Why You Shouldn’t Rely on Capital Gains from Stocks

February 2013 Client Letter

It’s hard to believe the S&P 500 has not kept pace with inflation during the past 15 years. Since year-end 1999, the index had an average annual return of just 2%. Even with an impressive rally since 2009, the broad-based index has been unable to recover significantly from two vicious bear markets during this period. And looking ahead does not inspire total confidence among investors, who see a lack of fiscal discipline from politicians and a Fed willing to continue with a monetary policy punitive to savers and potentially inflating another asset bubble.

Such an outlook could cause investors to throw in the towel on the stock market. While yields on CDs, money markets, and most bonds are at historical lows, at least these investments are unlikely to be subject to stock market volatility. However, an all-cash or all-bond portfolio is not without risk. Portfolios excluding equities are likely to suffer from inflation risk and income risk. For investors expecting to live for 10, 20, and 30 years or to pass assets on to heirs, these risks can be significant.

Today, the highest-yielding money market funds pay about 0.10% per year. With inflation running near 2%, a cash portfolio is not generating sufficient income to maintain its purchasing power. This is especially problematic for retired investors. Assuming a standard 4% withdrawal rate, the purchasing power of an all-cash portfolio yielding 10 basis points would fall about 6% per year (3.9% from taking more income than the portfolio generates and another 2% from inflation). It doesn’t take long to decimate a portfolio at a 6% depletion rate.

To maintain a portfolio’s purchasing power, an equity component is a must for most investors. Once the decision to buy equities is made, the question becomes what kind of equities should be bought? At Richard C. Young & Co., Ltd., dividends have always been the cornerstone of our common-stock-investment strategy. But investing in a stock just because it pays a dividend does not tell the complete story of our favored strategy. Dividend-payers offer many benefits that can provide comfort and the opportunity for long-term investment success.

A Vital Component of Stock Market Returns

A lesson learned during the past 15 years is to not rely solely on capital appreciation for stock market gains. Investors who overloaded on non-dividend-paying speculative shares before the dot-com and credit-crisis busts were not only left with decimated portfolios, but also with portfolios that produced little annual income.

Consider this: An investment in the ultra-low-yielding NASDAQ Composite Index at year-end 1999 through February 2013 is down 15%. That is more than 13 years without a positive return! Compare that to the S&P 500, which pays a higher, if still scant, yield. The S&P 500 is up 30% since year-end 1999, with almost 90% of that return coming from dividends.

