The Snap-Back Rally

July 2016 Client Letter

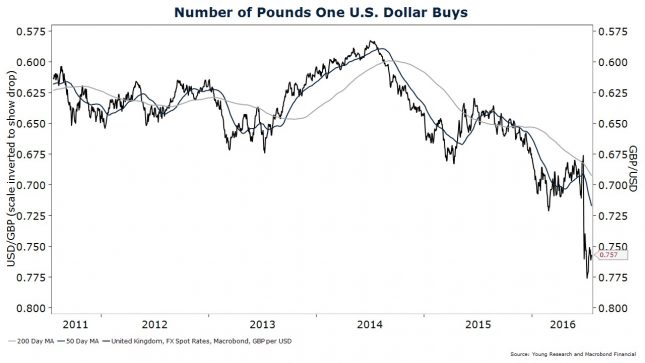

In a surprise vote on June 23, the British decided by a 52% to 48% margin to leave the European Union (EU). The vote caught many investors and pundits off-guard. Financial markets cratered on the news, with U.K. stocks falling 16%, euro-area shares dropping 13%, and stocks in the U.S. slipping 5.3%. The British pound fell over 13%, and government bond yields hit new lows. In the U.S., 10-year Treasury yields dropped to 1.36%—the lowest level in history.

As I have recently discussed with several clients, we viewed Brexit as a risk to financial markets and the global economy, but a risk that was low on the list of concerns for us.

Why was Brexit low on our list? Evaluated in isolation, it is difficult to envision much lasting economic damage from Britain’s decision to leave the EU. In the short-term, nothing actually changes. The U.K. first must invoke article 50 of the Lisbon Treaty (think of it as the EU constitution) before negotiations over the U.K.’s exit can even begin. Once article 50 is invoked, the negotiation period starts and can last for up to two years. During the negotiation period, the primary drag on growth will come from heightened uncertainty, but we suspect this effect will be marginal. After the negotiation period, any impact will depend on the terms of the deal. It probably isn’t in the U.K.’s, or the EU’s, interest to negotiate a deal that hurts global growth.

If Brexit is a minor event, then why the volatility following the vote? Our view is that some investors are worried Britain’s decision to leave the EU will act as the catalyst for a broader breakup of the euro-area. If voters in Spain, Italy, and France, for example, decide to hold referendums of their own on EU membership, and they vote to leave, the global economy may indeed have a problem. We have long viewed a breakup of the euro-area as a risk to the global economy, but we see this as more of a longer-term risk. We still see significant political capital invested in the idea of a united Europe. Many in the euro-area won’t give up on this idea easily. We could envision a scenario where Brexit extends the life of the euro-area by encouraging EU bureaucrats to roll back some of their most controversial mandates in an effort to quell the nationalist sentiment in Europe.

THE SNAP-BACK RALLY

Once the shock of Brexit wore off, and investors started to more fully evaluate its consequences (or lack thereof), share prices rallied sharply. The S&P 500 recovered all of its post-Brexit losses in three days and has since gone on to rally to new all-time highs.

What is pushing stocks to new highs? Brexit has been bullish for the market. Not because of the uncertainty it creates, but because it is yet another in the long and growing list of excuses for global central banks to keep interest rates lower for longer and pump more liquidity into the financial system. Following Brexit, Bank of England officials quickly signaled a desire to cut rates over coming months. The Federal Reserve Bank signaled a wait-and-watch approach (a dovish change from a tightening plan), the European Central Bank talked about altering its bond-buying program to favor more of the euro-area’s overly indebted countries, and there are signals that the Bank of Japan is readying the printing presses for helicopter money (a form of outright debt monetization).

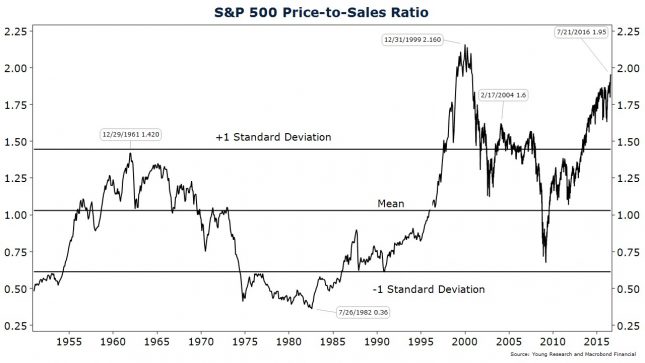

In our view, the response from policy makers has been a gross overreaction to Brexit. The world got along just fine before the U.K. was a member of the EU, and we suspect it will get along just fine when the U.K. regains its full independence. Flooding the system with liquidity is only likely to cause more economic pain down the road as it ignites a reach for yield and greatly increases the probability of another speculative blow-off phase in equities. The best you can do in U.S. government bonds today is 2.27%, and that is for a 30-year term. In Germany and Japan, yields are even lower. Thirty-year German bunds yield 0.50% and 30-year Japanese bonds yield 0.20%.

