The Stones on the Road

April 2024 Client Letter

The Rolling Stones will tour again this summer. This is not breaking news. It’s been six decades since their first U.S. tour. The Stones always seem to be on the road. What is a little surprising, however, is what Mick Jagger is doing at his age. He’s not in his 50s or 60s or 70s. The rock-’n’-roller is 80 and appears to have little interest in slowing down. The concerts are not being held at small venues like the Orpheum Theatre in downtown Boston, with a capacity of 2,700. They are at Gillette Stadium, with a capacity of 64,000. Big stadiums mean big stages offering Sir Mick lots of room to run, dance, and shimmy during each gig. How much ground does Mick cover during a show? He has said, “It’s something like 8 and 12 (miles), depending on how energetic I feel.”

Mick is a force of nature. Exercise has been a constant in his life, and he was encouraged from a young age by his father, who was a physical education teacher. His fitness regime is an intense and diversified program that includes running, cycling, and kickboxing. It also includes workouts focusing on posture, balance, and flexibility. Over the years, he has brought yoga, pilates, and ballet lessons into the mix.

Jagger’s tireless spirit is not just a testament to his vitality but also symbolizes a broader trend in our economy: the active aging-population.

More Americans are turning 65 than at any previous time in history. According to The Wall Street Journal:

About 4.1 million Americans will reach 65 years old this year, reaching a surge that will continue through 2027, according to an analysis by Jason Fichtner, executive director of the Retirement Income Institute and chief economist at the Bipartisan Policy Center. That is about 11,200 a day, compared with the 10,000 daily average from the previous decade, he says.

This dynamic segment of the population is on the go, traveling more, indulging in cruises, splurging on Rolling Stones concert tickets, and embracing an array of physical activities. Far from the outdated image of retirement as a time of slowing down, today’s seniors are more vibrantly contributing to the economy than ever.

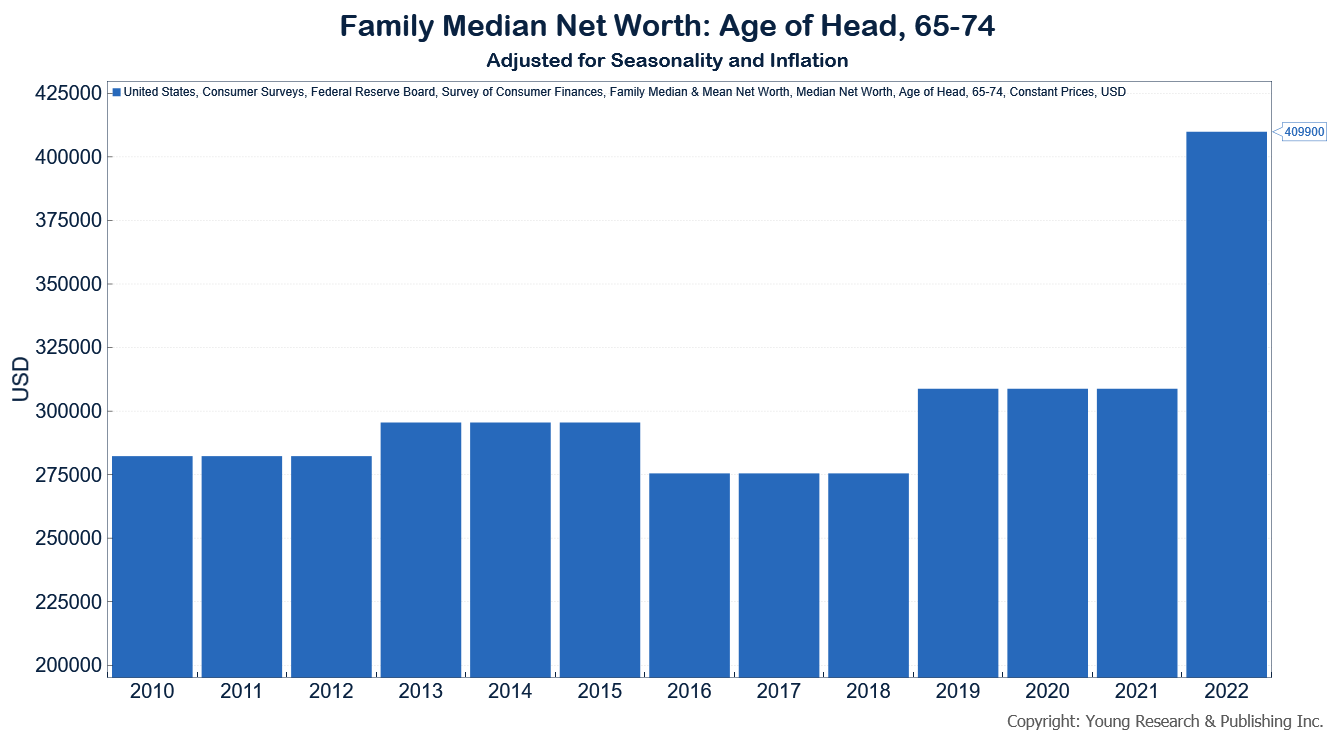

As noted in The Wall Street Journal, today’s 65-year-olds are wealthier than their predecessors. While significant disparities exist, the median net worth of those 65 to 74 was $410,000 in 2022, up from $282,270 in 2010 in inflation-adjusted 2022 dollars, according to the Federal Reserve’s Survey of Consumer Finances.

