Your Questions, Our Answers

January 2013 Client Letter

Are you familiar with the U-6 unemployment rate? The “U-6” rate is one of many different unemployment numbers released by The Bureau of Labor Statistics each month. However, the unemployment number referenced by the government and the media is known as “U-3”. The differences between the two numbers are significant.

U-6 Unemployment Rate vs. U-3 Unemployment Rate

The U-6 includes two groups of people not found in the U-3: 1. “Marginally attached workers” or people who are not actively looking for work, but who have indicated they want a job and have searched for work in the past 12 months. Also included in this group are “discouraged workers” who have given up looking for a job. 2. People looking for full-time work but have settled for part-time work due to economic reasons.

Both groups are fairly important when attempting to gauge the U.S. unemployment situation. In December 2012, the U-6 rate remained at historically high levels—14.4%—while the U-3 came in at 7.8%.

Without factoring in possible upward revisions, 2012 created fewer jobs than 2011 despite help from fiscal and monetary stimulus. And much of the stimulus is expected to expire or be wound down in 2013, making prospects for this year challenging. The payroll tax cut responsible for putting more money in 77% of Americans’ pockets each week expired, as have tax breaks for the most productive Americans (those earning more than $400,000).

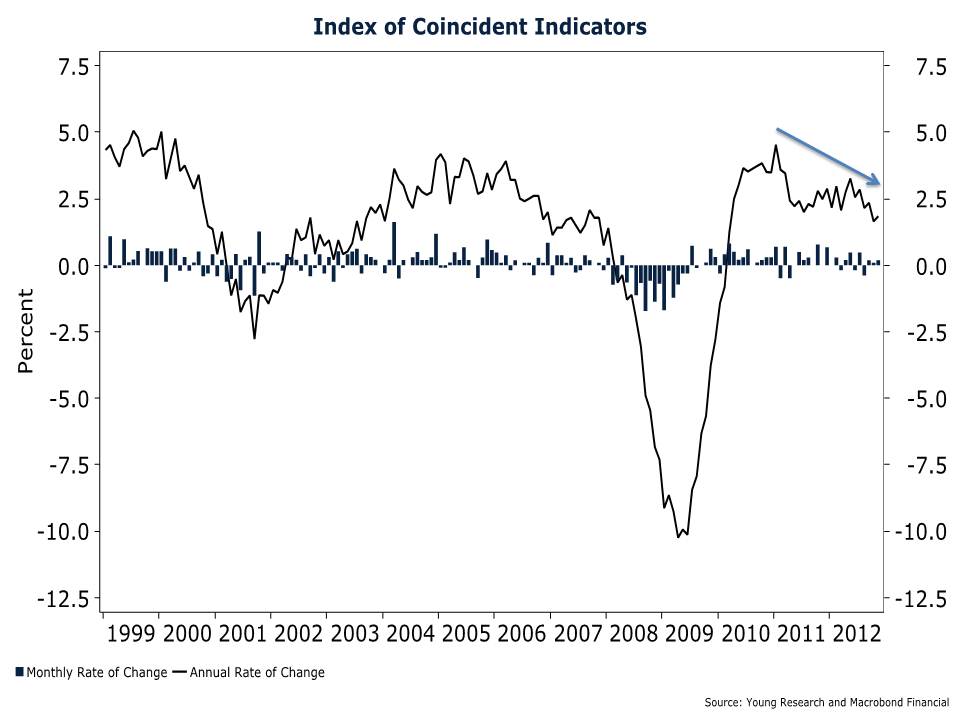

On the following chart, you can see the Conference Board’s Index of Coincident Indicators is developing a downward year-over-year trend. The index comprises indicators similar to those used by the National Bureau of Economic Research to determine the beginning and end of a recession. Unless the index improves, the U.S. economy could be in for tough times ahead.

As we begin a new year, investors will be paying close attention to the employment rate and various other economic indicators to gauge the health of the U.S. economy. Additionally, the actions of the Fed and the outcome of the fiscal negotiations will play a role in how the economy fairs. Combined, these issues generate questions from investors on how best to react to a still uncertain environment. Following are many of the questions I have been asked about our current investment strategy and what we advise.

As we begin a new year, investors will be paying close attention to the employment rate and various other economic indicators to gauge the health of the U.S. economy. Additionally, the actions of the Fed and the outcome of the fiscal negotiations will play a role in how the economy fairs. Combined, these issues generate questions from investors on how best to react to a still uncertain environment. Following are many of the questions I have been asked about our current investment strategy and what we advise.

