Yield Scarcity

May 2021 Client Letter

When I started working at Richard C. Young & Co. Ltd., our sole investment focus was investing in U.S. Treasury securities. The most profitable strategy we implemented during the early years of the 1990s was long-term zero-coupon bonds. The zeros strategy was classic. Unlike Treasury bills or intermediate-term notes, long-term zero-coupon bonds can significantly appreciate when interest rates decline. And, since zeros are backed by the U.S. government, they are free of default risk.

In running the zeros strategy, our daily research centered on the momentum of the U.S. economy, the Fed, and the direction of interest rates. In the years before spreadsheets, the web, and the cloud, various market and economic data points would be recorded daily into notebooks. As I write, I have one of my first notebooks in front of me. It is hard to believe the numbers I recorded. By example, in September 1993, a three-month certificate of deposit (CD) offered you 2.60%. A 10-year full-faith-and-credit-pledge U.S. Treasury note paid you 5.36%. Yields remained at those levels and even higher for several more years. What a great time to begin retirement!

Today, we are unfortunately a long way from the yield environment of the 1990s. The 10-year Treasury closed at a record-low 0.52% last August. The yield has climbed back up, but at 1.63% it remains historically low.

The broad stock-market also doesn’t offer much in the way of yield these days. The yield on the S&P 500 is currently 1.48%, and the NASDAQ offers a paltry 0.78%.