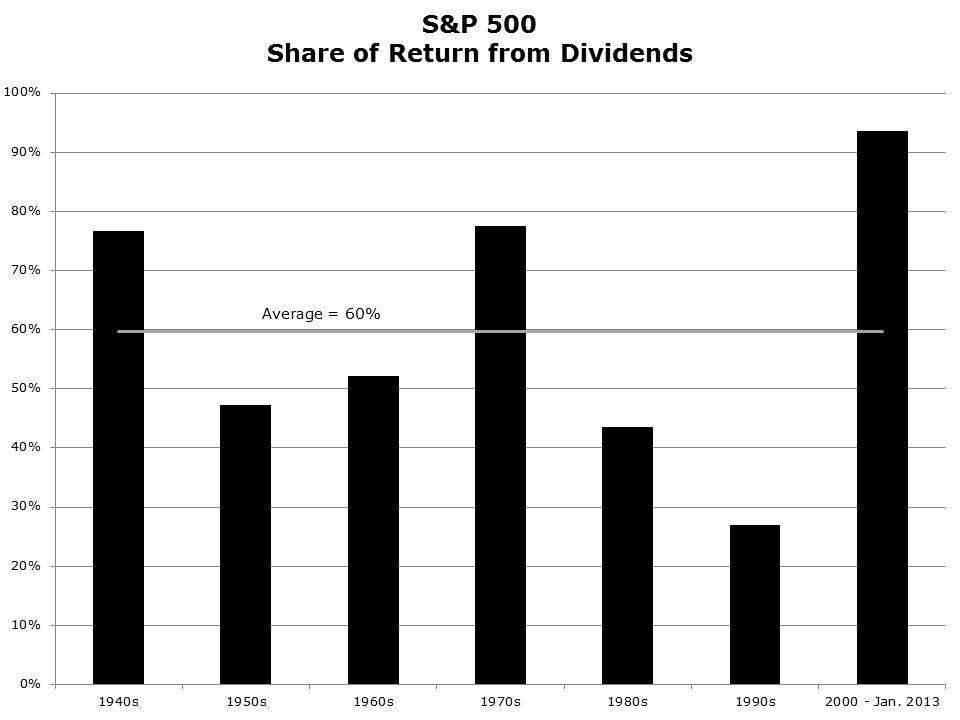

Dividends are a vital component of long-term-investment returns. This isn’t a recent phenomenon. Contrary to what many investors believe, dividends and the reinvestment of dividends have always played a leading role in common-stock returns. During bull markets, including that of 2012, dividends may seem like an afterthought, but, as Chart 1 shows, over the last seven decades, dividends have accounted for an average of 60% of each decade’s stock market returns.

A Steady Stream of Income

Dividends, and especially high-dividend-yielding stocks, appeal to conservative investors and those in or nearing retirement. A continuous stream of dividends can be used for living expenses or can be reinvested at a lower share price, resulting in higher future-dividend payments. During down markets, a steady stream of cash makes it easier for investors to stay patient and wait for the next stock market rebound.

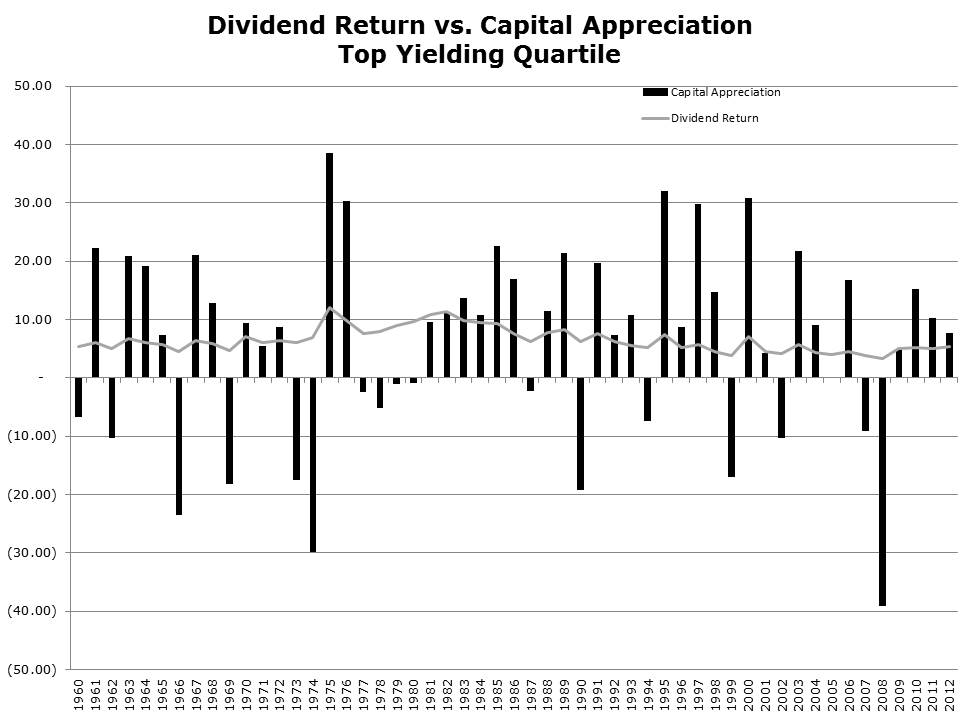

The stability of dividend returns is an added comfort to investors. Chart 2 compares the capital-gains component of returns to the dividend component of returns for high-yielding stocks. Note the stability of dividend returns compared to capital gains over the last five decades.

