Your Money Makes Money

February 2023 Client Letter

One of the more endearing characteristics of a stock, in our view, is its belonging to a company with a history of raising its dividend. That’s because if you own the stock, consistent dividend increases raise the yield on your original cost basis. Patient investors realize that a modest yield today can grow significantly in the future.

Throughout the year, your monthly brokerage statement shows the dividends paid into your account. When viewed individually, these payments may not appear as large numbers. But when aggregated for an entire year, you may be pleased with the final figure.

We target companies with track records of making annual dividend increases. Typically, these increases are in the single-digit percentage range. But as time passes, these annual increases have a big impact on the future dividends you receive.

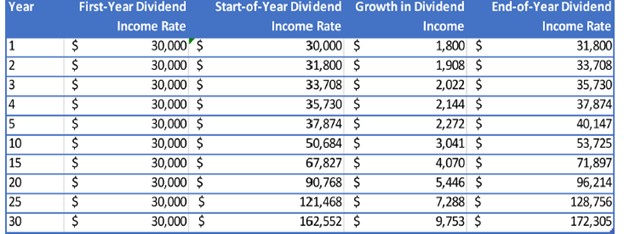

By example, take a hypothetical portfolio with $1 million invested in dividend payers. Assume a starting yield of 3% and annual dividend growth of 6%. After 20 years, that initial $30,000 in dividend income will have increased to $96,214. In two decades, the dividend yield on the original cost basis climbs to 9.6%.

After 25 years of dividend increases? The original $1 million will generate $128,756 in annual income or a yield of nearly 13%, which doesn’t include the additional dividend income that would be generated by reinvesting dividends. That’s the magic of compound interest. Or, as Ben Franklin said, “Money makes money. And the money that makes money makes more money.”

Our Retirement Compounders® (RCs) equity program targets consistent dividend payers. The longer the record of regular dividend payments, the better. Companies that have paid consistent dividends through numerous economic expansions and contractions are often quality businesses.

In the RCs, we favor firms with consistent records of paying regular dividends, but we also like firms that have consistently increased annual dividends. A growing stream of dividend income may be able to solve problems for investors.

Dividend growth can help offset the impact of inflation on the purchasing power of your retirement portfolio. Companies that pay meaningful dividends and raise those dividends over time also provide a more meaningful foundation for long-term capital appreciation.

Non-dividend payers can be subject to the whims of temperamental investors. Consider a stock that pays no dividend and has risen in price because investors believe the firm’s prospects have improved. DocuSign is a recent example with which many of you are likely familiar.

DocuSign is the leader in e-signature technology. During COVID, many investors discovered the ease of doing business with DocuSign. Prior to COVID, DocuSign shares were performing well as e-signature adoption was increasing and awareness proliferating. Post COVID, the shares went bananas, to use a technical term. In February of 2020, DocuSign shares were trading around $86. At $86 per share, DocuSign was trading for roughly 16X sales. Sales for the prior 12 months were approximately $1 billion. Once COVID hit, sales took off, and so did the share price. The stock went from $86 in February of 2020 to a high of $310 in the summer of 2021. By September of 2021, sales had doubled, and the price investors were paying for each dollar of sales had also doubled. Investors were apparently anticipating even faster growth than the firm experienced when the conditions for e-signature couldn’t have been better.

Today, DocuSign does annual sales of about $2.5 billion, a significant growth from the early 2020 levels, but investors’ opinions of DocuSign’s future prospects have dimmed. DocuSign shares now fetch $59 per share, which equates to about 4.9X sales. Investors who bought shares at the all-time high are nursing an 80% loss despite a solid performance from the underlying business.

Compare DocuSign to a hypothetical dividend-payer. I’ll keep the arithmetic simple for illustrative purposes. Assume a starting share price of $100, an annual dividend of $3, and a dividend growth rate of 7.2%. At 7.2% growth, the dividend will double in 10 years. To maintain a 3% yield in 10 years, the share price would also have to double. A cold hard stream of cash you can deposit in the bank provides a more meaningful foundation for capital appreciation than an increase in sales, which is a more abstract concept to shareholders.

What other problems can dividend stocks help investors solve? Bear markets aren’t fun for anybody. This is especially true for those in or nearing retirement. Retired investors may rely on their portfolio for income, and those nearing retirement simply don’t have as much time to make back any losses. While not a cure-all, stocks with a consistent record of paying and increasing dividends tend to fall less in bear markets than do non-dividend-payers. Why? Not only are companies that consistently pay and increase their dividends most often more stable and cash-generating; but when prices fall, a reliable dividend can provide a floor under the price as yields rise. Dividend consistency is comforting during periods of market volatility like we have today. The current bout of volatility has been wicked for non-dividend-payers and high-growth/technology companies. You may recall from previous letters that technology shares have come to dominate the S&P 500. Apple, Amazon, Google, Facebook, Microsoft, Nvidia, and Tesla are among the largest stocks in the index.

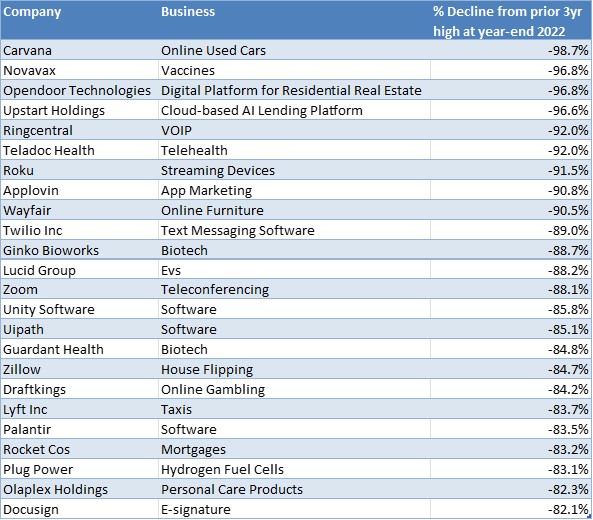

The table below lists the worst-performing large-cap high-growth/technology companies in the S&P 500 last year.

Select High-Growth/Technology Stock Performance 2022

Worst seven performing stocks in 2022 included in the S&P 500 Growth, S&P 500 Communications Services, or S&P 500 Information Technology indices that had a market capitalization of $100 billion or more on December 31, 2021.

If you broaden the list to include growth stocks in the Russell 1000 Index (1,000 largest companies), the losses are even more pronounced. The list below shows how much each company is down from its high price over the prior three years.

How did dividend-paying companies perform during last year’s bear market? The average dividend-paying stock in the S&P 500 was down 5.8% compared to a 23.6% loss for the average non-dividend-payer.

Dividend stocks may not perform as well in all bear markets as they did in the 2022 bear market, but we continue to like the risk-adjusted prospects for dividend strategies. Below I’ve profiled some of our more favored dividend-payers today.

General Dynamics

General Dynamics is a global aerospace and defense company that specializes in high-end design, engineering, and manufacturing of products and services in business aviation, ship construction and repair, land combat vehicles, weapons systems, and munitions. General Dynamics has increased its dividend for 30 consecutive years. Over the last five years, the dividend has compounded at a rate of 8.45%. We anticipate a similar rate of growth in the future. Today the shares offer a yield of 2.2%.

T. Rowe Price

T. Rowe Price Group is a financial services holding company that provides global investment management services through its subsidiaries to investors worldwide. The company provides an array of U.S. mutual funds, sub-advised funds, separately managed accounts, collective investment trusts, and other T. Rowe Price products to its customers. T. Rowe Price has increased its dividend every year for 35 years. T. Rowe Price shares yield 4.15% today. Barring a major market melt-down over the coming years, we estimate mid-to-high single-digit dividend growth.

Air Products

Air Products (APD) is in the industrial gases business. APD produces and distributes atmospheric, process, and specialty gases worldwide. Air Products generates more than 60% of its revenue outside of the U.S. APD has increased its dividend for 40 consecutive years. Over the last three years, the dividend has risen at an almost 12% compounded annual rate. The shares offer a respectable yield of 2.2% today.

Chevron

Chevron is one of the world’s largest integrated energy companies and the only energy company left in the Dow Jones Industrial Average. Chevron finds, develops, refines, and markets oil and natural gas. Chevron has raised its dividend every year for over three decades.

Medtronic

Medtronic is a leading manufacturer of medical devices. Medtronic’s medical device products treat a range of diseases and disorders. The company divides its business into cardiovascular products, medical surgical products, neuroscience, and diabetes. Medtronic has increased its dividend for 13 consecutive years, with dividend growth averaging about 8% over the last five-, three-, and one-year periods. After struggling in 2022, Medtronic shares offer a yield of 3.3% today.

Fed Watch

Over the last year, many investors have been focused on the Fed’s fight against inflation. The Fed has gone on one of the most aggressive rate-hiking cycles in history. It may be hard to believe, but the first interest rate increase of this hiking cycle was only 10 months ago. At its most recent meeting, the Fed pushed its policy rate up to 4.50%–4.75%—the highest level in 15 years. And with the Fed signaling another one-to-two-quarter-point hikes early this year, we may soon see Treasury bills and short-term notes with yields exceeding 5%.

The Fed’s aggressive rate-hiking campaign is a welcomed development in our view. Fifteen years of near-zero-percent interest rates placed a costly burden on savers and retired investors. Stock and bond prices have started to adjust to today’s interest rate realities, but hope springs eternal. There are still many investors banking on the idea that the Fed will do another about-face and cut interest rates later this year.