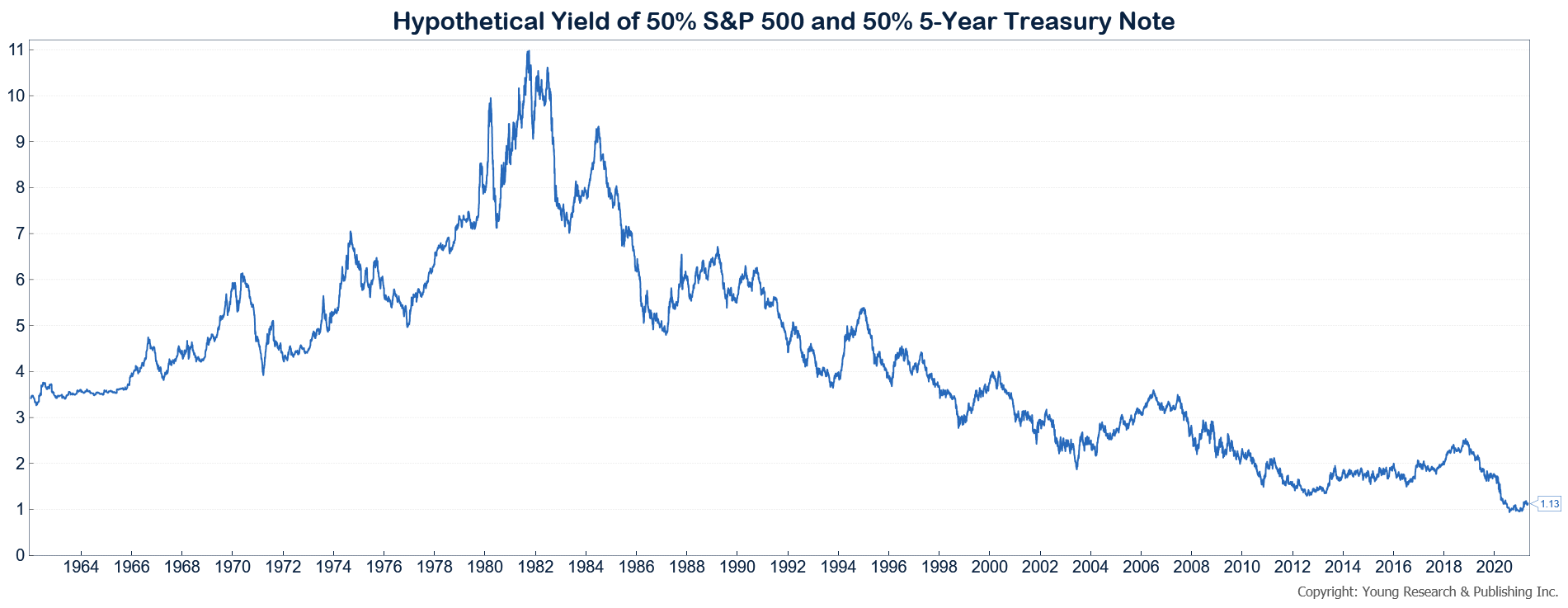

The chart below shows the evolution of the yield on a 50-50 portfolio of stocks and bonds, as measured by the S&P 500 and the 5-year Treasury rate, respectively.

To state the obvious, the environment for investors seeking income is much more hostile than it was in the early 1990s when full-faith-and-credit-pledge Treasuries offered 5%-plus.

An Income Plan

As investors continue to evaluate their investment strategy, I believe a greater emphasis will need to be placed on income generation. While the income environment has been bad for quite some time, it has been somewhat overshadowed as stock prices have been rising. An environment where stock returns are modest or negative will certainly cast a harsher light on today’s ultra-low yield environment. When constructing future investment portfolios, investors will need to take a harder look as to where their portfolio income will come from.

The Retirement Compounders® Solution

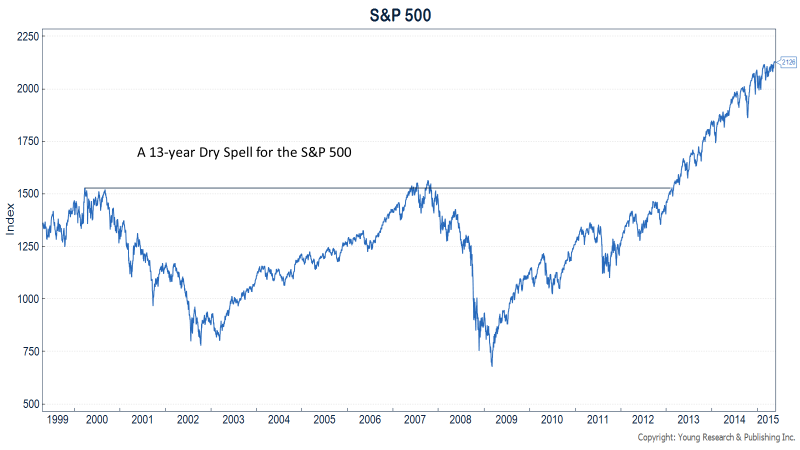

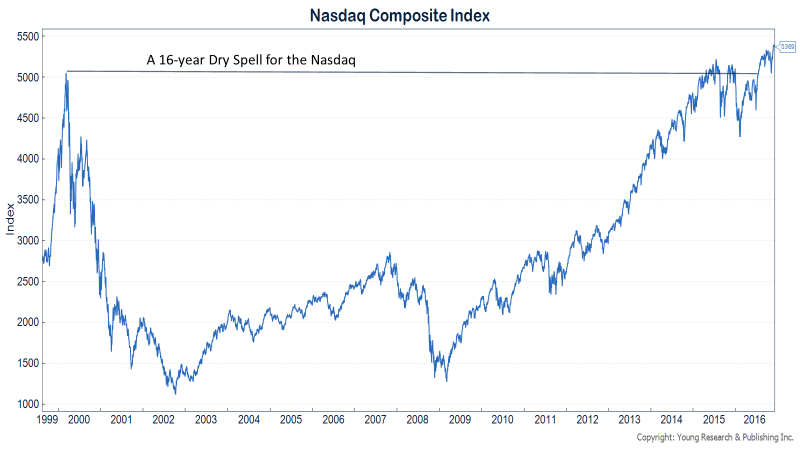

Fortunately for you, we have always emphasized yield. Low dividend-yields and appalling valuations during the dotcom bubble were the catalysts for establishing our Retirement Compounders® program (RCs). RCs is our globally diversified portfolio of dividend- and income-paying securities. When valuations are high (as they are today), stock-price appreciation can stall and remain depressed for long periods. By example, it took the S&P 500 more than 13 years to meaningfully surpass the high it had reached in March of 2000. It took the lower-yielding NASDAQ composite 16 years to achieve the same feat.

