wholesale transfer-pricing problem? In the case of Netflix, the problem has to do with licensed content. Content creators hold all the cards. As soon as Netflix started to earn profits, content creators could take substantially all of those profits by increasing the price to license content.

Of course, as we know now, things turned out much better for Netflix than they could have. The problem is that there is no reliable or repeatable strategy for identifying the source of Netflix’s success. Gross incompetence from cable providers and an extremely slow move into streaming from content creators were perhaps more responsible for Netflix’s success than the company’s own strategy and execution.

Disney Will Make Life Tough for Netflix

And not for nothing, but many of the issues Netflix faced in 2009 still lurk as major risks for the company today. Content providers are pulling their top shows off Netflix, and Disney, HBO, Apple, and Comcast all have competing streaming services that start rolling out next month. The Disney+ service launches November 12 for $6.99 per month and will be free for a year to many Verizon customers. Free will be hard for Netflix to compete against.

Betting that a company with almost no competitive advantage will succeed because of poor strategic decisions on the part of competitors probably isn’t a prudent strategy.

Our Focused Strategy For You

At Richard C. Young & Co., Ltd., we favor the tried and true. Our focus on seasoned dividend-paying companies provides a more reliable and repeatable stream of investment returns than trying to pick the next Netflix. We want to buy firms with competitive advantages, and we want those firms to pay a stream of cash to shareholders.

It’s not a complicated formula. It is unlikely to yield results anywhere near the results Netflix shareholders earned over the last decade, but it is a higher-confidence approach than trying to pick out the one or two needles that may be in the haystack.

Young’s Retirement Compounders© Program

For our equity purchases in the Retirement Compounders© (RCs) program, we focus on individual stocks. The RCs is our globally diversified portfolio of dividend- and income-paying securities. Our goal with the RCs is to buy dividend stocks with safe and growing payouts. We take a portfolio approach to achieving this objective. Some of the stocks in the RCs have modest yields but strong dividend-growth prospects, while others have high yields but modest growth prospects.

Microsoft and Verizon

Microsoft shares offer a yield of only 1.50% today; but over the last five years, the dividend has compounded at 10.4%. Microsoft’s dividend payout also appears safe. Over the last year, MSFT generated over $38 billion in free cash-flow compared to dividends of $13.8 billion. Even if Microsoft’s free cash-flow remained flat, the company could increase its dividend at a 10% annual rate for another decade and still have excess cash-flow.

Verizon is a firm that falls into the high-yield and modest-growth category. Its shares yield 4%, and we expect the dividend to increase at about 2% per year in the medium term.

For several years now, we have favored a portfolio of individual stocks as opposed to funds.

What Has Gone Wrong with the Mutual Fund and ETF Industry?

For starters, some of our favored mutual funds have gotten so big that their investment universe has shrunken significantly. The Dodge & Cox Stock fund is a mutual fund we used to buy for clients that falls into this category. Today, Dodge & Cox Stock is a lumbering $70-billion behemoth. If Dodge & Cox wants to take a 2% position in a stock, it has to deploy $1.4 billion. A 4% position requires a $2.8-billion investment. If D&C fund managers want to stay under the 5% ownership threshold that requires additional regulatory filings, the fund can only choose from about 120 stocks.

Limited Customizations

Crafting fund portfolios also limits customization for clients. We have clients who don’t want to hold a specific security because they have a legacy holding outside of our management, or they want to avoid tobacco stocks, for example. It is easier to accommodate requests like these with an individual security approach than with funds and ETFs.

Tax Efficiency of Individual Stocks vs. Mutual Funds

Tax efficiency is another significant advantage of investing in individual stocks instead of mutual funds. The tax-loss harvesting opportunities with a portfolio of 40 to 50 stocks are greater than they are in a portfolio of five or six mutual funds. And mutual fund investors must pay taxes on distributed capital gains annually and again at the time of sale. The former is true even if your mutual fund is held at a loss by the investor.