These investors should be careful of what they wish for, as rate cuts may come with an economic and corporate earnings recession. We would much prefer to see the Fed hold the line on rates and see the economy avoid recession, but we don’t craft portfolios based on one possible outcome. We craft portfolios with a range of possible outcomes in mind, both positive and negative.

A 4% Yield on Your Fidelity Money Market

Despite the adjustment lower in stock and bond prices due to the end of the free money era, there are major benefits to higher interest rates. Take your Fidelity Money Market fund by example. After offering investors close to no yield for the better part of 15 years, your Fidelity Money Market now pays close to 4%. Another one or two hikes could push rates above 4.5%. At a 4.5% yield, you would double your money every 16 years. At a 0.25% yield, it would take 288 years to double your money. Money market yields are also much more attractive than the yields offered by many banks today. According to Bankrate.com, the national average three-month certificate of deposit (CD) rate is only 1.38%. These rates will likely converge over the longer run, but if you are currently sitting on a pile of cash in a bank account, you might consider a higher-yielding alternative.

In addition to the higher yield on money market funds, Treasury and corporate yields are also at attractive levels. Short-term Treasuries offer yields in the 4–4.5% range, and short-to-intermediate-term corporate bonds offer yields of 4%–5% depending on maturity and rating.

Have a good month. As always, please call us at (800) 843-7273 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. For most portfolios, we favor individual securities over open-end mutual funds. The problems with open-end mutual funds are varied. One big drawback with mutual funds is taxes. With the major stock and bond indices both down double digits in 2022, one would think capital gains taxes wouldn’t be a worry. Unfortunately, for many open-end mutual fund investors, a down market can still mean taxable capital gains distributions. Take the Vanguard Wellesley Income fund as an example. Wellesley was down 9% last year, but the fund still made a significant capital gains distribution equal to about 4.5% of the fund’s net asset value. The problem isn’t unique to Vanguard Wellesley. The problem is with open-end mutual funds. In down markets, more shareholders than usual tend to sell their mutual funds. As investors cash in their holdings, portfolio managers have to raise cash to meet the redemptions by selling securities. Significant redemptions can force a fund manager to sell positions held at substantial gains. Patient shareholders who stayed the course during the market turbulence end up footing the bill for the impatient investors who bailed out. When you own individual securities, the capital gains are realized only when you place trades. Therefore, your patience may be rewarded instead of punished.

P.P.S. In light of roaring inflation, the slight drop in the price of gold in 2022 came as a surprise to some. If gold is an inflation hedge, why was it down 0.5%, with inflation soaring to 6.5% in 2022? Gold is an inflation hedge, but it is a long-term hedge. Over the shorter run, the strength of the dollar and interest rates play an important role in the performance of gold. While inflation was up big last year, interest rates soared, and so did the dollar. Since early November, when longer-term interest rates and the dollar topped out, gold prices have rallied 18%. Gold is also likely benefiting from central bank purchases. Central banks bought more gold last year than they have in over five decades. Regardless of gold’s short-term price action, we continue to buy gold and view it as an important component of a well-diversified portfolio.

P.P.P.S. At Richard C. Young & Co., Ltd., we seek to avoid the speculative elements in the market by pursuing a balanced approach. A mix of bonds, dividend-paying stocks, and precious metals has most often helped limit risk in our clients’ portfolios while delivering an acceptable return. A well-diversified balanced portfolio will probably never earn the highest return in any single year, but it is also unlikely to deliver the worst return.

P.P.P.P.S. Consumer-staples stocks have long been one of our favored sectors. Why? For starters, the dampened cyclicality of the sector provides a greater degree of confidence in the long-term prospects of firms in the space. Many companies in the staples sector are durable businesses with long operating histories and formidable brand portfolios. What startup will outspend P&G to gain market share in diapers or detergent? Or, when was the last time you saw a new candy bar not created by one of the big incumbents gain a foothold on store shelves? The barriers to entry in the branded consumer goods industry are significant.

P.P.P.P.P.S. In 2022, many were concerned that oil producers would not be able to respond to the significant increase in oil prices due to concerns over a lack of permitting. But, according to the Financial Times, America’s largest oilfield, the Permian Basin, has seen crude production soar to a record high:

At 5.6mn barrels a day, the field now accounts for almost half of all the oil produced in the US, pumping more than many OPEC countries. The state of New Mexico’s crude production last year eclipsed output from the entire country of Mexico. … Oil and gas producers deployed 350 drilling rigs in the region last week, up by about a fifth from the same time last year, according to data collected by Baker Hughes. Other jobs have followed, from truck drivers and mechanics to hotel cleaners and construction workers.