Where to Hide When the Major Asset Classes Are Falling

December 2018 Client Letter

The New York Times ran a piece in December titled “Investors Have Nowhere to Hide as Stocks, Bonds, and Commodities All Tumble.” The article highlighted the difficulty investors faced in 2018. Most major asset classes fell last year or edged out minimal gains in the final few days of the year.

For the first time in decades, every major type of investment has fared poorly, as the outlook for economic growth and corporate profits is dampened by rising trade tensions and interest rates. Stocks around the world are getting pummeled, while commodities and bonds are tumbling—all of which have left investors with few places to put their money.

If this persists or grows worse, it could create a damaging feedback loop, with doubts about the economy hurting the markets, and trouble in the markets undermining growth.

Pessimism emanating from the stock market could leave consumers and businesses scared to spend. The rout in junk bonds makes it more expensive for financially fragile businesses to borrow. The collapse in crude oil prices discourages new investment and hiring in the oil patch, which has been a source of job growth.

In that sense, the markets are both a gauge of what investors expect to happen in the economy, and a potential catalyst for their decisions. The mood in the financial markets ultimately feeds into spending by companies and consumers, and if they pull back, based on panicky ups and downs, growth could suffer.

Ned Davis Research explains in the Times article that in every year since 1972 at least one of the major asset class categories the firm looked at generated a return of 5% or more. 2018 has been a different story with losses (or minimal gains) in almost every asset class and style.

With unemployment at some of the lowest levels on record, third-quarter economic growth coming in above 3%, profit growth getting a boost from the corporate tax cut, and interest rates still at historically low levels, what is causing the widespread decline in financial asset prices?

The Monetary Policy Headwind

There are plenty of explanations to go around and no single cause, but a reversal in the monetary policy that helped levitate asset prices for much of the last decade may now be contributing to their decline.

We have written often in these monthly strategy updates about the distortive impact global central banks have had on financial asset prices of all kinds. Years of zero and even negative interest rates, along with trillions of dollars of liquidity injections from the world’s biggest central banks, unduly elevated stocks, bonds, real estate, commodities, private-equity, and almost any other asset you can think of.

Markets have been under the influence of quantitative easing for so long it has become background noise, but during the fourth quarter of 2018, global central banks transitioned from being a major tailwind to a headwind.

It is true the Fed stopped expanding its balance sheet through asset purchases in October of 2014, but almost as soon as the Fed stopped buying, the Bank of Japan and the European Central Bank stepped up their purchases, offsetting any reduction on a net basis.

The Fed started to unwind its balance sheet late last year, but the early reductions were modest and entirely offset by ongoing purchases from the ECB and BOJ.

It wasn’t until October of 2018—when the Fed increased the rate of monthly balance sheet reductions to $50 billion per month and the ECB reduced its monthly purchases to €15 billion per month—that a true unwinding of global central bank support began.

Where to Hide in an Investment Environment like This

When almost all asset classes are down on the year, you shouldn’t expect to make money hand over fist, but a defensive allocation that includes Treasury bonds can help limit losses.