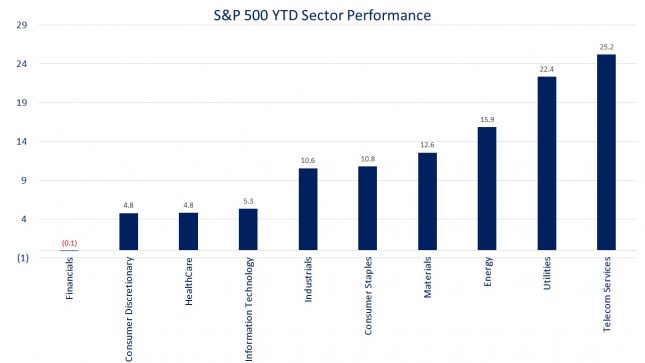

The dearth of safe yield has pushed many investors to flock to stocks for income. The top-performing sectors of the S&P 500 year-to-date (YTD) are those with companies that pay high and dependable dividends. YTD, utilities are up 22.5%, telecommunications shares are up 26.3%, and consumer staples shares have gained 11.6%. That is a welcome change from last year when dividend shares lagged the broader market, but the hot money nature of the flows into these sectors is probably unsustainable.

It is worth remembering that investment strategies move in cycles, falling in and out of favor relative to the broader market averages. Last year, speculative shares were in favor, this year dividend stocks are in favor, and next year something else will be in favor. We, however, will continue to invest how we have always invested, regardless of what is fashionable at the moment.

We buy dividend-paying companies with a propensity for making regular annual dividend increases. Fashionable or not, blue-chip dividend-payers like Siemens, Johnson & Johnson, CVS, and AB-InBev are the types of firms we favor.

THE GE OF EUROPE

Siemens is the GE of Europe. Founded almost 170 years ago, Siemens is a global powerhouse with businesses that span automation, energy, healthcare, and building technologies. During the Brexit-induced sell-off, we made an opportunistic buy of Siemens for clients who were underweight in the stock. We aren’t worried about any short-term problems that Brexit may cause for Siemens. Siemens is a blue-chip industrial company that will be around for many more decades—whether the U.K. is part of the EU or not. Siemens shares offer investors a yield of 3.75% today, and we are forecasting an almost 6% increase in the dividend next year.

We are not overly concerned with how Siemens shares perform over the next 6 or 12 months. We are interested in the next 6 to 12 years. And at that time horizon, we like the durability and value Siemens shares offer investors.

THE WORLD’S LARGEST DIVERSIFIED HEALTHCARE COMPANY

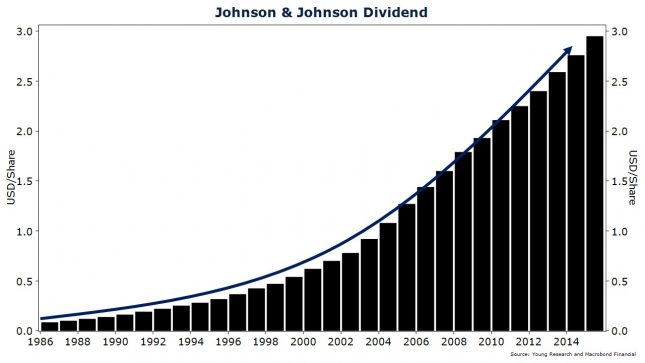

We also like the durability and value of a company like Johnson & Johnson. J&J is the world’s largest diversified healthcare company with sales of almost $70 billion across its pharmaceuticals, medical devices, and consumer products businesses. J&J’s diversification has helped the company achieve one of the most impressive dividend records of all U.S. companies. J&J is one of Standard and Poor’s Dividend Aristocrats. To qualify as an aristocrat, a company must have increased its dividend for at least 25 consecutive years. Fewer than 2% of all publicly traded U.S. companies make the cut. J&J is among the best, with a record of 53 consecutive dividend increases. Over the last five years, J&J’s dividends have compounded at 7% per year. In our view, with J&J’s low payout ratio (dividends as a share of earnings), the company has plenty of excess cash flow to continue making meaningful dividend increases for the foreseeable future.