Are there any changes to your Retirement Compounders program as a result of the tax increase on dividends for some individuals?

Our dividend-focused investment strategy will not change as a result of the higher tax rate. Until 2002, dividends were taxed as ordinary income and dividend payers still delivered some of the market’s strongest risk-adjusted returns.

WisdomTree looked at the after-tax return of the highest-yielding 30% of stocks in the market during various dividend tax regimes. From 1943 to 1963, the highest dividend tax rate averaged about 91%. During this period the highest-yielding stocks (again top 30%) returned 9.84% after tax compared to a return of 9.74% on the market and 9.19% on the lowest-yielding (bottom 30%) stocks. From 1963 to 1981, the highest dividend tax rate averaged 70% and the highest-yielding stocks earned an after-tax return of 4.63% compared to 4.79% for the broader market. From 1981 to 2002, the highest dividend tax rate averaged 39.5% and high-yielding stocks earned 13.4% after tax compared to 10.88% for the broader market.

According to WisdomTree, U.S. retirement accounts hold about $8 trillion worth of equities. That is equal to about half of the market capitalization of U.S. stocks. Retirement accounts are obviously exempt from taxes, so a higher dividend tax rate doesn’t impact their return on dividend stocks. If taxable investors decide to sell their dividend payers because of the higher tax rate, investors in tax-deferred accounts would likely step in to support the values of dividend-paying securities.

With taxes going up, will you be investing in municipal bonds?

We have no plans to invest in municipal bonds. While tax rates are one consideration when investing in municipal bonds, there are others factors to take into account. First and foremost is credit risk. State and municipal budgets have improved since the depths of the financial crisis, but they remain strained. In our view, the risk of default in the municipal bond sector is still greater today than it has been in decades past.

We continue to favor corporate bonds over municipals. Company profit margins are near record highs and corporate balance sheets are the strongest we have seen in years. On a tax-equivalent basis (assuming a 39.5% highest marginal rate) 5- to 10-year municipals yield only 2.61% vs. 2.88% for similar maturity corporates. And with corporates, you aren’t faced with the risk of sharp losses if Washington decides to tax municipal bond interest as part of a tax code overhaul.

What market index do you use to benchmark performance?

We don’t use indices to benchmark the performance of our clients’ portfolios. We benchmark portfolios based on our clients’ investment goals and tolerance for risk. We find that investors and investment managers who obsess over beating the market year in and year out often lose sight of the purpose of investing.

The goal of investing is not to boast to your friends and family that you beat the market. Beating the market by 2% isn’t such an impressive feat if the market has cratered 35%. The purpose of most investing is to fund a future liability—to generate retirement income, to buy a vacation home, to pass money on to heirs, or to fund the grandkids’ college tuition.

An index such as the S&P 500 is used to track the performance of large-capitalization stocks, not to plan for a comfortable retirement. The benchmarks we use to manage portfolios are more closely related to our clients’ investment objectives. By example, the point of the benchmark for many of the portfolios we manage is to provide a stream of current income with reduced risk while maintaining the purchasing power of future income and capital.

If you are meeting your objective to generate income and maintain purchasing power, does it really matter how the S&P 500 performs? If your goal is income, the S&P 500 and other indices like it are probably the least useful. Investors interested in income are probably going to buy more high-dividend-paying stocks than are included in the S&P 500. And investors looking to reduce risk will most likely include a significant allocation to fixed income. Finally, investors looking to maintain purchasing power might want to include gold and other hard-currency-denominated assets in their portfolio. You won’t find any of these asset classes in the S&P 500.

I have funds to invest but feel I should wait. When should I get into the market?

I suggest investors look at their total assets in various groups. Groups could include your house, real estate investments, investment portfolio, cash, and life insurance, etc. Each group serves a different purpose and varies in risk. If you have cash that is intended for the investment portfolio, then add it to the portfolio. If nothing else, you’ll be in a position to collect dividends.

Bond yields are near historic lows and bond prices will decline when interest rates eventually rise. Yet you continue to favor a bond component for most portfolios. It seems there are better places to invest than in bonds.

Long bond prices could decline dramatically when interest rates rise, but short-term bonds should not be impacted much by higher rates. Consider, by example, a portfolio of bonds with a duration of two. A one percentage point rise in interest rates translates into a manageable two-percentage-point drop in price. And that two-percentage-point drop in price is offset by interest collected on the portfolio of bonds.