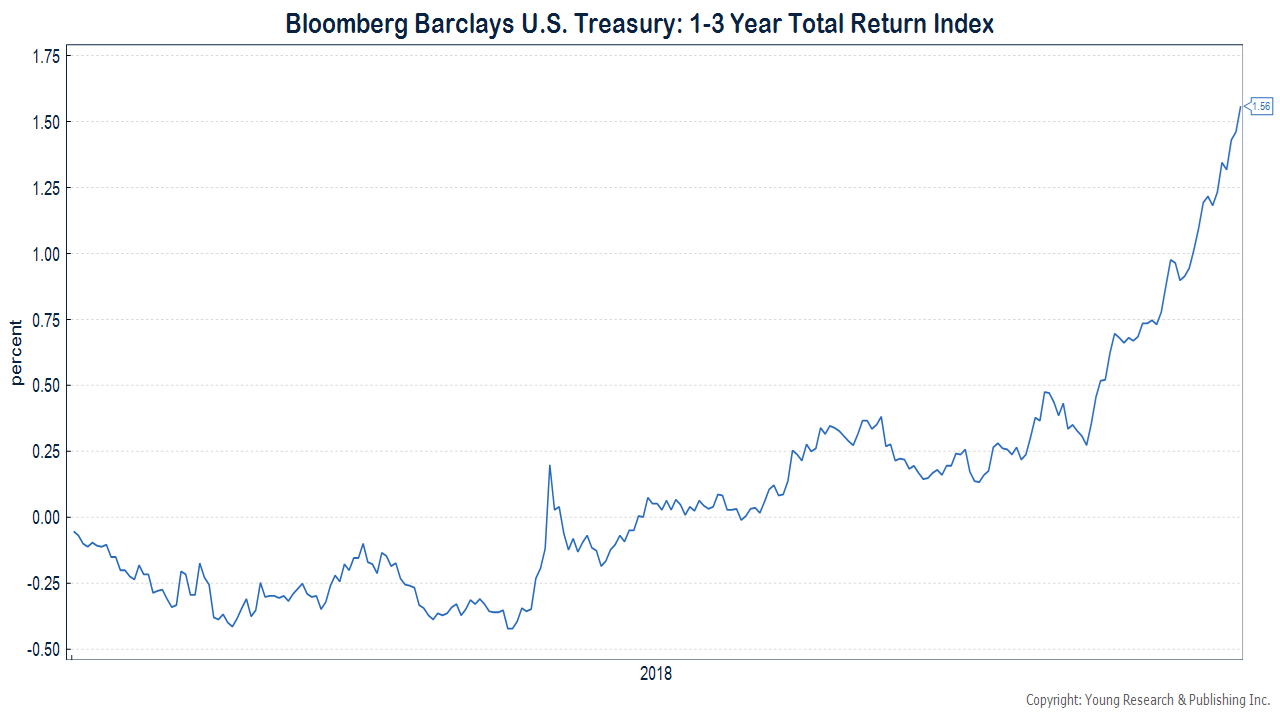

You can’t just buy any Treasury bond and expect to profit, though. Proper positioning within the Treasury market is important to limit your losses. Until mid-November of 2018, long-term Treasury bonds were down more than 8%, trailing stocks by as much as 16 percentage points. Alternatively, as the chart below shows, an investment in the Bloomberg Barclay’s 1-3 Year Treasury Index was in the black for most of the year, despite a better than 50% increase in the 2-year Treasury rate.

The bond portfolios we manage for you have been focused on shorter maturities, and over recent years we have upgraded the credit quality of the portfolio. We increased the amount we invested in Treasuries and focused more on higher-rated bonds. Both moves benefited the bond side of our clients’ portfolios in 2018. Short-term bonds outperformed long-term bonds. Treasuries and short-term investment-grade bonds outperformed high-yield bonds after a dismal fourth quarter for the latter.

While we remain hopeful the 3.2%+ 10-year Treasury rates we saw early last fall will return, based on the much less inspiring 2.66% 10-year Treasury yield we see today, we will continue to favor shorter-term maturities in bond portfolios.

Two Big Challenges Investors Face Today

During bull markets, many investors have an easy time riding though the minor ups and downs; but when bear markets begin, investing becomes much more difficult. Bear markets can be scary. For starters, the losses can come with a staggering amount of velocity. Historically, bear markets move from peak to trough more than twice as fast as bull markets move from trough to peak. The rapidity of the losses has been on display in recent weeks and months. From its September 20th high, the S&P 500 lost 19.8% through its December 24th low. That three-month loss wiped out all the capital appreciation in the index over the prior 20 months. The speed of the losses seems to have become even more exaggerated in recent years as high-frequency trading has proliferated.

Like you, we would prefer markets to have waved a yellow caution flag and allowed ample time to reduce equity allocations before losses ensued, but that’s not the world we live in. Unanticipated and high-velocity bear markets are likely here to stay. The solution in our view is to prepare for them by crafting a portfolio that will prevent panic even in a worst-case scenario.

Battling the Barrage of Negative Headlines

A declining portfolio value isn’t the only struggle investors face in a bear market. Another challenge is the 24-hour news cycle and access to up-to-the-minute headlines and alerts. Frightening headlines that used to be read with fresh eyes and a hot cup of coffee first thing in the morning are now blared over Twitter, Facebook, CNBC, and via text message the moment they happen. Some investors feel compelled to make snap decisions based on such headlines.