Higher Dividends = Lower Risk

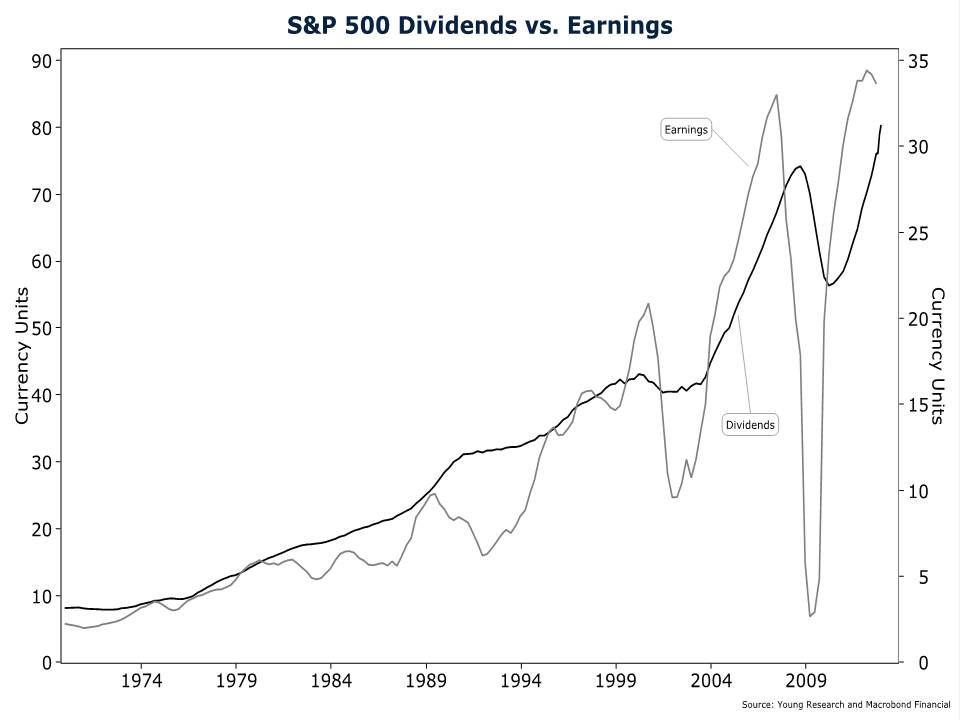

Not only does a steady stream of dividend income provide investors with peace of mind, but dividends also translate into tangible benefits. It is no secret that investors purchase high-yielding stocks for the dividend. It is also true that investors purchasing non-dividend-paying stocks tend to focus on earnings. This isn’t exactly a revelation, but it is important because, as Chart 3 shows, dividends are less volatile than earnings. Since dividend investors buy stocks for the dividend, the stability of dividend payments translates into lower stock-price volatility.

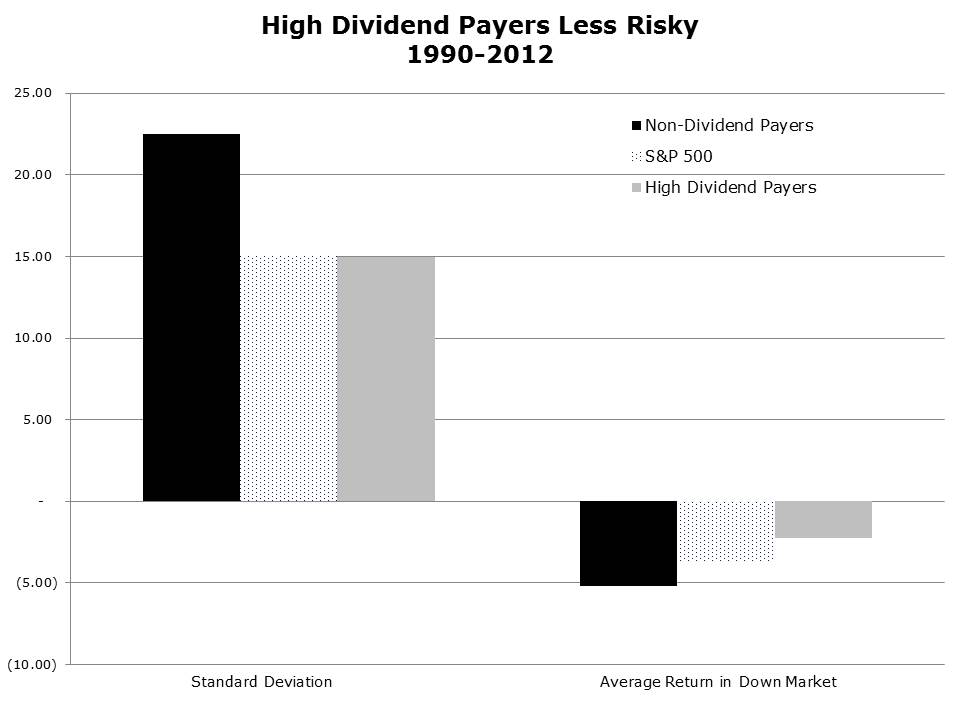

Chart 4 shows that high-yielding stocks have been less volatile than non-dividend-paying stocks. And high-yielders have also held up better in down markets than non-dividend-payers and even broad-based indices including the S&P 500.