The compounded annual total return of the S&P 500 from March 2000 to March 2013 was 2.27%. Over the same period, the Bloomberg Barclay’s T-bill Index earned 2.25% annually. In March 2000, the RCs didn’t exist, but the NASDAQ Dividend Achievers Select and S&P Dividend Aristocrats indices did. Both pursue similar dividend-focused strategies to our Retirement Compounders®. Dividend Achievers compounded at 5.5% and Dividend Aristocrats compounded at over 9% during the same 13-year period. Dividends and dividend growth helped boost the total return of both indices relative to the S&P 500.

A Yield 65% Higher than Inflation

Today, the RCs portfolios we are crafting for clients offer yields of approximately 3.0% or 65% more than the rate of inflation. What’s more, when inflation rises, firms’ profits and dividends also tend to increase.

Financial Stocks

Today we see financial stocks offering attractive yield opportunities. And with the economy poised for significant growth, loan and investment quality will likely remain solid.

Financial stocks we purchased over the last year include Evercore, US Bancorp, and Washington Trust.

Evercore

Evercore is the world’s leading independent merger-and-acquisition (M&A) investment advisory firm based on transaction value. The firm’s investment banking business generated 98% of its revenues in 2020 via fees from advisory clients. Evercore’s advisory services reach beyond just M&As and include:

• a strategic shareholder advisory service through which Evercore advises on activist shareholders, shareholder communications, and defense strategies;

• special committee assignments through which Evercore advises special committees with impartial, unconflicted advice; and

• transaction structuring through which Evercore advises on corporate events such as spin-offs, sales, joint ventures, and more.

Other Evercore operations include a capital markets advisory, an institutional equities arm, and other smaller businesses. Over the last ten years, Evercore’s board has increased its dividend per share by 15.95% annually, and the company can boast about 16 dividend increases in a row.

U.S. Bancorp

U.S. Bancorp is a holding company that owns U.S. Banking National Association, an American-based bank selling corporate and commercial banking, consumer and business banking, and wealth management and investment services to its clients. The company’s roots go back to 1863 when Abraham Lincoln signed a national bank charter spawning the First National Bank of Cincinnati with a mission to “Pursue a straightforward, upright banking business.” Another U.S. Bancorp predecessor, Mississippi Valley Trust Company, even helped Charles Lindbergh finance his transatlantic flight in 1929. Today, U.S. Bancorp subsidiary banks reach 26 states with 2,730 branch offices and 4,406 ATMs and are the fifth-largest commercial bank in the United States by asset size. U.S. Bancorp has paid a dividend every year since 1963. The shares yield 2.77% today.

Washington Trust Bancorp Inc. is the holding company of The Washington Trust Company, the largest state-chartered bank headquartered in Rhode Island. The Washington Trust Company, a premier regional financial services company in the northeast, was founded in 1800. It’s the oldest community bank in the United States. Today the bank runs 23 branches, five wealth management offices, seven residential mortgage loan offices, and three commercial lending offices. The bank sells commercial banking; mortgage and personal banking; wealth management; and trust services. Washington Trust Bancorp has increased its dividend for ten consecutive years. Growth over this ten-year period has averaged 9.3% per year. Today, shares can be purchased with a yield of 4.00%.

Investing in Bonds is a Strategy, Not a Trade

As difficult as it is to earn a decent yield in the stock market, the bond market is even more challenging today. However, that doesn’t mean bonds should be left out of your portfolio in favor of more stocks, as some advisors contend.

Investing in bonds is a strategy, not a trade. Bonds give you the courage to stick with stocks during down markets, and bonds help moderate the ups and downs of your portfolio. Just because bonds don’t offer attractive yields at this moment doesn’t mean they don’t offer benefits to investors, and it doesn’t mean they won’t ever again offer attractive yields.