When you combine periods of high volatility with relentless negative headlines, it is easy to see how investors are put in a state of anxiety. This can lead to emotionally driven investment decisions that can adversely affect one’s long-term investment plan. We have long counseled investors that a cold, calculating approach is necessary to achieve long-term investment success. CNBC and Twitter don’t factor into that equation, but the Bureau of Economic Analysis, the Conference Board’s Index of Leading Economic Indicators, and the Bureau of Labor Statistics certainly do.

While the price action in the stock and bond markets sends a signal of caution on the economy and should not be ignored, as outlined earlier the correction in markets may have more to do with the withdrawal of global central bank stimulus than economic growth.

Some of the economy’s interest-sensitive sectors do look soft, but there are also still positive factors to point to. Employment is still strong, wages are up, the tracking estimate for fourth-quarter GDP growth is still closer to 3% than 2%, and consumer spending over the holiday season was the best in six years according to Mastercard SpendingPulse. That is not to say things can’t change; but based on the current rate of economic momentum, one might expect another decent year for the economy in 2019.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Apple is having a hard time selling phones in India, the largest untapped market for smart phones in the world. There are 1.3 billion consumers in India, and only 24% of them own an iPhone. Apple’s market share in the country is a whopping 1%, down about 50% over the last year.

What is Apple doing wrong? Price is a major problem. Apple raised the price of its newest phone, the iPhone XS with 256Gb of storage, to $1,149. With 95% of smart phones costing less than $500 in India, there is almost no value to be found in the iPhone at $1,149.

While Apple’s $330-billion market value collapse over the last quarter may be overdone in the short run, as we see it, the long-term risk to the business remains unfavorable.

P.P.S. Here come the tax refunds. Many Americans haven’t really seen what the Trump tax reform will do for their returns. With big checks possibly coming back to many families, the retail sector could be buoyed for longer than anticipated. Bloomberg’s Matthew Townsend reports:

The law cut tax rates for some individuals, but lots of Americans haven’t seen all those savings flow through to their paychecks, according to Wells Fargo & Co. That will be made up during a “historic” refund season early next year, with, for example, a household earning $45,000 a year realizing 70 percent of its tax benefit, the bank said Friday in a research note.

Oftentimes, retailers struggle to draw shoppers in February and March. But bigger-than-expected refunds could help maintain the momentum this year from what is shaping up to be one of the best holiday shopping seasons in recent memory.

P.P.S. State budgets across the country are being massacred by spending requirements. Medicaid programs are especially to blame, according to a report released by the GAO on December 13. Johnny Kampis writes in The American Spectator that:

The main culprit is health-care spending, namely Medicaid expenses and spending on the health benefits of government employees and retirees. Fiscal hawks across the U.S. have warned that government debt is growing across the country not only because of underfunded pensions, but also due to the increased cost to provide these medical benefits to retired government workers.

The GAO noted that there are “long-term fiscal pressures” faced by the government sector. That’s likely an understatement; but most worrisome is how government actions to balance its budgets could affect retirees and savers. Higher tax rates are the most obvious bad solution to filling the budget gaps.

P.P.P.S. For years my father has extolled what he calls The Swiss Way. Switzerland’s low tax rates, neutral foreign policy, and locally focused governance combine to create one of the world’s highest standards of living. In a recent issue of his magazine, Steve Forbes took time to question why the IMF ignores the lessons of Switzerland’s success when giving recommendations to troubled nations. He writes on taxes:

Understanding investment’s basic importance to progress, this Alpine nation imposes no capital gains tax. That’s right: zero. Its value-added tax (VAT)—7.7%—is paltry by European standards, where punishing double-digit levies are the norm. The corporate tax rate averages 17.7%, better than the rates of most of its peers (the rate varies depending on which canton—the equivalent of a state or province—the company is located in; the lowest is a mere 11.5%). The highest personal income tax rate (federal and local) ranges from 22% to 45%. The comparative range in the U.S. is 37% to over 50%.

Naturally, the IMF and too many economists recommend burdening taxpayers even more.