Your Fellow Shareholders Are a Problem

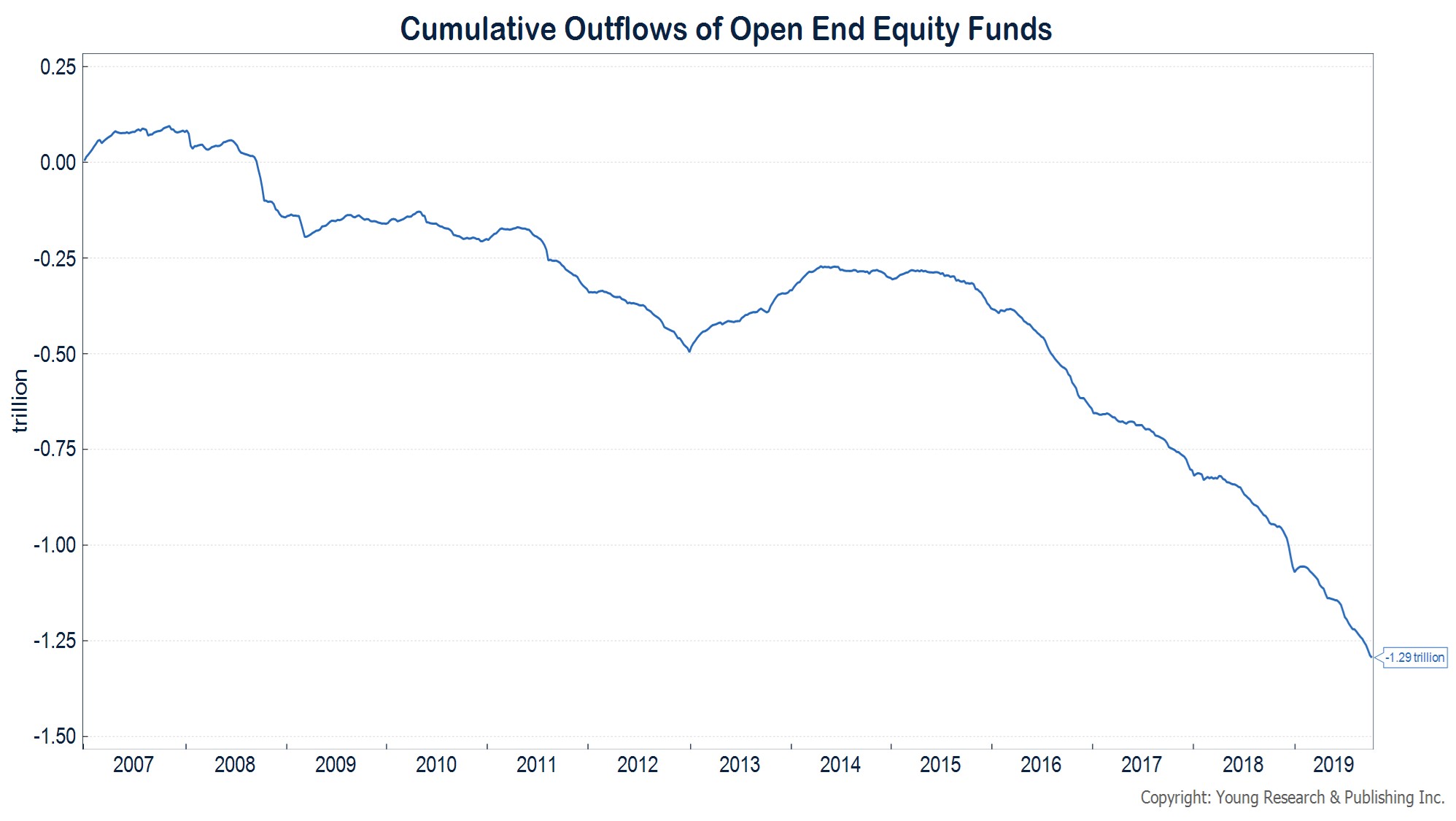

The performance of mutual funds and the tax liabilities that mutual funds generate are also dependent (to an extent) on other shareholders in the fund. Outflows can be a problem for shareholders who don’t redeem, and the mutual fund industry has been plagued by regular outflows for more than a decade now. The chart below shows the cumulative outflows from equity mutual funds since year-end 2006. Equity funds have lost $1.3 trillion in assets, with an acceleration of those outflows starting in 2015.

To meet redemptions, fund managers may be forced to sell high-conviction ideas or positions with large unrealized gains. Neither option bodes well for shareholders who decide to stick around. These problems can be magnified during sharp market corrections when other shareholders in a fund may panic and redeem shares.

Why Pay Twice for Financial Advice?

