August 2019 Client Letter

On August 15, the 10-year Treasury note offered a yield of 1.52%. The S&P 500 offered a yield of 1.83% and the NASDAQ composite a measly 0.97%. Think those yields are low? More than $15 trillion of government bonds worldwide now trade at negative yields, with 10-year German government bonds recently hitting a low of -0.71%.

Over the last year, inflation in the United States has averaged 1.8%, creating a dreadful environment in which investment income generated is less than the rate of inflation. If investors cannot find decent-yielding investments, they must rely on capital appreciation to keep pace with inflation. I’ve always been of the mind that relying on capital appreciation requires someone (a greater fool perhaps) to buy your appreciated asset at a higher price than you paid. Such an approach has more in common with speculation than investment.

The Retirement Compounders® Solution

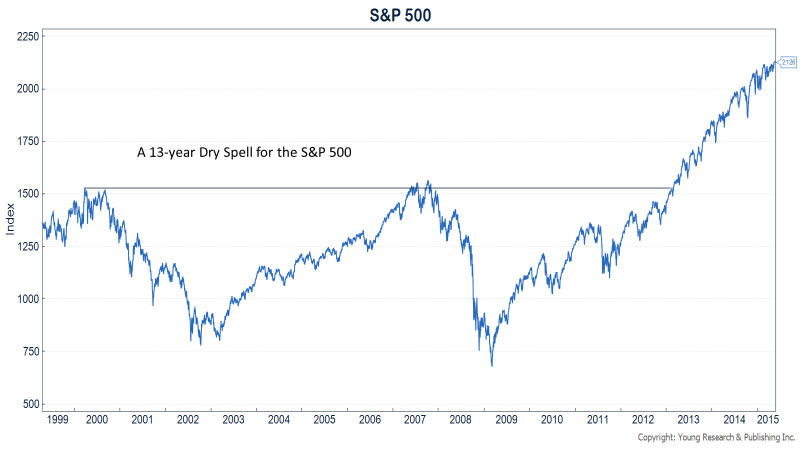

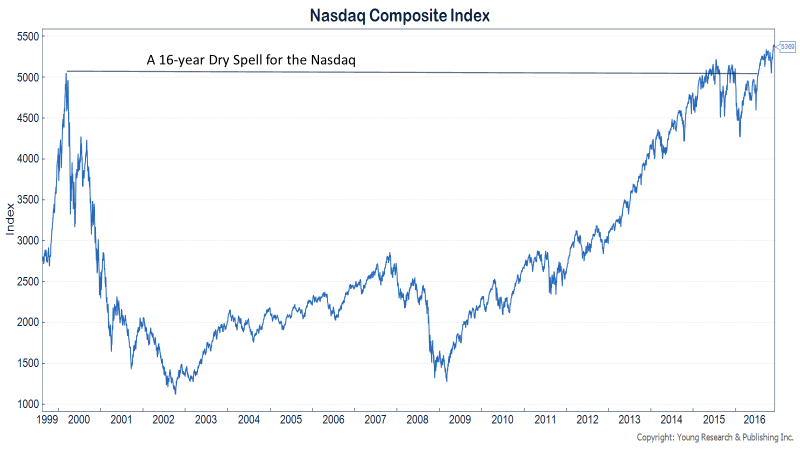

Low dividend-yields and appalling valuations during the dotcom bubble were the catalysts for establishment of the Retirement Compounders® program. Retirement Compounders® (RC) is our globally diversified portfolio of dividend- and income- paying securities. When valuations are high, as they were then and as we see them today, stock prices can remain depressed for long periods. It took the S&P 500 more than 13 years to convincingly surpass the high it had reached in March of 2000. It took the lower-yielding Nasdaq composite 16 years to achieve the same feat (see charts below).

Investing in stocks that pay dividends and regularly increase those dividends can offer a solution to prolonged dry spells in the stock market.

The total return of the S&P 500 from March 2000 to March 2013 was 2.27%. Over the same period, the Bloomberg Barclay’s T-bill Index earned 2.25%. In March 2000, the RCs didn’t exist, but the Nasdaq Broad Dividend Achievers Index and the S&P Dividend Aristocrats Index did. Both pursue similar dividend-focused strategies to our Retirement Compounders®. The Dividend Achievers Index was up 4.9%, and the Dividend Aristocrats Index was up 9% over the same 13-year period. Dividends and dividend growth helped boost the total return of both indices relative to the S&P 500.

A Yield 80% Higher than Inflation

Today, the Retirement Compounders® portfolios we are crafting for clients offer yields of approximately 3.2% or 80% more than the rate of inflation. What’s more, when inflation rises, the profits and dividends of firms tend to increase.