AMERICA’S SECOND-LARGEST DRUGSTORE CHAIN

Another of our favored dividend stocks involved in the healthcare industry is CVS. CVS is the nation’s second-largest drugstore chain. CVS owns over 9,000 retail pharmacies, 1,100 walk-in medical clinics, and one of the nation’s largest drug-benefits managers, serving 75 million plan members. CVS generates over $150 billion per year in sales. CVS’s in-store walk-in clinics look like a long-term winner. The clinics have convenient locations, low overhead, and the ability to treat common ailments and sicknesses. Patients are in and out in a matter of minutes and, on their way out, they can pick up prescriptions or over-the-counter medicines prescribed during their visit. CVS’s dividend bona fides come in the form of its exceptional dividend growth record. CVS shares yield a modest 1.75%, but over the last five years, dividend growth has averaged 30% per year. You don’t have to compound for very long at 30% to turn a small number into a big number.

THE KING OF BEERS

On the other end of the health spectrum is AB-InBev (Bud). Bud is the world’s largest brewery, and with its coming acquisition of SABMiller, it will get even bigger. Post-acquisition, Bud will have about 30% of the global beer market. The company’s suite of brands will includes Budweiser, Corona, Foster’s, Miller, Peroni, and Stella Artois, among others. We like Bud’s massive scale and dominance in key emerging markets, including Latin America and Africa. Bud shares yield 3.2% today and offer the prospect of double-digit dividend increases in the future. Over the last five years, Bud investors have enjoyed dividend hikes averaging over 27% per year. Even if Bud can maintain half that growth rate over the next five years, today’s 3.2% yield would turn into a more than 6% yield.

Investing in a group of stocks that includes the likes of Siemens, Johnson & Johnson, CVS, and Ab-InBev can offer investors multiple benefits. Income-dependent investors can be reasonably assured that Johnson & Johnson will continue on with its annual dividend record. These companies are also likely to continue to raise their dividend payment annually, helping offset some nasty effects of inflation. When stock prices are down, reinvested dividends at a lower share price will result in higher future dividend payments. And during periods of post-Brexit-type volatility, a steady stream of cash makes it easier to avoid the emotionally charged decisions that tend to sabotage a portfolio’s long-term investment strategy.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Despite the Dow Jones Industrial Average trading at record highs, the overall investing environment continues to be challenging. The largest U.S. public pension fund, California Public Employees’ Retirement System (Calpers), failed to hit its internal investment target for the second straight year. And, as reported in the Wall Street Journal, for its recent fiscal year ended June 30, the plan posted its lowest annual gain since the last financial crisis, earning just 0.6%.

P.P.S. From Rex Singuefield, Forbes, July 18, 2016:

Now in the third year of his bold tax experiment, Kansas Governor Sam Brownback can see the ways in which reducing (and, in many cases, eliminating) the state income tax is yielding incremental, positive effects for Kansans.

Significantly, every year since the tax cuts were implemented, Kansas has surpassed the state record for new business formations. When we consider that startups have decreased nationwide since the Great Recession of 2008, this achievement is particularly remarkable. What’s more, the Kansas unemployment rate stands at 3.7% – the lowest the state has seen since 2001, and well below the national average of 5.5%.

Governor Brownback put his faith in the private sector to grow the Kansas economy, rather than the government. By eliminating the income tax for small business, the Brownback administration effectively put money back in families’ pockets and provided promising new businesses with an environment primed for growth. Following the major tax reform in 2013, individual income taxes for individuals, families and small business went down by 30% on average. Seventy-one percent of the savings went to individuals and families, who could then save or spend as they chose. Twenty-nine percent of the savings went to small businesses, allowing them to make larger investments in equipment, space and staff.

P.P.S. While today’s environment is challenging for investors, we have not exactly had smooth sailing since this century began. From December 31, 1999, through June 30, 2016, for example, the Nasdaq has posted an average annual return of 2.03%. That seems difficult to believe.