Dividends Not Just for Widows and Orphans

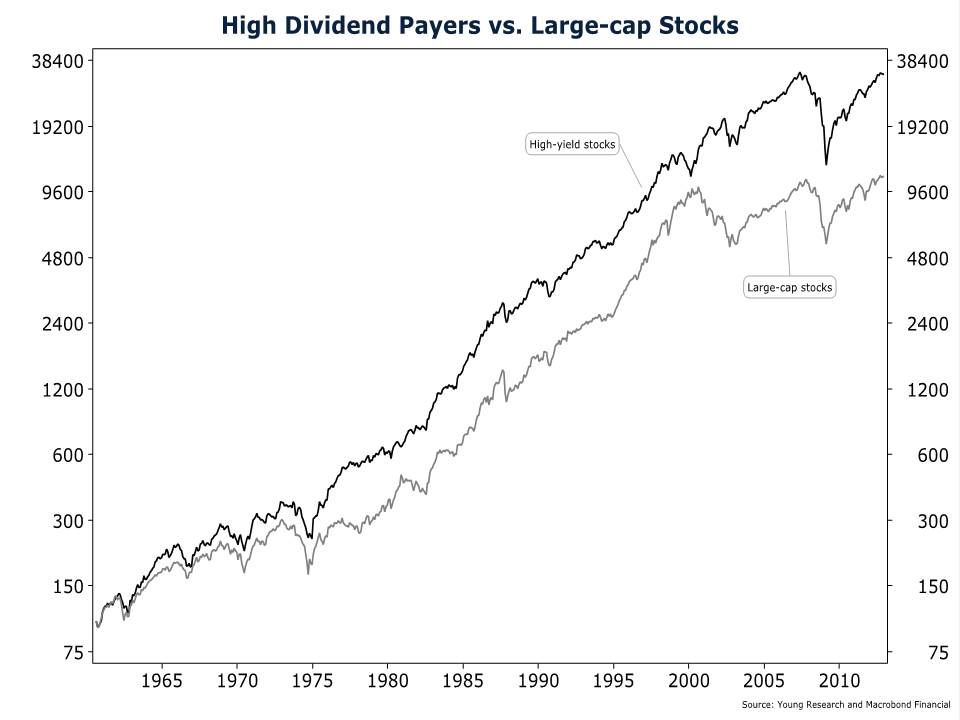

Investing in high-yielding stocks isn’t just a defensive strategy, though. Over the long run, high-yielding stocks have outperformed the broader market. Not every year of course, but, as chart 5 clearly shows, over the long run the highest-yielding quintile (top 20%) of stocks beat the market. As always, it is wise to remember that past performance is no guarantee of future results.

Dividend Payers as an Inflation Hedge

With the Federal Reserve and other global central banks pumping trillions of dollars into the global financial system while holding interest rates at zero, the risk of accelerating inflation is high. To help guard against the threat of rising inflation, we invest in gold and other hard assets, but we also buy stocks. While stocks aren’t the first asset that most turn to as an inflation hedge, over the long run, stocks do indeed maintain their purchasing power.