Beat Inflation with Dividends

An example will help illustrate this essential point. Let’s assume I own an ice cream parlor. We’ll call it Matt’s Sweet Treats. Matt’s Sweet Treats did revenue of $10,000 last year (OK, so maybe the ice cream isn’t that good). The cost of making the ice cream and paying a couple of employees to serve it was $9,000. That left me $1,000 in profit. If inflation this year runs hot at 10%, I will increase my prices because I know my costs are also likely to go up 10%. A 10% increase in price will give Matt’s Sweet Treats revenue of $11,000 this year. A similar 10% increase in expenses will drive costs up to $9,900. That leaves me with a profit of $1,100. Voila, my profits are precisely 10% more than they were last year.

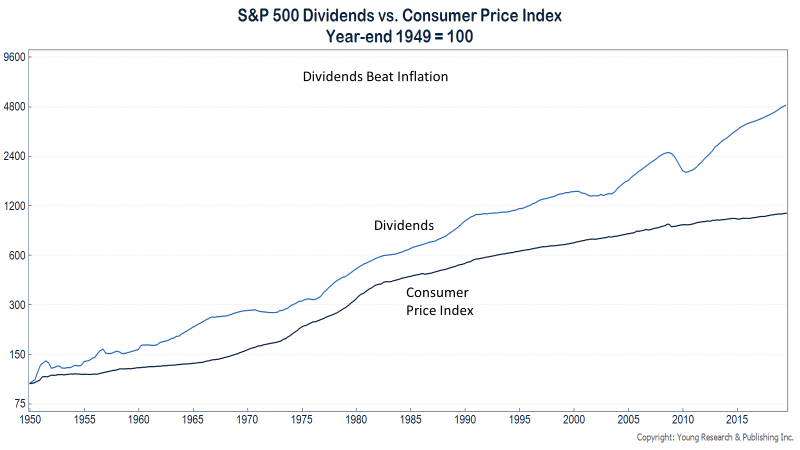

While my example is admittedly simple, and not all firms have the pricing power to pass on higher costs from inflation, over more extended periods, profits and dividends have kept pace with inflation. The chart below shows dividends of the S&P 500 vs. the U.S. Consumer Price Index used to calculate inflation. Both series are set equal to 100 at year-end 1949. Over the last seven decades, dividends have outpaced inflation by a wide margin.

Pricing power is an important lever in a company’s ability to maintain and raise its dividend. By example, if inflation heats up and costs soar, a high-end yacht manufacturer may have a harder time passing on higher costs than a firm that provides lower-priced consumer essentials.

The term “essentials” means different things to different people, of course. If you ask my teenage daughter, life’s essentials would include a cell phone and an unlimited data plan from AT&T.

If the cost of providing cellular service rises 10%, my daughter won’t let me cancel her AT&T plan. As a result, firms such as Verizon and AT&T shouldn’t have trouble passing on higher costs from inflation. Both telecommunications firms feature prominently in our Retirement Compounders® portfolios.

AT&T’s 5.8% Dividend Yield

AT&T is currently the higher-yielding of the two. The stock sports a yield of 5.8%, one of the highest-yielding names in our universe. With the acquisition of Time Warner, AT&T is a telecom and entertainment powerhouse. The company used debt to acquire Time Warner, which has made some investors hesitant on the stock; but we believe AT&T’s cash-flow profile makes both the debt and dividend serviceable.

Over the last 12 months, AT&T generated almost $30 billion in free-cash-flow. Free cash-flow is the cash left over after paying all cash expenses, including interest expense, and making investments to maintain and expand the company’s asset base.

AT&T Dividend Safety

AT&T’s $30 billion in free-cash-flow covers the firm’s annual-dividend payments twice over and leaves an additional $15 billion for debt reduction. Dividend growth is likely to be limited while the firm pays down debt, but we anticipate modest annual increases over the next few years. AT&T has an impressive record of 34 consecutive annual-dividend increases that we believe the firm will be reluctant to abandon.

Not only do firms like AT&T and Verizon pay good yields, but both firms offer investors a measured way to gain exposure to 5G.

AT&T and 5G

5G is the fifth generation of wireless telecommunications networks that promises significantly faster speeds. 5G networks may be up to 100 times faster than today’s 4G networks and competitive with cable internet. You will be able to download a 3 Gigabit movie over a 5G wireless network in under a minute compared to a half-hour using 4G and an hour using 3G. Will consumers still bother with wired cable and internet once 5G proliferates? 5G also has low latency, which makes it useful for applications in the internet of things, including self-driving vehicles and robotics. It’s possible that entire new markets will open for AT&T and Verizon as 5G spreads.

