What to Expect from Stocks

December 2017 Client Letter

One of 2017’s surprising outcomes was the lack of stock market volatility. We are in the midst of the second-longest bull market on record and we haven’t seen as much as a 3% correction in the S&P 500 in over a year. That’s a record.

Heading into 2018, investors’ willingness to take on risk appears to be in full swing, supported by U.S. GDP growth on pace to surpass 3% for the third consecutive quarter (a feat not achieved in over a decade), business and consumer confidence bordering near multi-year highs, a major tax-cut now in the books, reduced regulations, investor sentiment at levels not seen since the late 1990s, and market volatility apparently on sabbatical. Risk has taken a backseat in the portfolios of many investors.

The stock market could have another double-digit gain year in 2018, but we are not as upbeat on the longer-term outlook for stocks. Stock price growth has far exceeded earnings growth during the bull market. The result is an environment where stock market valuations have once again reached levels that 1) risk a significant down year when the party finally comes to an end and 2) necessitate much lower long-term return expectations.

What may be reasonable return expectations when looking five to ten years out? In a recent Morningstar interview, Vanguard founder Jack Bogle commented on his expectations for the coming decade.

My reasonable expectations for the coming decade—as in my new book, The Little Book of Common Sense Investing, 10th anniversary edition just coming out—I’m pretty conservative. I look at the sources of returns, that’s all I do, and the fact that other people don’t do it that way doesn’t bother me in the slightest. I look at investment return and that’s today’s dividend yield, which is less than 2% for the S&P 500, and I look at future earnings growth. While future earnings growth has averaged 5% or 6%, I’m looking for a lower future earnings growth, say 4%. I got my 2% dividend yield, there’s no arguing about that, and I’m guessing the earnings growth will be slower. So, that gives me a 6% investment return from the fundamentals of the marketplace.

Now the other part of it is not investment return, but what I call speculative return. That is valuations. If a valuation goes from 10 times earnings to 20, that adds 7% a year over a decade. It’s kind of amazing. We’re not in anywhere near that extreme territory, but I think valuations will probably take 2 percentage points a year off that 6, getting to 4.Where does that come from? Well, we’re looking at a price/earnings multiple on the S&P. By my standards, past reported earnings, not by Wall Street’s standards, future operating earnings—there’s a big difference between the two—so, I have the P/E at about 25 right now. If it goes down to 18, we’ll lose a couple of points in valuation, which will take that 6 down to 4.

A 4% return probably isn’t what many stock market investors are signing up for when they jump into a portfolio of index-based ETFs. It is of course possible that Bogle’s 4% return expectation may turn out to be too low, but our strategy has always been—and will continue to be—to favor a bird in the hand over two in the bush.

Investing in dividend stocks today that offer the prospect of higher dividends tomorrow is a timeless strategy, but it historically has the most appeal during long dry spells in the market. Dividend stocks offer a greater share of return in the form of regular cash payments. And those payments can be reinvested in more shares, generating even greater cash payments.

The Two Most Important Words in Investing

Dividends on dividends or interest on interest is the essence of compounding. The two most important words in investing are compound interest. Given enough time to work, compounding generates exponential profits. What do I mean by exponential profits? When you double the return on an investment, your profits more than double. By example, if you compound an investment at 2% for 20 years, your profit is 2.2X your profit when compounding at 1%. When you compound at 8% for 20 years, you have more than 3X the profit that you do when you compound at 4%. Double your return again, which is admittedly unrealistic over a 20-year period, and your profit is 5X your profit when compounding for 20 years at 8%.

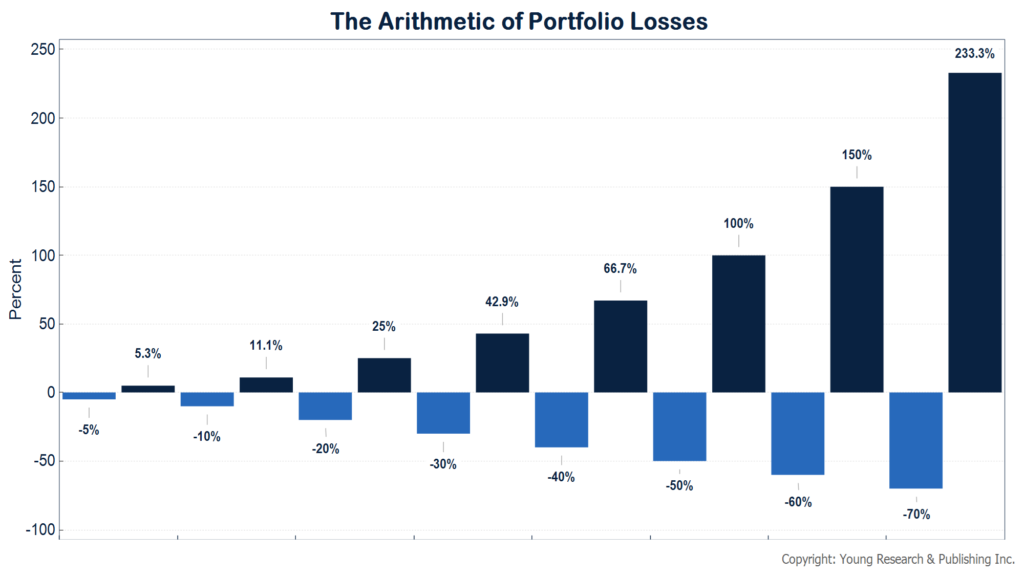

In addition to favoring dividend payers, we also help clients manage risk and mitigate losses by taking a balanced approach. Mitigating losses is vital for retired investors and those approaching retirement. As the chart below illustrates, when your portfolio falls by 10%, you only need an 11% gain to get back to even. Increase the size of that loss to 25%, and you need a 33% gain to break even—high but doable. Now look at the gain needed to recover from a 50% loss and a 70% loss. To break even from a 50% loss you need a 100% gain, and to break even from a 70% loss—the NASDAQ fell 78% during the dotcom bust—you have to more than triple your money.

Retired investors and those approaching retirement may not have the time to recover from severe losses. A balanced portfolio helps tame volatility and mitigate losses. By example, during the last bear market when the S&P 500 fell 55% from peak to trough, a portfolio invested 50% in stocks and 50% in bonds cut that loss to 24%. If rebalanced at the market low, the 50/50 portfolio would have recovered all of its losses within seven months. It took the S&P 500 more than three years to recover from its losses.

Balanced portfolios may not keep pace with the stock market during the bull phase of a cycle, but the downside protection they offer helps many avoid the emotionally charged decisions that often decimate long-term returns.

Tax Reform Success!

After years of putting up with an inefficient and overly complicated tax code, we finally have improvement. The bill that was passed is far from perfect, but it is significantly better than the current system, especially with respect to business taxes. The corporate rate was dropped to 21% from 35% and pass-through business tax rates were also reduced. Businesses are now allowed to write off capital investments in the year they are purchased (a temporary provision), and the U.S. moved to a territorial tax system, which should no longer incentivize companies to move operations and intellectual property overseas to avoid punitive U.S. tax rates.

S&P earnings per share should get an added boost next year from the tax cut as well as a reduction in share count from repatriated money that is likely to be used for share buybacks. The benefits of the corporate tax cut will not be shared equally. For many companies, the boost won’t be as big as one might assume based on the 14-percentage-point reduction in the corporate rate. The effective tax rate of S&P 500 companies is only about 25%, so the reduction to 21% isn’t that big of a jump. Smaller firms and those that operate primarily in the U.S. are likely to benefit the most from lower corporate-tax rates.

As far as changes to the individual tax code, reforms were more marginal. And because of Senate budget rules, many of the individual changes are likely to expire in 2025.

Below I’ve summarized our understanding of some of the significant changes to the individual tax code.

Individual Rates and Standard Deduction

Individual rates and brackets were reduced across the board. The top rate was reduced to 37% on income in excess of $600,000 (married filing jointly). The standard deduction was nearly doubled to $24,000 and the child tax credit was increased to $2,000 with a phase-out threshold increased to $400,000 instead of the $110,000 level under current law.

State and Local Tax and Mortgage Interest Deductions

For those who itemize, the biggest deductions are often for state and local taxes, mortgage interest, and charitable donations. The charitable deduction is maintained. The new bill puts a limit of $10,000 on the deduction for state and local property, income, and sales tax.

The mortgage interest deduction will also be lowered starting next year. Individuals can now deduct up to $750,000 in mortgage interest, including both primary and second homes acquired after December 15, 2017. The limit on mortgage interest remains $1,000,000 if incurred before that date. The deduction for home equity interest was eliminated. Importantly, individuals who refinance mortgage debt of more than $750,000 (but less than $1 million) incurred before December 15, 2017, will still be allowed to take the full interest deduction as long as the principal balance does not increase.

Alternative Minimum Tax (AMT)

The individual AMT unfortunately survived. The exemption amount was increased to $109,400 for married couples who file jointly, and the phase-out threshold was boosted to $1,000,000. This should lower the number of tax-payers subject to the AMT.

Capital Gains and Dividends

Capital gains and dividend rates are essentially the same under the tax reform bill. For married couples filing jointly, if your income including dividends and capital gains is above $77,200 but below $479,000, you pay a 15% capital gains rate. Above $479,000, the capital gains rate is 20%. If you make over $250,000 as a married person filing jointly, your capital gains and dividend tax rate increases by an extra 3.8 percentage points. You can thank Obamacare for that peach.

529 Plans and Coverdell Savings Plans

One of the more interesting changes in the tax-reform bill was made to 529 plans. The tax bill expands the use of 529 savings plans to elementary and secondary schools. A maximum of $10,000 per beneficiary per year can be used to pay for qualifying expenses for elementary and secondary school. 529s are funded with after-tax money, but income and gains are not taxed, and distributions are tax-free when used for qualifying education expenses. The expansion of the 529 to elementary and secondary schools is likely to make the Coverdell savings account obsolete.

Estate Taxes

The estate tax exemption will be doubled to $11 million starting in 2018 and will be adjusted for inflation annually. The increased exemption expires starting in January 2026. Married couples will be able to pass on estates worth up to $22 million without paying estate tax. Unfortunately, the change was not made permanent and a higher estate-tax exemption isn’t something Democrats have historically favored.

Chained CPI

One big disappointment in the bill was the change Congress made in the way almost everything in the code is indexed for inflation. Instead of using the traditional Consumer Price Index (CPI), the IRS will make inflation adjustments using the chained CPI. The chained CPI has increased at a slower rate than the traditional CPI. The change will slowly and quietly result in higher taxes than would otherwise be the case under the traditional CPI. The primary difference between the chained and the traditional CPI is how substitutions are accounted for. Under the traditional CPI, if the price of steak increases, it is assumed consumers still want to buy steak. The chained CPI says that if the price of steak increases, consumers will buy less steak and more chicken, so the weight of steak in the index is reduced and the weight of chicken is increased, which effectively reduces the rate of inflation under the chained CPI.

With tax-reform complete, the administration and Congress have set their sights on welfare reform. The welfare system needs a major overhaul. Far too many programs and incentives are misaligned. As Michael Tanner of the Cato Institute recently wrote, the Nordics are leading the way on welfare reform. Michael writes:

Even the so-called “Nordic model,” long touted by advocates of the welfare state, is undergoing profound changes. Sweden long ago enacted significant reforms to its safety net, including the partial privatization of its social-security system. This August, Finland announced plans to increase the effective retirement age, cut payments to students, and reform maternity leave. And in Denmark, the government has said that the time has come to embrace the “modernization of the welfare state,” adding that the system “needs to prioritize things in a new way and create the best possible conditions for people to get a job.” In fact, the Danish government has already slashed the length of unemployment benefits from four years to just two.

Perhaps the last holdout, Norway, long buoyed by oil revenue, elected a new center-right government this fall on a platform that called for, among other things, cutting taxes, reducing bureaucracy, and reforming the welfare system to better encourage entrepreneurship. The new government has plenty of public support for its plans: A recent survey by Fafo, a Norwegian research foundation, reported 51 percent of Norwegians supported reducing welfare benefits in order to secure economic growth.

The Nordic region happens to also be one of our favored regions for investment. We invest in individual stocks from the region and gain exposure through The Fidelity Nordic Fund, which invests 80% of its assets in securities that are tied economically to the Nordic region.

The entire region continues to rank in the top 10 in the World Happiness Report. The 2017 report notes that Norway

moves to the top of the ranking despite weaker oil prices. It is sometimes said that Norway achieves and maintains its high happiness not because of its oil wealth, but in spite of it. By choosing to produce its oil slowly, and investing the proceeds for the future rather than spending them in the present, Norway has insulated itself from the boom and bust cycle of many other resource-rich economies. To do this successfully requires high levels of mutual trust, shared purpose, generosity and good governance, all factors that help to keep Norway and other top countries where they are in the happiness rankings.

Have a healthy and happy new year. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. AT&T declared its 34th consecutive annual dividend increase on December 15. At the current dividend rate of $2 per share, AT&T shares yield a healthy 5.26%. AT&T looks like a winner if Jack Bogle’s 4% return expectations for the next decade become reality.

P.P.S. Boeing is another of our clients’ holdings that recently increased its dividend. In December, Boeing raised its dividend by 20% to $6.84 per share. Boeing doesn’t meet our most stringent test for dividend growth, as the company took a pause on hikes during the financial crisis. But since the crisis ended, dividends have compounded at an annual rate of 28%. This is an exception we are glad we made.

P.P.P.S. It has been suggested that the risk of us Southwest Floridians getting the flu increases during the winter as an increase of germ-ridden travelers visit the Sunshine State. Whether this is true or not, I do not take chances, and I follow along with what my dad has researched on the health and wellness front. In December my dad posted “Never Get a Cold,” by Chris Masterjohn, on his personal blog, which lists several essential cold prevention supplements. For more information on one of my dad’s favorite health researchers, click here.