“This is one of the untold success stories of the modern economy: There is a lot more wealth as people enter retirement,” says Ben Harris, director of the Retirement Security Project at The Brookings Institution and former chief economist at the U.S. Treasury Department.

From an investing perspective, the healthcare sector may be a potential beneficiary of an affluent aging population as more people live longer and continue to consume healthcare products. One company we recently took a position in is AbbVie Inc (ABBV).

AbbVie

AbbVie is primarily engaged in the discovery, development, manufacture, and sale of pharmaceuticals worldwide. The company’s main revenue sources include:

• Humira: A therapy administered as an injection for autoimmune and intestinal diseases;

• Skyrizi: Used to treat moderate to severe plaque psoriasis, psoriatic disease, and Crohn’s disease;

• Rinvoq: For treating rheumatoid and psoriatic arthritis, ankylosing spondylitis, atopic dermatitis, and more;

• Imbruvica: A treatment for adult patients with blood cancers; and

• Epkinly: For lymphoma treatment.

AbbVie has a yield of 3.46% and has had a 10-year dividend growth rate of 13.43%.

Equity Additions

In addition to AbbVie, we recently purchased other new equities in many accounts. Below, you can read about some new companies you may find in your account, though not necessarily all of them.

Broadcom

Broadcom (AVGO) is a global infrastructure technology leader focusing on semiconductor and software solutions. Broadcom’s automative-grade wireless chips, by example, feature the latest in 5G WiFi and Bluetooth Smart technology, enabling car makers and tier-one integrators the ability to keep pace with the speed and growth of consumer electronics and the Internet of Things (IoT) industry. Broadcom has a yield of 1.56% and a 10-year dividend growth rate of 39.40%.

Subsea Cables

You may have first become familiar with Microsoft using Word or Excel. But do you know Microsoft is involved in laying undersea cables globally? A notable project is the MAREA subsea cable, which Microsoft, Meta, and Telxius completed together. This high-capacity subsea cable crosses the Atlantic and is part of the global network, providing customers with access to internet and cloud technology. These undersea networks play a critical role in enabling various tasks, from simple activities like uploading photos and searching webpages to complex operations like conducting banking transactions and managing air-travel logistics. The involvement of Microsoft in such projects underscores the importance of these cables in supporting global connectivity and the company’s commitment to advancing internet infrastructure.

We recently purchased Microsoft and favor its diverse revenue streams, which include:

1. Office productivity tools: Revenue from the Office suite of productivity software, including both Office 365 subscriptions and traditional Office software sales. This includes products for both consumers and enterprises.

2. Windows: Revenue from licensing the Windows operating system to PC manufacturers and direct sales of Windows to consumers and businesses.

3. Cloud services: Significant revenue comes from Microsoft’s Azure cloud services, which offer a wide range of cloud computing services. Azure’s growth has been a major revenue driver in recent years.

4. LinkedIn: Revenue from LinkedIn services, including subscriptions for professional networking, learning, and talent solutions.

5. Gaming: Revenue from Xbox hardware and software, Xbox Game Pass subscriptions, and other gaming services.

6. Server products and cloud services: Revenue from server products, including Windows Server, SQL Server, and enterprise services.

7. Search advertising: Revenue from Bing and associated search advertising services.

8. Device sales: Revenue from the sale of Surface devices and other hardware.

Microsoft’s dividend slowly but surely continues to rise. It has had 18 years of dividend growth and a 10-year growth rate of 11.83%.

Data Is the New Oil

In 2006, Clive Humby, a British mathematician and data science entrepreneur, said, “Data is the new oil. It’s valuable, but if unrefined, it cannot really be used. It has to be changed into gas, plastic, chemicals, etc. to create a valuable entity that drives profitable activity; so data must be broken down, analyzed for it to have value.”

Futurist author Bernard Marr has written, “No list of the top big data businesses would be complete without mentioning the still-undisputed king of search. Google [known now as Alphabet]. The company has turned data collection and analysis into a business model by providing a service ostensibly for free, then selling on information it gathers about us by monitoring the way we use that service.”

Like Microsoft, Alphabet is involved with undersea cables and the broader internet infrastructure. The company has invested in undersea cable projects to improve internet connectivity and speed around the world. These cables are critical for handling the massive amount of data traffic that Google services generate, including search, cloud computing, and video streaming via YouTube.