Kudlow’s King Dollar

Before being selected to serve as President Trump’s Director of the National Economic Council, Larry Kudlow was the economics editor at National Review Online and the host of CNBC’s The Kudlow Report. If you’ve spent time reading and watching Larry, you may remember his frequent arguments for a strong dollar. King Dollar is how Larry referred to it.

Writing in NRO back in March 2015, Kudlow quoted Economics Editor John Tamny as saying, “When investors invest, they’re hoping to get back the dollars they invested, plus an additional dollar return.”

Said another way, investors invest for a return of their capital and a return on their capital.

Investors risk their money in hopes of getting back the dollars they invested. Getting your money back is never a guarantee in investing, but it is the hope and belief of many. The fact is, businesses fail, currencies collapse and markets crash. Earning a return on capital would not be possible if there wasn’t the risk of capital loss.

To minimize these risks, it is necessary to craft a diversified portfolio. Putting all your eggs in one basket—or relying too heavily on any one company—is, in our view, a recipe for ruin. While diversification may seem to be a basic tenet of investing, not everyone agrees on its benefits.

Diversification vs. Concentration

Some professional investors eschew diversification. This crowd tends to subscribe to the philosophy that you should carefully pick the best eggs and watch them closely. But how many best eggs (ideas) can one have? The problem we see with this approach is today’s best idea may turn out to be tomorrow’s biggest loser. That isn’t a problem specific to concentrated portfolios. There is often a disaster or two in every portfolio (even the ones we manage!). The trouble is you don’t know which are the disasters ahead of time, and in a concentrated portfolio, a single wipeout can result in financial devastation.

Consider that, just before the turn of the century, a concentrated stock manager may have considered Enron, Bear Stearns, Lehman Brothers, General Motors, and GE to be his best-ideas portfolio. All were Fortune 500 companies at the time; but looking back today, four went bankrupt, and one has lost 80% of its value.

Proper diversification is essential to earning a return of capital and a return on capital. At Richard C. Young & Co., Ltd. we craft portfolios focused on cash flow. We diversify geographically and across industries, sectors, and asset classes in an effort to achieve both the return of capital and a return on capital.

Proper Portfolio Management is More than a Best-Ideas List

Our best ideas make it into your portfolio, but proper portfolio management is not just picking the securities that offer the highest return potential. Putting together a portfolio is a craft. All the pieces of the puzzle must be put in place, monitored regularly, and evaluated for change.

By example, let’s say you have an abundance of best ideas in the banking sector. That’s fine and well, but unless you have both the willingness (few do) and the ability (better not need to make any withdrawals) to take significant risk, putting all your assets in financials could lead to trouble. A savvy portfolio manager would likely complement a portfolio heavy in banks, which tend to fall when interest rates decline, with stocks or bonds that rise when interest rates drop.

Have a good month. As always, please call us at (888) 456-5444 if your financial situation has changed or if you have questions about your investment portfolio.

Warm regards,

Matthew A. Young

President and Chief Executive Officer

P.S. With more than $15 trillion in negative-yielding debt globally, the options for income investors are narrowing. The 30-year Treasury yield hit an all-time low of 1.97% in August. If a sub-2% yield on 30-year Treasuries doesn’t tickle your fancy, the indexing crowd can offer you a 1.8% yield on the S&P 500 or a .97% yield on the Nasdaq. Alternatively, if you have concerns about the future global yield environment, as we do, you may find comfort in our Retirement Compounders® equity portfolio. It offers a yield of 3.2% today and comes without the second layer of fees and hidden costs prevalent in the ETF and fund portfolios that many advisors peddle.

P.P.S. We include gold in your portfolio as a counterbalancer. Gold tends to zig when other assets zag, but that isn’t always true. Year-to-date, gold is up 17%. Stocks are up a comparable amount, and bonds are also having a solid year. Why is gold up when stocks and bonds are also rallying? Maybe the better question is why are stocks up when bond yields are crashing to new lows and gold prices are soaring? What do investors in bonds and gold (traditional safe-haven assets) see that stock-market investors are missing?

P.P.P.S. There are at least some investors in the stock market who see risk. The WSJ recently pointed out that defensive areas of the market have been rallying as some fear faltering economic growth. Our defensively positioned portfolios have benefited from the rush to safe-haven assets. Consumer staples stocks are up 20.6% YTD and 1.3% so far in August. The more cyclically sensitive consumer discretionary and technology shares are both down in August.

Client Portal

Client Portal Secure Upload

Secure Upload Client Letter Sign Up

Client Letter Sign Up