While bonds still belong in most investors’ portfolios, navigating the bond market when interest rates are in the tank is not a set-it-and-forget-it affair. When interest rates were much higher, investors could park some cash in T-bills or short-term Treasury notes and earn 3% to 5% without taking default risk. That compensated for inflation and offered a decent return.

Today, T-bills are being issued with a yield of 0.00%, and short-term Treasury notes offer yields in the range of 0.30%. There is still no default risk, but that safety will cost you money after factoring in inflation.

A Tactical and Opportunistic Approach to Bonds

To deal with this period of ultra-low interest rates, we have taken a tactical and opportunistic approach with bonds. As the prior economic cycle was maturing, we scaled back the credit risk in our clients’ bond portfolios and scaled up Treasury positions. Going into the COVID crash, we held a significant position in Treasury bonds that we sold as interest rates on corporate bonds shot up. Remember, higher yields equal lower bond prices and vice versa.

Many of the corporate bond positions we purchased with the proceeds of Treasury sales worked out well for our clients.

As the economic implications of the pandemic came into focus, and the Fed made it clear it planned to hold short-term interest rates at zero for years, we moderately increased the average maturity of our clients’ bond portfolios to boost yield.

Late last fall, with corporate bond prices back to normal levels, the vaccine news, and a spendthrift administration coming to power, we sold some of our longest-maturity corporate-bond positions and purchased high-yield bonds and bank loans. Both have much higher credit risk than investment-grade bonds; but, with a supportive monetary and fiscal policy and an improving economy, we saw the risk-reward tradeoff as appealing.