These investments reflect Alphabet’s broader strategy to control more of the internet’s backbone, reducing its reliance on telecom companies and ensuring that it has the necessary infrastructure to support its growing array of services. Alphabet’s involvement in undersea cables is part of its commitment to expanding internet access and capabilities, which in turn supports its core business and future growth.

Some fun facts from Broadbandnow:

• Alphabet owns major shares of 63,605 miles of submarine cables.

• Alphabet is the sole owner of Curie, a private subsea cable connecting the U.S. to Chile and Panama.

• Alphabet holds partial ownership of 8.5% of submarine cables worldwide.

• Alphabet holds sole ownership of 1.4% of submarine cables worldwide.

Alphabet is dominant in many of the markets it competes in. According to StatCounter, as of February of this year Alphabet’s Google search platform maintained a global market share of 91.61%, its Android operating system was also the world’s most popular, with 43.72% of the market, and its Chrome web browser led its competitors with a market share of 65.3%. Another jewel in Alphabet’s crown is YouTube, which boasts over 100 million subscribers and recently surpassed Twitter to become the world’s fourth-largest social media site.

In 2023, Alphabet generated over $101 billion in cash flow from operating activities, and in the words of Bloomberg’s Subrat Patnaik, “is facing a new and, by most accounts, welcome problem—how to spend its rapidly expanding pile of cash.” Alphabet doesn’t yet pay a dividend, but it has expanded its efforts to return value to shareholders with buybacks, authorizing an additional $70 billion of share buybacks in April. Alphabet’s current blended forward price to earnings ratio (BF P/E) is 18.5, a discount of -23% to comparable companies, according to Bloomberg.

At the end of 2023, Alphabet was sitting on a mountain of cash, cash equivalents, and marketable securities of over $110 billion. That’s nearly enough to pay off all the company’s liabilities without even dipping into other current assets.

Amazon.com

We recently sold FedEx and UPS and purchased Amazon.com with the proceeds. In 2020, Amazon delivered more packages in the U.S. than FedEx for the first time. In 2022, Amazon surpassed UPS in U.S. package delivery. In 2023, Amazon delivered more than seven billion packages, including four billion in the U.S. and two billion in Europe. UPS and FedEx are good businesses, but we feel Amazon delivers shareholders a more diverse portfolio of leading businesses in addition to global parcel delivery.

Amazon’s portfolio of businesses includes but isn’t limited to:

• Amazon’s leading e-commerce platform: In 2023, Amazon’s e-commerce platform was visited 108.3 billion times, up 33.81% compared to five years before.

• Amazon Web Services: AWS operates the most extensive global cloud computing infrastructure, with more services and features than any other cloud provider. In 2023, AWS alone had revenue of over $90 billion.

• Amazon’s advertising business, its fastest growing segment, has grown to hold 7.3% of the online ad market.

• Amazon’s Echo dominates U.S. market share, representing 65% of American smart speaker ownership.

• Amazon has a growing healthcare business, with new partnerships with Meridian Health, and CommonSpirit Health’s Virginia Mason Franciscan Health.

Amazon does not pay a dividend, but there has been talk that it will introduce one in 2024.

JPMorgan Chase

We also recently purchased JPMorgan Chase in many accounts. JPMorgan is one of the world’s largest financial institutions, with operations in over 100 countries and $2.6 trillion in assets. The company is organized into two brands. The first is J.P. Morgan, which operates asset management, commercial banking, payments, private banking, and wealth management businesses. The second is Chase, which caters to U.S. consumer and commercial banking customers.

JPMorgan Chase traces its roots back to 1799 when its earliest predecessor company, The Manhattan Company, was founded by early Americans, including Alexander Hamilton and Aaron Burr. While things didn’t work out too well for Hamilton and Burr, the bank has grown into America’s largest chartered commercial bank by assets and by number of branches, which stood at 4,905 on December 31, 2023. JPMorgan Chase has increased its dividend for 12 consecutive years, and its board has increased the dividend on average by 13.28% for the last 10 years.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. We recently updated Part 2A and Part 2B of our Form ADV as part of our annual filing with the SEC. This document provides information about the qualifications and business practices of Richard C. Young & Co., Ltd. If you would like a free copy of the updated document, please contact us at (401) 849-2137 or email us at cstack@younginvestments.com. Since the last annual update of the document in March 2023, Jeremy Jones, a senior member of the management team of the firm, voluntarily left to pursue a new career opportunity.

P.P.S. Each year, Barron’s* ranks the nation’s top independent advisors. Richard C. Young & Co., Ltd. has been recognized on this list for 12 consecutive years (2012–23).

*Rankings by unaffiliated ratings services and publications should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if Richard C. Young & Co., Ltd. is engaged or continues to be engaged to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Rankings are generally limited to participating advisors and should not be construed as a current or past endorsement of Richard C. Young & Co., Ltd. Richard C. Young & Co., Ltd. has never paid a fee to be considered for any rankings but does pay a license fee to utilize them. Barron’s is a trademark of Dow Jones & Company, Inc. All rights reserved.