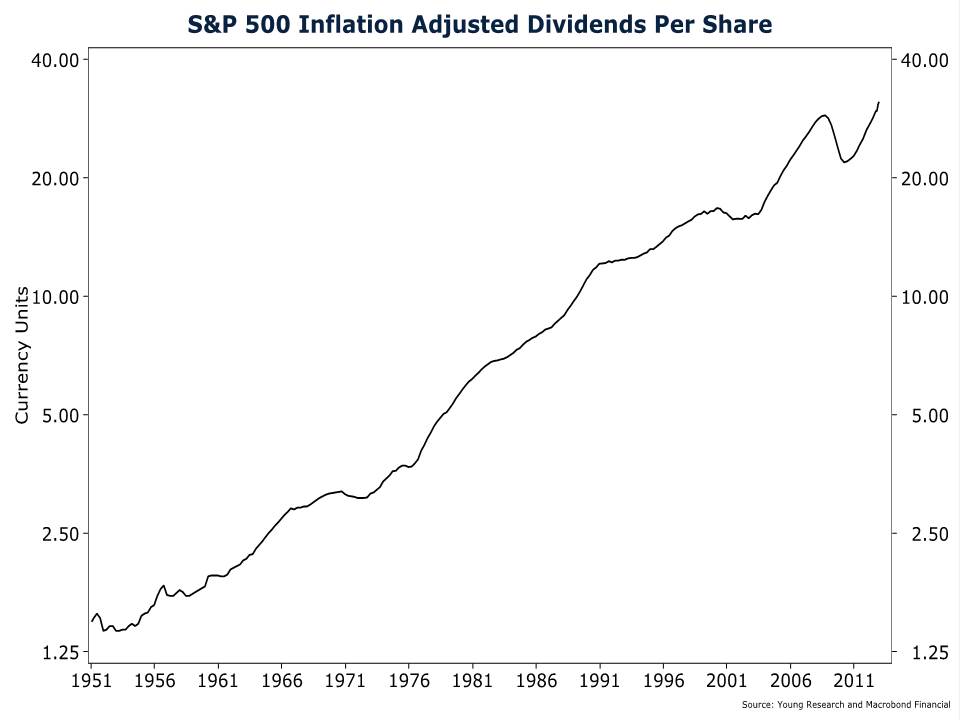

Stocks maintain their purchasing power during inflationary episodes because they are real assets. When inflation rises, the revenues, earnings, and dividends of companies also rise—not always immediately, but usually over time (Chart 6). As corporate fundamentals strengthen, so too do corporate values.

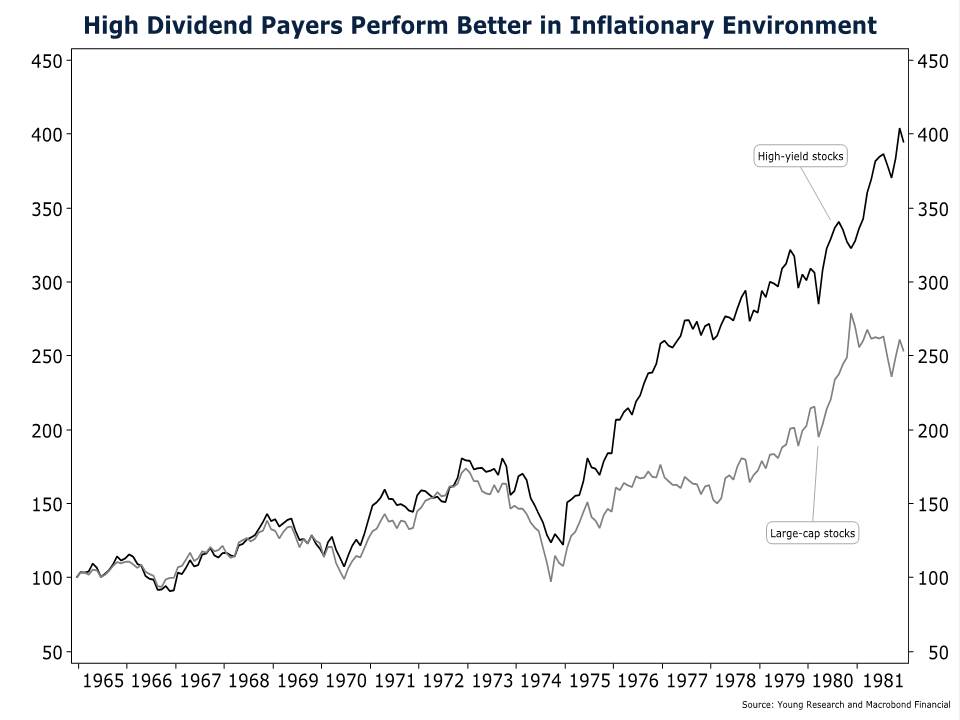

But you don’t just want to own any stocks during an inflationary episode. Historically, the high-yielding stocks have been the ones more resistant to the corrosive effects of inflation. Chart 7 shows that, during the inflationary 1970s, high-yielding stocks earned a higher inflation-adjusted return than did large-capitalization stocks.

Durable Businesses

Dividend-paying companies are often more durable businesses than are non-dividend-payers. Payers often have higher barriers to entry and stronger balance sheets than do non-dividend payers. And because there is a stigma associated with cutting dividend payments, the consistent payment of dividends is a signal of management confidence in the future prospects of a company. This is especially true of companies that raise dividends. Management teams rarely commit to higher dividend payments unless they are confident the dividend can be maintained through thick and thin.