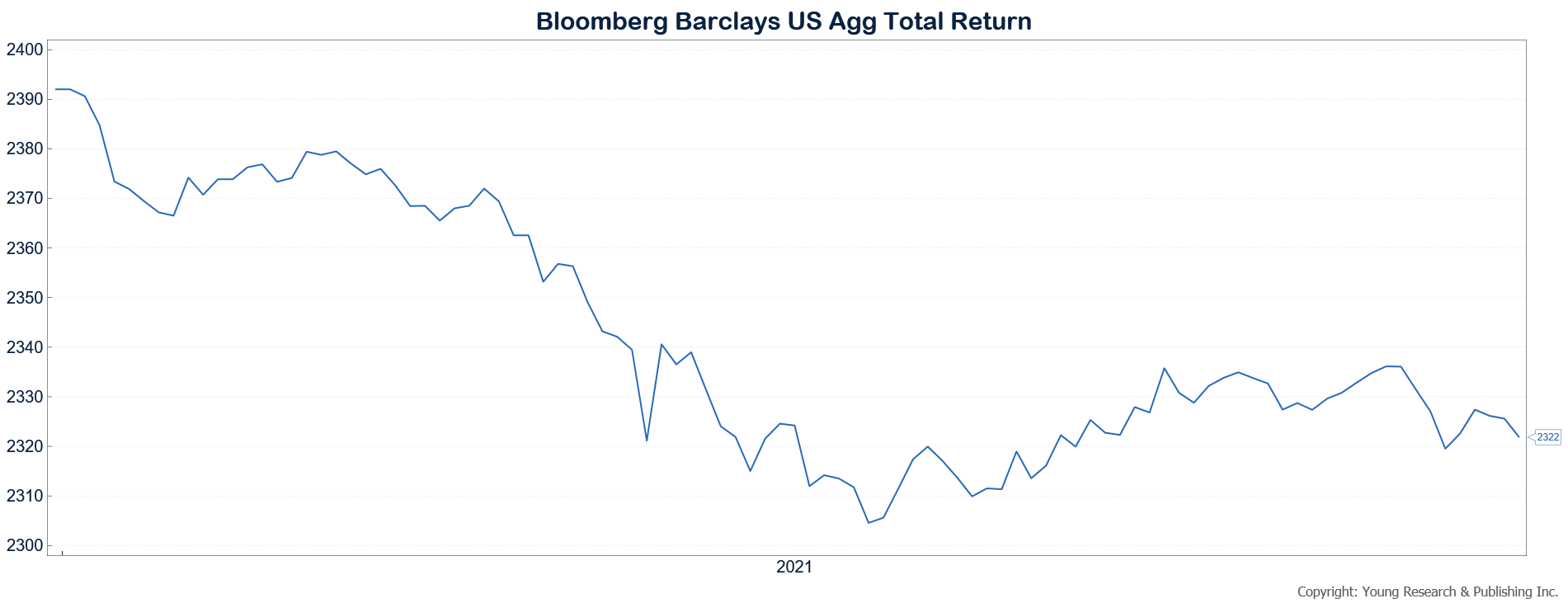

As we moved into 2021 and interest rates started to climb, we have slowly and deliberately drawn on our elevated cash position to purchase higher-yielding bonds. We have purposefully held cash at elevated levels in recent quarters. Cash is not an exciting investment, but cash has outperformed bonds YTD. And cash offers optionality, which we view as highly desirable in the current environment.

These tactical moves, which may sometimes seem counterintuitive, are part of a strategy for navigating the ultra-low-interest-rate environment. I would like nothing more than to be able to buy long zeros as we did in the early 1990s at exceptional interest rates, but that’s simply not the environment we are in today. Our environment is one where, since March of 2009, T-bill yields have averaged about 0.50%, and short-term investment-grade bond yields have averaged about 1.5%. By taking a tactical and opportunistic approach, we have been able to improve on these numbers.

In Front of the Action

One of the best ways to handle a stock-market correction is to be properly positioned ahead of significant volatility. During the last two major crises, the Financial Crisis and COVID-19, we did not take specific action during the initial stages of the market correction. Most of our clients already owned diversified portfolios that included a significant allocation to bonds and gold. This helped limit the stock market’s downside volatility. Having proper asset allocation based on risk tolerance is one of the best defenses to deal with a bear market.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. Diversification vs. concentration. Some professional investors eschew diversification. This crowd tends to subscribe to the philosophy that you should carefully pick the best eggs and watch them closely. But how many best eggs (ideas) can one have? The problem we see with this approach is that today’s best idea may turn out to be tomorrow’s biggest loser. That isn’t a problem specific to concentrated portfolios. There is often a disaster or two in every portfolio (even the ones we manage!). The trouble is, you don’t know which are the disasters ahead of time, and in a concentrated portfolio, a single wipeout can result in financial heartache. Consider that, just before the turn of the century, a concentrated stock manager may have considered Enron, Bear Stearns, Lehman Brothers, General Motors, and GE to be his best-ideas portfolio. All were Fortune 500 companies at the time; but, looking back, four went bankrupt and the fifth has lost almost 80% of its value. Proper diversification is essential to earning a return of capital and a return on capital. At Richard C. Young & Co., Ltd., we craft portfolios focused on cash flow. We diversify geographically and across industries, sectors, and asset classes in an effort to achieve the return of capital and a return on capital.

P.P.S. I get asked about inflation often. One way to deal with inflation risk is to invest in companies that can pass price increases along to the consumer. Demand for toilet paper, diapers, and toothpaste, by example, is unlikely to fall much as their prices increase. We own positions in Procter & Gamble, Kimberly-Clark, and Colgate in many client portfolios.

P.P.P.S. We recently updated both Part 2A and Part 2B of our Form ADV as part of our annual filing with the SEC. This document provides information about the qualifications and business practices of Richard C. Young & Co., Ltd. If you would like a free copy of the updated document, please contact us at (401) 849-2137 or email cstack@younginvestments.com. Since the document was last updated in March 2020 there have been no material changes.

P.P.P.P.S. After trailing the market badly in 2020, energy is having a banner year. The S&P 500 energy sector is up 40%, the highest return among the 11 sectors in the index. Oil-and-gas demand is returning to normal, while supply may take longer to return as capital spending plans were curtailed last year. Despite their strong performance YTD, the oil-and-gas majors, as well as refiners and pipelines, remain an attractive source of dividend income. Chevron, a holding in many client portfolios, recently announced a 3.8% dividend hike. Chevron shares yield 4.9% today.