One of the other big benefits of an individual security approach is cost. Mutual funds can be expensive, adding an unnecessary second level of fees. An advisory firm charging a 1% management fee, and investing in a portfolio of mutual funds with an average expense ratio of 1%, costs the end investor 2% per year.

The Overdiversification Problem With

Advisor-Managed Mutual Fund Portfolios

Investing in a portfolio of mutual funds can also lead to overdiversification. Owning three large-cap mutual funds, for example, may result in owning every stock in the large-cap universe. Building a portfolio stock by stock allows an investor to buy big enough positions of his best ideas to make a difference without taking on too much concentration risk.

Risk of Concentrated Positions

Most investors with some experience in markets have likely heard that diversification is “the only free lunch in investing.” Despite what is a universally accepted tenet of investing, some choose to believe they are more like Jeff Bezos or Warren Buffett than a passive investor. Yes, it is true that some of the wealthiest people in the world became rich by owning one stock, but many more lost a fortune by staying too concentrated.

The risks of a concentrated portfolio are many and varied. There is industry risk, which we have seen with the energy sector in recent years. There is management risk, with which GE shareholders should be familiar. There is company-specific risk, of which GoPro, BlackBerry, and Eastman Kodak are examples. And then there is the risk of outright fraud, which can take down even large firms such as Enron and Worldcom.

At Richard C. Young & Co., Ltd., we diversify portfolios across sectors and industries as well as individual firms. By example, we are currently purchasing eight stocks in the healthcare sector. Most are drug companies. Why don’t we just try to buy the top stock in pharma? The pharmaceutical industry has certain low-probability, high-impact risks that can result in big losses if realized. Spreading assets across different stocks reduces the risk that one of these unpredictable events will have an outsize impact on the overall portfolio.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. It can be easy to dismiss stock-market risk during periods of a rising market. 2019 has been a solid year for stocks. Today’s bull market is in its 11th year, which puts the financial crisis further in the rear-view mirror. But market risk still exists and requires thoughtful consideration. If you have a risk-seeking personality and tend not to become concerned during bouts of volatility, you may not seek to craft a portfolio that limits losses during bear markets. But, if market panics and volatility are a bother, ensuring your portfolio is tailored to your risk profile may be the most important investment decision you make. Remember, during the 2007–2009 bear market, the S&P 500 Index lost 55%. When your portfolio loses 50% you need to make over 100% to just get back to even. If you lost 55% during the financial crisis, that required a 122% gain to get you out of the red. Meanwhile, during that 2007–2009 period many bond-holdings were up 6%; and GLD, which is considered a counter-balancer, was up 20%.

P.P.S. If you drive through Tate, Mississippi, today and fill up your car’s gas tank, you’ll pay about $2.059/gallon. Meanwhile, if you fill your vehicle nearly anywhere in California, you’ll pay over $4. Why the disparity? The Wall Street Journal offers some indication of the cause, writing: “California gas prices have been increasing relative to the other 49 states for years. The disparity especially widened in 2013 when the state’s cap-and-trade program took effect and in 2018 after Democrats raised the state gas tax. Last year California’s gas prices tracked about 77 cents higher than the U.S. average.” If you are living on a fixed income, these sorts of cost-of-living increases can erode your disposable income and reduce your standard of living. Other areas that retirees must consider are property taxes, utility costs, taxes on retirement income, and sales taxes. These are all quiet reducers of disposable income that must be taken into consideration.

P.P.P.S. Have you met your 2019 required minimum distribution (RMD)? Do you plan on making a charitable donation from your IRA in 2019? To help us facilitate the processing of your RMD by year-end, we recommend you submit a completed distribution form before December 1. If you haven’t satisfied your RMD and don’t have a distribution plan in place, please contact our office as soon as possible. Submitting your request early will allow us to address any problems before year-end. If you fail to take your RMD by the December 31 deadline, a 50% penalty may be assessed on the amount you are required to take.

P.P.P.P.S. Each year, Barron’s ranks the nation’s top independent advisors. Richard C. Young & Co., Ltd. has been recognized on this list for eight consecutive years.*

* Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Rankings are generally limited to participating advisors and should not be construed as a current or past endorsement of Richard C. Young & Co., Ltd. Barron’s is a trademark of Dow Jones & Company, Inc. All rights reserved.