Earnings Quality

Cold hard cash in the form of quarterly dividend payments gives investors confidence in a company’s earnings quality. Companies can manipulate and fake earnings through creative accounting techniques, whereas regular dividend payments can’t be faked.

Dividends Discipline Management

And contrary to conventional wisdom (and basic finance theory), empirical research shows that companies returning more earnings to shareholders in the form of dividend payments often have greater earnings growth. Why? Isn’t it true that the fastest-growing companies often pay no dividends at all? Indeed it is and, while the research isn’t settled on this, one of the more plausible theories as to why higher dividends result in higher earnings growth is that high dividend payments create a scarcity of capital. The management teams of companies paying higher dividends might be forced to allocate capital more efficiently. At non-dividend-paying companies, where retained earnings are abundant, management teams may be more likely to make questionable acquisitions or invest in marginally profitable expansion projects that hurt profitability. With a scarce supply of capital, management teams at companies paying higher dividends must choose only the best opportunities.

Richard C. Young & Co., Ltd.’s Dividend Strategy

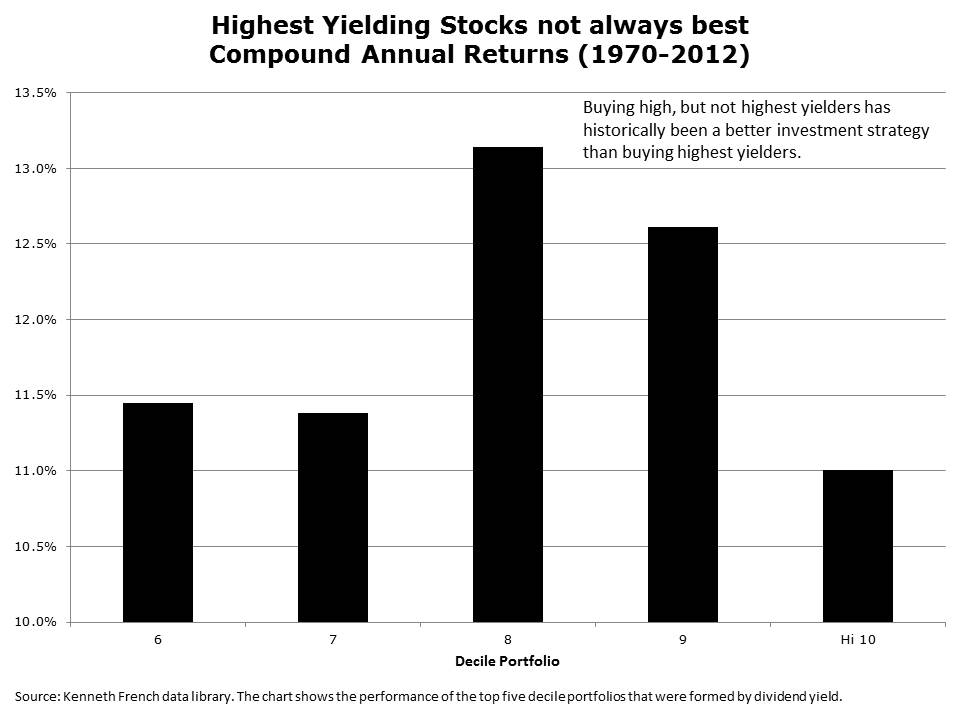

When investing in dividend-paying securities, our goal is not simply to choose the highest-yielding stocks. Yield alone is not the best indicator of future stock performance. A high-dividend yield can be a warning sign that the dividend may be unsustainable or that the dividend-paying company is not growing. Data show that an investment strategy that buys the highest-yielding 10% of the stock market and rebalances annually delivers investment returns that trail stocks with high, but not the highest, yields. Chart 8 shows the compound annual return from 1970–2012 of five portfolios based on dividend yield alone. As you can see in the chart, the portfolio including stocks from the highest-yielding portfolio actually earned less than did the other four.

At Richard C. Young & Co., Ltd., an important feature of our investment strategy is to find companies with a strong record of regular dividend increases. As outlined earlier, companies with annual dividend increases are most often confident about their future earnings, tend to be stable businesses well positioned in their markets, and are able to perform through various business cycles.

Have a good month and, as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer