December 2019 Client Letter

They will probably rise. Our forecast (it’s a guess really) is favorable not only because stocks rise in seven out of every ten years, but also because election years have historically been good for stocks.

Since 1952 the average election year performance of the S&P 500 (the 12 months from the first week of November in the preceding year to the first week of November in the election year) has been 8.2%.

Stocks Batting Almost .900 in Election Years since 1952

The only two election years in the 17 since 1952 when the S&P 500 fell were from November 1959 to November 1960 and from November 2007 to November 2008. That’s almost a .900 batting average.

Frequency isn’t everything, though. Magnitude matters as well. What do the magnitudes of the losses look like in election years?

In 1960, the S&P 500 fell a little over 4%; but if you add dividends back, the loss was under 1%. The 2008 decline was a butchering. The S&P 500 cratered 37% as the financial sector imploded.

Could 2020 be another big down year like 2008? Indeed it could be, but here is a nugget that may put you at ease. On the two occasions when the stock market fell in an election year, there wasn’t an incumbent running. Eisenhower in 1960 and Bush in 2008 were both finishing their second terms in office. Opposition party candidates replaced both—Kennedy in 1960 and Obama in 2008. Trump is in his first term and, as things stand today, his prospects look good.

A Positive Outlook for 2020

So there you have it. Stocks are guaranteed winners in 2020! I am, of course, not being serious. There is clearly some data mining in my later point.

Without making any guarantees, it is our view that stocks will likely be up in 2020.

Economy Still OK

In addition to the tailwind from the election cycle, the economy still appears to be in decent shape. The jobs market continues to boom with unemployment at multi-decade lows, consumer spending is strong, and the Trump tax-reform package has helped the competitiveness of the U.S.

Negative Headlines a Nightmare for Long-Term Investors

Negative headlines can be an investor’s worst nightmare, as they can trigger imprudent emotionally-charged investment decisions. We weren’t on board with the recession focus in 2019, and our view today is that there is no recession yet, but the margin of safety has narrowed.

As my dad recently wrote:

Conditions are still generally good with 3rd-quarter GDP growth having been revised up to 2.1% from 1.9% which comes despite a nasty 40-day GM strike and Boeing’s 737 MAX airliner debacle.

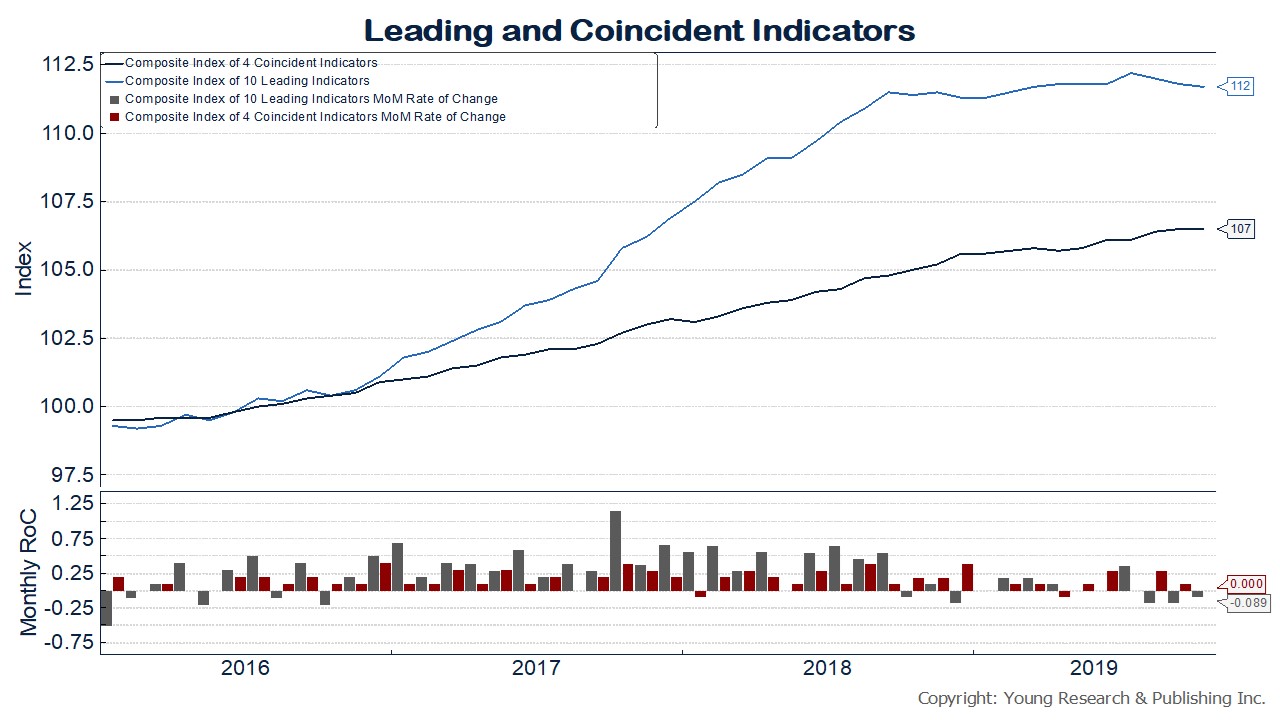

It would be helpful if the sensitive leading and coincident indicators (see chart below) still had the oomph of the early months of the long, long economic recovery; but given the length of the recovery, mismanaged Fed policy, and the headwinds noted earlier, no can do.

Remember, months of revision will follow. The cards we are initially dealt are never the ones played once revisions are complete.

No Recession Yet, Margin of Safety Slim

OK, no recession yet, but not much margin of safety either. I’ve been analyzing these things each month since early 1971. The best way to explain how I view the leaders and coincidents at year-end 2019 is, well, uncomfortable.

Two consecutive fully revised negative quarters for the coincidents will signal official recession (once the NBER concurs). The same progression applies to the leading economic indicators.

There has now been one pre-revision down quarter reported for the leaders, but none yet for the coincidents. The most recent monthly coincidents report was a zero for the coincidents. Although no big deal this early in the game, zero makes me uncomfortable matched with a negative quarter for the leaders.

It will most probably be eight months before the Fed, NBER, or an honest media could use the word recession.

What If We Are Wrong?

There’s always a chance the markets and the economy won’t play out exactly as we anticipate. In fact, that is our expectation. Proper portfolio management shouldn’t stake much on an unknowable outcome. That’s what differentiates our approach from that of many of the “financial advisors” at the big-brokerage firms.

Despite our positive outlook for 2020, we aren’t writing about an overweight of stocks or an underweight of bonds or an equal weight of cash, or whatever other jive is being pitched to big-brokerage firm clients.

Your Time Horizon is a Decade or More

The fact is we aren’t managing your portfolio for the next 12 months. We are managing your portfolio for at least the next decade or two. Consider that men who are 75 years old today have a 30% chance of living another 18 years. If you and your spouse are both 75 today, there is a 30% chance that at least one of you will live to 97.

Temporarily boosting your allocation to the stock market 5 or 10 percentage points for 2020 is unlikely to make a lick of difference to your total return over the coming decade.

What is likely to matter for returns over the coming decade are today’s elevated stock market valuations. High valuations today imply lower prospective stock market returns. Based on current valuation levels, we would be shocked if stock returns over the next decade are anywhere near what they generated over the last decade.

Stock Market Strategy Focused on Quality, Dividends, and Dividend Increases

Among other factors, frothy market valuations are why our stock market strategy for the current environment remains focused on quality, dividends, and annual dividend increases.

Stock’s such as Procter & Gamble tell the story of our investment strategy.

Procter & Gamble

Procter & Gamble has paid a dividend since 1891. P&G has also increased its dividend every single year for 65 years. P&G is tied for first place with American States Water for most consecutive annual dividend increases.

What Is the Key to P&G’s More Than Six-Decade Record of Dividend Success?

In addition to operating in an industry unlikely to face big cyclical swings, P&G’s marketing and innovation have helped the firm achieve long-term dividend success.

After employee salaries and material costs, Procter & Gamble’s third-largest cost is advertising. Some financial analysts view advertising as an expense, but advertising done right can create enduring brand value as it has at Procter & Gamble.

Procter & Gamble Business Overview

P&G has operations in some 70 countries worldwide and markets its products in more than 180. It is the world’s largest maker of consumer goods for home and health. P&G breaks its business down into five segments: fabric and home care (33%); baby, feminine and family care (27%); beauty (19%), health (12%), and grooming (9%).

Procter & Gamble’s portfolio of consumer brands is unmatched in the industry. P&G has about 65 brands in 10 different categories within the five segments listed above. P&G’s brands include Pampers, Always, Bounty, Tide, Gain, Pantene, Gillette, Crest, and NyQuil, among others.

Building Durable Brands Not as Easy as It Used To Be

For many years, establishing brand value by outspending the competition was a sure path to success, but industry dynamics are changing. The Internet and social media platforms have lowered the barriers to mass marketing. Almost any firm can now get in front of consumers to explain why they offer the best shampoo or detergent.

Procter & Gamble and other consumer-branded companies still have an edge as they have the scale and ad budgets that can crush almost any startup. But it’s now more important than ever for the product to live up to the claims made in advertisements, or consumers will look elsewhere.

Most firms in the consumer-packaged goods industry have been impacted by these shifting industry dynamics, but not all have identified a strategy to stay on top.

Procter & Gamble believes it can maintain market leadership by truly creating value for consumers. P&G wants to be the preferred choice for consumers by offering superior products. That includes having the best product, the best packaging, the best advertising, the best retail strategy, and the best customer value.

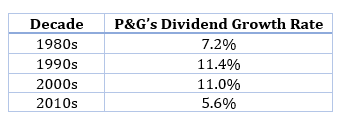

Procter & Gamble’s Dividend Growth through the Decades

The table below shows the compounded annual dividend growth of P&G’s dividend by decade.

Bonds Still a Must-Own Asset Class

One of the benefits of investing in companies that pay reliable dividends is that even in a market with subdued broader prospective returns, a stream of rising dividends is still likely to result in positive returns for investors.

In addition to favoring dividend-paying stocks, we also insist on a bond allocation for most clients. In a bear market or recession, bonds can provide a powerful counterweight to falling stock prices.

Bond returns far exceeded our expectations in 2019 as both short- and long-term interest rates fell. If interest rates were to reverse course and rise significantly, bonds would likely give up some of their 2019 gains. Still, at least in the short-term maturities where most of our bond portfolios are positioned, we don’t anticipate an increase in 2020.

After cutting interest rates three times in 2019, the Fed’s current view (which should be taken with a grain of salt) is that short-term interest rates will not be increased until measured inflation at least meets their 2% target and stays there.

As for longer-term rates, we can envision a couple of scenarios where long-term interest rates would rise meaningfully over the medium term. I will expand on those scenarios and risks in future letters.

The big challenge we see for bond investors in 2020 is finding worthy choices to replace some maturing higher coupon bonds with bonds that offer decent yield and modest risk.

The only upshot I have to offer you is that it could be worse. While rates are low here in the U.S., at least, we are not facing the negative yields that exist in other parts of the world.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. The world is aging. According to the World Health Organization, the percentage of the world’s population aged 60 and over will nearly double between 2015 and 2050. And, in 2050, “80% of all older people will live in low- and middle-income countries.” Meanwhile, in OECD countries, the population of people over 65 years old will grow from 17% in 2015 to 28% by 2050. One of the hardest-hit countries will be China, where years of the “one-child policy” have created an inverted population pyramid that will leave many older Chinese for each younger one. Despite the demographic challenges many countries will face, there is good in this news because it means people are living longer. Lifespans in both the developed world and the emerging world are improving, and with that comes a higher proportion of older people. One reason that lifespans are lengthening is improved health care and greater access to it among people who haven’t had it. Elderly Americans need much more health care than younger generations, with Americans between 65 and 79 spending $811 a year on prescription drugs versus $124 a year for Americans aged 18 to 34. With a rapidly increasing elderly population, drugmakers can assume much higher demand for their products. Companies positioned to benefit from this trend that we own in client portfolios include Novo Nordisk, Walgreen’s, and Merck, among others.

P.P.S. As the world ages, an increasing number of fraudsters are looking to take advantage of the elderly. Kiplinger reports:

Financial exploitation is one of the most vicious kinds of abuse inflicted on seniors. It can range from petty financial crimes, such as stealing cash or forging checks, to more-elaborate deceptions in which the perpetrator manipulates an older adult into handing over money or control. Only one in 44 cases of elder financial abuse are reported, according to the New York State Elder Abuse Prevalence Study from 2011. Victims are hesitant to speak up because they are embarrassed, fear losing their independence or are reluctant to sever ties if the perpetrator is a loved one.

Financial abuse and elder fraud can do more than devastate an adult’s savings, credit or ability to pay for long-term care. Many victims suffer medical and psychological harm, and they experience higher mortality rates than seniors who are not abused.

“Older adults make great targets because they have accumulated assets over time and are living off their savings,” says Larry Santucci, who co-authored a report about elder financial victimization for the Federal Reserve Bank of Philadelphia. “Some are also very lonely or socially isolated, which makes them susceptible to exploitation.”

The FTC (877-438-4338), AARP (877-908-3360), and the IRS (800-366-4484) all have hotlines providing information, help, and reporting for fraud, identity theft, and tax scams. If you feel like you have been the victim of identity theft, fraud, or abuse, please seek assistance.

P.P.P.S. CNBC reports that Goldman Sachs sees a significant correction if Democrats sweep the 2020 elections. Goldman says S&P 500 earnings could tumble 12% if the 2017 tax-cuts are rescinded. Goldman is being modest in our view. A Democrat sweep, which increases the likelihood that many of the anti-business policies being discussed in the primaries are implemented, sounds like a recipe for recession. Earnings would likely fall much more than 12% in such a scenario.

P.P.P.S. Speaking of CNBC, I am honored to announce that Richard C. Young & Co., Ltd. was named in the Top 10 of CNBC’s 2019 Top 100 Financial Advisors ranking. We are one of only a handful of firms with listed offices in Florida or Rhode Island to make the list.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up