Our strategy with bonds is to keep maturities short and roll maturing bonds into higher coupon bonds as rates rise. While bond yields are in the basement today, they will not remain near zero forever. Long before the Fed begins to raise the federal funds rate (current target date is mid-2015) bond yields will begin to rise.

And while it is true that bonds don’t offer much in the way of income today, they add stability to a portfolio and reduce risk.

With the problems in the U.S., doesn’t it make sense to invest more in foreign markets?

We craft globally diversified portfolios that include a substantial foreign component and will continue to do so in the future. But even with all the problems facing the U.S., in our view a significant allocation to domestic securities remains a prudent approach. Why? Most U.S. investors are also U.S. residents, and so the vast majority of their expenses are denominated in U.S. dollars. If a retired U.S. investor puts all of his money in non-dollar-denominated assets and all of his expenses are denominated in dollars, he is at the mercy of foreign-exchange markets. What happens to this investor if the dollar soars versus foreign currencies? Will he be able to fund his expenses with his now depreciated non-dollar-denominated assets? There are benefits to international diversification, but too much in any sector or country is not advisable.

What mistakes are investors making today?

Some of the more common mistakes we are seeing today include reaching for yield and getting too aggressive. With today’s ultra-low yield environment, some income-oriented investors are reaching for yield in long maturity bonds or in the lowest-quality sectors of the bond market. It is indeed possible to boost yield with such a strategy, but the extra yield adds an extraordinary amount of risk. By example, if interest rates rise by only 50 basis points on a 30-year Treasury bond (a level we saw in April 2012), the drop in price on the bond would wipe out more than three years’ worth of interest. And a one-percentage-point rise in rates would wipe out over six years’ worth of interest.

We are also seeing early signs of investors taking on more risk in equities than they can most likely afford. This tends to happen during periods of extended stock market appreciation. During bull markets, investors’ beer muscles come out; but as soon as the next bear market hits, the buzz wears off and nausea sets in. Getting more aggressive in the midst of an extended bull market can lead to undesired and unpleasant results.

How do we fight against inflation?

Inflation has the potential to become an enormous issue for investors. We employ a multi-pronged strategy to guard against a potential wealth-destroying assault from inflation. On the fixed income side of portfolios, we keep bond maturities short. Shorter maturities dampen the impact of higher inflation on bonds. As inflation begins to rise, bond investors will demand higher interest rates to compensate for greater inflation. As short-term bonds mature, they are reinvested at higher interest rates.

On the equities side of portfolios, we invest in industries with pricing power. Inflation does not have to be a problem for companies with the ability to pass on higher costs to their customers. Branded consumer products companies tend to have reliable pricing power. As do utilities and pipeline companies. We also invest in natural resource companies, which are often the first to benefit from higher inflation.

To further guard against inflation, we invest in precious metals and foreign currencies. Precious metals are hard assets that retain their purchasing power over long periods of time. Foreign currencies serve a similar role. All else being equal, a relative increase in U.S. prices will result in a depreciation of the U.S. dollar, thereby benefiting foreign currencies.

Have a good month, and, as always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Sincerely,

Matthew A. Young

President and Chief Executive Officer

P.S. We believe proper industry selection is an important component to long-term investment success. While we certainly favor a diversified portfolio, we are not looking to invite everyone to the table. Industries currently of interest include consumer staples, pipeline companies, rails, regulated utilities, and timber. On the other hand, technology, airlines, restaurants, and clothing manufacturers lack appeal.

P.P.S. Investing internationally comes with several risks, including currency risk. Recently, some investment professionals point to Japan as a good short-term play, in part because of the Nikkei 225 stock index’s depreciated value compared to the Dow Jones Industrial Average. However, it’s also important to factor in the outlook for Japan’s currency, the yen. Since its recent trough in early October, the Nikkei has risen 24%. But the yen has depreciated by 12% against the dollar during the same period, wiping out half the gain for U.S. investors. If Japan’s central bank continues to print money, the yen could have a further decline versus the dollar. It is also worth noting that Japan’s gross government debt is 240% of the country’s economic output.

P.P.P.S. Most of the stocks in our Retirement Compounders equity portfolio raise their dividends annually. Annual increases in dividend payments is an automatic inflation fighter and a feature that does not exist with bonds whose interest payments are fixed.